Japan 3D Imaging Market Size, Share & Trends Analysis Report By Component (Hardware (3D Display, 3D Camera, 3D Scanner, Others), Software, and Services), By Software Deployment Type (On-premise, and Cloud), Outlook and Forecast, 2023 - 2030

Published Date : 19-Mar-2024 |

Pages: 106 |

Formats: PDF |

COVID-19 Impact on the Japan 3D Imaging Market

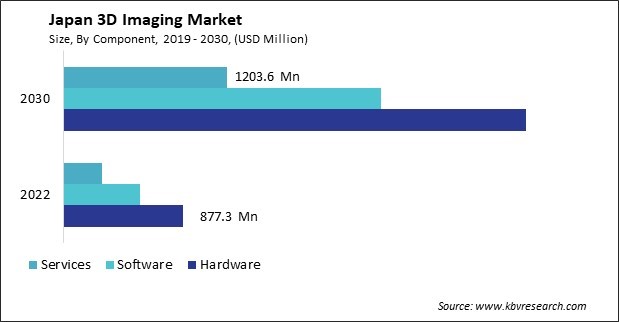

The Japan 3D Imaging Market size is expected to reach $7 billion by 2030, rising at a market growth of 19.3% CAGR during the forecast period.

The 3D imaging market in Japan has experienced substantial growth in recent years, fueled by advancements in technology and a robust industrial landscape. The architectural industry in Japan has leveraged 3D imaging for precise spatial mapping and visualization, aiding architects and urban planners in creating innovative and sustainable designs. This utilization extends to virtual walkthroughs, allowing stakeholders to experience proposed structures before construction, minimizing potential issues, and optimizing project outcomes.

The COVID-19 pandemic has accelerated the adoption of 3D imaging technologies in Japan. In the healthcare sector, 3D imaging has been instrumental in the development of diagnostic tools, vaccine research, and treatment planning for COVID-19 patients. The increased need for remote collaboration and virtual experiences during lockdowns has also driven demand in other sectors.

Furthermore, the educational landscape in Japan has witnessed a paradigm shift with the integration of 3D imaging technologies. Educational institutions have embraced immersive learning experiences, utilizing 3D imaging for interactive lessons and simulations. This approach not only enhances student engagement but also equips future workforce with essential skills in navigating and understanding complex spatial data.

Cultural preservation is another domain where Japan has harnessed 3D imaging to safeguard its rich heritage. Museums and historical sites have adopted these technologies for digitizing artifacts and architectural wonders, ensuring their preservation for future generations. The precision of 3D imaging allows for detailed documentation and restoration efforts, contributing to the conservation of Japan's cultural legacy.

Market Trends

Expansion Of the Manufacturing Industry

The expansion of the manufacturing industry in Japan has been significantly influenced by the integration of 3D imaging technologies, marking a transformative shift in production processes and product development. This evolution has been particularly pronounced in precision engineering, with Japanese manufacturers embracing 3D imaging for enhanced design, quality control, and efficiency.

Manufacturing firms in Japan have increasingly adopted 3D imaging to create intricate and detailed prototypes. Quality control in manufacturing has also witnessed a paradigm shift with the widespread adoption of 3D imaging technologies. Japanese companies utilize advanced 3D scanning techniques to meticulously inspect and analyze components, ensuring that each product meets stringent quality standards.

Japanese automakers leverage 3D imaging to design and test components, optimize vehicle safety, and streamline manufacturing processes. The integration of 3D imaging in automotive manufacturing has produced cutting-edge vehicles with advanced safety features, solidifying Japan's position as a global leader in automotive technology.

According to the International Trade Administration, Japanese manufacturing companies have demonstrated a substantial commitment to advancing their digital infrastructure, with an estimated expenditure of $890 million. This investment is projected to experience a remarkable surge, reaching an anticipated $4.1 billion by 2030. Concurrently, the manufacturing industry has played a pivotal role in Japan's economic landscape, contributing over 20% to the nation's GDP through value-added processes.

This robust growth in digital infrastructure investment aligns with a broader trend in expanding the manufacturing industry in the 3D imaging market within Japan. The substantial financial commitment made by these companies underscores a strategic focus on leveraging cutting-edge technologies to enhance and innovate manufacturing processes. Therefore, as Japan continues prioritizing technological advancements and digital transformation in manufacturing, the 3D imaging market is poised for sustained growth.

Efficiency in Product Development

Japan's 3D imaging market has witnessed a surge in technological advancements, and ensuring efficiency in product development has become paramount in this dynamic landscape. One key factor contributing to efficiency in 3D imaging product development in Japan is the robust collaboration between industry players, research institutions, and government bodies. The country's well-established network of technology clusters fosters synergies that accelerate the innovation process.

Additionally, Japan's strong focus on research and development (R&D) investment is pivotal in driving efficiency. Companies allocate significant resources to R&D, enabling them to stay ahead in a rapidly evolving industry. The emphasis on long-term strategic planning allows Japanese firms to anticipate industry trends and proactively develop products that meet or exceed customer expectations.

Moreover, the Japanese work ethic and commitment to perfection are pivotal in enhancing product development efficiency. Engineers and researchers adhere to strict quality standards, ensuring that products meet or exceed customer expectations. This dedication to excellence positions Japanese 3D imaging products as reliable and high performing globally.

Japan's culture of continuous improvement, encapsulated by the concept of "Kaizen," permeates the product development process. Companies prioritize incremental advancements in product features, functionality, and manufacturing processes. This dedication to refinement ensures that 3D imaging products are technologically advanced but also reliable and user-friendly. Thus, Japan's thriving 3D imaging market benefits from a collaborative ecosystem, strong R&D investment, and a culture of continuous improvement, positioning the country at the forefront of technological innovation.

Competition Analysis

Japan has been a hub of technological innovation, and the 3D imaging market is no exception. With a strong focus on precision engineering and cutting-edge technologies, several Japanese companies have played pivotal roles in shaping the 3D imaging landscape. Canon Inc., headquartered in Tokyo, is a prominent player in the Japanese 3D imaging market. Known for its imaging and optical products, Canon has ventured into 3D printing and scanning technologies. The company's range of 3D scanning solutions caters to various industries, including manufacturing and healthcare, providing high-precision imaging for intricate applications.

Based in Tokyo, Fujifilm Corporation has made significant strides in the medical imaging sector, particularly in 3D medical imaging. Fujifilm's advancements in medical diagnostic imaging, such as computed tomography (CT) and ultrasound, contribute to improved healthcare outcomes. The company's commitment to innovation positions it as a key player in Japan's 3D imaging market.

Sony Corporation has been a driving force in the gaming and entertainment industry. Headquartered in Tokyo, Sony has developed advanced 3D imaging technologies used in gaming consoles and virtual reality (VR) systems. The PlayStation VR, powered by Sony's 3D imaging solutions, offers immersive gaming experiences, showcasing the company's prowess in this field.

Keyence Corporation, based in Osaka, specializes in manufacturing automation and inspection equipment, including 3D imaging systems. The company's 3D measuring instruments are widely used in industrial settings for quality control and precision measurement, contributing to Japan's reputation for manufacturing excellence.

Ricoh Ltd., headquartered in Tokyo, is a diversified multinational company interested in imaging and electronics. Ricoh's 3D printing and imaging solutions cater to industries such as automotive and aerospace. Similarly, Shimadzu Corporation, based in Kyoto, is a leading analytical and measuring instrument manufacturer. The company's 3D X-ray imaging systems find applications in material science and non-destructive testing. Shimadzu's high-performance imaging technologies contribute to research and development across various scientific disciplines. The collaborative efforts of these companies in developing advanced 3D imaging solutions across various industries highlight Japan's commitment to technological innovation and its impact on shaping the global 3D imaging landscape.

List of Key Companies Profiled

- GE HealthCare Technologies, Inc.

- Autodesk, Inc.

- STMicroelectronics N.V.

- Panasonic Holdings Corporation

- Sony Corporation

- Trimble, Inc.

- Koninklijke Philips N.V.

- Dassault Systemes SE

- Adobe, Inc.

- Google LLC (Alphabet Inc.)

Japan 3D Imaging Market Report Segmentation

By Component

- Hardware

- 3D Display

- 3D Camera

- 3D Scanner

- Others

- Software

- Software Type

- 3D Modeling Software

- 3D Scanning Software

- 3D Layout & Animation Software

- 3D Visualization & Rendering Software

- Image Reconstruction Software

- Others

- Software Deployment Type

- On-premise

- Cloud

- Services

- Software Type

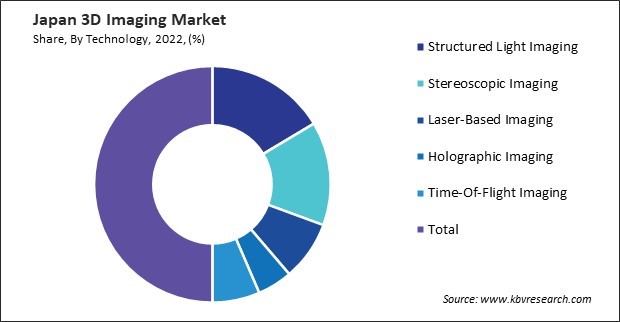

By Technology

- Structured Light Imaging

- Stereoscopic Imaging

- Laser-Based Imaging

- Holographic Imaging

- Time-Of-Flight Imaging

By Vertical

- Automotive

- Government & Defense

- Architecture & Construction

- Healthcare & Lifesciences

- Media & Entertainment

- Manufacturing

- Retail & eCommerce

- Aerospace & Defense

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Japan 3D Imaging Market, by Component

1.4.2 Japan 3D Imaging Market, by Technology

1.4.3 Japan 3D Imaging Market, by Vertical

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities

2.2.3 Market Restraints

2.2.4 Market Challenges

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Market Share Analysis, 2022

3.4 Top Winning Strategies

3.4.1 Key Leading Strategies: Percentage Distribution (2019-2023)

3.4.2 Key Strategic Move: (Product Launches and Product Expansions : 2020, Feb – 2023, Sep) Leading Players

3.5 Porter’s Five Forces Analysis

Chapter 4. Japan 3D Imaging Market

4.1 Japan 3D Imaging Market by Component

4.2 Japan 3D Imaging Market by Technology

4.3 Japan 3D Imaging Market by Vertical

Chapter 5. Company Profiles – Global Leaders

5.1 GE HealthCare Technologies, Inc.

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 Recent strategies and developments:

5.1.5.1 Partnerships, Collaborations, and Agreements:

5.1.6 SWOT Analysis

5.2 Autodesk, Inc.

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Regional Analysis

5.2.4 Research & Development Expenses

5.2.5 Recent strategies and developments:

5.2.5.1 Product Launches and Product Expansions:

5.2.6 SWOT Analysis

5.3 STMicroelectronics N.V.

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expense

5.3.5 Recent strategies and developments:

5.3.5.1 Partnerships, Collaborations, and Agreements:

5.3.6 SWOT Analysis

5.4 Panasonic Holdings Corporation

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expenses

5.4.5 Recent strategies and developments:

5.4.5.1 Product Launches and Product Expansions:

5.4.6 SWOT Analysis

5.5 Sony Corporation

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expenses

5.5.5 SWOT Analysis

5.6 Trimble, Inc.

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expenses

5.6.5 Recent strategies and developments:

5.6.5.1 Product Launches and Product Expansions:

5.6.6 SWOT Analysis

5.7 Koninklijke Philips N.V.

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expense

5.7.5 Recent strategies and developments:

5.7.5.1 Product Launches and Product Expansions:

5.7.6 SWOT Analysis

5.8 Dassault Systemes SE

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Product Category and Regional Analysis

5.8.4 Research & Development Expense

5.8.5 Recent strategies and developments:

5.8.5.1 Partnerships, Collaborations, and Agreements:

5.8.5.2 Product Launches and Product Expansions:

5.8.5.3 Acquisition and Mergers:

5.8.5.4 Geographical Expansions:

5.8.6 SWOT Analysis

5.9 Adobe, Inc.

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Segmental and Regional Analysis

5.9.4 Research & Development Expense

5.9.5 Recent strategies and developments:

5.9.5.1 Partnerships, Collaborations, and Agreements:

5.9.5.2 Product Launches and Product Expansions:

5.9.5.3 Acquisition and Mergers:

5.9.5.4 Geographical Expansions:

5.9.6 SWOT Analysis

5.10. Google LLC (Alphabet Inc.)

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Segmental and Regional Analysis

5.10.4 Research & Development Expense

5.10.5 Recent strategies and developments:

5.10.5.1 Product Launches and Product Expansions:

5.10.6 SWOT Analysis

TABLE 2 Japan 3D Imaging Market, 2023 - 2030, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– 3D Imaging Market

TABLE 4 Product Launches And Product Expansions– 3D Imaging Market

TABLE 5 Acquisition and Mergers– 3D Imaging Market

TABLE 6 Japan 3D Imaging Market by Component, 2019 - 2022, USD Million

TABLE 7 Japan 3D Imaging Market by Component, 2023 - 2030, USD Million

TABLE 8 Japan 3D Imaging Market by Hardware Component, 2019 - 2022, USD Million

TABLE 9 Japan 3D Imaging Market by Hardware Component, 2023 - 2030, USD Million

TABLE 10 Japan 3D Imaging Market by Software Type, 2019 - 2022, USD Million

TABLE 11 Japan 3D Imaging Market by Software Type, 2023 - 2030, USD Million

TABLE 12 Japan 3D Imaging Market by Software Deployment Type, 2019 - 2022, USD Million

TABLE 13 Japan 3D Imaging Market by Software Deployment Type, 2023 - 2030, USD Million

TABLE 14 Japan 3D Imaging Market by Technology, 2019 - 2022, USD Million

TABLE 15 Japan 3D Imaging Market by Technology, 2023 - 2030, USD Million

TABLE 16 Japan 3D Imaging Market by Vertical, 2019 - 2022, USD Million

TABLE 17 Japan 3D Imaging Market by Vertical, 2023 - 2030, USD Million

TABLE 18 Key Information – GE HealthCare Technologies, Inc.

TABLE 19 Key Information – Autodesk, Inc.

TABLE 20 Key Information – STMicroelectronics N.V.

TABLE 21 Key Information – Panasonic Holdings Corporation

TABLE 22 Key Information – Sony Corporation

TABLE 23 Key Information – Trimble, Inc.

TABLE 24 Key Information – Koninklijke Philips N.V.

TABLE 25 Key Information – Dassault Systemes SE

TABLE 26 Key Information – Adobe, Inc.

TABLE 27 Key Information – Google LLC

List of Figures

FIG 1 Methodology for the research

FIG 2 Japan 3D Imaging Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting 3D Imaging Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2022

FIG 6 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 7 Key Strategic Move: (Product Launches and Product Expansions : 2020, Feb – 2023, Sep) Leading Players

FIG 8 Porter’s Five Forces Analysis - 3D Imaging Market

FIG 9 Japan 3D Imaging Market Share by Hardware Component, 2022

FIG 10 Japan 3D Imaging Market Share by Hardware Component, 2030

FIG 11 Japan 3D Imaging Market by Component, 2019 - 2030, USD Million

FIG 12 Japan 3D Imaging Market Share by Technology, 2022

FIG 13 Japan 3D Imaging Market Share by Technology, 2030

FIG 14 Japan 3D Imaging Market by Technology, 2019 - 2030, USD Million

FIG 15 Japan 3D Imaging Market Share by Vertical, 2022

FIG 16 Japan 3D Imaging Market Share by Vertical, 2030

FIG 17 Japan 3D Imaging Market by Vertical, 2019 - 2030, USD Million

FIG 18 SWOT Analysis: GE HealthCare Technologies, Inc.

FIG 19 SWOT Analysis: Autodesk, Inc.

FIG 20 SWOT Analysis: STMicroelectronics N.V.

FIG 21 SWOT Analysis: Panasonic Holdings Corporation

FIG 22 SWOT Analysis: Sony Corporation

FIG 23 Swot Analysis: Trimble, Inc.,

FIG 24 SWOT Analysis: Koninklijke Philips N.V.

FIG 25 Recent strategies and developments: Dassault Systemes SE

FIG 26 SWOT Analysis: Dassault Systemes SE

FIG 27 Recent strategies and developments: Adobe, Inc.

FIG 28 SWOT Analysis: Adobe, Inc.

FIG 29 SWOT Analysis: Google LLC