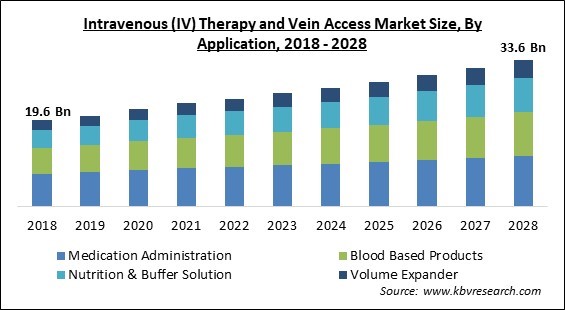

The Global Intravenous (IV) Therapy and Vein Access Market size is expected to reach $33.6 billion by 2028, rising at a Market growth of 5.3% CAGR during the forecast period.

Intravenous (IV) therapy is a therapeutic procedure that involves infusing liquid substances such as electrolytes, medications, nourishment, and blood-based products directly into the veins. The fastest approach to give fluids to different regions of the body is through IV therapy. Heart attacks, strokes, and poisoning are all treated with this medication. In such instances, the patient should receive medication as soon as possible, hence IV medication is administered. Chemotherapy treatments, antibiotics, antifungal drugs, pain relievers, immunoglobulin therapies, and blood pressure meds are among the drugs given intravenously.

Intravenous treatment (IV) is a way of delivering drugs and fluids to the body through the veins. Vitamin and mineral-containing drugs are administered through an IV drip or vein injection, allowing the therapy to flow swiftly through the bloodstream. IV administration, according to the Scope, is when a patient receives substances straight into their veins using a tube called a cannula. This could be a side effect of medication or a nutrient deficiency. IV therapy is a typical way to provide dehydrated patients fluids, medicines, chemotherapeutic treatments, and blood transfusions. During IV administration, various IV equipment like IV Catheters, Infusion Pumps, Securement Devices, Administration Sets, and so on are used.

IV treatment is quick to administer, easy to track, and free of gastrointestinal side effects. When compared to oral treatment, it promotes a faster immune system response and relief from chronic conditions. It has an infusion pump that controls the volume of a chemical to be supplied to the body and can be easily monitored. Over the forecast period, the global intravenous treatment and vein access devices Market is expected to increase. Diabetes prevalence, rising incidence of traffic accidents, and an increase in surgical operations are projected to propel the industry forward. This industry is also being driven by rising demand for sophisticated approaches such as drug administration without needles.

COVID-19 has a positive overall influence on the IV treatment Market . In patients with severe COVID-19-associated Acute Respiratory Distress Syndrome, IV treatment is administered (ARDS). The use of intravenous immunoglobulin therapy for COVID-19 ARDS, for example, was published in The Lancet Respiratory Medicine Journal on November 11, 2021, as an appealing adjuvant for the management of severe COVID-19-associated ARDS because of its ability to simultaneously modulate multiple immune compartments. As a result, the demand for IV therapy and vein access products has increased as the number of patients suffering from COVID-19-associated ARDS has increased.

Over the previous decade, the prevalence of various chronic conditions requiring vascular access treatment has increased. Cancer, kidney failure, and heart disease, among other chronic diseases, as well as various lifestyle conditions like hypertension, diabetes, obesity, and depression, among others, necessitate critical care during hospitalization. In the next years, the increasing burden of chronic diseases like cardiovascular disease, cancer, stroke, and diabetes, combined with an aging population, generates more demand for intravenous therapy.

Intravenous catheters (peripheral and central), accessories with safety devices, and cutting-edge infusion pumps are among the technological resources that can contribute to a safer and higher-quality intravenous treatment (IVT) practice. Because health technology is a complicated subject that produces daily reflections and discussions among the health professionals involved in the care of the patient in the Intensive Care Unit, major changes in nursing care have occurred as a result of the incorporation of new technologies, and cutting-edge infusion pumps are among the technological resources that can contribute to a safer and higher-quality intravenous treatment (IVT) practice.

The licensing process for new items is being slowed by more severe requirements surrounding the production and incorporation of pumps. Additionally, rising product recalls owing to manufacturing faults would slow down the adoption rate of these therapies. Fresenius Kabi, for example, recalled the Vigilant Agilia drug library and the Volumat MC Agilia infusion pump in August 2019 due to infusion alarm issues, low priority keep vein open (KVO), and other software errors. The major barriers to the industry growth are complications associated with utilizing the IV method and IV infusion products.

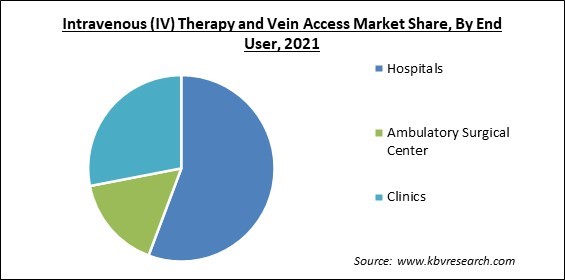

Based on End User, the Market is segmented into Hospitals, Ambulatory Surgical Center, and Clinics. In 2021, the Hospitals segment garnered the maximum revenue share of the Intravenous (IV) Therapy and Vein Access Market . This is due to a rise in the number of surgeries conducted compared to ambulatory surgical centers and clinics. Moreover, the growth of the segment is credited to an increase in the use of IV therapy in hospitals, which includes IV antibiotic treatment, medication for unconscious patients, drugs that cannot be administered orally, interventional radiology, anti-cancer drugs, hemodialysis, repeated blood sample drawings, and blood transfusion. The Market for IV therapy and vein access devices is growing thanks to technological advancements and hospital investments.

Based on Application, the Market is segmented into Medication Administration, Blood Based Products, Nutrition & Buffer Solution, and Volume Expander. The Volume Expander segment obtained a significant revenue share of the Intravenous (IV) Therapy and Vein Access Market in 2021. For a minority of fluid-sensitive athletes, IV fluid may be useful; however, this should be reserved for high-level athletes with strong histories of symptoms in well-monitored situations. Some athletes may benefit from using volume expanders. In contests controlled by the World Anti-Doping Agency, IV fluids and plasma binders are prohibited. For the vast majority of athletes, routine IV therapy is not the best option.

Based on Type, the Market is segmented into Intravenous Catheters, Infusion Pumps, Hypodermic Needles, Implantable Ports, and Others. In 2021, the Intravenous Catheters segment procured the largest revenue share of the Intravenous (IV) Therapy and Vein Access Market . This is due to the increased usage of IV catheters during surgical procedures for IV therapies and during the transfer of blood, medicine, and other nutrients to various parts of the body. An intravenous catheter is a tiny tube that is placed into a cavity or lumen in the body. Intravenous catheters are a type of intravenous catheter that is used to deliver drugs, fluids, or other therapies straight into the bloodstream. They're most commonly introduced into a vein in the arm, although they can also be inserted in the neck, chest, or groin. Depending on their intended purpose, intravenous catheters come in a variety of sizes and forms.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 23.5 Billion |

| Market size forecast in 2028 | USD 33.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.3% from 2022 to 2028 |

| Number of Pages | 244 |

| Number of Tables | 387 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the Market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, North America emerged as the leading region in the Intravenous (IV) Therapy and Vein Access Market by acquiring the highest revenue share of the Market . The growth of the regional Market can be attributed to an uptick in the pool of patient population, a rise in the prevalence of road accidents, a high rise in trauma cases, and an increase in federal investments in the development of better healthcare facilities and R&D activities.

Free Valuable Insights: Global Intravenous (IV) Therapy and Vein Access Market size to reach USD 33.6 Billion by 2028

The Market research report covers the analysis of key stake holders of the Market . Key companies profiled in the report include B. Braun Melsungen AG, Medtronic PLC, Terumo Corporation, Fresenius SE & Co. KGaA, Cardinal Health, Inc., Pfizer, Inc., Teleflex, Inc., Baxter International, Inc., Smiths Group PLC, and AngioDynamics, Inc.

By End User

By Application

By Type

By Geography

The global intravenous (IV) therapy and vein access market size is expected to reach $33.6 billion by 2028.

Increased operations and a growing geriatric population are increasing are driving the market in coming years, however, pump manufacturing requires strict regulations and concerns about complications growth of the market.

B. Braun Melsungen AG, Medtronic PLC, Terumo Corporation, Fresenius SE & Co. KGaA, Cardinal Health, Inc., Pfizer, Inc., Teleflex, Inc., Baxter International, Inc., Smiths Group PLC, and AngioDynamics, Inc.

The Medication Administration segment acquired maximum revenue share in the Global Intravenous (IV) Therapy and Vein Access Market by Application in 2021; thereby, achieving a Market value of $11.5 billion by 2028.

The North America Market dominated the Global Intravenous (IV) Therapy and Vein Access Market by Region in 2021, and would continue to be a dominant Market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.