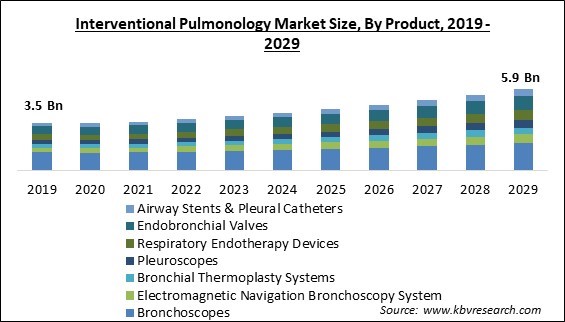

The Global Interventional Pulmonology Market size is expected to reach $5.9 billion by 2029, rising at a market growth of 6.9% CAGR during the forecast period.

Interventional pulmonology is a medical specialty focusing on the minimally invasive diagnosis and treatment of lung problems. Interventional pulmonology is utilized for procedures such as bronchoscopy and thoracoscopy. These treatments are often performed via small incisions, which decreases the risk of problems and accelerates healing. Governments in several nations worldwide are taking steps to enhance healthcare facilities and provide effective treatments for respiratory disorders.

As a result, pulmonologists continually search for novel and inventive diagnostic and therapeutic approaches for respiratory disorders. In addition, increased public awareness of respiratory disorders has increased early diagnosis and treatment, improving patient outcomes.

Governments and insurance companies across the globe are rapidly enacting rules that encourage the use of generic medications, hence intensifying market competition. This is because generic medications are viewed as cost-effective options that can drastically lower healthcare expenses for governments and insurance companies.

The rising demand for pulmonology therapies has increased R&D spending on novel medications and devices. This is helping to enhance the detection and treatment of respiratory disorders, giving a substantial opportunity for expansion in interventional pulmonology. In addition, the incidence of respiratory disorders like COPD and lung cancer is increasing as the population ages. This boosts the need for pulmonology therapies, creating significant growth potential for key players operating in the interventional pulmonology market.

Due to supply chain disruptions brought on by the pandemic, prices have increased, and shortages have occurred for several pulmonology-related products. In addition, many healthcare facilities postponed or discontinued non-emergency procedures, including sleep studies and pulmonary function tests, which reduced revenue for pulmonologists and associated enterprises. Also, more research and development have created new interventional pulmonology therapies to treat COVID-19 patients, increasing market competitiveness. However, the majority of government financing was directed toward the healthcare sector due to the rapid expansion of COVID-19 pandemic. The interventional pulmonology market has significantly been impacted by the COVID-19 pandemic.

The acceptance and usage of modern medical technologies in healthcare institutions, such as hospitals, would be bolstered by enhanced healthcare infrastructure and greater healthcare spending by the appropriate public authorities. This would increase the demand for interventional pulmonology. India, Brazil, and Mexico are growing economies with a significant COPD patient population. COPD patients require breathing help regularly. The market's long-term survival will be bolstered by an increase in patient disposable income & economic growth in these emerging markets.

The multiple benefits of electromagnetic navigation bronchoscopy, specifically its precision, greater accuracy, and ability to generate a 3D (three-dimensional) bronchial map, are likely to be recognized in the coming years as critical growth factors for the demand for electromagnetic navigation bronchoscopy. In addition to this, it is anticipated that the increasing incidence of bronchial diseases such as lung cancer will be one of the primary drivers for the need for electromagnetic navigation bronchoscopy systems throughout the course of the projected period.

The dangers of bronchoscopy procedures, like contamination and infection following a bronchoscopy, are lowering adoption rates. The dangers associated with bronchoscopies, such as bleeding, respiratory problems, and low blood oxygen levels during the procedure, are another factor restricting the market. The likelihood that a patient would experience a post-bronchoscopy infection has increased with the emergence of methicillin-resistant staphylococcus aureus and other resistant bacteria. The strict regulations, and the availability of alternative options is predicted to support the market’s expansion.

Based on end-user, the interventional pulmonology market is segmented into hospitals, ambulatory surgical centers, diagnostic centers, specialty clinics, and others. The ambulatory surgical centers segment garnered a significant revenue share in the interventional pulmonology market in 2022. Ambulatory surgical centers are less expensive than regular hospitals, providing a shorter stay following surgery. Also, the availability of more minimally invasive procedures and the growth of ambulatory surgery centers influence the market.

On the basis of product, the interventional pulmonology market is fragmented into bronchoscopes, electromagnetic navigation bronchoscopy system, pleuroscopes, respiratory endotherapy devices, airway stents, pleural catheters, endobronchial valves, and bronchial thermoplasty systems. In 2022, the respiratory endotherapy devices segment procured a promising growth rate in the interventional pulmonology market. The global need for endoscopy equipment has increased along with the prevalence of respiratory disease and the aging population, increasing the demand for respiratory endotherapy devices.

By indication, the interventional pulmonology market is bifurcated into asthma, COPD, lung cancer, tracheal & bronchial stenosis and others. In 2022, the asthma segment dominated the interventional pulmonology market with the maximum revenue share. All ages are affected by asthma, but children are the ones it impacts the most. It is a condition marked by recurrent episodes of wheezing and shortness of breath that differ in intensity and frequency from individual to individual. Due to reasons such as an aging population and rising asthma prevalence, the market in the asthma segment is growing.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 3.7 Billion |

| Market size forecast in 2029 | USD 5.9 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 6.9% from 2023 to 2029 |

| Number of Pages | 270 |

| Number of Table | 430 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Indication, End-user, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the interventional pulmonology market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2022, the North America region led the interventional pulmonology market by generating the highest revenue share. The market is expanding due to rising healthcare expenditures, technological advancements in the diagnosis and treatment of pulmonary disorders, and a shift toward less-invasive procedures in industrialized nations such as the United States. In addition, the occurrence of lung diseases caused by heavy smoking and the rise in air pollution are significant market growth drivers.

Free Valuable Insights: Global Interventional Pulmonology Market size to reach USD 5.9 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Medtronic PLC, Boston Scientific Corporation, Becton, Dickinson and Company, Olympus Corporation, Fujifilm Holdings Corporation, ICU Medical, Inc. (Smiths Medical), HUGER Medical Instrument Co., Ltd, Cook Medical, Inc. (Cook Group), Clarus Medical LLC and Vygon SAS.

By Product

By Indication

By End-user

By Geography

The Market size is projected to reach USD 5.9 billion by 2029.

Grown occurrence of lung cancer are driving the Market in coming years, however, Availability of alternatives options & strict regulations restraints the growth of the Market.

Medtronic PLC, Boston Scientific Corporation, Becton, Dickinson and Company, Olympus Corporation, Fujifilm Holdings Corporation, ICU Medical, Inc. (Smiths Medical), HUGER Medical Instrument Co., Ltd, Cook Medical, Inc. (Cook Group), Clarus Medical LLC and Vygon SAS.

The Bronchoscopes segment acquired maximum revenue share in the Global Interventional Pulmonology Market by Product in 2022 thereby, achieving a market value of $2 billion by 2029.

The Hospitals segment is leading the Market by End-user in 2022 thereby, achieving a market value of $2.7 billion by 2029.

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $2.3 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.