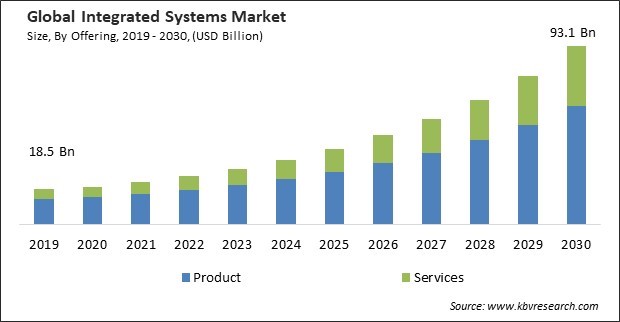

The Global Integrated Systems Market size is expected to reach $93.1 billion by 2030, rising at a market growth of 17.9% CAGR during the forecast period.

The emergence of Industry 4.0 has been a pivotal driver for integrated systems in manufacturing. The Industrial Internet of Things (IIoT), automation, data analytics, and cyber-physical systems are all part of Industry 4.0, which focuses on the digital transformation of manufacturing processes. Hence, the manufacturing sector accounted for $2,829.7 million revenue in the market in 2022. Integrated systems are at the core of smart manufacturing, enabling real-time data analysis and process optimization. Integrated systems are increasingly being used to automate various manufacturing processes. Robotic automation systems, known as "cobots" (collaborative robots), are integrated into production lines, working alongside human operators to improve productivity, precision, and safety. Therefore, the demand will increase in the coming years.

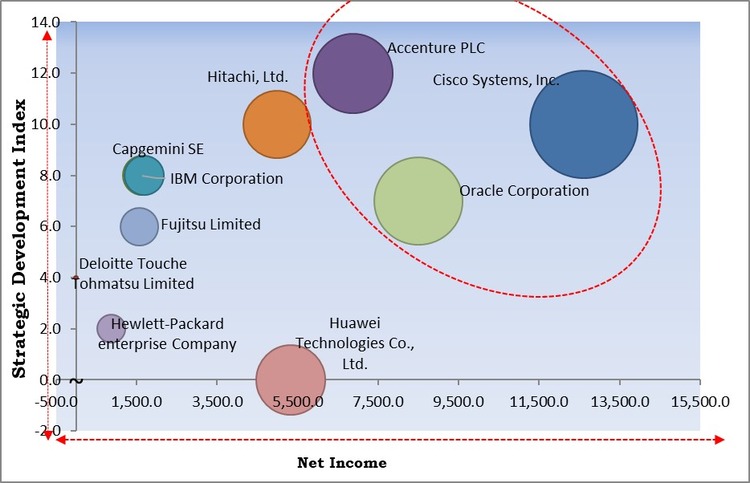

The major strategies followed by the market participants are Mergers & Acquisition as the key developmental strategy to keep pace with the changing demands of end users. For instance, In August, 2023, Accenture PLC completed the acquisition of ATI Solutions Group Pty Ltd to augment its position in the fields of specialized digital and industrial talents in West Australia. Moreover, In September, 2023, Cisco Systems, Inc. came into an agreement to acquire Splunk Inc., an American software company. Through this acquisition, the companies would introduce next-generation AI-enabled security. Additionally, the companies would provide security and resilience to the companies through threat detection and prevention.

Based on the Analysis presented in the KBV Cardinal matrix; Accenture PLC, Cisco Systems, Inc. and Oracle Corporation are the forerunners in the Market. In October, 2023, Accenture PLC took over SIGNAL, a Japanese integrated marketing firm. Through this acquisition, Accenture supported the market transformation of the clients overpaid and owned media. Additionally, Accenture strengthened its ability to accelerate the business transformation of its clients and build a competitive base in the market. Companies such as Hitachi, Ltd., Capgemini SE, IBM Corporation are some of the key innovators in the Market.

Organizations across various industries increasingly recognize the value of integrated systems in improving their operations. The desire to streamline processes and reduce complexity strongly incentivizes more companies to adopt these systems. This growth can be seen in various sectors, from IT and data centers to manufacturing, healthcare, and beyond. A growing number of adopters contributes to the market's maturity. This, in turn, attracts more attention from technology providers, which leads to further innovation and development of these systems tailored to the specific needs of different industries. With the positive impact of cost savings, more organizations are encouraged to explore the market. The barriers to entry decrease, making it easier for businesses to consider implementing these solutions, which, in turn, fuels market growth. Therefore, these factors will boost the demand for these systems in the coming years.

The growth of digital transformation is fueled by a combination of technological advancements, evolving business paradigms, and changing consumer expectations. Rapid developments in digital technologies, such as artificial intelligence (AI), the Internet of Things (IoT), cloud computing, and data analytics, provide the foundation for digital transformation. These technologies enable organizations to automate processes, collect and analyze data, and enhance decision-making. Organizations seek to optimize their operations by streamlining processes and reducing operational costs. Automation and digital tools play a crucial role in achieving these goals, making businesses more efficient and responsive. The market will grow in the coming years due to these factors.

The complexity and expertise required for integration can deter many organizations, particularly smaller businesses or those with limited IT resources, from considering these systems. This reduces the overall pool of potential customers and hinders market growth. Specialized skills and expertise come at a cost. Organizations may need to hire or contract IT professionals with expertise in integration, which can lead to higher expenses. As a result, the overall cost of adopting these systems may become prohibitive for some organizations. The time and effort required for complex integrations can delay an organization's ability to realize the benefits of integrated systems, such as improved efficiency, cost savings, and innovation. This delay can be a disincentive for potential adopters. Therefore, these factors are expected to hinder the future market's growth.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

On the basis of services type, the market is divided into integration & installation, consulting, and maintenance & support. The integration and installation segment recorded the maximum revenue share in the market in 2022. As businesses seek tailored solutions to meet their needs, the demand for integration and installation services has surged. Integrators work closely with clients to design and implement systems that align with their unique requirements, from data centers to smart manufacturing solutions. Integrated systems are becoming increasingly complex, encompassing many technologies, from IoT devices to cloud-based applications. Integration and installation services are necessary to ensure these components work seamlessly together, meeting performance and reliability expectations. Therefore, the segment is expected to grow rapidly in the coming years.

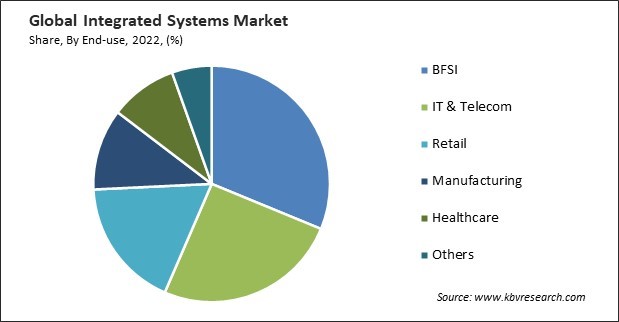

Based on end-use, the market is segmented into BFSI, IT & telecom, retail, manufacturing, healthcare, and others. The BFSI segment held the largest revenue share in the market in 2022. The BFSI sector has witnessed a profound digital transformation in recent years. Traditional banking processes and financial services are rapidly shifting towards digital platforms. To give clients a seamless and unified experience, this transition requires integrating numerous systems, including core banking, payment processing, and customer relationship management. To modernize fundamental banking activities, integrated systems are essential. Banks and financial institutions combine their core banking systems with other technology solutions, such as CRM, data analytics, and mobile banking, to improve customer service and streamline internal processes. These factors will propel the growth of the BFSI segment in the future.

By offering, the market is divided into products and services. In 2022, the services segment garnered a significant revenue share in the market. Integrated systems often need to be customized to meet the unique requirements of different organizations. Service providers offer customization and tailoring services to ensure that these systems align with the specific needs of their clients. Integrated systems require continuous support, updates, and maintenance. Service providers offer ongoing services to ensure the integrated systems operate smoothly and securely. This provides peace of mind for organizations and allows them to focus on their core operations. These factors will help in the expansion of the services segment.

Based on product type, the market is segmented into integrated platform/workload systems and integrated infrastructure systems. The integrated platform/workload systems segment held the largest revenue share in the market in 2022. Integrated platform/workload systems combine hardware, software, and management tools into a single, pre-configured solution. This simplifies deployment, reduces complexity, and accelerates time-to-value for businesses. These systems are designed to provide optimized performance for specific workloads. They are often highly scalable, allowing organizations to easily expand their infrastructure as their needs grow, which is particularly beneficial for data-intensive workloads. These factors are expected to boost the demand in the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 25.4 Billion |

| Market size forecast in 2030 | USD 93.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 17.9% from 2023 to 2030 |

| Number of Pages | 308 |

| Number of Table | 454 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Offering, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured the highest revenue share in the market in 2022. North America is home to many technology giants and data-intensive industries. As a result, there is a strong demand for integrated systems to streamline data center operations. Technological advancements, such as hyper-converged infrastructure and software-defined solutions, have driven growth in this segment. Organizations are constantly seeking more efficient and innovative ways to manage their data, which has led to the adoption of cutting-edge integrated systems. Owing to these factors, there will be increased demand in the segment.

Free Valuable Insights: The Global Integrated Systems Market size to reach USD 93.1 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Accenture PLC, Capgemini SE, Cisco Systems, Inc., Deloitte Touche Tohmatsu Limited, Fujitsu Limited, Hitachi, Ltd., Hewlett-Packard enterprise Company, Huawei Technologies Co., Ltd., IBM Corporation, and Oracle Corporation.

By Offering

By End Use

By Geography

The Market size is projected to reach USD 93.1 billion by 2030.

Efficiency and cost reduction benefits for organizations are driving the Market in coming years, however, Complex integration process and need for expertise restraints the growth of the Market.

Accenture PLC, Capgemini SE, Cisco Systems, Inc., Deloitte Touche Tohmatsu Limited, Fujitsu Limited, Hitachi, Ltd., Hewlett-Packard enterprise Company, Huawei Technologies Co., Ltd., IBM Corporation, and Oracle Corporation.

The expected CAGR of this Market is 17.9% from 2023 to 2030.

The Product segment has acquired the maximum revenue share in the Market by Offering in 2022 thereby achieving a market value of $61.8 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $32 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.