Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 15-May-2024 |

Pages: 91 |

Formats: PDF |

The Japan Business Process Outsourcing Market size is expected to reach $24.9 Billion by 2030, rising at a market growth of 9% CAGR during the forecast period.

Japan's business process outsourcing market has witnessed significant growth and transformation over the past few decades. Initially, business process outsourcing (BPO) services primarily focused on basic functions such as data entry and customer support. However, as businesses in Japan increasingly seek to streamline operations, improve efficiency, and reduce costs, the scope of BPO services has expanded to encompass various processes across various industries.

One key driver behind the growth of the business process outsourcing market in Japan is the country's aging population and shrinking workforce. With a declining pool of available talent, many Japanese companies are turning to outsourcing as a strategic solution to fill the gaps in their workforce. By outsourcing non-core functions to specialized service providers, businesses in Japan allocate resources more effectively and focus on their core competencies.

According to the International Trade Administration, in Japan, by 2025, the entire generation born during the baby boom years of 1947-1949 will be 75 or older. This population is expected to reach 22 million, or one in four in Japan. At the recent Council on Economic and Fiscal Policy, the Government of Japan (GOJ) stated that starting in 2022, the growth rate of social security costs overtook previous expectations. As the elderly population rises, the workforce continues to decrease due to an overall population decline. This so-called "2025 problem" in Japan is imminent, with concerns about sharp increases in social security costs, medical and nursing care costs, and a shortage of nursing care workers. As the country navigates these demographic and economic shifts, the role of outsourcing in driving operational excellence and fostering innovation is likely to become increasingly pronounced.

Moreover, the advancement of technology has played a pivotal role in shaping the landscape of BPO in Japan. Automation, artificial intelligence, and machine learning have enabled BPO providers to offer their clients more sophisticated and efficient solutions. For instance, robotic process automation (RPA) has revolutionized repetitive, rule-based tasks, allowing BPO companies to deliver faster turnaround times and higher accuracy rates.

The COVID-19 pandemic has also had a profound impact on the business process outsourcing market in Japan. As businesses adapt to remote work environments and navigate disruptions to their operations, many turn to outsourcing as a flexible and cost-effective solution. BPO providers have played a critical role in supporting businesses during these challenging times, offering virtual assistance, IT support, and digital transformation services to ensure continuity and resilience.

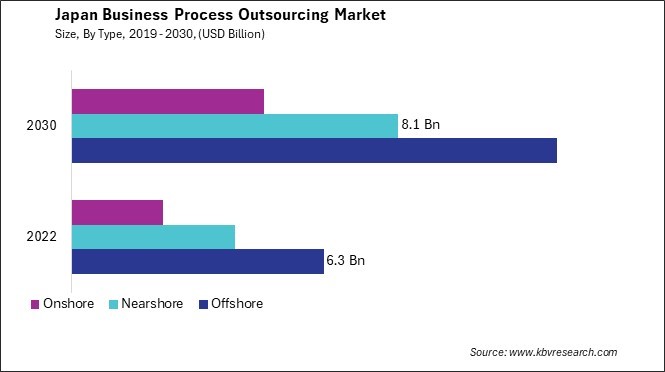

The growth of onshore business process outsourcing (BPO) in Japan has been steadily gaining momentum, fueled by several factors unique to the Japanese industry. One significant driver of onshore BPO growth in Japan is the rising need for cost optimization and operational efficiency. With a highly skilled and educated workforce, Japan presents an attractive destination for companies seeking high-quality services at competitive rates. Onshore BPO providers leverage this talent pool to deliver tailored solutions across various domains, including customer support, finance and accounting, human resources, and IT services.

Furthermore, the Japanese government's initiatives to promote foreign investment and streamline business processes have expanded onshore BPO. Policies aimed at deregulation and economic reforms have created a more conducive environment for outsourcing companies to establish operations in Japan, driving job creation and fostering innovation in the business process outsourcing market.

Moreover, cultural and linguistic affinity plays a crucial role in Japanese businesses' preference for onshore BPO. Local service providers possess a deep understanding of Japanese business culture, etiquette, and language nuances, essential for delivering seamless customer experiences and maintaining brand reputation. Another factor propelling the growth of onshore BPO in Japan is the increasing demand for digital transformation and technology-driven solutions. Hence, the growth of onshore BPO in Japan is driven by factors such as cost optimization, government initiatives, cultural affinity, and the demand for digital transformation.

Japan's business process outsourcing market is witnessing a notable surge in demand for customer service outsourcing services. Japanese companies increasingly recognize the benefits of outsourcing customer service operations to specialized business process outsourcing (BPO) firms. Outsourcing allows Japanese companies to streamline their operations, reduce costs, and improve efficiency by leveraging the expertise and resources of third-party service providers. By offloading customer service tasks to experienced professionals, companies focus on their core competencies and strategic initiatives, enhancing overall competitiveness.

Additionally, the rise of online shopping has expanded the scope and complexity of customer interactions. Japanese companies need help to deliver seamless and personalized customer experiences across multiple touchpoints, including websites, mobile apps, social media platforms, and messaging apps. According to the International Trade Administration, there has been a consistent increase in the percentage of Japanese households engaging in online shopping, starting at 35.9% in 2018 and steadily rising to 47.8% in 2021. In December 2021, 56% of Japanese households shopped online.

Moreover, the evolving business landscape in Japan is driving the need for more flexible and scalable customer service solutions. As businesses in Japan adapt to rapid technological advancements and changing consumer preferences, they require agile customer support capabilities that quickly adjust to fluctuating demands. Thus, the surge in demand for customer service outsourcing in Japan underscores the strategic advantage of leveraging specialized BPO firms to enhance operational efficiency, adaptability, and customer experience in a rapidly evolving business landscape.

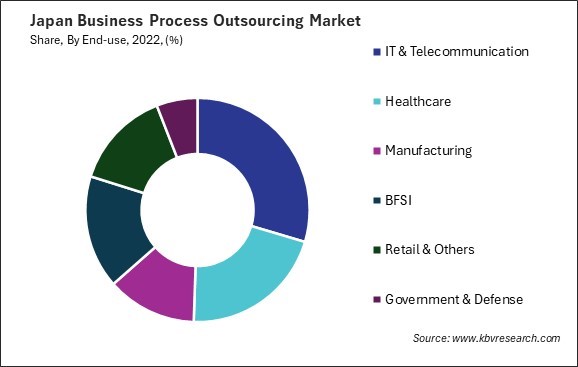

In Japan, the business process outsourcing market has witnessed significant growth in recent years, driven by the increasing demand for cost-effective and efficient business solutions. One prominent player in the Japanese business process outsourcing market is NTT Data. As one of Japan's largest IT services providers, NTT Data offers comprehensive business process outsourcing (BPO) solutions to clients across industries such as finance, healthcare, and telecommunications. Leveraging its extensive expertise in technology and deep understanding of the Japanese industry, NTT Data helps organizations streamline their operations, improve efficiency, and drive innovation through its tailored BPO services.

Another key player is Fujitsu Limited, a global leader in IT services and solutions. Fujitsu's BPO offerings encompass various services, including finance and accounting, human resources, and procurement. With its strong focus on leveraging digital technologies such as artificial intelligence and cloud computing, Fujitsu enables Japanese businesses to enhance agility, reduce costs, and accelerate growth through its innovative BPO solutions.

Additionally, Ricoh is a notable player in the Japanese business process outsourcing market, providing end-to-end document management and business process outsourcing services. With its extensive portfolio of services, including document scanning, data entry, and workflow automation, Ricoh helps organizations streamline their document-intensive processes and improve productivity while reducing operational costs.

Furthermore, SoftBank Group Corp. has also made significant strides in the Japanese business process outsourcing market, offering a wide range of services, including customer support, IT outsourcing, and back-office operations. Leveraging its strong brand presence and extensive network of partners, SoftBank delivers innovative BPO solutions that enable Japanese businesses to drive efficiency, enhance customer experience, and achieve sustainable growth in today's rapidly evolving business landscape.

In addition to these established players, several niche providers have emerged to address specific needs within the Japanese business process outsourcing market. One such company is SCSK Corporation, a leading IT solutions and services provider. SCSK offers a comprehensive suite of BPO services, including data center management, application development, and system integration, helping Japanese businesses leverage technology to optimize their processes and drive business success. Hence, the Japanese business process outsourcing market is characterized by intense competition and rapid technological advancements, driving companies to innovate and evolve their service offerings to meet the evolving needs of Japanese businesses.

By Deployment

By Type

By End-use

By Service Type