Japan Copper Sulfate Market Size, Share & Trends Analysis Report By Type (Pentahydrate, AnhydroJapan, and Others), By Application (Agriculture, Chemicals, Construction, Healthcare, Mining & Metallurgy, and Others), and Forecast, 2023 - 2030

Published Date : 17-May-2024 |

Pages: 44 |

Formats: PDF |

COVID-19 Impact on the Japan Copper Sulfate Market

The Japan Copper Sulfate Market size is expected to reach $43.16 Million by 2030, rising at a market growth of 5.0% CAGR during the forecast period. In the year 2022, the market attained a volume of 104.28 Hundred Tonnes, experiencing a growth of 4.0% (2019-2022).

The Japanese copper sulfate market has witnessed notable trends shaping its dynamics and demand in recent years. One significant trend is the increasing emphasis on sustainable agricultural practices, driving the demand for copper sulfate as a key component in environmentally friendly fungicides and pesticides. This trend reflects Japan's commitment to eco-friendly farming and its focus on ensuring food safety and security.

Furthermore, the expansion of Japan's industrial sector, particularly in advanced manufacturing and electronics, has led to a growing need for copper sulfate in applications such as electroplating and producing electronic components. The country's technological advancements and high standards for quality and precision have contributed to the steady demand for copper sulfate in these industries.

In addition, regulatory developments related to chemical usage and environmental protection have influenced the Japanese copper sulfate market. Stricter regulations aimed at reducing the environmental impact of industrial processes and agricultural practices have led to adopting cleaner production methods, potentially affecting the demand for copper sulfate and its use in various sectors. Moreover, Japan's position as a global leader in technology and innovation has driven research and development efforts in materials science, where copper sulfate can develop advanced materials and technologies.

Market Trends

Rapidly expanding healthcare sector

Japan is known for its advanced healthcare technologies and medical innovations. The country has been at the forefront of research and development in robotics, medical devices, and biotechnology, which have contributed to improvements in healthcare delivery and patient outcomes. The nation has a well-developed healthcare infrastructure, including modern hospitals, clinics, and research institutions. The government has been investing in upgrading and expanding this infrastructure to meet the growing healthcare needs of the population.

Based on the Annual Pharmaceutical Production Statistics published by the Ministry of Health, Labour and Welfare (MHLW), the medical device and material sector in Japan generated an estimated value of $26 billion USD in 2020 (USD 1 = Yen 106.8). It is anticipated that there will be a growing need for sophisticated medical technologies in Japan due to the country's rapidly ageing demographic composition and the rising expectations of relatively affluent seniors for an enhanced quality of life during their later years.

Due to its antimicrobial properties, copper sulfate is used in producing various medical devices and equipment. As the healthcare sector in Japan expands, there is an increasing demand for medical devices and equipment, which drives the demand for copper sulfate as a raw material. Moreover, copper sulfate has antimicrobial properties that make it useful in various healthcare applications, such as wound care products, antiseptic solutions, and medical textiles. With the growing focus on infection control and prevention in healthcare settings, there is a rising demand for antimicrobial products, increasing the demand for copper sulfate. Therefore, as the healthcare industry continues to grow and evolve, the demand for copper sulfate will likely remain strong, driven by its essential role in various healthcare-related applications.

Increasing usage of pentahydrate copper sulfate

Recently, Japan has seen increasing usage of pentahydrate copper sulfate across various industries, driven by its versatile applications and effectiveness in different processes. One significant growth area is the agricultural sector, where pentahydrate copper sulfate is used as a fungicide and pesticide to protect crops from fungal and bacterial diseases. With Japan's emphasis on high-quality agricultural products and food safety, the demand for pentahydrate copper sulfate as an essential agricultural input has been rising, supporting the country's agricultural productivity and ensuring the quality of its agricultural exports.

In addition to agriculture, the industrial sector in Japan has also seen an increasing usage of pentahydrate copper sulfate. Industries such as electronics, chemicals, and manufacturing utilize copper sulfate for various purposes, including as a raw material in producing copper-based chemicals, a catalyst in chemical reactions, and an additive in metal plating processes. The solubility and stability of the pentahydrate form make it well-suited for these industrial applications, where precise control over chemical compositions and reactions is crucial. Therefore, the increasing usage of pentahydrate copper sulfate owing to its effectiveness, solubility, and versatility has positioned it as a valuable chemical compound with wide-ranging uses, contributing to its steady demand and continued relevance in the Japanese market.

Competition Analysis

In the Japanese copper sulfate market, several companies are prominent players contributing to this essential chemical compound's production, distribution, and supply. These companies serve various industries and sectors, including agriculture, industrial manufacturing, pharmaceuticals, and more, reflecting the diverse applications of copper sulfate.

One of the key players in the Japanese copper sulfate market is Sumitomo Metal Mining Co., Ltd., a major mining and smelting company with a significant presence in the production of copper sulfate. Sumitomo Metal Mining is known for its expertise in mining operations, smelting processes, and producing high-quality copper products for industrial use. The company's commitment to quality and innovation has established it as a leading supplier in the Japanese market.

Mitsui Mining & Smelting Co., Ltd. is another prominent company in the Japanese copper sulfate market, specializing in the exploration, mining, smelting, and refining of various metals, including copper. The company is recognized for its comprehensive approach to metal production, focusing on sustainable practices and technological advancements to meet the evolving demands of the market.

Nippon Chemical Industrial Co., Ltd. is a notable chemical manufacturing company contributing to the Japanese copper sulfate market. The company produces various chemicals, including copper sulfate, for diverse industry applications. Nippon Chemical Industrial's commitment to research and development and dedication to meeting customer needs has positioned it as a reliable supplier in the Japanese market.

Ube Industries, Ltd. is a diversified chemical company with a significant Japanese copper sulfate market presence. The company's expertise in chemical manufacturing and its focus on innovation and sustainability have made it a key player in supplying copper sulfate for various industrial and agricultural applications in Japan.

Nippon Shokubai Co., Ltd. is recognized for its expertise in producing functional chemicals, including copper sulfate, for various applications. The company's commitment to quality, safety, and environmental responsibility has established it as a trusted supplier in the Japanese market, catering to the diverse needs of industries and sectors. These companies and others play a crucial role in meeting the demand for copper sulfate in Japan, leveraging their expertise, technology, and commitment to quality to contribute to the country's industrial and agricultural sectors.

List of Key Companies Profiled

- Beneut Enterprise

- JX Metals Corporation (Eneos Holdings)

- NOAH Technologies Corp.

- Sumitomo Metal Mining Co., Ltd.

- Univertical Corp. (Alconix Corporation)

- Jost Chemical Co.

- LAFFORT

Japan Copper Sulfate Market Report Segmentation

By Type

- Pentahydrate

- Anhydrous

- Others

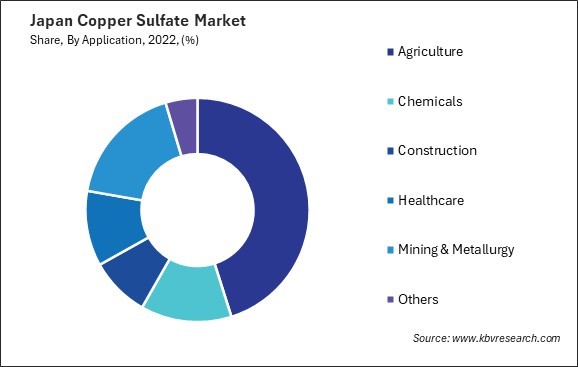

By Application

- Agriculture

- Chemicals

- Construction

- Healthcare

- Mining & Metallurgy

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Japan Copper Sulfate Market, by Type

1.4.2 Japan Copper Sulfate Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities

2.2.3 Market Restraints

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter Five Forces Analysis

Chapter 3. Japan Copper Sulfate Market

3.1 Japan Copper Sulfate Market by Type

3.2 Japan Copper Sulfate Market by Application

Chapter 4. Company Profiles - Global Leaders

4.1 Beneut Enterprise

4.1.1 Company Overview

4.2 JX Metals Corporation (Eneos Holdings)

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 Segmental and Regional Analysis

4.2.4 Research & Development Expenses

4.3 NOAH Technologies Corp.

4.3.1 Company Overview

4.4 Sumitomo Metal Mining Co., Ltd.

4.4.1 Company Overview

4.4.2 Financial Analysis

4.4.3 Segmental and Regional Analysis

4.4.4 Research & Development Expenses

4.5 Univertical Corp. (Alconix Corporation)

4.5.1 Company Overview

4.5.2 Financial Analysis

4.6 LAFFORT

4.6.1 Company Overview

4.6.2 SWOT Analysis

TABLE 2 Japan Copper Sulfate Market, 2023 - 2030, USD Million

TABLE 3 Japan Copper Sulfate Market, 2019 - 2022, Hundred Tonnes

TABLE 4 Japan Copper Sulfate Market, 2023 - 2030, Hundred Tonnes

TABLE 5 Japan Copper Sulfate Market by Type, 2019 - 2022, USD Million

TABLE 6 Japan Copper Sulfate Market by Type, 2023 - 2030, USD Million

TABLE 7 Japan Copper Sulfate Market by Type, 2019 - 2022, Hundred Tonnes

TABLE 8 Japan Copper Sulfate Market by Type, 2023 - 2030, Hundred Tonnes

TABLE 9 Japan Copper Sulfate Market by Application, 2019 - 2022, USD Million

TABLE 10 Japan Copper Sulfate Market by Application, 2023 - 2030, USD Million

TABLE 11 Japan Copper Sulfate Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 12 Japan Copper Sulfate Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 13 Key Information – Beneut Enterprise

TABLE 14 Key Information – JX Metals Corporation

TABLE 15 Key Information – NOAH Technologies Corp.

TABLE 16 Key Information – Sumitomo Metal Mining Co., Ltd.

TABLE 17 Key Information – Univertical Corp.

TABLE 18 Key Information – LAFFORT

List of Figures

FIG 1 Methodology for the research

FIG 2 Japan Copper Sulfate Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Copper Sulfate Market

FIG 4 Porter’s Five Forces Analysis – Copper Sulfate Market

FIG 5 Japan Copper Sulfate Market share by Type, 2022

FIG 6 Japan Copper Sulfate Market share by Type, 2030

FIG 7 Japan Copper Sulfate Market by Type, 2019 - 2030, USD Million

FIG 8 Japan Copper Sulfate Market share by Application, 2022

FIG 9 Japan Copper Sulfate Market share by Application, 2030

FIG 10 Japan Copper Sulfate Market by Application, 2019 - 2030, USD Million

FIG 11 SWOT Analysis: LAFFORT