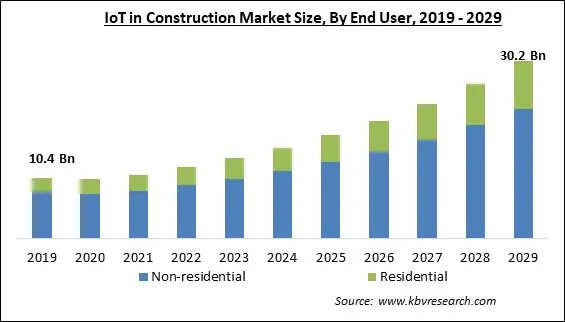

The Global IoT in Construction Market size is expected to reach $30.2 billion by 2029, rising at a market growth of 14.1% CAGR during the forecast period.

IoT in construction market primarily aims to use electronically connected equipment and software to provide efficient resource usage, a well-thought-out technological approach, and controlled construction costs. In addition, IoT provides a framework for connecting employees, inventories, and equipment to a centralized server that manages and monitors their operations in real-time. Nowadays, various technology is used in the construction industry for various purposes.

Risks at construction sites include scaffold collapse, trench collapse, falls, repetitive motion injuries, a lack of adequate safety gear, and others. Construction IoT integration and smart wearables provide real-time site safety management, such as smart helmets, smart glasses, safety vests, wearable sensors, wearable hex-skeletons, and others. Additionally, active data monitoring using such wearable technology enables the measurement of heart rate and breathing rate and the active observation of a worker's body's reaction to a particular work environment.

Construction sites are connected via IoT-based solutions that use sensors, CCTV cameras, drones, and RFID tags. As a result, real-time statistics regarding inventories, workforce, and ongoing activities are now available. Among other advantages, sensors and RFID tags on materials enable efficient workflows, equipment servicing, prompt material ordering, monitoring of equipment usage, and preventative maintenance. Furthermore, to avoid delays & save time and money, efficient time management minimizes employee and equipment downtime on construction sites.

The majority of industry verticals and the world economy were significantly impacted by the COVID-19 pandemic. During the lockdown phase of the COVID-19 pandemic, the market for IoT in construction has been significantly impacted. Decreased sales of new construction robots, corresponding aftermarket services, and restrictions on building operations led to the decline. The COVID-19 pandemic profoundly affected the construction, industrial, hotel, and tourism industries. This led to a decline in the output of construction equipment, which impacted the market for IoT in construction.

The construction sector can benefit greatly from IoT. The advantages of the technology have already been established in the manufacturing, healthcare, automotive, and other sectors where systems management and automation are essential. With its multiple uses, loT has the ability to enhance security and boost output on building sites. Systems & devices that are connected to one another can be synced to a central server for easier monitoring. As a result, supervisors may accomplish their duties quickly and are notified of all the elements of a project. These benefits offered by IoT adoption in construction sector are supporting market growth.

Construction robotics is the practice of carrying out construction tasks automatically with the aid of construction robots or automated construction machinery. It is employed in tasks including constructing and destroying infrastructures for homes, businesses, and industries. Construction tasks now involve less or no human interaction due to construction robotics. Although robotics has been employed in the construction industry for some time, very few commercial robots are still being deployed there. As a result, the market share for IoT in construction is expected to increase as demand for robotics in construction rises.

In the construction industry, digitization is lesser than in other industries. The construction industry experiences low productivity due to a lack of digitization. Large-scale building projects frequently conclude later than originally planned and incur additional costs, reducing contractors' financial returns. Since most of the work is done on paper, there's not much coordination between the office and the field regarding project planning. This, in turn, leads to inefficient management of the supply chain. This disparity may present a problem for companies with a foothold in the market.

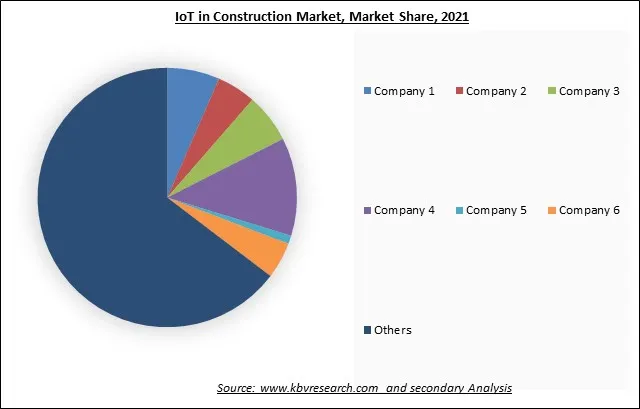

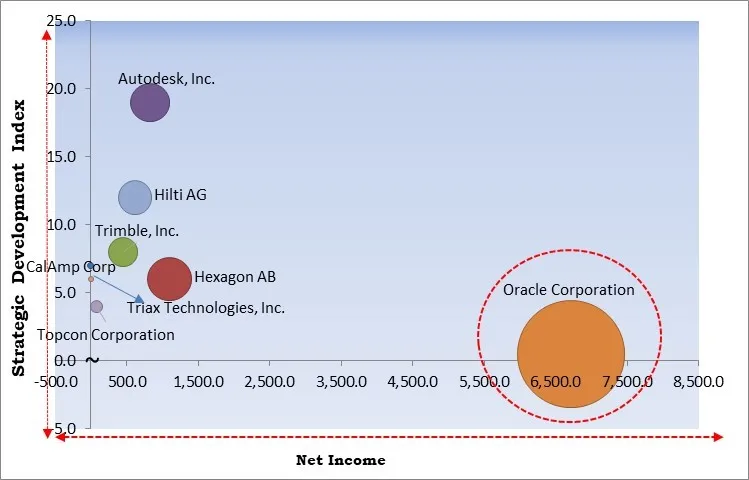

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Based on application, the IoT in construction market is segmented into asset monitoring, predictive maintenance, fleet management, wearables and others. The fleet management segment procured a promising growth rate in the IoT in construction market in 2022. Telematics, also referred to as fleet management, provides a range of solutions, such as driver behavior, vehicle tracking, fleet safety, fleet management, and economical driving. In addition, fleet management provides daily information about fleet operations, weak points, equipment downtimes, and upcoming tasks to minimize fuel consumption and maximize vehicle productivity.

On the basis of end-user, the IoT in construction market is classified into residential, and non-residential. In 2022, the non-residential segment witnessed the largest revenue share in the IoT in construction market. Hospitals, resorts, office complexes, and infrastructure projects are all included in non-residential construction. Large-scale commercial construction projects demand highly skilled planning, designing, and management of resources, personnel, staff, and equipment. IoT technology improves project productivity and decreases operational delays across various construction tasks.

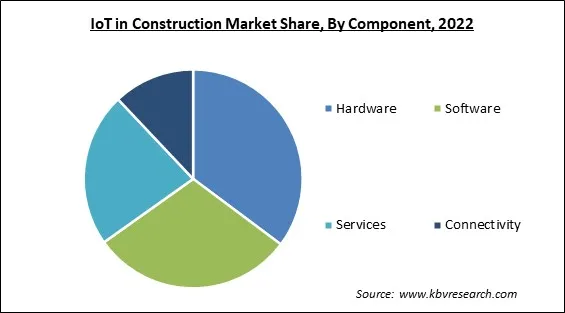

By component, the IoT in construction market is bifurcated into hardware, software, services and connectivity. The services segment acquired a substantial revenue share in the IoT in construction market in 2022. Implementing services such as retrofitting, routine maintenance, and personnel training preserves the equipment's efficiency and production, hence lowering unnecessary or unintended expenses. Recognizing these benefits may contribute to the expansion of services segment in the IoT in construction market.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 12.1 Billion |

| Market size forecast in 2029 | USD 30.2 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 14.1% from 2023 to 2029 |

| Number of Pages | 233 |

| Number of Table | 374 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the IoT in construction market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2022, the North America region led the IoT in construction market by generating the largest revenue share. It results from new technology's quick adoption on construction sites across Canada and the U.S. The high consumer spending on advanced technologies drives people to use IoT-connected devices. Although many companies have corporate headquarters in the United States, the cost of cutting-edge new technology is relatively affordable in this region. These factors support the regional IoT in construction market.

Free Valuable Insights: Global IoT in Construction Market size to reach USD 30.2 Billion by 2029

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Oracle Corporation is the major forerunner in the IoT in Construction Market. Companies such as Topcon Corporation, Autodesk, Inc., and Trimble, Inc. are some of the key innovators in IoT in Construction Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Autodesk, Inc., Advanced Opto-Mechanical Systems and Technologies Inc., CalAmp Corp, Hexagon AB, Hilti AG, Oracle Corporation, Topcon Corporation, Triax Technologies, Inc., Trimble, Inc., and Giatec Scientific Inc.

By End User

By Component

By Application

By Geography

The Market size is projected to reach USD 30.2 billion by 2029.

Rising adoption of construction robotics offering growth prospects are driving the Market in coming years, however, More dependence on conventional methods restraints the growth of the Market.

Autodesk, Inc., Advanced Opto-Mechanical Systems and Technologies Inc., CalAmp Corp, Hexagon AB, Hilti AG, Oracle Corporation, Topcon Corporation, Triax Technologies, Inc., Trimble, Inc., and Giatec Scientific Inc.

The Hardware segment is leading the Market by Component in 2022 thereby, achieving a market value of $10.1 billion by 2029.

The North America market dominated the Global IoT in Construction Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $10.2 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.