The Japan Industrial Low-voltage Alternator Market size is expected to reach $135.7 Million by 2030, rising at a market growth of 8.4% CAGR during the forecast period.

Japan's industrial low-voltage alternator market represents a crucial segment within the broader machinery and equipment sector. With Japan's strong industrial base and advanced manufacturing capabilities, the demand for low-voltage alternators remains significant, driven by various industries. Low-voltage alternators are vital in converting mechanical energy into electrical energy for powering machinery, equipment, and other electrical systems in industrial settings. These alternators typically operate at voltages below 1000 volts and are essential components in various applications, including generators, motors, pumps, and various industrial machinery.

Additionally, Japan's industrial landscape is characterized by its high-tech manufacturing facilities, which require reliable and efficient electrical power solutions. According to the Ministry of Land, Infrastructure, and Transportation (MLIT), early detection and repair of at-risk infrastructure will help avert serious incidents and reduce maintenance and renewal costs by a massive 47 %, resulting in savings of $46 billion through 2048. As a result, the demand for low-voltage alternators in Japan remains robust, with domestic production and imports fulfilling industry needs.

Moreover, Japan's energy sector presents opportunities for the industrial low-voltage alternator market in the renewable energy segment. With a strong emphasis on reducing dependence on fossil fuels and mitigating climate change, Japan has invested in renewable energy sources such as solar, wind, and hydroelectric power. Low-voltage alternators play a crucial role in renewable energy systems by converting mechanical energy from turbines or generators into electrical energy for distribution to the grid or local consumers.

The COVID-19 pandemic has had a significant impact on the industrial low-voltage alternator market in Japan. The outbreak led to disruptions in global supply chains, affecting the production and distribution of components used in alternators. Manufacturers faced challenges sourcing raw materials and components, leading to delays in production and delivery schedules. Moreover, the pandemic-induced economic slowdown reduced demand for industrial machinery and equipment, including alternators. However, amidst these challenges, the industry also witnessed some opportunities. The pandemic highlighted the importance of reliable power supply for essential services such as healthcare facilities and data centers.

The construction industry in Japan has been experiencing a notable surge in activity, leading to increased demand across various sectors, including the industrial low-voltage alternator market. As Japan continues to recover from the economic downturns and natural disasters it has faced in recent years, there has been a concerted effort to revitalize infrastructure and pursue new development projects. This revitalization effort has spurred a significant uptick in construction activities, driving the demand for industrial low-voltage alternators.

One of the primary factors contributing to the heightened utilization in the construction industry is the government's ambitious infrastructure development initiatives. Japan's government has invested in large-scale infrastructure projects, such as transportation systems, energy facilities, and commercial complexes, to stimulate economic growth and enhance competitiveness. These projects require a wide range of machinery and equipment, including industrial low-voltage alternators, to power various operations and ensure smooth functioning.

Moreover, the ongoing urbanization trend in Japan has led to an increasing need for residential and commercial spaces in metropolitan areas. This demand has led to a surge in construction projects, including developing high-rise buildings, residential complexes, and commercial centers. According to the U.S. Geological Survey, in 2019, Japan's nominal gross domestic product (GDP) reached $5.13 trillion, with the construction sector contributing 5.4% of the overall GDP. As construction companies strive to meet deadlines and deliver quality projects, the demand for reliable and efficient power generation equipment like industrial low-voltage alternators has grown substantially.

Furthermore, the emphasis on sustainable development and energy efficiency has prompted construction firms to invest in modern, eco-friendly technologies. Therefore, Japan's booming construction industry, driven by government infrastructure projects and urbanization trends, has fueled significant demand for industrial low-voltage alternators.

The industrial low-voltage alternator market in Japan is experiencing a notable surge in demand for power generation equipment, driven by several key factors that reflect the evolving landscape of the country's industrial sector. One significant driver of this rising demand is the increasing need for reliable and efficient power generation solutions within Japan's industrial sector. Japan's heightened focus on energy efficiency and sustainability fuels the demand for advanced power generation equipment. With growing concerns over environmental impact and energy consumption, industries seek innovative alternative solutions that offer higher efficiency and reduced carbon footprint.

Furthermore, government initiatives and regulatory frameworks promoting renewable energy integration and grid stability further drive Japan's demand for low-voltage alternators. As the country strives to reduce its reliance on traditional fossil fuels and embrace clean energy sources, there is a growing need for versatile alternator solutions that can efficiently integrate with renewable energy systems such as solar and wind power.

Additionally, the rapid pace of technological advancements in power generation is influencing industry trends in Japan. Japanese manufacturers are increasingly incorporating advanced materials, design techniques, and digital solutions to enhance the performance and reliability of low-voltage alternators. Hence, the surge in demand for low-voltage alternators in Japan is driven by a combination of factors, including the need for reliable power generation, emphasis on energy efficiency and sustainability, and technological advancements in the industry.

Japan's industrial low-voltage alternator market is a vital component of the country's electrical equipment industry. One of the prominent players in the Japanese industrial low-voltage alternator market is Mitsubishi Electric Corporation. Mitsubishi Electric is a leading global electrical and electronic equipment manufacturer with a strong presence in power generation systems, including alternators. The company's alternators are known for their robust construction, high efficiency, and reliability, making them ideal for industrial applications requiring continuous and stable power supply. Mitsubishi Electric's alternator solutions cater to various industries, from manufacturing and construction to telecommunications and transportation, providing customers with dependable power generation solutions to support their operations.

Another significant participant in the Japanese industrial low-voltage alternator market is Hitachi, Ltd. Hitachi is a diversified conglomerate with expertise in various sectors, including power generation and electrical equipment. The company's alternators are renowned for their advanced technology, energy efficiency, and performance, making them suitable for various industrial applications. Hitachi's alternator offerings include products tailored to specific customer requirements, such as high-efficiency models for environmentally conscious operations and compact designs for space-constrained applications.

Furthermore, Denyo Co., Ltd. is also a notable player in the Japanese industrial low-voltage alternator market. Denyo specializes in manufacturing power generation equipment, including alternators, generators, and welding machines, catering to diverse industrial and commercial applications. The company's alternators are characterized by their reliability, durability, and ease of maintenance, making them popular choices for industrial customers requiring dependable power generation solutions. Denyo's alternator offerings encompass a wide range of capacities and features to meet the varying needs of customers across different industries.

Additionally, companies such as Meidensha Corporation, Toshiba Corporation, and Fuji Electric Co., Ltd. play significant roles in the Japanese industrial low-voltage alternator market, leveraging their expertise and technological capabilities to develop innovative alternator solutions. These companies specialize in manufacturing alternators with advanced features, such as digital control systems, remote monitoring capabilities, and compatibility with renewable energy sources, to meet the evolving demands of industrial customers seeking efficient and sustainable power generation solutions. As Japan continues to emphasize technological innovation and energy efficiency in its industrial sectors, the demand for advanced alternator solutions is expected to grow, presenting opportunities for companies to innovate and expand their industry presence in this dynamic and evolving industry landscape.

By Type

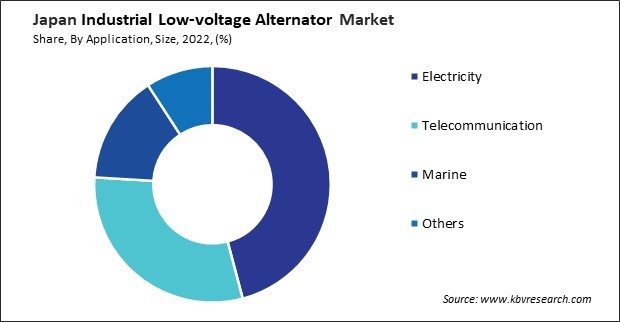

By Application

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.