Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 14-Feb-2024 |

Pages: 83 |

Formats: PDF |

The Japan Audience Analytics Market size is expected to reach $583.7 Million by 2030, rising at a market growth of 12.2% CAGR during the forecast period.

The audience analytics market in Japan focuses on understanding and meeting the demands of a tech-savvy and discerning audience; businesses across various sectors are increasingly turning to audience analytics to gain a competitive edge. Japan's digital ecosystem is experiencing a substantial shift characterized by a burgeoning demand for personalized content. Businesses recognize the significance of audience analytics in delivering tailored experiences to meet individual preferences. The media and entertainment industry is witnessing a paradigm shift, with companies leveraging analytics to curate content that resonates with specific audience segments. This emphasis on personalization extends to traditional media, where broadcasters integrate analytics insights to align programming with viewer preferences.

In tandem with the demand for personalized content, there is a strong focus on competitive intelligence within Japan's audience analytics market. The diverse landscape features established industry giants, innovative startups, and active telecom players, each leveraging analytics to redefine their industry presence. The regulatory environment in Japan plays a crucial role in shaping the trajectory of the audience analytics market. The industry's response to evolving regulatory frameworks reflects a commitment to ethical data practices and responsible use of audience analytics.

In Japan, the healthcare industry is increasingly leveraging audience analytics to enhance patient care, optimize operational processes, and improve overall health outcomes. Audience analytics in healthcare involves understanding patient behaviors, preferences, and engagement patterns, enabling providers to tailor services for a more personalized and effective approach.

According to the International Trade Administration, the Fuji Chimera Research Institute's "IoMT New Market Outlook" report for 2021 revealed promising growth prospects in Japan's telemedicine and healthcare IT sectors. The telemedicine industry is expected to rise from USD 243 million in 2020 to USD 404.5 million by 2025, focusing on operational efficiency and solving the shortage of medical specialists. The healthcare IT industry, particularly wearable devices and online monitoring services, is anticipated to reach 16 billion by 2025, focusing on smartwear solutions gathering biometric data for enhanced patient care. Additionally, Japan's Healthtech segment, encompassing areas like sleep tech and baby tech, is set to reach USD 2 billion by 2025, emphasizing advancements in sleep improvement services and innovative applications and devices for infant care. This comprehensive growth signifies a significant expansion driven by technological integration and major IT vendors and health management companies entering the healthcare industry.

In Japan's rapidly evolving audience analytics market, there is a discernible and substantial surge in the demand for personalized content. As the digital ecosystem continues to expand, businesses across various sectors, including media, entertainment, e-commerce, and beyond, recognize audience analytics’ critical role in delivering tailored and highly personalized experiences to their target audiences.

Japanese consumers, known for their discerning tastes and preferences, are increasingly expecting content and services that align with their needs. This shift in consumer behavior has catalyzed a heightened emphasis on understanding and anticipating user preferences through robust audience analytics solutions. Businesses are investing significantly in advanced analytics tools and technologies that enable them to glean insights into user behavior, engagement patterns, and content consumption habits.

E-commerce platforms in Japan are also capitalizing on the demand for personalized content. By analyzing user data, these platforms provide tailor-made product recommendations, optimize the online shopping journey, and enhance overall user satisfaction. The integration of audience analytics in the e-commerce sector goes beyond transactional data, delving into user preferences, purchase history, and behavioral insights.

This surge in demand for personalized content is not only limited to digital platforms but extends to traditional media. Japanese companies are exploring ways to integrate analytics insights into their broadcast strategies, ensuring that television programming aligns with viewer preferences and trends. Moreover, businesses are recognizing that personalization goes beyond content recommendations; it encompasses the entire user experience. From website interfaces to mobile applications, companies leverage audience analytics to create user-centric designs that enhance accessibility and engagement. Hence, the burgeoning demand for personalized content in Japan's audience analytics market reflects a strategic imperative across diverse sectors to meet the discerning expectations of consumers.

Audience analytics in Japan and localized influencer marketing have emerged as strategic imperatives, blending cultural insights and data-driven precision to engage diverse regional audiences effectively. Leveraging audience analytics, businesses delve into the intricacies of Japanese consumer preferences, demographics, and cultural nuances, allowing them to segment and analyze localized audiences. By employing these insights, companies can pinpoint influencers whose personal brand aligns seamlessly with specific regions, ensuring authenticity and resonance with local communities' unique tastes and interests.

The power of audience analytics in localized influencer marketing extends beyond selection to the strategic adaptation of content and campaigns. Analyzing real-time performance metrics, businesses can assess the impact of influencer collaborations in specific regions, adjusting content strategies to align with localized trends and preferences. This approach builds trust by addressing regional sentiments and enables businesses to navigate crises effectively, as sentiment analysis helps gauge the impact of influencer content during unforeseen events. In essence, localized influencer marketing, guided by audience analytics in Japan, becomes a dynamic fusion of cultural understanding and data-driven precision, enhancing the authenticity and effectiveness of engagements with diverse audiences across the Japanese industry.

In Japan's burgeoning audience analytics market, intense competition prevails as companies vie for dominance in this rapidly evolving landscape. The industry is characterized by a diverse mix of established industry leaders, innovative startups, and active telecom players, each striving to carve out a significant niche in this competitive arena.

Global technology giants such as Sony, NEC Corporation, and Fujitsu are pivotal players, leveraging their extensive resources and technological prowess to offer comprehensive audience analytics solutions. With their historical footprint and innovative offerings, these industry titans set the benchmark for technological advancement and client engagement, solidifying their positions as dominant forces shaping the industry.

Complementing these established players are a plethora of innovative startups injecting fresh perspectives and agility into Japan's audience analytics landscape. Companies like Vaizle, Uncover Truth, and Repro exemplify this trend, providing agile and adaptive analytics tools tailored to specific industry needs. These startups contribute to a culture of continuous innovation, challenging traditional models and fostering a dynamic environment.

The telecom sector, represented by industry giants like NTT Docomo and SoftBank, is not merely a consumer but an active contributor to audience analytics solutions. These telecom companies leverage their vast datasets to develop in-house analytics capabilities, enhancing their understanding of user behavior and solidifying their roles as key players influencing industry dynamics.

Consulting and technology services firms, including Accenture and NRI, play a crucial role in the competition by providing services ranging from strategic advice on analytics to implementing and customizing solutions. Their expertise in system integration positions them as valuable partners for businesses navigating the complex landscape of audience analytics in Japan.

Cloud service providers like Microsoft Azure, AWS, and Google Cloud Platform are integral components, offering scalable and flexible solutions to address the growing demand for real-time analytics. Beyond providing tools, these providers contribute by offering scalable infrastructure for efficient data processing, further fueling the competitive ecosystem.

By Component

By Application

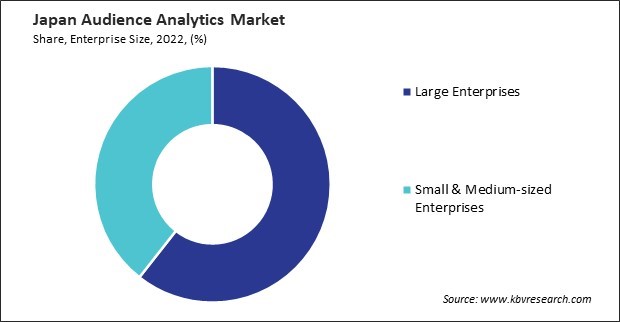

By Enterprise Size

By Vertical