Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 20-May-2024 |

Pages: 103 |

Formats: PDF |

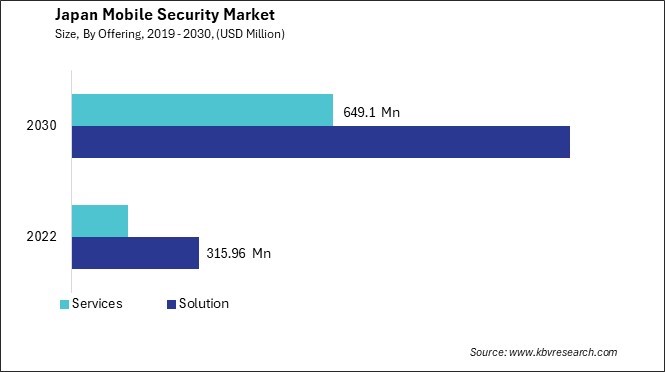

The Japan Mobile Security Market size is expected to reach $1.9 Billion by 2030, rising at a market growth of 19.5% CAGR during the forecast period.

With Japan's ongoing adoption of digital transformation in diverse sectors, there has been an increased urgency for resilient mobile security solutions that can safeguard mobile endpoints from an extensive array of cyber threats. With the proliferation of mobile malware, phishing attacks, and other mobile-specific threats, mobile security solutions in Japan have evolved to incorporate sophisticated algorithms and machine learning techniques to detect and mitigate these threats in real-time, ensuring the security of mobile devices and the data they handle.

Furthermore, the Japan mobile security market has seen mobile authentication and access control advancements. As mobile devices increasingly serve as primary authentication factors for accessing corporate networks and sensitive data, there has been a growing demand for mobile security solutions that can provide secure and seamless authentication experiences while maintaining high levels of security. This has led to the development of innovative biometric authentication methods and multi-factor authentication solutions tailored to mobile devices, enhancing the overall security posture of mobile deployments in Japan.

Additionally, adopting mobile security solutions that leverage biometric authentication technologies has gained traction in Japan. Biometric authentication has emerged as a crucial component of mobile security, providing a more convenient and secure substitute for conventional password-driven authentication approaches (e.g., facial recognition and fingerprint scanning). This advancement has enhanced the overall security posture of mobile devices and applications in Japan.

Moreover, the pandemic has accelerated digital transformation initiatives across industries in Japan, leading to a greater reliance on mobile technologies for business operations and customer interactions. This rapid digitalization has increased the demand for mobile security solutions that provide comprehensive protection for mobile devices, applications, and data in the evolving digital landscape. Therefore, as organizations continue to adapt to the changing digital landscape, the need for robust mobile security measures is expected to remain a top priority, shaping the future of the mobile security market in Japan.

In Japan, there has been a noticeable increase in the demand for mobile data protection (MDP) tools, driven by various factors that have reshaped the mobile security landscape and heightened the need for robust data protection measures. The increasing prevalence of bring-your-own-device (BYOD) policies and the increasing prevalence of mobile devices for work-related tasks are significant factors driving the rising demand for MDP tools. With more employees using personal and company-issued mobile devices to access corporate data and applications, there is a greater need for MDP tools that can secure sensitive information and prevent unauthorized access or data breaches.

Furthermore, Japan's evolving regulatory landscape and stricter data protection regulations, such as the amended Act on the Protection of Personal Information (APPI), have contributed to the growing demand for MDP tools. Organizations are under increasing pressure to comply with data protection laws and regulations, necessitating robust MDP solutions to safeguard sensitive data and ensure compliance with legal requirements.

Moreover, the evolving threat landscape and the increasing frequency of cyber attacks targeting mobile devices have contributed to the growing demand for mobile data protection tools. In order to exploit weaknesses in mobile devices and applications, cybercriminals are perpetually developing new strategies; therefore, users must implement stringent security measures. Mobile data protection tools provide users with a proactive safeguard against these risks, enabling them to identify and address potential security breaches prior to their ability to inflict damage.

Moreover, the proliferation of mobile payment systems and the growing utilization of mobile devices for conducting financial transactions have exponentially escalated the demand for mobile data protection tools in Japan. Given the prevalence of mobile device usage for the exchange of sensitive financial data, it is of the utmost importance that this data be protected from unauthorized access and kept secure. Mobile data protection tools give users the confidence to use mobile devices for financial transactions while maintaining the security of their personal and financial information. Thus, all of these factors result in the increasing demand for mobile security tools.

Retailers have expanded their digital presence and implemented a unified omnichannel shopping experience in response to the expanding number of consumers turning to online platforms for their purchases. New prospects have emerged for retailers to expand their reach and accommodate the changing demands of contemporary consumers as a result of this transition to digital retail.

Additionally, the growing influence of technology in the retail sector has contributed to its rapid expansion. Retailers in Japan are capitalizing on cutting-edge technologies, including automation, data analytics, and artificial intelligence (AI), to optimize operations and tailor marketing initiatives to individual consumers. These technological advancements have enabled retailers to gain valuable insights into consumer behavior, improve supply chain efficiency, and deliver more personalized and targeted shopping experiences.

Moreover, the government's initiatives to boost consumer spending and stimulate economic growth have also contributed to Japan's retail sector expansion. Policies promoting domestic consumption, such as the "Go To Travel" campaign, have incentivized consumers to spend more, particularly in the retail and hospitality sectors. These initiatives have provided a much-needed boost to the retail industry, driving growth and supporting the economy's recovery.

Additionally, the rise of mobile commerce (m-commerce) in Japan has amplified the need for secure mobile transactions and data protection. With the increasing prevalence of consumers conducting online shopping through mobile devices, retailers are confronted with the imperative of fortifying the security of mobile payment systems and applications. Mobile security solutions are critical in securing m-commerce transactions, encrypting sensitive data, and providing secure authentication methods to protect against fraudulent activities and unauthorized access.

Moreover, the increasing adoption of mobile-based customer engagement strategies, such as mobile marketing campaigns and loyalty programs, has further fueled the demand for mobile security in the retail sector. Retailers rely on mobile apps and platforms to engage with customers, collect data for personalized marketing, and deliver targeted promotions. This influx of customer data requires robust security measures to safeguard against data breaches and uphold customer trust, driving the need for comprehensive mobile security solutions tailored to the retail industry's specific requirements. Hence, as retailers continue to innovate and embrace digital technologies, the demand for mobile security is expected to remain strong, driving further advancements in mobile threat detection, data protection, and secure mobile commerce solutions tailored to the unique needs of the retail industry.

Within Japan's mobile security market, a number of firms have positioned themselves as significant contenders by providing a diverse selection of cutting-edge mobile security solutions that are developed to meet the requirements of both commercial enterprises and individual consumers. One prominent company in the Japan mobile security market is Trend Micro Inc., a global cybersecurity leader known for its comprehensive portfolio of security solutions. Trend Micro provides a diverse selection of mobile security services and products that safeguard mobile devices against an extensive array of perils. Such threats comprise data breaches, phishing attempts, and malware. The company's mobile security solutions are known for their advanced threat detection capabilities and ability to provide real-time protection for mobile devices.

Another significant player in the Japan mobile security market is NTT Security Corporation, a Nippon Telegraph and Telephone Corporation (NTT) subsidiary and a leading provider of managed security services. NTT Security offers a suite of mobile security solutions focused on threat intelligence, mobile device protection, and secure mobile application development, helping organizations in Japan navigate the complex cybersecurity landscape.

Furthermore, SoftBank Corp., a major telecommunications company in Japan, actively provides mobile security solutions to its customers. SoftBank offers mobile security services, including antivirus protection, secure web browsing, and threat detection for mobile devices, leveraging its extensive network infrastructure to deliver reliable security solutions to businesses and consumers.

Additionally, NEC Corporation, a global technology company headquartered in Japan, offers various mobile security solutions to protect against advanced cyber threats targeting mobile devices and applications. NEC's mobile security offerings include threat detection, secure mobile communications, and identity management solutions, addressing the security needs of enterprises and government organizations in Japan.

Another significant player in the Japan mobile security market is Kaspersky Lab Japan, the Japanese arm of the renowned cybersecurity company Kaspersky. Kaspersky Lab Japan offers a comprehensive suite of mobile security solutions to protect mobile devices from cyber threats, including mobile antivirus, anti-theft features, and secure web browsing. The company is known for its cybersecurity expertise and commitment to providing effective mobile security solutions to businesses and consumers in Japan.

Sophos Japan KK is also a notable player in the Japan mobile security market, offering various mobile security solutions to protect against malware, ransomware, and other mobile threats. Providing secure web browsing, mobile device management, and threat detection services, the organization's mobile security offerings target Japanese businesses and individuals.

Furthermore, F-Secure Japan is widely acknowledged as a frontrunner in the Japanese mobile security solutions industry, delivering products and services designed to safeguard mobile devices against cyber threats. F-Secure's mobile security solutions are known for their user-friendly interfaces and their ability to provide comprehensive protection against a wide range of mobile threats, making them popular choices among businesses and consumers in Japan.

In conclusion, the Japan mobile security market is characterized by several established companies offering diverse mobile security solutions. These companies are known for their expertise in cybersecurity and commitment to providing effective and innovative mobile security solutions tailored to the unique needs of the Japanese market.

By Offering

By Operating System

By Deployment

By Enterprise Size

By Vertical