Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 15-May-2024 |

Pages: 92 |

Formats: PDF |

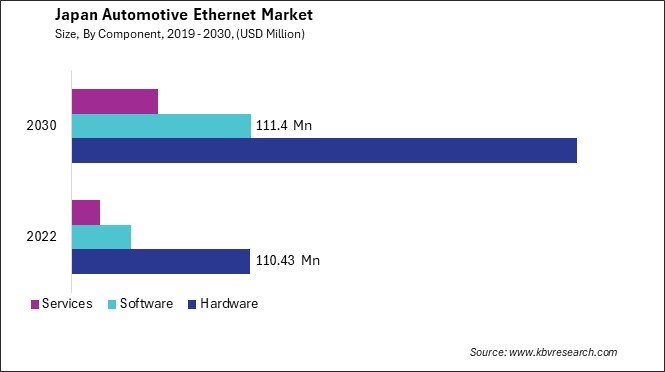

The Japan Automotive Ethernet Market size is expected to reach $478.41 Million by 2030, rising at a market growth of 14.0% CAGR during the forecast period.

The automotive ethernet market in Japan is experiencing robust growth, propelled by several factors. The proliferation of connected features in vehicles, such as infotainment systems, telematics, and in-car communication networks, necessitates a robust and high-speed data backbone in Japan. Additionally, the shift towards electrification and the rise of electric vehicles (EVs) have fueled the demand for ethernet technology in the automotive sector. EVs feature sophisticated battery management systems, powertrain controls, and charging infrastructure, all of which rely on efficient communication networks for optimal performance and safety.

In Japan, automotive manufacturers and suppliers are actively investing in research and development to enhance ethernet-based solutions tailored to the unique requirements of the automotive industry. Collaborations between automakers, semiconductor companies, and networking specialists drive innovation in ethernet technology, leading to the development of advanced communication protocols, network architectures, and components optimized for automotive applications.

Furthermore, the Japanese government's initiatives to promote next-generation mobility solutions and intelligent transportation systems have provided additional impetus to the automotive ethernet market. Through funding programs, regulatory support, and industry partnerships, Japan aims to accelerate the adoption of ethernet technology in vehicles, thereby enhancing road safety, efficiency, and environmental sustainability.

The COVID-19 pandemic has significantly impacted the automotive industry worldwide, including the automotive ethernet market in Japan. The pandemic disrupted global supply chains, causing production slowdowns and delays in vehicle manufacturing. However, the pandemic also accelerated certain trends within the automotive industry, such as the shift towards remote work and digital connectivity. With more people working from home and relying on digital services, the demand for connected vehicles and in-car entertainment systems surged. This increased demand for advanced connectivity solutions, including automotive ethernet, helped mitigate the negative impact of the pandemic on the automotive ethernet market.

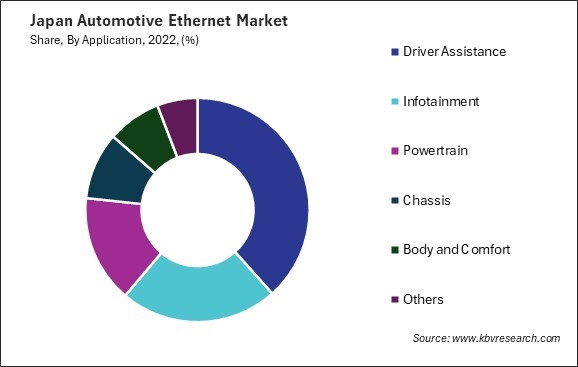

The automotive industry in Japan is witnessing a significant surge in demand for advanced driver assistance systems (ADAS), particularly within the realm of automotive ethernet. As vehicles become increasingly interconnected and autonomous, the need for robust and high-speed communication networks within vehicles has become paramount. One of the primary drivers behind the rising demand for ADAS in the automotive ethernet market in Japan is the country's commitment to technological innovation and safety.

Japan has long been at the forefront of automotive engineering, with companies such as Toyota, Honda, and Nissan leading in developing cutting-edge vehicle technologies. With an aging population and a strong emphasis on road safety, there is a growing imperative to integrate ADAS into vehicles to mitigate accidents and improve overall road safety. Furthermore, the Japanese government's initiatives to promote the adoption of electric and autonomous vehicles through subsidies and incentives have created a favorable environment for the growth of ADAS and automotive ethernet technologies.

Moreover, the proliferation of electric vehicles (EVs) and autonomous driving technologies has fueled the adoption of ADAS and automotive ethernet in Japan. EVs and autonomous vehicles rely heavily on sophisticated sensor arrays and communication networks to operate efficiently and safely. As such, there is a growing need for high-bandwidth communication protocols like ethernet to facilitate real-time data exchange between various vehicle components and systems.

According to the Japan Automobile Dealers Association (JADA), sales of new electric vehicles in 2020 reached close to 1.4 million. New electric vehicles accounted for 36.2% of total new car sales, up from 35.2% in 2019 and 32.9% in 2017. The robust demand for hybrid electric vehicles (HEVs) in Japan has been evident since the introduction of the Toyota Prius in 1997, with HEVs claiming a staggering 97.8% share of the new electric vehicles sold in 2020.

This trend mirrors the growing demand for advanced driver assistance systems (ADAS) in the automotive ethernet market in Japan. Thus, Japan's commitment to technological innovation and safety and its growing adoption of electric and autonomous vehicles are driving the surge in demand for advanced driver assistance systems (ADAS) and automotive ethernet in the automotive industry.

The automotive ethernet network has experienced significant growth in Japan, paralleling the global trend towards advanced automotive connectivity solutions. The increasing complexity of automotive systems and the demand for higher data bandwidth have propelled the transition from traditional communication protocols to ethernet-based networks. With the rise of advanced driver-assistance systems (ADAS), autonomous driving technologies, and in-vehicle infotainment systems, vehicles need robust and high-speed data transmission.

Japan's automotive industry, renowned for its innovation and technological prowess, has embraced ethernet as a standard communication protocol. Major Japanese automotive manufacturers and suppliers have been actively involved in developing ethernet-based networking solutions tailored to the specific requirements of the automotive sector. This collaborative effort has facilitated the integration of ethernet technology into vehicles manufactured in Japan.

Additionally, the cost-effectiveness of ethernet solutions compared to traditional wiring harnesses and proprietary communication protocols has made them increasingly attractive to automakers seeking to optimize production costs without compromising performance or reliability. The automotive ethernet market in Japan is poised for continued expansion as automotive manufacturers increasingly incorporate ethernet technology into their vehicles to meet the evolving demands of consumers for connectivity, safety, and convenience features. Hence, Japan's automotive industry is embracing ethernet technology to meet the demands of advanced automotive connectivity, driven by the rise of ADAS and autonomous driving.

In Japan, the automotive industry has been a crucial player in the global industry for decades. As the automotive landscape evolves, integrating ethernet technology into vehicles has become increasingly important. Several companies in Japan have been at the forefront of developing the automotive ethernet market, catering to the evolving needs of the automotive industry.

Toyota Motor Corporation, one of Japan's most prominent automotive manufacturers, has been actively involved in developing and implementing automotive ethernet technology. Recognizing the importance of connectivity in modern vehicles, Toyota has been integrating ethernet networks to support various advanced features. Through collaborations with technology partners and continuous research efforts, Toyota aims to enhance automotive ethernet systems' performance, reliability, and security.

Another major player in the Japanese automotive industry, Honda Motor Co., has also been investing in the automotive ethernet market. Honda's focus on innovation and cutting-edge technology is reflected in its efforts to incorporate ethernet networks into its vehicles. By leveraging ethernet's high-speed capabilities, Honda aims to improve the efficiency of vehicle communication systems, enabling seamless connectivity and advanced functionalities.

Nissan Motor Corporation, known for its pioneering electric vehicle technologies, has been exploring the potential of automotive ethernet in its vehicles. With a strong emphasis on connectivity and smart mobility solutions, Nissan is working towards integrating ethernet networks to support next-generation automotive applications. By harnessing ethernet technology, Nissan aims to enhance the performance, safety, and convenience features of its vehicles, catering to the evolving needs of consumers.

Furthermore, Denso Corporation, a leading supplier of automotive components and systems, has been instrumental in developing automotive ethernet solutions. Denso's expertise in automotive electronics and networking technologies positions it as a key player in advancing vehicle ethernet connectivity. Through collaborations with automakers and technology partners, Denso aims to drive innovation in automotive ethernet systems, supporting the integration of advanced vehicle features and services. These companies are driving innovation and pushing the boundaries of technology to enhance vehicle connectivity, functionality, and safety. Through continuous research, development, and collaboration, they aim to shape the future of the automotive industry, offering cutting-edge solutions that cater to the evolving needs of consumers and society.

By Vehicle Type

By Component

By Application