Int'l : +1(646) 832-2886 | query@kbvresearch.com

Int'l : +1(646) 832-2886 | query@kbvresearch.com

Published Date : 20-May-2024 |

Pages: 92 |

Formats: PDF |

The Japan Mineral Supplements Market size is expected to reach $1.8 Billion by 2030, rising at a market growth of 5.0% CAGR during the forecast period.

The mineral supplements market in Japan has experienced significant growth in recent years, driven by a combination of factors such as increasing health awareness, an aging population, and a growing focus on preventive healthcare. Japanese consumers increasingly recognize the importance of minerals in maintaining overall well-being, leading to a surge in demand for mineral supplements. One key driver of the industry is the aging population in Japan.

Japan's unique dietary habits also influence the mineral supplements market. Traditional Japanese cuisine, while rich in certain nutrients, sometimes lack specific minerals. This has prompted consumers to turn to supplements to fill nutritional gaps and ensure a balanced intake of essential minerals like calcium, magnesium, and iron. Moreover, the Japanese industry is characterized by a preference for high-quality and well-researched products. Consumers in Japan are known for their discerning taste and meticulous approach to health-related decisions.

The COVID-19 pandemic has had a notable impact on the mineral supplements market in Japan. With the heightened focus on health and immunity, there has been an increased awareness of the role minerals play in supporting overall well-being. Japanese consumers are now more inclined to invest in supplements that boost their immune system and promote resilience against infections. The pandemic has also accelerated the shift towards online channels for purchasing nutritional supplements, as consumers prioritize convenience and safety.

Additionally, Japan has a system known as the Foods with Functional Claims (FFC) system, which allows manufacturers to make specific health claims on their products after conducting scientific research and receiving approval from the government. This system has implications for the marketing of mineral supplements, as companies can differentiate their products by highlighting approved functional claims, such as "promotes bone health" or "supports immune function."

In recent years, Japan has witnessed a notable surge in the demand for dietary supplements, particularly in the mineral supplements market. The cultural significance of longevity in Japan is pivotal in adopting dietary supplements. While rich in certain nutrients, the traditional Japanese diet lacks specific minerals essential for optimal health. The health-conscious mindset prevalent in Japan is another factor driving the demand for mineral supplements. Japanese consumers are increasingly educated about the benefits of minerals in promoting various bodily functions, from bone health to immune system support.

According to the International Trade Administration, Japan is the world's third-largest dietary supplements industry, valued at USD 9.4 billion (JPY1 trillion). With a discerning consumer base and a growing focus on health and wellness, the Japanese market continues to witness significant expansion. This surge in demand for mineral supplements further contributes to the dynamic landscape of Japan's flourishing dietary supplements industry.

Government initiatives and regulations also contribute to Japan's mineral supplements market growth. The Japanese authorities have implemented stringent quality standards and regulations, assuring consumers of the safety and efficacy of dietary supplements. This regulatory environment fosters trust among Japanese consumers, encouraging them to explore and embrace various mineral supplements.

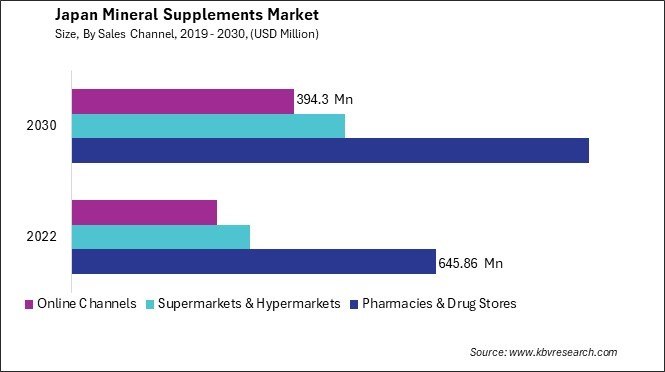

Moreover, the e-commerce boom in Japan has made it easier for consumers to access a wide array of dietary supplements online. The convenience of online shopping has further contributed to the accessibility and popularity of mineral supplements in the Japanese industry. With the burgeoning health and wellness awareness, the demand for mineral supplements has increased in recent years. As consumers in Japan increasingly turn to online platforms for their shopping needs, the e-commerce space becomes a vital channel for distributing and selling mineral supplements.

According to the International Trade Administration, e-commerce sales of goods grew by 8.6% in 2021 compared to the previous year, estimating the total e-commerce industry at USD 188.1 billion. The digital marketplace not only offers a wide array of choices for consumers but also facilitates efficient and seamless transactions, contributing to the growth of the mineral supplements market in Japan and further emphasizing the transformative impact of e-commerce on diverse industries. Hence, the surge in demand for mineral supplements in Japan is propelled by cultural emphasis on longevity and the convenience of e-commerce platforms, collectively driving the industry's growth and reflecting the evolving landscape of consumer preferences.

In recent years, there has been a notable surge in the popularity of magnesium supplements within the mineral supplements market in Japan. Japanese consumers are becoming more health-conscious, actively seeking ways to enhance their lifestyles and prevent health issues. Magnesium, an essential mineral, is recognized for its pivotal role in numerous bodily functions, including muscle and nerve function, energy production, and bone health. As the Japanese population ages, there is a heightened emphasis on maintaining bone density and preventing conditions like osteoporosis, further fueling the demand for magnesium supplements.

Although rich in certain nutrients, the Japanese diet sometimes lack sufficient magnesium intake. Individuals recognize this dietary gap and take supplements to meet their recommended daily magnesium requirements. The ease of access to a diverse range of magnesium supplements in pharmacies, health stores, and online platforms contributes significantly to their increasing popularity.

Moreover, the Japanese industry has witnessed a surge in the variety of magnesium formulations, catering to diverse consumer preferences. These include magnesium citrate, glycinate, and magnesium oxide, each with specific benefits. Additionally, the prevalence of lifestyle-related issues such as stress and fatigue has led to a growing interest in magnesium's potential benefits in Japan. Government initiatives and healthcare campaigns promoting the importance of preventive healthcare also influence consumer behavior. Thus, the growing awareness of magnesium's essential role in health, an aging population, and lifestyle-related concerns have propelled the popularity of magnesium supplements in Japan.

Japan has witnessed a growing demand for mineral supplements, reflecting a shift towards health and wellness. Several companies have emerged as key players in the mineral supplements market, catering to the diverse needs of consumers. One prominent player in the Japanese mineral supplements market is Otsuka Pharmaceutical Co., Ltd. Established in 1964, Otsuka Pharmaceutical has a strong presence in the healthcare industry and offers various nutritional products, including mineral supplements. The company focuses on research and development to create innovative and effective solutions to meet the evolving health needs of the Japanese population.

Meiji Holdings Co., Ltd. is a well-established Japanese conglomerate that operates in various sectors, including food and healthcare. The brand has a robust portfolio of mineral supplements that cater to different age groups and health requirements. The company's commitment to quality and safety has increased popularity among consumers seeking reliable nutritional products.

Another significant contributor is Eisai Co., Ltd., whose history dates back to 1941. Eisai is a pharmaceutical company that emphasizes pharmaceuticals and nutritional and supplement products. With a commitment to human health, Eisai has expanded its presence in the mineral supplements market, offering products that address specific health concerns and nutritional deficiencies.

Nippon Suisan Kaisha, Ltd. (Nissui) is a leading company in the fisheries and seafood industry. In addition to its core business, Nissui has diversified into health and wellness products, including mineral supplements derived from marine sources. Leveraging its expertise in marine resources, Nissui has created a niche in the industry by offering unique mineral supplements rich in marine minerals.

Furthermore, Rohto Pharmaceutical Co., Ltd. has made a mark in the Japanese mineral supplements market. The company, founded in 1899, has a comprehensive product line that includes pharmaceuticals, cosmetics, and health supplements. Rohto's mineral supplements are formulated to support various aspects of health, reflecting the company's commitment to enhancing the overall well-being of consumers. These companies contribute to the nation's growing emphasis on health and wellness by providing a wide range of mineral supplements tailored to the unique needs of the Japanese population. As consumers continue to prioritize preventive healthcare, the mineral supplements market in Japan is likely to witness further growth and innovation.

By Sales Channel

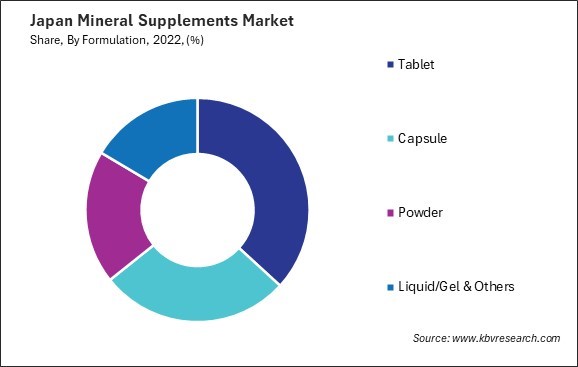

By Formulation

By Application

By End-use

By Product