Int'l : +1(646) 832-2886 | query@kbvresearch.com

Int'l : +1(646) 832-2886 | query@kbvresearch.com

Published Date : 20-Mar-2024 |

Pages: 64 |

Formats: PDF |

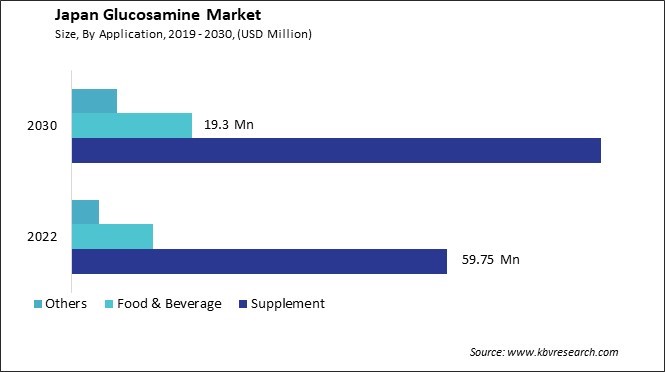

The Japan Glucosamine Market size is expected to reach $110.85 million by 2030, rising at a market growth of 4.7% CAGR during the forecast period. In the year 2022, the market attained a volume of 6,557.73 Tonnes units, experiencing a growth of 4.3% (2019-2022).

The glucosamine market has experienced notable growth and evolution in Japan, driven by the country's aging population and a cultural emphasis on health and longevity. The Japanese market for glucosamine is influenced by factors such as the rising prevalence of osteoarthritis and an increased awareness of the importance of maintaining joint function.

A remarkable surge in e-commerce platforms in Japan is reshaping the glucosamine market. Consumers, driven by convenience and an evolving digital landscape, increasingly turn to online platforms to fulfill their glucosamine-related needs. The shift is evident as traditional retail outlets compete with virtual marketplaces offering various glucosamine products. Factors such as streamlined purchasing processes, diverse product availability, and doorstep delivery appeal to Japanese consumers.

According to the International Trade Administration, in 2021, the United States witnessed a notable 8.6% increase in the sales of goods through e-commerce platforms compared to the previous year, marking a substantial growth in the e-commerce industry, reaching an estimated USD 188.1 billion. This surge becomes even more apparent when compared to the pre-COVID levels of 2019, revealing a remarkable 32.2% uptick in sales of goods. Meanwhile, Japanese consumers actively participated in cross-border online shopping from other country outlets, generating a substantial industry worth of USD 3.1 billion in 2021, reflecting a significant 9.3% surge from the previous year. This surge in e-commerce activity indicates a growing trend analogous to the increased interest and engagement observed in the glucosamine market in Japan.

In Japan, consumer preferences for natural products in the glucosamine market reflect a cultural inclination towards health-conscious choices and a strong belief in the efficacy of traditional remedies. Glucosamine, a popular supplement known for its joint health benefits, has witnessed a surge in demand, with consumers increasingly favoring natural alternatives.

Japanese consumers place a significant emphasis on holistic well-being, often seeking products derived from natural sources. This trend is particularly pronounced in the glucosamine market, where individuals prefer supplements extracted from crustacean shells, such as crab and shrimp, rather than synthetic versions. The preference for natural glucosamine aligns with traditional Japanese dietary habits, which emphasize consuming wholesome, minimally processed foods.

The cultural significance of holistic health practices also plays a role in shaping consumer preferences. Traditional Japanese medicine, including practices like Kampo, has long recognized the benefits of natural ingredients in promoting overall health. As a result, consumers in Japan are more inclined to trust and adopt glucosamine products that align with these traditional values.

Furthermore, the aging population in Japan has contributed to the growing demand for glucosamine as individuals seek proactive measures to support joint health. Natural products are often perceived as gentler on the body, resonating well with older consumers who are more attuned to the potential side effects of synthetic alternatives. Thus, the glucosamine market in Japan is witnessing a notable shift towards natural products driven by cultural preferences for holistic well-being, trust in traditional remedies, and a desire for gentler alternatives, especially among the aging population.

In the Japanese glucosamine market, glucosamine products are widely available in various forms, catering to diverse consumer preferences and needs. Glucosamine, a popular dietary supplement known for its potential joint health benefits, found in tablets, capsules, and powders across numerous retail outlets in Japan.

Tablets are a common and convenient form of glucosamine consumption in the Japanese industry. Many brands offer glucosamine tablets, allowing consumers to incorporate them into their daily supplement routine easily. These tablets often have different strengths, providing options for individuals with varying dosage requirements.

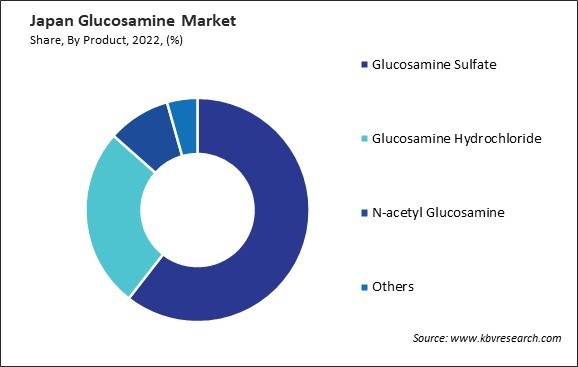

Capsules are another prevalent form of glucosamine in Japan. Capsules offer the advantage of easy ingestion, and they are available in different formulations, such as glucosamine sulfate and glucosamine hydrochloride, allowing consumers to choose the one that suits their preferences and dietary needs. Glucosamine powders are also present in the Japanese glucosamine market. These powders are easily mixed with water, juice, or other beverages, providing a flexible and customizable way to consume glucosamine.

Japanese consumers are increasingly health-conscious, increasing the demand for glucosamine products with added ingredients for enhanced joint support. Some formulations may include additional components like chondroitin, MSM (methylsulfonylmethane), or collagen, reflecting a trend toward comprehensive joint health supplements. Hence, the Japanese glucosamine market provides a diverse array of products in tablet, capsule, and powder forms, meeting the preferences of a health-conscious consumer base.

In Japan, the glucosamine market is influenced by factors such as an aging population, a cultural emphasis on joint health, and a strong awareness of preventive healthcare. One of the key players in the Japanese glucosamine market is Welcia Yakkyoku, a major drugstore chain operated by Aeon Group. Welcia Yakkyoku offers a wide range of health and wellness products, including glucosamine supplements, catering to the growing needs of the aging population in Japan. The chain's extensive retail network and emphasis on health promotion make it a significant player in distributing glucosamine products nationwide.

Another prominent contributor to the Japanese glucosamine market is Otsuka Pharmaceutical Co., Ltd. Otsuka is a well-established pharmaceutical company that manufactures various healthcare products. The company's glucosamine offerings address joint health concerns, and Otsuka's commitment to research and development aligns with the Japanese industry's demand for scientifically backed supplements.

Meiji Holdings Co., Ltd., a major food and pharmaceutical company in Japan, also has a noteworthy presence in the glucosamine market. Meiji produces a range of nutritional supplements, including those with glucosamine, targeting consumers seeking joint support. The company's reputation for quality and its long-standing presence in the Japanese industry contribute to its credibility among consumers looking for reliable glucosamine products.

Domestic companies like Nichi-Iko Pharmaceutical Co., Ltd. also play a crucial role in the Japanese glucosamine market. Nichi-Iko is one of the leading generic pharmaceutical companies in Japan, and it has expanded its portfolio to include nutraceuticals, including glucosamine-based products. The company's understanding of the local industry dynamics positions it well to address the growing demand for joint health solutions in Japan. Similarly, domestic Japanese brands like Q&P Corporation play a significant role in shaping the glucosamine market. Q&P Corporation specializes in developing and manufacturing health and nutritional supplements, focusing on joint care products. These local brands often deeply understand Japanese consumers' preferences and needs, allowing them to tailor their glucosamine formulations accordingly.

Japanese consumers often rely on recommendations from healthcare professionals, and companies like Eisai Co., Ltd. leverage these partnerships to enhance the credibility of their glucosamine products. Collaborations with healthcare providers and pharmacists contribute to higher consumer trust, influencing their purchasing decisions in the glucosamine market.

By Application

By Product