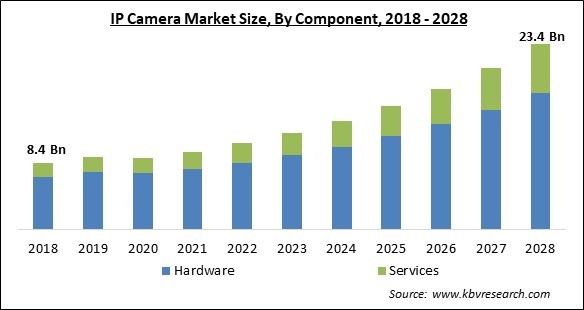

The Global IP Camera Market size is expected to reach $23.4 billion by 2028, rising at a market growth of 13.7% CAGR during the forecast period.

IP cameras are used in a variety of organisations to protect workers, assets, or information. These are also frequently used in both business and residential buildings. The electronics business is also being significantly impacted by the worldwide spread of COVID-19, which is changing customer preferences over time.

The variation in preferences, disposable income, and spending patterns has increased economic instability worldwide. In the market for internet protocol cameras, this has caused uncertainty on the demand side. The IP camera market is anticipated to grow at a high growth rate during the projected period.

The ongoing advancement of infrared cameras and the acceptance of IoT in video surveillance have increased the demand for IP camera systems. Residential security is one of the key concerns of homeowners due to an increase in squatting and home burglaries. The residential market is expected to increase strongly due to the growing number of smartphone users and the accessibility of installment-based security solution subscriptions.

Concerns about home security coupled with the availability of connected alert security services and cost-effective solutions are some of the key factors fueling the market growth. These cameras' built-in video intelligence enables users to respond faster to any intrusions inside premises, the abandonment of strange objects, and loitering and trespassing by people and vehicles.

The industry is anticipated to rebound when the situation gets better because IP cameras and different video analytics software will be installed for security purposes in public areas. Due to supply chain disruptions, the availability of raw materials has decreased, including the delivery of IP camera hardware systems. The closure of factories has slowed production and research & development. The drop in hardware sales income will result in reduced R&D spending in 2021.

Public safety is of top priority in the world. Public safety agencies are investing in numerous new technologies to ensure efficiency. This includes smart applications to securely connect radio networks to users carrying smartphones and other devices, video surveillance devices that can be worn to increase safety and accountability for officers and citizens as well as purpose-built mobile applications to improve the management of daily workflows.

Internet Protocol (IP) Surveillance is a digitalized and networked version of the CCTV system and is rapidly becoming the most flexible and future-proof option for security and surveillance systems. The IP Surveillance system is made up of two components, IP-based camera that records video content using a Network Video Recorder (NVR) and video surveillance platform that captures and distributes the video content through the network. IP cameras are preferred for large installation sites that already have a high bandwidth network installed.

As the telecommunication standards change, IP surveillance system should at par; else it would create hurdles in the widespread adoption of this system. Current IP cameras support IEEE 802.3 but the latest wireless standard is IEEE802.11n. IP cameras do not support this new standard of the wireless communication system. This is a major problem faced by IP surveillance system. End users find it difficult to tune the system to new standards on a regular basis.

Based on the Components, the market is segmented into hardware and services. Because manufacturers and service providers are responding to the market's desire for better solutions, the service segment is expected to experience the highest CAGR during the forecast period. To meet the increasing demand for IP camera systems on the market, the manufacturers are diversifying their product lines.

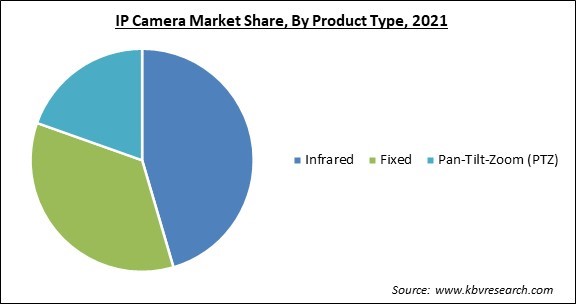

Based on the Product Type, the market is segmented into fixed, Pan-Tilt-Zoom (PTZ) and infrared. During the projection period, the Pan-Tilt-Zoom (PTZ) is anticipated to expand at a faster CAGR. PTZ enables the user to adjust the field of view as needed and can move between zero pan/tilt and 360-degree pan/180-degree tilt. To increase monitoring capabilities, PTZ cameras can be combined with stationary cameras.

Based on the Connection Type, the market is segmented into consolidated and distributed. Due to the fact that it uses a central management server that stores a master database, the consolidated product type is anticipated to garner the highest market share in 2021. For later access and analysis, the master database receives all configuration information for the cameras, NVRs, and DVRs that make up the system. It also receives all content. A distributed architecture also disperses the data throughout the system, typically close to where it is created or needed.

Based on the Application, the market is segmented into residential, commercial and government. In 2021, residential applications showcased a substantial revenue share in the market. The rise of the industry is also being driven by the growing use of IoT in smart homes. Customers are moving away from traditional CCTV cameras and toward deploying IP cameras with new cutting-edge features to increase the security of their properties. Numerous benefits of these cutting-edge smart home security cameras encourage their installation in many households.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 9.7 Billion |

| Market size forecast in 2028 | USD 23.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 13.7% from 2022 to 2028 |

| Number of Pages | 237 |

| Number of Tables | 422 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, Application, Component, Connection Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the IP Camera Market is analysed in North America, Europe, Asia Pacific, and LAMEA. In 2021, the market is expected to be dominated by the Asia Pacific region because of the region's growing network camera use and awareness. The region's market growth is also continuing to be boosted by the effects of government laws and investments. The sector that rules the world has a number of important component suppliers.

Free Valuable Insights: Global IP Camera Market size to reach USD 23.4 Billion by 2028

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Samsung Electronics Co., Ltd. is the major forerunner in the IP Camera Market. Companies such as Johnson Controls International PLC, Panasonic Corporation, Sony Corporation are some of the key innovators in IP Camera Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Avigilon Corporation (Motorola Solutions), Belkin International, Inc. (Hon Hai Precision Industry Co., Ltd.), Bosch Security Systems GmbH (Robert Bosch GmbH), D-Link Corporation, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International, Inc., Johnson Controls International PLC, Panasonic Corporation, Samsung Electronics Co., Ltd. (Samsung Group), and Sony Corporation.

By Product Type

By Application

By Component

By Connection Type

By Geography

The global IP Camera Market size is expected to reach $23.4 billion by 2028.

Rise In Need of Safety in High-Risk Areas are driving the market in coming years, however, Requisite Of High Bandwidth and Channel Partner Assistance & Association with Poe Switches restraints the growth of the market.

Avigilon Corporation (Motorola Solutions), Belkin International, Inc. (Hon Hai Precision Industry Co., Ltd.), Bosch Security Systems GmbH (Robert Bosch GmbH), D-Link Corporation, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International, Inc., Johnson Controls International PLC, Panasonic Corporation, Samsung Electronics Co., Ltd. (Samsung Group), and Sony Corporation.

The Infrared segment acquired maximum revenue share in the Global IP Camera Market by Product Type 2021 thereby, achieving a market value of $10.4 billion by 2028.

The Hardware segment is leading the Global IP Camera Market by Component 2021 thereby, achieving a market value of $17.3 billion by 2028.

The Asia Pacific market dominated the Global IP Camera Market by Region 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $8.6 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.