Int'l : +1(646) 832-2886 | query@kbvresearch.com

Int'l : +1(646) 832-2886 | query@kbvresearch.com

Published Date : 15-Feb-2024 |

Pages: 113 |

Formats: PDF |

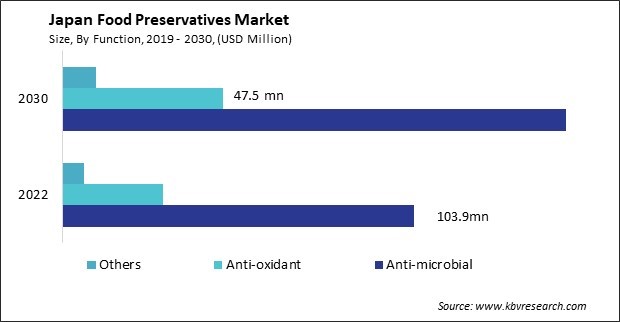

The Japan Food Preservatives Market size is expected to reach $206.6 million by 2030, rising at a market growth of 5.1% CAGR during the forecast period. In the year 2022, the market attained a volume of 9,823.5 kilo Tonnes units, experiencing a growth of 4.5% (2019-2022).

Japan's rapid economic growth and hectic lifestyles have catalyzed a significant shift in dietary preferences, with a notable transition from homemade meals to processed foods. This transformation is characterized by the rising popularity of packaged sauces, instant meals, and ready-to-cook options, typically purchased from local convenience stores.

The nation is well-known for its rapid development and hectic routine in life. Because of their fast-paced lifestyle, Japanese people increasingly buy processed foods like boxed sauces, instant meals, and ready-to-cook options from nearby convenience stores instead of consuming homemade meals. The need for food preservatives is being driven by the rising popularity of these items nationwide. The Japanese food industry is adapting to changing consumer preferences and industry trends by increasing the production of processed foods with extended shelf lives.

Moreover, Japan's expanding food industries have a notable impact on the demand for food preservatives. According to the U.S. Department of Agriculture, Japan's food processing sector produced $218.3 billion of food and drink goods in 2020. The COVID-19 pandemic reduced eating out and increased cooking at home. Significant declines in the production values of water, juices, soft drinks, and alcoholic beverages were almost completely offset by increases in dairy, wheat flour, health foods, and convenience or ready-to-eat items.

Because of the strict regulations, the Japanese processed food business has been seen as challenging to break into. It does, however, have a lot of potential. Over the last 20 years, the consumption of frozen meals has doubled and is still escalating. The amount of time devoted to cooking at home has been steadily reducing, while demand for quick, prepared meals is rising. The COVID-19 pandemic has also impacted customers, who are now looking for easy-to-prepare, nutritious, and satisfying foods and beverages to make at home. The rising number of elderly people living alone, the increasing proportion of women in the labor force, the expanding number of single-member families, and other factors contribute to Japan's frozen food industry's growth.

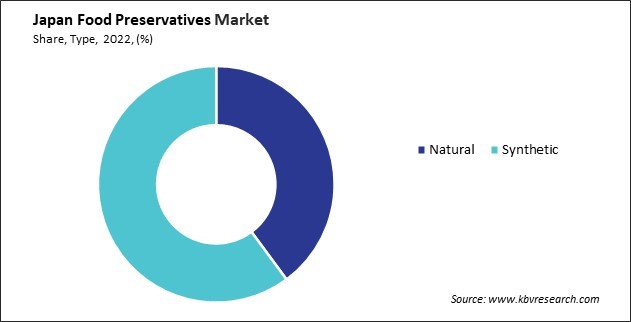

The widespread use of synthetic food preservatives, particularly benzoic acid, is a prominent feature in various food applications in Japan. This compound is favored for its antimicrobial properties, making it particularly effective as a pickling preservative. Japan places a strong emphasis on food safety and hygiene. Preservatives are of paramount importance in mitigating the risks of foodborne illnesses, microbial contamination, and spoilage, thereby supporting the nation's dedication to safeguarding its food supply.

Synthetic preservatives are often favored for their cost-effectiveness and efficiency in preserving various food products. Food manufacturers choose them because of their well-established safety profiles endorsed by regulatory bodies, particularly in an industry where food safety standards are highly valued. Therefore, the rising use of synthetic preservatives in food applications will augment the demand for food preservatives in Japan.

In Japan, dairy products are the most important nutritional recommendations for consuming daily in appropriate amounts. Japanese consumers increasingly rely on dairy and frozen items due to their convenience, extended shelf life, and diverse offerings. Notably, several Japan-based companies contribute significantly to the prominence of these categories.

Convenience stores are an essential part of the food retail landscape in Japan. They provide an extensive range of dairy and frozen goods, convenient for customers searching for quick and easily accessible food options. Dairy and frozen products have been adapted into traditional Japanese dishes, contributing to their popularity. For example, frozen ingredients are often used in home cooking, and dairy products are incorporated into desserts and savory dishes.

A key consideration in applying preservatives in dairy products is ensuring the safety and purity of items like fruit yogurts. Preservatives play a pivotal role in preventing contamination, both before and after the fermentation process. This proactive approach addresses critical hygiene concerns associated with dairy production, assuring consumers of the safety and freshness of their chosen dairy items.

Meiji is a leading company in the Japanese food industry, mainly known for its excellence in dairy products. The company offers many dairy items, including milk, yogurt, cheese, and ice cream. Meiji's dairy products are widely consumed across Japan, reflecting the cultural significance of dairy in the Japanese diet. According to Meiji's financial reports and industry analyses, the company has consistently demonstrated a strong industry presence in Japan's dairy sector. Its commitment to quality, innovation, and meeting consumer preferences has contributed to the widespread popularity of Meiji dairy products in Japan. Hence, the dominance of the dairy sector, which necessitates the use of various types of food preservatives, aids in the development of market.

The Japanese food preservatives market is characterized by consolidation, with a few global players holding dominant positions. Notable companies mentioned include Kerry, Celanese, and Corbion. These international vital players have a significant presence in the Japanese industry, indicating that multinational companies are essential in supplying food preservatives to the region.

The more significant usage of natural preservatives in Japan's food and beverages is a factor contributing to the industry's growth. There is a notable shift toward natural preservatives and clean-label categories in Japan. Companies like Corbion and Kerry are mentioned to have a strong position in these fast-growing segments, aligning with the increased consumer preference for natural ingredients and transparency in food labels.

In 2022, Kerry continued to play a significant role in advancing the food preservatives market in Japan, demonstrating its commitment to innovation and meeting the unique demands of the Japanese food industry. Kerry's expertise in taste modulation has been utilized to ensure that synthetic preservatives do not compromise the sensory attributes of Japanese cuisine.

Kerry ensures that its preservative solutions meet Japan's food safety and quality regulatory requirements. Kerry mainly focuses on providing preservatives that align with the preferences of Japanese consumers. They are often interested in natural and minimally processed foods, which may influence Kerry's product offerings in Japan.

By Function

By Type

By Application