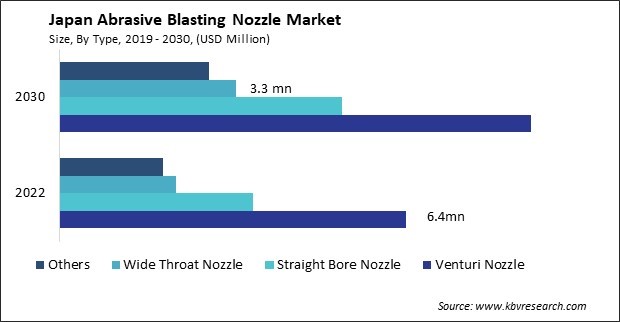

The Japan Abrasive Blasting Nozzle Market size is expected to reach 20 million by 2030, rising at a market growth of 4.6% CAGR during the forecast period.

The Japanese market for abrasive blasting nozzles is experiencing a dynamic environment characterized by fierce competition as firms endeavor to fulfill the changing demands of sectors prioritizing environmentally sustainable practices and precise manufacturing. With Japan's reputation as a global technology and innovation hub, the competition analysis in the abrasive blasting nozzle market sector reveals key trends and strategies driving industry players.

The interconnected global economy has facilitated the entry of international players into the Japanese abrasive blasting nozzle market, intensifying competition. Companies worldwide leverage their unique strengths, whether cost-effective manufacturing processes, established distribution networks, or specialized product offerings, to gain a foothold in the lucrative Japanese market. This globalization has prompted local manufacturers to enhance their competitiveness, fostering innovation and efficiency to maintain and expand their market share.

The push for environmental sustainability is a prominent competition driver in Japan's abrasive blasting nozzle market. With stringent environmental regulations and increasing awareness of eco-conscious practices, companies are racing to introduce nozzles that minimize abrasive material waste, reduce energy consumption, and utilize environmentally friendly materials. This green revolution within the industry addresses regulatory concerns and resonates with environmentally conscious consumers, adding an extra layer of competitiveness. Manufacturers positioning themselves as leaders in sustainable abrasive blasting solutions gain a distinct competitive advantage in a market where environmental considerations are increasingly pivotal.

Japanese manufacturers are exploring advanced materials that enhance the environmental sustainability of abrasive blasting nozzle markets. This includes materials with improved durability, wear resistance, and operational efficiency, all while minimizing adverse environmental effects. The goal is to extend the operational lifespan of nozzles, thereby reducing the need for frequent replacements and contributing to resource conservation.

Japan's rich maritime history and strategic geographical location have propelled its shipbuilding industry to a position of global prominence. With a robust infrastructure and skilled workforce, Japan has become a key player in constructing a wide range of vessels, from commercial ships to technologically advanced naval vessels. This extensive shipbuilding activity necessitates efficient and cutting-edge surface preparation tools for cleaning, coating, and corrosion control tasks, such as abrasive blasting nozzles.

Moreover, Japan's commitment to innovation and technological advancement has driven the shipbuilding sector's growth. The industry continually integrates state-of-the-art technologies to enhance productivity and produce vessels with superior performance. As a result, the demand for advanced abrasive blasting nozzles has surged, as these nozzles are crucial in achieving precise surface finishes, meeting stringent quality standards, and ensuring the durability of coatings in challenging marine environments.

Furthermore, the global demand for shipping, driven by international trade and commerce, has provided a continuous stream of orders for Japanese shipbuilders. This sustained demand for new vessels and the refurbishment of existing ones has bolstered the need for abrasive blasting equipment, including specialized nozzles, in shipyards across Japan. Therefore, the consistent demand for vessels, driven by international trade, has fueled the need for advanced abrasive blasting nozzle market, solidifying their integral role in maintaining high standards of surface preparation and coating durability in the Japanese shipbuilding industry.

Japan's abrasive blasting nozzle market is undergoing a significant transformation, marked by a discernible upsurge in demand driven by the imperative for precision manufacturing. The Japanese manufacturing ethos is at the forefront of this surge, renowned for its meticulous attention to detail and pursuit of excellence. As industries ranging from automotive to electronics and aerospace increasingly embrace precision manufacturing, the demand for advanced abrasive blasting nozzle market has surged. These nozzles, crucial components in abrasive blasting systems, play an important role in shaping and refining surfaces with unparalleled accuracy.

Moreover, the aerospace industry, with its rigorous standards for safety and performance, underscores the imperative for precision manufacturing. The demand for precise surface finishing is paramount, from turbine blades to structural components. When integrated into the manufacturing processes, abrasive blasting nozzles offer a solution that meets and exceeds the aerospace sector's stringent requirements. In the civil aircraft industry, Japanese manufacturers such as Mitsubishi Heavy Industries (MHI), Kawasaki Heavy Industries (KHI), and Subaru (former Fuji Heavy Industries) supply much of the content for the Boeing 787 and 21 percent of Boeing 777. Thus, the commercial aerospace business is influenced by the success of Boeing programs.

Similarly, the electronics industry, another cornerstone of Japan's economy, relies heavily on precision manufacturing to produce microchips, semiconductors, and electronic components. Export.gov states that the world's third-largest electronic sector mostly drives demand for semiconductor sales to Japan. From $36.6 billion in 2017 to 40.0 billion in 2018, the Japanese semiconductor sector expanded, according to the World Semiconductor Trade Statistics (WSTS). In 2020, the sector grew to up to $37.4 billion, according to WSTS, which also anticipates increased investment in data centers, the rollout of 5G services, and the growth of vehicle electronics. Hence, these nozzles play a critical role across sectors such as electronics and aerospace; their ability to deliver micron-level precision aligns with Japan's commitment to meticulous craftsmanship and technological excellence.

In Japan's abrasive blasting nozzle market, companies are crafting the future of surface preparation. Each entity, from established giants to newcomers, contributes to a dynamic technological prowess and sustainability canvas.

Sintokogio, Ltd. is a well-established Japanese company known for its expertise in developing and manufacturing foundry and surface treatment equipment. The company likely plays a significant role in Japan's broader surface treatment industry. The core business encompasses foundry equipment and surface treatment solutions, which include systems for shot blasting, sandblasting, and related processes. The company provides comprehensive solutions in the abrasive blasting nozzle market, including the machinery, systems, and technologies that support efficient and effective abrasive blasting operations.

Techno-Solutions Corporation is a Japanese company known for providing various solutions in surface treatment, including abrasive blasting. Given Japan's diverse automotive, electronics, and manufacturing industries, Techno-Solutions Corporation will likely offer customized abrasive blasting solutions. This involves tailoring equipment specifications, nozzle configurations, and system parameters to meet the unique requirements of different sectors. The ability to provide solutions adapted to specific industry needs contributes to the company's competitiveness in the Japanese abrasive blasting nozzle market.

By Type

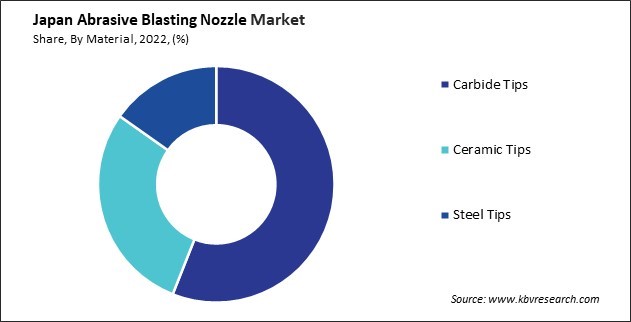

By Material

By Bore Size

By End-use

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.