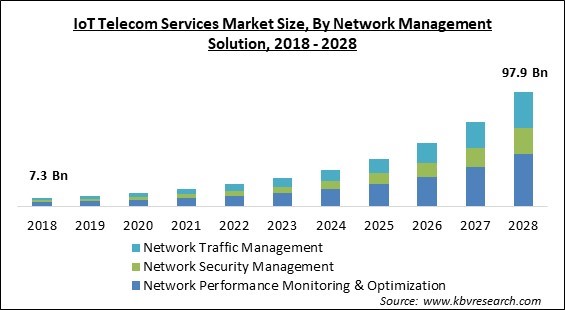

The Global IoT Telecom Services Market size is expected to reach $97.9 billion by 2028, rising at a market growth of 31.8% CAGR during the forecast period.

The Internet of Things is no longer a revolutionary concept; as a result of the digital revolution, these technologies have become commonplace and are constantly being improved and expanded. IoT offers numerous opportunities and benefits to telecom operators, thereby revolutionizing the telecom industry. It is anticipated that the Internet of Things will continue to alter the roles of telecommunications service providers in facilitating communication between humans and devices.

Consequently, telecommunications companies must develop new IoT solutions for their clients. The market for IoT telecom services has expanded significantly due to the widespread adoption of IoT devices and emerging technological developments. IoT platforms are utilized for an assortment of business objectives and use cases. Therefore, it is essential to implement novel, forward-thinking, and individualized strategies.

The deployment of IoT-based initiatives is now essential for telecom companies that want to start embracing the digital age, gain a significant competitive advantage, and take advantage of the opportunities that modern technology offers. With the use of Internet of things technology, the method of real-time data collection can be altered to improve performance, use fewer resources, and eliminate human factor errors. Additionally, increased speed and bandwidth are outcomes of the collaboration between telecom as well as IoT companies.

IoT protocols and 5G interconnection can broadcast information from thousands of devices to a large number of consumers without slowing communication speed or limiting capacity. The market for IoT telecom services is driven by these factors, which are anticipated to increase in the future. The growth of the IoT telecom services market is primarily driven by the increasing acceptance of technological advancement and innovation, as well as IoT-powered smart security cameras.

Customers will benefit from the changes made by telecommunications providers, as networking services are in greater demand than ever. Some nations are using data to monitor and control the spread of the virus. In recent years, the market for loT telecom services has expanded significantly, and this trend is anticipated to continue in the coming years. In addition, it is anticipated that loT will have a significant impact on the telecom industry. For example, during the pandemic, loT has been extremely beneficial for the telecom industry, from routers to mobile devices, to enable remote access. This not only reduced costs but also led to smart development.

As time has passed, there has been a rise in demand for improved connectivity as a result of technological development as well as expanding innovation. It is anticipated that this will accelerate IoT acceptance in the telecom sector and stimulate market growth. Along with the increase in telecommunications-related data volume, the demand for data-management-improving technology has also increased. Additionally, manufacturers emphasize the importance of IoT and wireless connectivity. In addition, the expansion of next-generation wireless networks due to the implementation of smart technologies and distributed applications are anticipated to provide growth opportunities for the telecom IoT market over the forecast period.

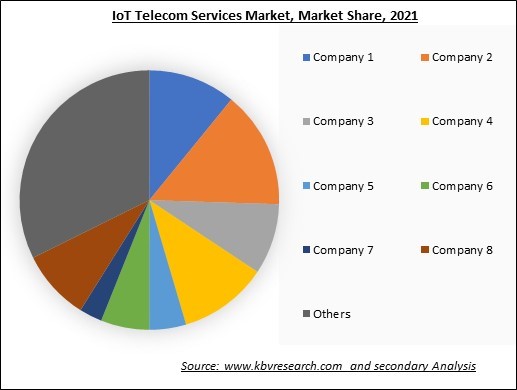

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Telecom companies can also utilize beacons and RFID badges to secure the perimeter and bar unauthorized access. Telecom companies can use this method to create a geofence for their IoT devices. A networked barrier can be constructed with the aid of a geofence installation. Building an IoT-enabled barrier that only allows authorized users to pass through has been made simpler with the help of a geofence. IoT deployment in telecom companies can therefore make it easier to develop security standards that are more effective.

Ownership of data and processes, access to and control over interoperability and communication, the ability to delete tags (tag clipping), and context-sensitive tag behaviour are three key technical safeguards for privacy. A technically competent solution is required to guarantee the security and privacy of customers who utilize different types of identification. This could be a complex security method that counters attacks by combining hardware security and key diversification. Projects that emulate smart networks can be based on existing cities and projects that do so. Therefore, it is projected that over the forecasting period, these privacy and security concerns will restrain the growth of the total IoT telecom services market.

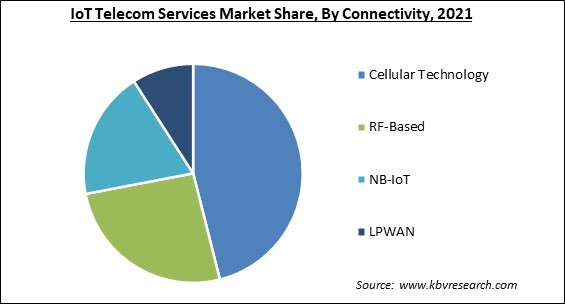

Based on connectivity, the IoT telecom services market is segmented into cellular technology, LPWAN, NB-IoT, and RF-based. In 2021, the LPWAN segment garnered a substantial revenue share in the IoT telecom service market. This is due to the widespread acceptance of the IoT telecom service market to strengthen LPWA Network (LPWAN) technologies, which offer a low-cost, low-power wireless option with global reach and robust security. In the telecom industry, machine-to-machine connections are crucial; for this, WiFi and GSM technologies are typically employed.

On the basis of network management solution, the IoT telecom services market is fragmented into network performance monitoring & optimization, network traffic management, and network security management. In 2021, the network security management segment acquired a significant revenue share in the IoT telecom services market. For effective network management, they utilize firewalls as well as other IoT-enabled security solutions to protect network data and resources. Network security management allows an administrator to manage a network with both physical & virtual firewalls from a central location.

By type, the IoT telecom services market is divided into business consulting services, installation & integration services, devices & application management solution, IoT billing & subscription management, and M2M billing management. The IoT billing & subscription management segment covered a considerable revenue share in the IoT telecom services market in 2021. Today's market is characterized by hybrid products, services, and business models. Many businesses that have not utilized recurring revenue models or subscription services in the past are now entering this market niche. Establish and manage subscription offers as well as pricing tiers, user billing, and management of cellular plans, as well as notifications and taxes.

On the basis of application, the IoT telecom services market is bifurcated into smart building & home automation, capillary network management, industrial manufacturing & automation, vehicle telematics, energy & utilities, and smart healthcare. In 2021, the vehicle telematics segment recorded a remarkable revenue share in the IoT telecom services market. Connected vehicles, autonomous driving, and the entire automotive infrastructure are key aspects of the Internet of Things as well as 5G mobile technologies. For cars to be fully autonomous, their surroundings must be equipped with sensors that send signals that can be interpreted in real-time to ensure safe and dependable driving.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 14.8 Billion |

| Market size forecast in 2028 | USD 97.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 31.8% from 2022 to 2028 |

| Number of Pages | 329 |

| Number of Tables | 503 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Network Management Solution, Type, Connectivity, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the IoT telecom services market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the North America region led the IoT telecom services market by generating the largest revenue share. This is a result of a rise in data security awareness among banks, insurance companies, and financial institutions, as well as an increase in the number of cyberattacks, which aids the expansion of the IoT telecom services market. In addition, the rising adoption of smart connected devices and technologies and the promotion of OTT applications by telcos are driving the expansion of IoT telecom services in this region.

Free Valuable Insights: Global IoT Telecom Services Market size to reach USD 97.9 Billion by 2028

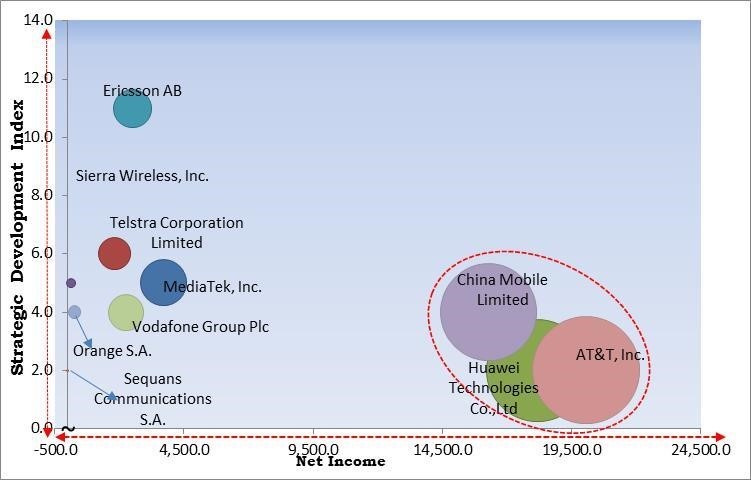

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; AT&T, Inc., China Mobile Limited and Huawei Technologies Co., Ltd are the forerunners in the IoT Telecom Services Market. Companies such as MediaTek, Inc., Vodafone Group Plc and Telstra Corporation Limited are some of the key innovators in IoT Telecom Services Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Orange S.A., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), AT&T, Inc., Vodafone Group Plc, MediaTek, Inc., Sequans Communications S.A., China Mobile Limited, Telstra Corporation Limited, Sierra Wireless, Inc. (Semtech Corporation), and Ericsson AB.

By Network Management Solution

By Type

By Connectivity

By Application

By Geography

The global IoT Telecom Services Market size is expected to reach $97.9 billion by 2028.

Technological development and innovation are driving the market in coming years, however, Issues related to privacy & security while IoT utilization restraints the growth of the market.

Orange S.A., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), AT&T, Inc., Vodafone Group Plc, MediaTek, Inc., Sequans Communications S.A., China Mobile Limited, Telstra Corporation Limited, Sierra Wireless, Inc. (Semtech Corporation), and Ericsson AB.

The expected CAGR of the IoT Telecom Services Market is 31.8% from 2022 to 2028.

The Network Performance Monitoring & Optimization segment acquired maximum revenue share in the Global IoT Telecom Services Market by Network Management Solution in 2021 thereby, achieving a market value of $45.1 billion by 2028.

The North America market dominated the Global IoT Telecom Services Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $35.3 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.