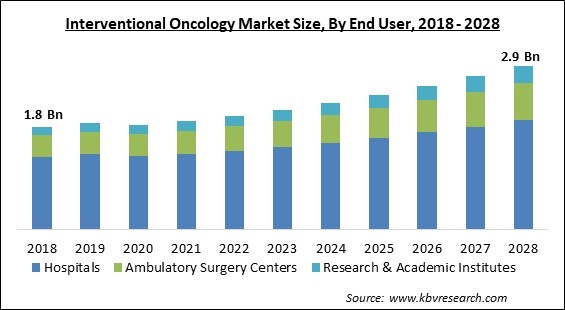

The Global Interventional Oncology Market size is expected to reach $2.9 billion by 2028, rising at a market growth of 6.2% CAGR during the forecast period.

Interventional oncology (IO) is an emerging subspecialty that emphasizes on using image-guided processes (diagnostics/surgeries) to improve cancer therapy. Along with surgery, medication, and radiation, IO is currently the fourth pillar of modern oncology care. The three key areas of cancer intervention that IO focuses on are diagnosis, therapy, and symptom relief. Improvements in cross-sectional imaging techniques such as ultrasound, computed tomography (CT), magnetic resonance (MR), and positron emission tomography (PET) have enabled progress in IO (PET).

Because of the rising number of cancer cases among individuals around the world, the interventional oncology market is expected to rise faster in the coming years. Cancer is one of the most rapidly developing health problems, impacting individuals of different ages. Breast cancer & throat cancer are two of the most common types of cancer in individuals. The need for technologically improved cancer management therapy has expanded in tandem with the rise in the number of cancer patients.

Patients with cancer, both adults and children, have benefited from the innovative interventional oncology therapy line. In the coming years, such advancements are expected to have a positive influence on interventional oncology market growth. IO, along with Medical, Surgical, and Radiation Oncology, has successfully established itself as a significant treatment specialism within multidisciplinary oncologic care. In today's cancer care, IO is currently regarded the fourth pillar. Though surgical removal of tumours is typically thought to be the greatest therapy, it is not always achievable owing to the tumor's size, quantity, or location. IO treatments can be used to reduce a tumour, allowing for surgery or interventional treatment. A few patients may be unable to endure open surgery due to their health.

Patients have constrained themselves from going to visit hospitals and clinics for diagnosis of medical problems other than coronavirus symptoms owing to the increase incidence of coronaviral transmission. As a result, fewer cancer patients have reported to hospitals for treatment. The market is confronted with production and supply chain problems, such as providing items to end users on time and catering to an inconsistent demand for the sector's products and services. Furthermore, a scarcity of talented lab experts to perform diagnostic tests, restricted operations in most businesses, insufficient financing for research & academic institutes, the temporary closure of main academic institutes, a disrupted supply chain, and obstacles in offering a service owing to lockdowns have all contributed to a decrease in the supply of interventional oncology products to end users. As a result, the pandemic is unlikely to have long-term consequences for the basic growth drivers or end consumers in the economy.

While utilizing medical imaging technologies during vascular therapies, radiologists & technologists have a lot of sight. Professionals can accurately identify and treat diseases throughout the operation, which can take less than an hour in some cases. These procedures are also regarded a more effective usage medical resources than major surgery because they are relatively rapid. Because most outpatient processes, particularly interventional radiology, are less costly than inpatient hospital stays, patients often find interventional radiology to be a more cost-effective therapy.

Because of the benefits given by these techniques over traditional treatment processes, the demand for minimally invasive procedures has increased significantly in recent years. Fewer operating complications, shorter hospitalization, reduced pain, smaller & more cosmetic incisions, reduced risk of infection, less post-surgical care, and faster recovery are all benefits of minimally invasive procedures. Sophisticated technology is used in minimally invasive treatments to detect and cure a variety of disorders, including cancer. These treatments are intended to remove malignant tumours and lymph nodes from the body without leaving scars.

A medication must have comprehensive safety data from Phase I studies, established effectiveness from Phase II trials, and analysis of clinical results better than current therapies from randomized, controlled Phase III trials before it can be introduced as a standard of care. In addition, performing well-controlled clinical trials in interventional oncology procedures, on the other hand, is challenging owing to a dearth of recognized methodology. Chemoembolization, for example, is the most common treatment for hepatocellular cancer. On the other hand, the clinical evidence for chemoembolization is inadequate, and the clinical advantages generated from current trials are smaller than those derived from other cancer treatment alternatives.

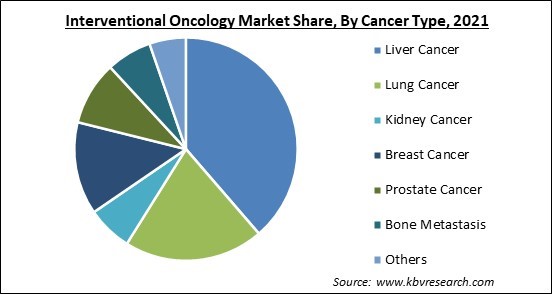

Based on Cancer Type, the market is segmented into Liver Cancer, Lung Cancer, Kidney Cancer, Breast Cancer, Prostate Cancer, Bone Metastasis, and Others. The liver cancer segment witnessed the maximum revenue share in the interventional oncology market in 2021. Primary liver tumours caused by metastatic cancer can be successfully treated using interventional oncology techniques. Increased research/development efforts using interventional oncology to improve liver cancer therapy, and an increase in the number of instances of liver cancer in the world, are among the factors driving liver sub-growth.

Based on Product Type, the market is segmented into Embolization Devices, Ablation Devices, and Support Devices. The Ablation devices segment acquired a significant revenue share in the interventional oncology market in 2021. Because of the expanding popularity of minimally invasive treatments and the rising frequency of certain soft tissue malignancies, ablation devices provide a minimally invasive option to conventional surgical treatment of liver, kidney, prostate, and lung cancers.

Based on End User, the market is segmented into Hospitals, Ambulatory Surgery Centers, and Research & Academic Institutes. Hospitals segment acquired the highest revenue share in the interventional oncology market in 2021. The hospital sub-segment might benefit greatly from advancements in healthcare infrastructure and a boom in the adoption of innovative interventional oncology technologies like embolization and ablation devices in hospitals. Additionally, several patients prefer to undergo cancer treatment from hospitals because numerous innovative treatment facilities are housed under one roof, and patients do not have to worry about their treatment.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.9 Billion |

| Market size forecast in 2028 | USD 2.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.2% from 2022 to 2028 |

| Number of Pages | 242 |

| Number of Tables | 390 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Cancer Type, Product Type, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia Pacific recorded a significant revenue share in the interventional oncology market in 2021. This is due to a variety of variables, including an increase in cancer cases amongst people and improved healthcare facilities. The key factors propelling the market of the APAC interventional oncology market are government efforts to raise funding, supportive regulations for the manufacture and marketing of innovative interventional oncology products, increasing healthcare expenditure, growing amount of hospitals and clinics in India and China, broadening research base all over China, India, and Japan, and the rising incidences of surgeries.

Free Valuable Insights: Global Interventional Oncology Market size to reach USD 2.9 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Boston Scientific Corporation, Teleflex, Inc., Cook Medical, Inc. (Cook Group), Medtronic PLC, Terumo Corporation , Johnson & Johnson (Johnson & Johnson Services, Inc.), Becton, Dickinson and Company, AngioDynamics, Inc., Merit Medical Systems, Inc., and HealthTronics, Inc. (Altaris Capital Partners, LLC)

By Cancer Type

By Product Type

By End User

By Geography

The global interventional oncology market size is expected to reach $2.9 billion by 2028.

More efficiency and quick recovery offered by interventional oncology are driving the market in coming years, however, Restricted clinical data to maintain therapeutic efficacy limited the growth of the market.

Boston Scientific Corporation, Teleflex, Inc., Cook Medical, Inc. (Cook Group), Medtronic PLC, Terumo Corporation , Johnson & Johnson (Johnson & Johnson Services, Inc.), Becton, Dickinson and Company, AngioDynamics, Inc., Merit Medical Systems, Inc., and HealthTronics, Inc. (Altaris Capital Partners, LLC).

The expected CAGR of the interventional oncology market is 8.7% from 2022 to 2028.

The Embolization Devices segment acquired maximum revenue share in the Global Interventional Oncology Market by Product Type in 2021, thereby, achieving a market value of $1.31 billion by 2028.

The North America market dominated the Global Interventional Oncology Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $1,067.2 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.