Japan Folding Furniture Market Size, Share & Trends Analysis Report By Product (Table & Chair, Sofa, Bed, and Others), By Distribution Channel (Offline, and Online), and Forecast, 2023 - 2032

Published Date : 22-Apr-2024 |

Pages: 60 |

Formats: PDF |

COVID-19 Impact on the Japan Folding Furniture Market

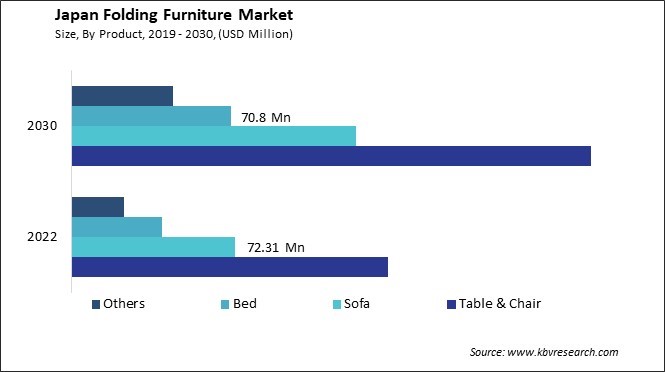

The Japan Folding Furniture Market size is expected to reach $471.40 Million by 2030, rising at a market growth of 7.1% CAGR during the forecast period. In the year 2022, the market attained a volume of 1334.27 thousand units, experiencing a growth of 7.0% (2019-2022).

The foldable furniture market in Japan has experienced significant growth and evolution in recent years, driven by cultural preferences, urban living constraints, and a growing demand for versatile and space-saving solutions. One of the key factors driving the foldable furniture market in Japan is the increasing urbanization of the population. As people move into smaller apartments or houses in urban centers, there is a growing need for furniture that adapts to limited living spaces.

Additionally, the high cost of living and the trend toward minimalistic living spaces have made Japanese consumers more conscious of the value and functionality of their furniture. Foldable furniture aligns with these preferences by offering multi-functional designs that serve multiple purposes, such as sofa beds, folding tables, and collapsible storage units. This adaptability appeals to Japanese consumers seeking practical and efficient home solutions.

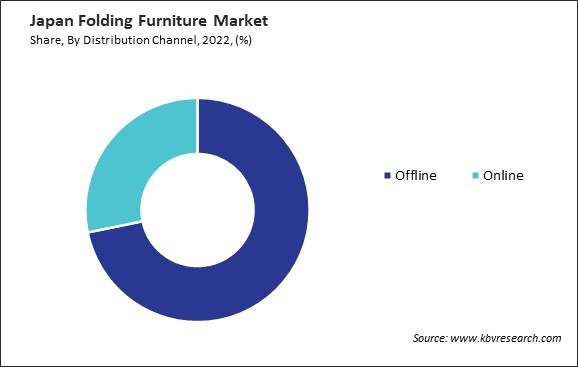

In recent years, the folding furniture market in Japan has witnessed a notable surge in popularity, with e-commerce platforms playing a pivotal role in shaping consumer trends and market dynamics. The convenience offered by e-commerce platforms aligns seamlessly with the fast-paced and time-conscious nature of modern Japanese society. Consumers appreciate the ease of browsing through a diverse range of folding furniture options from the comfort of their homes or on-the-go, saving valuable time that would otherwise be spent in physical stores.

According to the International Trade Administration, Rakuten, Japan's largest online marketplace, reported a substantial growth of 45.2% in gross merchandise sales (GMS) in 2020. The company experienced an impressive 11.7% year-on-year expansion, resulting in revenues of 5 trillion-yen, equivalent to around $45.5 billion, in domestic ecommerce GMS by the close of 2021. Specifically, there was a 42.4% increase in GMS for home and life products, with household goods and furniture contributing over $18 billion in sales. This category accounted for approximately 73% of the overall industry, showcasing a significant presence and demand for folding furniture market in Japan.

Market Trends

Demand for foldable furniture has extended to commercial settings

In Japan, the demand for foldable furniture is witnessing a significant surge, transcending its traditional application in residential spaces to encompass commercial settings. This trend indicates a broader shift in the Japanese industry towards flexible and space-efficient solutions, aligning with the country's cultural emphasis on maximizing limited space.

The corporate sector in Japan, known for its innovation and efficiency, has embraced foldable furniture as a practical solution to address spatial constraints. Folding tables and chairs offer the flexibility needed for dynamic work environments, allowing for quick reconfigurations of meeting spaces or collaborative areas. This adaptability aligns with the agile work culture many Japanese companies adopt to enhance productivity. In the hospitality industry, particularly in restaurants and cafes, the use of foldable furniture has become a strategic choice. Establishments can optimize seating arrangements based on varying customer demands throughout the day, ensuring efficient space utilization without compromising style or comfort.

In recent years, the folding furniture market in Japan has experienced a notable evolution, driven by the growing need for versatile and adaptable solutions in both homes and businesses. The compact nature of foldable furniture resonates with the Japanese lifestyle, where space optimization is a key consideration. This has led to an increased adoption of foldable tables, chairs, and storage units in various commercial establishments, such as offices, co-working spaces, and restaurants. Thus, the surge in demand for foldable furniture in Japan reflects a cultural emphasis on maximizing limited space, with businesses and commercial establishments adopting these versatile solutions to address spatial constraints and promote adaptability.

Rise in expenditure for celebrations and events

In recent years, Japan has witnessed a notable surge in expenditure dedicated to celebrations and events, propelling the demand for folding furniture market. The cultural significance placed on traditional ceremonies, festivals, and social gatherings has played a pivotal role in this burgeoning trend. Japanese society places immense importance on communal festivities, from religious ceremonies to seasonal celebrations, requiring meticulous planning and execution. Consequently, there has been a discernible increase in the allocation of budgets for event organization, including the procurement of versatile and space-efficient folding furniture.

One key factor contributing to the rise in expenditure is the meticulous attention to detail that characterizes Japanese celebrations. Whether it's a traditional tea ceremony or a contemporary corporate event, the need for flexible and easily deployable furniture has become paramount. Folding furniture, with its space-saving and portable design, perfectly aligns with the Japanese preference for efficiency and functionality.

Furthermore, the aesthetic appeal of folding furniture has not gone unnoticed in Japan. As design and style play an integral role in the cultural fabric, consumers increasingly opt for folding furniture that seamlessly integrates with their decor while offering practical solutions for event hosting. Hence, Japan's surge in expenditure on folding furniture is driven by the cultural emphasis on communal celebrations and the need for space-efficient solutions in the face of spatial constraints.

Competition Analysis

The folding furniture market in Japan reflects a unique blend of traditional design sensibilities and modern functionality, with several companies playing significant roles in meeting the demand for space-saving and versatile solutions. One of the notable players in the Japanese folding furniture market is Karimoku, a well-established Japanese brand known for its craftsmanship and commitment to quality. Karimoku produces various folding furniture pieces that blend traditional Japanese aesthetics with contemporary design. The company's folding tables, chairs, and storage units often feature sleek lines and natural materials, catering to consumers who appreciate both functionality and the beauty of well-crafted furniture.

Another key participant is Tendo Mokko, a Japanese furniture manufacturer focusing on wooden furniture. Tendo Mokko has a rich history and is recognized for its expertise in crafting wooden folding chairs. The company's folding chairs often perfectly integrate form and function, emphasizing comfort and simplicity. Tendo Mokko's dedication to wooden craftsmanship resonates well with Japanese consumers who value traditional materials and design.

Nitori, a major Japanese furniture retail chain, is also a significant player in the folding furniture market. The company offers a wide range of folding furniture, including tables, chairs, and storage solutions. The brand is known for its affordable and practical furniture options, making folding furniture accessible to a broad consumer base. The company’s folding furniture caters to the needs of Japanese households seeking space-efficient solutions without compromising on quality.

Muji, a popular Japanese retail company known for its minimalist and functional designs, is actively involved in the folding furniture market. The company’s folding furniture collection includes tables, chairs, and storage units that embody simplicity and versatility. The brand's commitment to a clean and uncluttered aesthetic appeal to Japanese consumers looking for modern, adaptable home furniture solutions.

In recent years, global players like IKEA have impacted the Japanese folding furniture market. IKEA's innovative and modular designs provide Japanese consumers with various folding furniture options that align with optimizing living spaces. The brand's folding tables, chairs, and storage units often incorporate smart features and modern aesthetics, catering to the evolving preferences of Japanese consumers seeking practical and stylish home furnishings.

Small-scale manufacturers like Kirino, specializing in compact and foldable furniture, have also gained recognition in the Japanese folding furniture market. Kirino produces a range of folding tables and chairs designed for small apartments and minimalist living. The company's products often feature space-saving mechanisms and contemporary designs, appealing to urban dwellers in Japan. These companies focus on functionality and practicality and also incorporate Japanese design sensibilities, making them well-aligned with the unique preferences of the Japanese folding furniture market.

List of Key Companies Profiled

- Ashley Furniture Industries, LLC

- Haworth, Inc.

- Lifetime Products

- Expand Furniture Inc

- Murphy Wall Beds Hardware Inc.

- Resource Furniture

- Inter IKEA Systems B.V. (Inter IKEA Holding B.V.)

- Meco Corporation (Unaka Corporation)

- Dorel Industries, Inc.

Japan Folding Furniture Market Report Segmentation

By Product

- Table & Chair

- Sofa

- Bed

- Others

By Distribution Channel

- Offline

- Online

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Japan Folding Furniture Market, by Product

1.4.2 Japan Folding Furniture Market, by Distribution Channel

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities

2.2.3 Market Restraints

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter’s Five Forces Analysis

Chapter 3. Japan Folding Furniture Market

3.1 Japan Folding Furniture Market by Product

3.2 Japan Folding Furniture Market by Distribution Channel

Chapter 4. Company Profiles

4.1 Ashley Furniture Industries, LLC

4.1.1 Company Overview

4.1.2 SWOT Analysis

4.2 Haworth, Inc.

4.2.1 Company Overview

4.2.2 SWOT Analysis

4.3 Lifetime Products

4.3.1 Company Overview

4.3.2 Recent strategies and developments:

4.3.2.1 Partnerships, Collaborations, and Agreements:

4.3.3 SWOT Analysis

4.4 Expand Furniture Inc

4.4.1 Company Overview

4.4.2 SWOT Analysis

4.5 Inter IKEA Systems B.V. (Inter IKEA Holding B.V.)

4.5.1 Company Overview

4.5.2 Financial Analysis

4.5.3 Regional Analysis

4.5.4 Recent strategies and developments:

4.5.4.1 Product Launches and Product Expansions:

4.5.5 SWOT Analysis

4.6 Meco Corporation (Unaka Corporation)

4.6.1 Company Overview

4.6.2 SWOT Analysis

4.7 Dorel Industries, Inc.

4.7.1 Company Overview

4.7.2 Financial Analysis

4.7.3 Segmental and Regional Analysis

4.7.4 Research & Development Expense

4.7.5 SWOT Analysis

TABLE 2 Japan Folding Furniture Market, 2023 - 2030, USD Million

TABLE 3 Japan Folding Furniture Market, 2019 - 2022, ThoUSnd Units

TABLE 4 Japan Folding Furniture Market, 2023 - 2030, ThoUSnd Units

TABLE 5 Japan Folding Furniture Market by Product, 2019 - 2022, USD Million

TABLE 6 Japan Folding Furniture Market by Product, 2023 - 2030, USD Million

TABLE 7 Japan Folding Furniture Market by Product, 2019 - 2022, ThoUSnd Units

TABLE 8 Japan Folding Furniture Market by Product, 2023 - 2030, ThoUSnd Units

TABLE 9 Japan Folding Furniture Market by Distribution Channel, 2019 - 2022, USD Million

TABLE 10 Japan Folding Furniture Market by Distribution Channel, 2023 - 2030, USD Million

TABLE 11 Japan Folding Furniture Market by Distribution Channel, 2019 - 2022, ThoUSnd Units

TABLE 12 Japan Folding Furniture Market by Distribution Channel, 2023 - 2030, ThoUSnd Units

TABLE 13 Key Information - Ashley Furniture Industries, LLC

TABLE 14 Key Information – Haworth, Inc.

TABLE 15 Key Information – Lifetime products

TABLE 16 Key Information – Expand Furniture Inc

TABLE 17 Key information – Inter IKEA Systems B.V.

TABLE 18 Key information – Meco Corporation

TABLE 19 Key Information – Dorel Industries, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 Japan Folding Furniture Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Folding Furniture Market

FIG 4 Porter’s Five Forces Analysis - Folding Furniture Market

FIG 5 Japan Folding Furniture Market share by Product, 2022

FIG 6 Japan Folding Furniture Market share by Product, 2030

FIG 7 Japan Folding Furniture Market by Product, 2019 - 2030, USD Million

FIG 8 Japan Folding Furniture Market share by Distribution Channel, 2022

FIG 9 Japan Folding Furniture Market share by Distribution Channel, 2030

FIG 10 Japan Folding Furniture Market by Distribution Channel, 2019 - 2030, USD Million

FIG 11 SWOT Analysis: Ashley Furniture Industries, LLC

FIG 12 SWOT Analysis: Haworth, Inc.

FIG 13 SWOT Analysis: Lifetime Products

FIG 14 SWOT Analysis: Expand Furniture Inc

FIG 15 SWOT Analysis: Inter IKEA Systems B.V.

FIG 16 SWOT Analysis: Meco Corporation

FIG 17 SWOT Analysis: Dorel Industries, Inc.