Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 15-May-2024 |

Pages: 83 |

Formats: PDF |

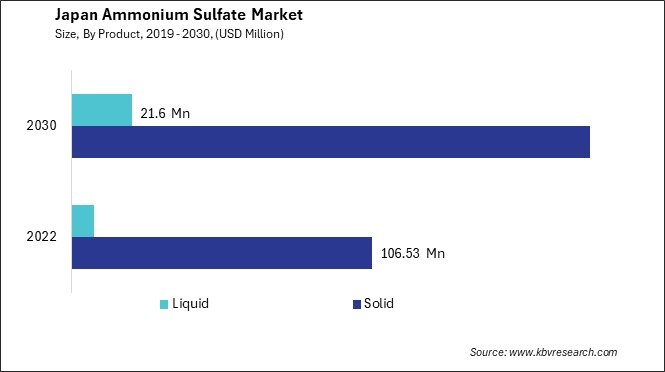

The Japan Ammonium Sulfate Market size is expected to reach $205.27 Million by 2030, rising at a market growth of 7.7% CAGR during the forecast period. In the year 2022, the market attained a volume of 656.14 Kilo Tonnes, experiencing a growth of 6.6% (2019-2022).

The ammonium sulfate market in Japan has witnessed steady growth over the years owing to its diverse applications across various industries such as agriculture, pharmaceuticals, food, and chemical manufacturing. In Japan, where agriculture is a significant sector of the economy, the demand for ammonium sulfate remains robust, driven by the need to enhance crop yields and improve soil fertility. One of the key factors propelling the growth of the ammonium sulfate market in Japan is the increasing adoption of advanced agricultural practices aimed at maximizing productivity.

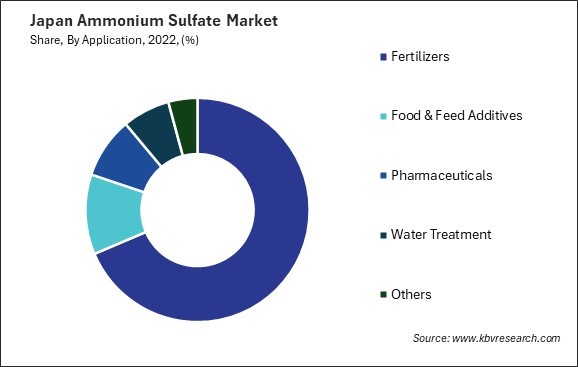

Furthermore, Japan's growing population and rising food demand necessitate using efficient fertilizers to meet the increasing agricultural output. With its high nitrogen content and compatibility with various soil types, ammonium sulfate emerges as a preferred choice among Japanese farmers seeking to optimize their crop production. Additionally, the versatility of ammonium sulfate extends its application beyond agriculture, finding usage in industrial processes such as water treatment, flame retardants, and pharmaceuticals, thereby augmenting its ammonium sulfate market growth in Japan.

The COVID-19 pandemic profoundly impacted the ammonium sulfate market in Japan, disrupting supply chains and causing fluctuations in demand dynamics. The stringent lockdown measures and transportation disruptions significantly affected the distribution channels, leading to temporary disruptions in the availability of ammonium sulfate. Moreover, the economic uncertainties stemming from the pandemic prompted farmers to reevaluate their spending patterns, leading to a temporary slowdown in fertilizer purchases.

However, amidst the challenges posed by the pandemic, the agriculture sector emerged as a resilient industry, with governments implementing various measures to ensure continuity in agricultural activities. In Japan, policymakers rolled out support schemes and subsidies to aid farmers in mitigating the adverse effects of the pandemic, thereby sustaining the demand for fertilizers like ammonium sulfate.

The Japanese agricultural sector has been experiencing a notable increase in the adoption of fertilizers, particularly in the ammonium sulfate market. One significant factor contributing to Japan's rising adoption of fertilizers like ammonium sulfate is the intensification of agricultural production. With a growing population and limited arable land, Japanese farmers are pressured to maximize yields from existing agricultural areas. As a result, there is a heightened focus on improving soil fertility and crop productivity through applying fertilizers.

According to the International Trade Administration, in 2020, Japan imported $671 million worth of fertilizers. Fertilizer is a key component in supporting small-scale farms. As agricultural practices evolve and demand for high-quality produce rises, there has been a noticeable uptick in the adoption of fertilizers, notably in the ammonium sulfate market in Japan. This trend reflects a growing recognition among farmers of the benefits of using fertilizers to improve yields and ensure sustainable agricultural practices for the future.

Furthermore, advancements in agricultural technology and practices have facilitated the precise application of fertilizers, minimizing waste and environmental impact. Techniques such as soil testing and nutrient management planning allow farmers in Japan to tailor fertilizer applications to the specific requirements of their crops and soil conditions, optimizing resource use and reducing the risk of nutrient runoff.

Moreover, increasing awareness among Japanese farmers about the importance of soil health and nutrient balance has led to a greater appreciation for the role of fertilizers in sustainable agriculture. Hence, the combination of intensifying agricultural production, advancements in technology, and heightened awareness of sustainable practices has fueled the notable increase in the adoption of fertilizers, particularly ammonium sulfate, within Japan's agricultural sector.

In recent years, Japan has witnessed a notable surge in adopting sustainable agriculture practices, particularly within the ammonium sulfate market. One of the key drivers behind the growing demand for sustainable agriculture practices in Japan's ammonium sulfate market is the increasing recognition of the negative environmental impacts associated with conventional farming techniques. Traditional agricultural practices rely heavily on synthetic fertilizers, such as ammonium sulfate, contributing to soil erosion, water pollution, and greenhouse gas emissions.

Moreover, the Japanese government has implemented various policies and initiatives aimed at promoting sustainable agriculture and reducing the reliance on chemical inputs. These include incentives for Japanese farmers to adopt organic farming practices, subsidies for developing and implementing environmentally friendly technologies, and stricter regulations on synthetic fertilizers and pesticides.

Furthermore, consumer demand for sustainably produced food products has also played a significant role in adopting sustainable agriculture practices in Japan. As consumers become increasingly aware of the environmental and health implications of conventional farming methods, there is growing pressure on food producers and retailers to prioritize sustainability throughout the supply chain. Thus, the surge in sustainable agriculture practices in Japan's ammonium sulfate market is driven by environmental awareness, government initiatives, and consumer demand for eco-friendly food production.

The ammonium sulfate market in Japan is a significant segment within the country's chemical industry, catering to diverse agricultural and industrial needs. One prominent player in the Japanese ammonium sulfate market is Toray Industries, Inc., a diversified multinational corporation with interests in chemicals, textiles, and advanced materials. Toray Industries supplies chemical products, including ammonium sulfate, to domestic and international industries. Leveraging its technological expertise and strong research capabilities, Toray Industries ensures high-quality products that meet the stringent standards of the Japanese ammonium sulfate market.

Another major participant in the Japanese ammonium sulfate market is Mitsubishi Chemical Corporation, one of the largest chemical companies in the country. Mitsubishi Chemical Corporation manufactures various chemical products, including fertilizers and industrial chemicals like ammonium sulfate. With a focus on sustainability and innovation, the company continuously invests in research and development to enhance product quality and efficiency.

Sumitomo Chemical Co., Ltd. is also a significant player in the Japanese ammonium sulfate market. As one of Japan's leading chemical companies, Sumitomo Chemical produces various fertilizers and agricultural chemicals, including ammonium sulfate. With a strong emphasis on agricultural solutions and environmental sustainability, Sumitomo Chemical contributes to the productivity and efficiency of Japan's agriculture sector through its high-quality products.

Furthermore, Mitsui Chemicals, Inc., a global chemical company with operations in various sectors, including agriculture and fertilizers, is actively involved in the Japanese ammonium sulfate market. Mitsui Chemicals produces ammonium sulfate as part of its portfolio of fertilizers and agrochemicals, catering to the needs of Japanese farmers and agricultural businesses.

Additionally, Nippon Carbide Industries Co., Inc. (NCI), a subsidiary of JXTG Holdings, Inc., is a notable player in the Japanese ammonium sulfate market. NCI specializes in producing various chemical products, including fertilizers and industrial chemicals like ammonium sulfate. With a focus on quality and reliability, NCI ensures consistent supply to meet the demands of its customers in Japan and beyond. With a focus on innovation, sustainability, and customer satisfaction, these companies play a crucial role in meeting the evolving needs of Japan's economy and society.

By Product

By Application