Int'l : +1(646) 832-2886 | query@kbvresearch.com

Int'l : +1(646) 832-2886 | query@kbvresearch.com

Published Date : 17-May-2024 |

Pages: 69 |

Formats: PDF |

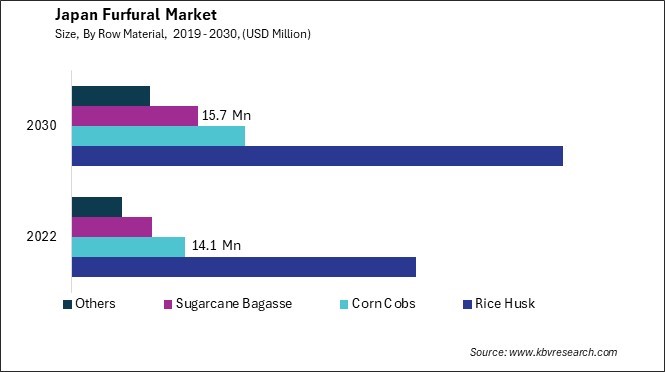

The Japan Furfural Market size is expected to reach $107.7 Million by 2030, rising at a market growth of 5.0% CAGR during the forecast period. In the year 2022, the market attained a volume of 323.90 Hundred Tonnes, experiencing a growth of 4.6% (2019-2022).

The furfural market in Japan has experienced significant growth and transformation in recent years, driven by diverse applications across various industries. Furfural, a derivative of agricultural byproducts such as corncobs, oat hulls, and sawdust, is a crucial intermediate in producing various chemicals, solvents, and resins. Japan's demand for furfural has been steadily rising due to its versatility and eco-friendly nature.

One of the primary drivers of the furfural market in Japan is its utilization in producing furan resins. Furan resins have extensive applications in manufacturing foundry sand binders, which are essential in metal casting processes. With Japan's robust manufacturing sector, especially in automotive and electronics, the demand for furan resins remains consistently high, thus propelling the growth of the furfural market.

Furthermore, the development of innovative applications has expanded the potential of furfural in Japan. It is increasingly being explored as a renewable solvent in industries such as paints and coatings, adhesives, and flavors and fragrances. The biodegradability and low toxicity of furfural make it an attractive alternative to conventional solvents, driving its adoption among environmentally conscious manufacturers.

The COVID-19 pandemic has presented both challenges and opportunities for the furfural market in Japan. The initial disruptions in supply chains and manufacturing operations led to a temporary slowdown in demand for furfural across several industries. However, the pandemic has also accelerated the adoption of sustainable practices and renewable resources in response to global environmental concerns. As Japan seeks to reduce its dependency on fossil fuels and mitigate climate change, there is a growing emphasis on developing bio-based chemicals such as furfural.

In recent years, Japan has witnessed a notable rise in its agriculture industry, subsequently impacting its furfural market. Furfural, a key chemical derived from agricultural byproducts such as corn cobs, oat husks, and rice husks, has gained prominence due to its versatile applications in various sectors including pharmaceuticals, petrochemicals, and agriculture. The Japanese government has been actively promoting initiatives to support the agriculture sector, including subsidies, incentives for innovation, and industry development programs.

One of the significant drivers behind the growth of Japan's agriculture industry is the adoption of advanced agricultural techniques and practices. Farmers in Japan are increasingly embracing modern methods such as precision agriculture, hydroponics, and vertical farming to enhance crop yield and quality. These practices improve productivity and contribute to the generation of agricultural residues, which serve as feedstock for furfural production.

According to the International Trade Administration, in 2022, Japan was the fourth largest single-country export industry for agriculture and related products, valued at $16.8 billion. Furthermore, there has been a growing awareness among consumers regarding the importance of sustainable and environmentally friendly products. As a result, there is a rising demand for bio-based chemicals like furfural derived from renewable resources, which have lower environmental impacts than their fossil fuel-based counterparts. Therefore, Japan's burgeoning agriculture industry, fueled by advanced techniques and a growing emphasis on sustainability, has catalyzed the expansion of the furfural market, driven by its versatile applications and eco-friendly nature.

In recent years, Japan has witnessed a remarkable surge in the popularity of bioplastics within the furfural market, driven by growing environmental concerns and the pursuit of sustainable alternatives to conventional plastics. Increasing awareness about the detrimental effects of traditional plastics on the environment, particularly in terms of pollution and non-biodegradability, has prompted a societal push for eco-friendly alternatives. Bioplastics, derived from renewable resources, offer a promising solution by significantly reducing carbon footprint and alleviating plastic waste accumulation.

Moreover, stringent government regulations and policies to curb plastic usage and promote sustainable practices have further incentivized industries to adopt bioplastics. Japan's commitment to achieving carbon neutrality and its ambitious targets for reducing greenhouse gas emissions have bolstered investments in renewable technologies, including bioplastics production.

Additionally, bioplastics' versatility and performance characteristics have enhanced their appeal in various sectors, including packaging, automotive, electronics, and consumer goods. Advances in bioplastic manufacturing processes have led to the development of materials with comparable or even superior properties to conventional plastics, such as durability, flexibility, and heat resistance. Partnerships between Japanese firms and international bioplastics manufacturers have facilitated knowledge exchange and technology transfer, accelerating the adoption of bioplastics across diverse applications. Hence, Japan's embrace of bioplastics reflects a significant shift towards sustainability driven by environmental concerns, government initiatives, technological advancements, and industry collaborations.

The furfural market in Japan is characterized by several prominent companies operating within various segments of the industry. One notable company in the Japanese furfural market is Japan Corn Starch Co., Ltd. (JCS). Established in 1960, JCS has been a pioneer in producing furfural and furfuryl alcohol, leveraging corn as its primary raw material. With a strong emphasis on research and development, JCS continuously improves its manufacturing processes to enhance product quality and efficiency. The company's furfural products cater to various industrial applications, including resins, solvents, and agricultural chemicals, contributing significantly to Japan's chemical industry.

Another significant player in the Japanese furfural market is Osaka Gas Chemicals Co., Ltd. (OGC). OGC specializes in producing various chemicals, including furfural and its derivatives, for applications in pharmaceuticals, agrochemicals, and flavorings. The company's state-of-the-art manufacturing facilities and stringent quality control measures ensure the reliability and consistency of its furfural products, meeting the stringent requirements of diverse industries. OGC's strategic partnerships and global presence further strengthen its position in the furfural market.

Furthermore, Mitsui Chemicals, Inc., one of Japan's leading chemical companies, is actively involved in the furfural market through its subsidiary, Mitsui Chemicals Agro, Inc. Mitsui Chemicals Agro focuses on the development and commercialization of innovative agricultural chemicals derived from furfural and other renewable sources. Leveraging Mitsui Chemicals' extensive chemical engineering and technology expertise, Mitsui Chemicals Agro offers a diverse portfolio of furfural-based products that enhance crop protection and yield, contributing to sustainable agriculture in Japan.

Moreover, Nippon Steel Chemical & Material Co., Ltd., a subsidiary of Nippon Steel Corporation, is a key player in the Japanese furfural market. The company specializes in producing furfural and furfuryl alcohol, utilizing lignocellulosic biomass as its primary feedstock. Nippon Steel Chemical & Material's advanced production facilities and research capabilities enable the efficient conversion of biomass into high-quality furfural products, meeting the evolving needs of various industries such as automotive, construction, and electronics. The company's commitment to sustainability and innovation underscores its significant contribution to the furfural market in Japan. As the demand for sustainable chemicals continues to rise, these companies are well-positioned to capitalize on emerging opportunities and contribute to the sustainable development of Japan's chemical industry.

By Row Material

By End User

By Application