Int'l : +1(646) 832-2886 | query@kbvresearch.com

Int'l : +1(646) 832-2886 | query@kbvresearch.com

Published Date : 19-Apr-2024 |

Pages: 83 |

Formats: PDF |

The Japan Bakery Premixes Market size is expected to reach $32 Million by 2030, rising at a market growth of 5.8% CAGR during the forecast period.

The bakery premixes market in Japan has witnessed significant growth in recent years, driven by evolving consumer preferences, urbanization, and a growing inclination towards convenience. One of the key factors contributing to the growth of the bakery premixes market in Japan is the rising demand for time-saving solutions. As the pace of life accelerates in urban areas, consumers increasingly seek convenient options that enable them to enjoy freshly baked goods without the extensive preparation time. Bakery premixes cater to this need by providing a hassle-free and efficient way to create a variety of baked goods.

Manufacturers focus on creating premixes that align with traditional Japanese flavors and textures. This includes matcha-flavored cake mixes, red bean paste-filled buns, and other products that resonate with local tastes. The integration of traditional ingredients into premixes not only appeals to the sense of nostalgia but also attracts consumers who value authenticity in their culinary experiences.

In Japan, where gift-giving holds cultural significance, bakery premixes have found a niche industry. Specially packaged and aesthetically pleasing premixes are popular choices for gifting, reflecting the Japanese value of presenting thoughtfully curated items. This trend is particularly notable during festive seasons and special occasions when the exchange of gifts is common. Manufacturers also incorporate functional ingredients, such as whole grains, seeds, and plant-based options, to meet the rising demand for healthier baked goods.

The bakery premixes market in Japan has witnessed a significant surge in popularity, largely attributed to the growing influence of online sales channels. In recent years, Japanese consumers have experienced a notable shift towards digital platforms for purchasing various goods, and bakery premixes have not been an exception to this trend. One key factor driving the increasing preference for online sales channels is convenience.

Japanese shoppers are known for their meticulous approach to product selection, and online channels facilitate this by offering comprehensive details about ingredients, nutritional content, and usage instructions. This transparency helps consumers make informed decisions and fosters a sense of confidence in the quality of the bakery premixes. The fast-paced nature of modern life in Japan has amplified the appeal of online shopping for bakery premixes.

Continuous innovation in the e-commerce sector has contributed to the popularity of online sales channels in Japan. Advanced features such as personalized recommendations, secure payment gateways, and efficient delivery logistics enhance the online shopping experience for Japanese consumers. Consumers appreciate the convenience of browsing and purchasing products without the constraints of physical store hours.

According to the International Trade Administration, e-commerce sales of goods in Japan grew by 8.6% in 2021, surpassing the figures from the preceding year and reaching an estimated total industry value of USD 188.1 billion. This surge is even more pronounced compared to 2019, showcasing an impressive 32.2% increase in the sales of goods. This data underscores the increasing prominence of online platforms as preferred avenues for purchasing bakery premixes, reflecting a significant shift in consumer behavior. Thus, the bakery premixes market in Japan has experienced a substantial uptick in popularity, driven by the convenience and transparency offered through online sales channels.

In recent years, Japan has witnessed a notable surge in home baking enthusiasts, contributing to the flourishing bakery premixes market in the country. This trend is driven by cultural, social, and economic factors that have increased interest in home-based culinary activities, particularly baking. One of the key drivers behind the increased adoption of bakery premixes is the desire for convenience without compromising on quality. Japanese consumers, known for their busy lifestyles, are turning to premixes as a time-saving solution that allows them to indulge in the joy of baking without the need for extensive preparation.

Japan has a rich culinary heritage, and baking has found renewed popularity among individuals seeking to explore and express their creativity in the kitchen. The availability of a wide range of premix options in Japan, from cake and bread mixes to pastry and pancake mixes, caters to diverse preferences, making it easier for individuals to experiment with different recipes in the comfort of their homes.

Visually captivating images and engaging content on platforms like Instagram and YouTube have popularized baking trends and fostered a sense of community among enthusiasts. Sharing baking experiences and recipes has become a cultural phenomenon, inspiring more people to join the home baking movement. Hence, the surge in home baking enthusiasts in Japan is fueled by a blend of cultural appreciation, time-saving convenience, and the communal influence of social media, propelling the flourishing bakery premixes market and fostering a dynamic culinary community.

Japan's bakery premixes market has experienced notable growth, reflecting the nation's rich culinary culture and the increasing demand for convenient yet high-quality baked goods. Several companies have emerged as key players, contributing to the evolution of this industry by offering a diverse array of premix products tailored to Japanese tastes and preferences.

Nisshin Seifun Group is a major player in the Japanese bakery premixes market. With a history dating back to 1900, the company has a deep-rooted presence in the food industry. Nisshin Seifun Group's expertise in flour milling and food processing extends to its bakery premix offerings, which cater to Japanese baked goods' traditional flavors and styles. The company's commitment to quality and innovation has positioned it as a leader in the Japanese industry.

Another influential participant is Yamazaki Baking Co., Ltd., a well-established bakery and food company in Japan. With a focus on providing delicious and high-quality baked products, Yamazaki Baking has ventured into the bakery premixes segment. The company leverages its understanding of local preferences to offer premix solutions that align with traditional Japanese bakery items.

Nagase & Co., Ltd. is a diversified chemical trading company that has made significant inroads into the Japanese bakery premixes market. The brand collaborates with international suppliers to bring innovative premix solutions to Japanese bakers. The company's approach involves adapting global trends to suit local tastes, ensuring that its premix products resonate with the unique flavor profiles preferred by Japanese consumers.

In recent years, there has been a rise in the popularity of health-conscious and organic bakery products in Japan, and Fuji Oil Co., Ltd. has capitalized on this trend. The brand offers premixes that align with the demand for clean-label and natural ingredient options. The company's commitment to sustainability and health-focused baking solutions has resonated well with Japanese consumers seeking healthier alternatives.

Shimanto Shokuhin Co., Ltd. is a notable regional player contributing to the Japanese bakery premixes market. The company focuses on supplying premix solutions to local bakeries, ensuring its products are well-suited to regional culinary preferences. Shimanto Shokuhin's emphasis on supporting local businesses has helped it carve a niche in the competitive Japanese industry. Thus, the Japanese bakery premixes market is marked by established companies with deep roots in the nation's food industry and newer entrants bringing innovative solutions.

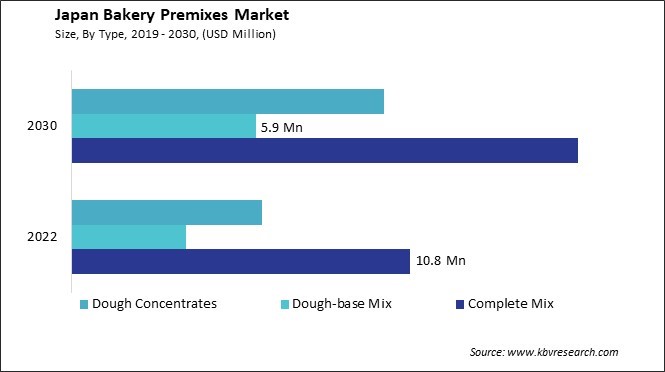

By Type

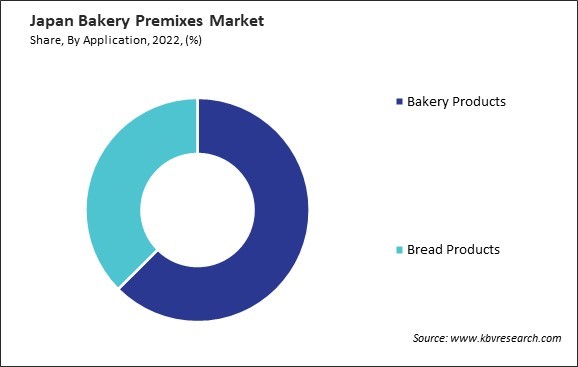

By Application