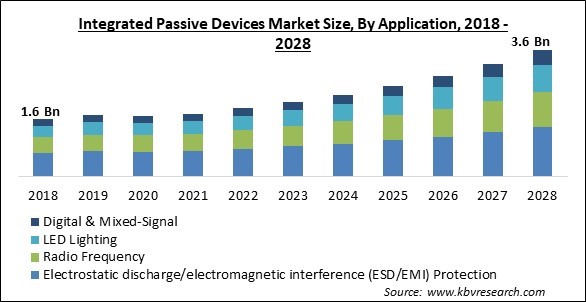

The Global Integrated Passive Devices Market size is expected to reach $3.6 billion by 2028, rising at a market growth of 10.9% CAGR during the forecast period.

The integrated passive device (IPD), also known as the integrated passive component (IPC), or embedded passive component (EPC), is an electronic component that combines resistors, capacitors, inductors, coils/chokes, microstrip lines, impedance matching components, baluns, or any combination of these components in the same package or on the same substrate. Even though the distinction between incorporated and integrated passives is technically ambiguous, integrated passives are occasionally referred to as embedded passives.

In both situations, passives are implemented on the same substrate or in-between dielectric layers. Resistor, capacitor, resistor-capacitor, coil/inductor (RCL), and resistor-capacitor networks are the first types of IPDs. Additionally, passive transformers can be created as integrated passive devices, such as by stacking two coils on top of one another and separating them with a thin layer of dielectric. When the substrate is silicon or another semiconductor like gallium arsenide, diodes (PN, PIN, Zener, etc.) can occasionally be integrated into it with integrated passives (GaAs).

In an electronic system assembly, integrated passive devices may be packaged, used as bare dies or chips, or even stacked in three dimensions (3D) on top of other IPDs or active integrated circuits. Standard in Line (SIL), SIP, or any other packages (such as DIL, DIP, QFN, chip-scale package/CSP, wafer level package/WLP, etc.) used in electronic packaging are typical packages for integrated passives. Integrated passives can also serve as a module substrate, making them a component of chipset modules, multi-chip modules, and hybrid modules.

The substrate for IPDs can be stiff materials like glass, silicon covered with a dielectric layer like silicon dioxide, layered ceramics (low temperature co-fired ceramic/LTCC, high-temperature, and high co-fired ceramic/HTCC), aluminum oxide/alumina ceramic, and co-fired ceramics (LTCC, HTCC). The substrate can also be flexible, such as a laminate made of Kapton, FR4, or a similar polyimide, or any other suitable polyposis, such as a package interposer (also known as an active interposer). The ability to ignore or understand the impact of the substrate and potential package on the performance of IPDs is advantageous for the design of electronics systems.

The COVID-19 outbreak and its effects on passive electronic components resulted in lower functioning levels throughout the supply chain at the components and raw materials manufacturing levels. This indicates a decline in the sales of passive integrated devices across numerous countries and regions. On the other hand, the Japanese traders and associated businesses in the area stayed the same. By combining several functional blocks, such as couplers, harmonic filters, couplers, and impedance matching devices, into a single silicon wafer, integrated passive devices can miniaturize devices while improving device performance.

One of the IPD technology's most common uses is in white goods. According to research, integrated passive devices are widely used in the consumer electronics industry, which includes products like digital TVs, set-top boxes, smartphones, tablets, and portable media players. Since there has been such a high demand for smartphones in recent years, integrated passive devices have emerged as a result of the necessity for many features to be crammed into a compact form factor. Numerous functions, including Wi-Fi, Bluetooth, the positioning system, near-field communication, and others, are available on smartphones.

5G is anticipated to be commercially available. IPDs must be incorporated into items like baluns, filters, and diplexers to make them 5G compliant. The telecom industry in particular would benefit from the integration of IPDs since it would assist reduce the size and energy consumption of telecom infrastructure items. By 2022, the 5G market is anticipated to have 89 million subscriptions, which would present a growth potential for the IPD market. 5G IPD RF filters with great efficiency have been created by 3D Glass Solutions. In addition, 5G technology is expected to be implemented in the US, Japan, South Korea, UK, Germany, and China by 2021, which is projected to support the expansion of the market for integrated passive devices in the ensuing years.

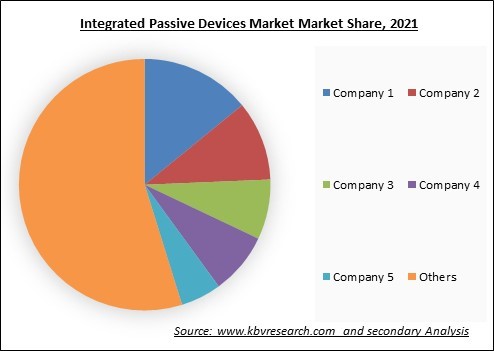

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

The market for integrated passive devices is being constrained by IPDs' high cost when compared to discrete components. Long-term effects are anticipated to be minimal because major companies in this industry are working to bring down the price of IPDs. To optimize profitability, low-cost manufacturing is also crucial. Traditional printed circuit boards, however, are not specified for IPDs; rather, they are for individual discrete components. Using traditional PCBs with IPDs results in additional costs. A single discrete component's cost to IPD is 1:31 (1.5 X 1.5). This is partly because discrete components have become commodities and are widely used.

On the basis of Application, The Integrated Passive Devices market is segmented into Electrostatic discharge/electromagnetic interference (ESD/EMI) Protection, Radio frequency, LED lighting, and Digital & mixed-signal IPD. The Electrostatic discharge/electromagnetic interference (ESD/EMI) Protection segment acquired the highest revenue share in the integrated passive device market in 2021. It is due to the adoption of these passive integrated components in mobile phones is a major driver of this market's expansion. Over the next nine years, it is anticipated that the EMS and EMI protection product segments would experience significant growth. These solutions avoid transmission loss and enhance signal reception.

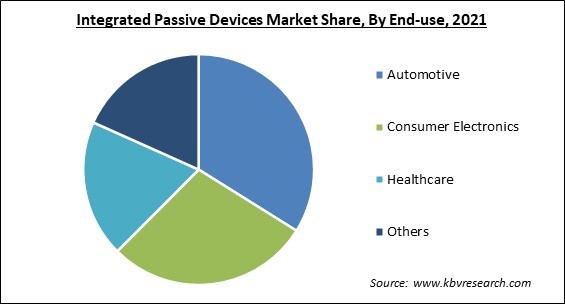

Based on End-use, The Integrated Passive Devices market is classified into Automotive, Consumer electronics, Healthcare, and Others. The consumer electronics segment recorded a substantial revenue share in the integrated passive device market in 2021. The main driver of the market expansion for integrated passive devices is the rising adoption of smartphones and other IoT devices. Additionally, technological developments like smaller chips have made it possible for electrical gadgets to be smaller, which helps to explain why consumer electronics like mobile phones, LED televisions, tablets, and laptops are becoming more and more popular.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.8 Billion |

| Market size forecast in 2028 | USD 3.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 10.9% from 2022 to 2028 |

| Number of Pages | 175 |

| Number of Tables | 279 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Market Share Analysis, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Application, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, The Integrated Passive Devices market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segments procured the highest revenue share in the integrated passive device market in 2021. Key vendors like Infineon Technologies AG, STMicroelectronics, and IPDiA that provide cutting-edge products based on efficient research and development are present in this region, which contributes to the growth. Additionally, the developments serve a variety of industries, including healthcare, automobile, and electronics, generating significant investment in this region.

Free Valuable Insights: Global Integrated Passive Devices Market size to reach USD 3.6 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include STMicroelectronics N.V., Infineon Technologies AG, Jiangsu Changjing Electronics Technology Co., Ltd., Amkor Technology, Inc., Taiwan Semiconductor Manufacturing Company Limited, ON Semiconductor Corporation, Murata Manufacturing Co., Ltd., Johanson Technology, Inc., and OnChip Devices, Inc.

By Application

By End User

By Geography

The global Integrated Passive Devices Market size is expected to reach $3.6 billion by 2028.

Ipd Is Becoming More Widely Used In Consumer Goods are driving the market in coming years, however, Ipds Are More Expensive Than Discrete Components restraints the growth of the market.

STMicroelectronics N.V., Infineon Technologies AG, Jiangsu Changjing Electronics Technology Co., Ltd., Amkor Technology, Inc., Taiwan Semiconductor Manufacturing Company Limited, ON Semiconductor Corporation, Murata Manufacturing Co., Ltd., Johanson Technology, Inc., and OnChip Devices, Inc.

The expected CAGR of the Integrated Passive Devices Market is 10.9% from 2022 to 2028.

The COVID-19 outbreak and its effects on passive electronic components resulted in lower functioning levels throughout the supply chain at the components and raw materials manufacturing levels.

The Europe market dominated the Global Integrated Passive Devices Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $1.2 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.