Japan Mobile SoC Market Size, Share & Trends Analysis Report By Operating System (Android, and iOS), By Core Type (Octa Core, Quad Core, Hexa Core, and Others), and Forecast, 2023 - 2030

Published Date : 20-May-2024 |

Pages: 88 |

Formats: PDF |

COVID-19 Impact on the Japan Mobile SoC Market

The Japan Mobile SoC Market size is expected to reach $152.59 Million by 2030, rising at a market growth of 16.6% CAGR during the forecast period.

The mobile SoC market in Japan has seen significant growth and innovation over the years, driven by the country's advanced technology infrastructure and a strong focus on research and development. One of the key factors driving the growth of the mobile SoC market in Japan is the increasing demand for smartphones and tablets. These devices have become essential tools for communication, entertainment, and productivity, leading to a continuous need for more powerful and energy-efficient SoCs to power them. Japanese companies have been at the forefront of developing cutting-edge SoC designs that meet the demands of consumers worldwide.

Another important aspect of the mobile SoC market in Japan is the emphasis on integration and miniaturization. Japanese semiconductor companies have invested heavily in developing SoCs that combine multiple functionalities into a single chip, enabling smaller, more energy-efficient mobile devices. This trend toward integration has led to highly integrated SoC solutions that offer improved performance and reduced power consumption.

Moreover, Japan's automotive industry is also driving demand for mobile SoCs, particularly for applications such as advanced driver-assistance systems (ADAS) and in-vehicle infotainment systems. Japanese semiconductor companies have been leveraging their expertise in automotive electronics to develop specialized SoC solutions tailored to the requirements of the automotive industry.

The COVID-19 pandemic has significantly impacted the mobile SoC market in Japan. The pandemic disrupted supply chains, leading to shortages of critical components and delaying the launch of new products. The shift towards remote work and online learning also increased the demand for smartphones, tablets, and other mobile devices, driving up the need for SoCs in Japan.

Market Trends

Growing adoption of 5G networks

The mobile SoC market in Japan has witnessed a significant uptick in adopting 5G networks, marking a transformative shift in the country's telecommunications landscape. One of the primary drivers behind the growing adoption of 5G networks in Japan's mobile SoC market is the increasing demand for high-speed internet connectivity and data-intensive applications. As Japanese consumers rely more on bandwidth-hungry services such as streaming high-definition videos, online gaming, and augmented reality (AR) experiences, faster and more reliable network infrastructure becomes paramount.

Moreover, the proliferation of Internet of Things (IoT) devices and the emergence of smart city initiatives fuel the demand for robust and scalable connectivity solutions. The establishment of 5G is a high priority for the Japanese government. The burgeoning adoption of 5G networks in Japan's mobile SoC market drives significant investments from Japanese mobile carriers.

According to the International Trade Administration, the Japanese mobile carriers will spend more than $14 billion combined in capital expenditures over the next five years to build out their 5G networks. In 2019, suppliers exported telecom equipment (HS 8517.62) worth more than $720 million to Japan, reflecting the increasing demand for technology to support the country's evolving mobile network landscape.

Furthermore, deploying 5G networks is expected to catalyze industrial automation and autonomous systems advancements. The ultra-low latency capabilities of 5G networks in Japan enable mission-critical applications such as remote surgery, autonomous vehicles, and industrial robotics to operate with unprecedented responsiveness and reliability, unlocking new possibilities for automation and efficiency improvement in various sectors. Thus, the widespread adoption of 5G networks in Japan's mobile SoC market is revolutionizing connectivity and driving significant industry advancements.

Rising advancements in mobile technology

In Japan, the mobile SoC market is witnessing a rapid evolution driven by relentless advancements in mobile technology. One prominent trend in Japan's mobile SoC market is pursuing higher computational power within smaller form factors. This drive is fueled by the demand for seamless user experiences, including gaming, multimedia streaming, augmented reality (AR), and artificial intelligence (AI) applications. Manufacturers in Japan are continuously pushing the boundaries of chip design, leveraging cutting-edge fabrication processes and architectural optimizations to deliver superior processing prowess while conserving energy.

Furthermore, integrating AI capabilities into mobile SoCs has become a pivotal development. AI accelerators embedded within SoCs empower devices to execute complex machine learning algorithms locally, enabling tasks such as image recognition, natural language processing, and predictive analytics with remarkable speed and efficiency. This localization of AI processing reduces reliance on cloud services, enhancing user privacy and enabling real-time responsiveness in AI-driven applications.

With the growing emphasis on sustainability and energy efficiency, Japanese SoC manufacturers are investing in power-efficient designs to prolong battery life and reduce carbon footprint. This involves the development of low-power CPU and GPU architectures, advanced power management techniques, and energy-efficient manufacturing processes such as 7nm and 5nm lithography. By optimizing power consumption without compromising performance, these SoCs enable users to enjoy longer usage times between charges. Hence, Japan's mobile SoC market is witnessing a rapid evolution driven by advancements in computational power, AI integration, and a commitment to sustainability.

Competition Analysis

The mobile SoC market in Japan is a dynamic and competitive landscape, with several key players vying for industry share and technological dominance. One of the leading companies in the Japanese mobile SoC market is MediaTek. Based in Taiwan, MediaTek is a leading fabless semiconductor company that designs a diverse portfolio of SoC solutions for various consumer electronics applications. MediaTek's Helio series of SoCs are widely used in smartphones and tablets, offering a compelling combination of performance, affordability, and power efficiency. These SoCs feature MediaTek's proprietary CPU and GPU architectures and integrated connectivity solutions for Wi-Fi, Bluetooth, and cellular networks. MediaTek has established itself as a key player in the Japanese industry, catering to the diverse needs of consumers and OEMs with its comprehensive range of SoC offerings.

In addition to Qualcomm and MediaTek, Japanese companies such as Sony and Toshiba play significant roles in the mobile SoC market. Sony, known for its imaging and multimedia technologies expertise, develops custom SoCs for its Xperia line of smartphones and tablets. These SoCs incorporate Sony's advanced image signal processing algorithms, enabling high-quality photography and video recording capabilities. Toshiba, on the other hand, focuses on power-efficient SoC designs for a variety of mobile and embedded applications. The company's expertise in semiconductor manufacturing and system integration allows it to deliver SoC solutions that meet modern mobile devices' performance and power requirements.

Furthermore, Japanese semiconductor companies like Renesas Electronics and Socionext contribute to the mobile SoC market with their specialized expertise in system-on-chip design and development. Renesas Electronics offers a range of SoC solutions tailored for automotive applications, leveraging its extensive experience in electronics and embedded systems. Socionext, a spin-off from Fujitsu and Panasonic, specializes in high-performance SoCs for multimedia and networking applications, targeting industries such as digital signage, surveillance cameras, and industrial automation. With the continued evolution of mobile devices and the proliferation of new applications such as augmented reality (AR), virtual reality (VR), and artificial intelligence (AI), the demand for advanced SoC solutions is expected to grow, further fueling competition and innovation in the Japanese mobile SoC market.

List of Key Companies Profiled

- Unisoc (Shanghai) Technologies Co., Ltd. (Wise Road Capital LTD)

- HiSilicon (Shanghai) Technologies CO., LIMITED (Huawei Technologies Co., Ltd.) (Huawei Investment & Holding Co., Ltd.)

- NVIDIA Corporation

- Intel Corporation

- Apple, Inc.

- Advanced Micro Devices, Inc.

- Qualcomm Incorporated

- MediaTek, Inc.

- NXP Semiconductors N.V.

- Samsung Electronics Co., Ltd. (Samsung Group)

Japan Mobile SoC Market Report Segmentation

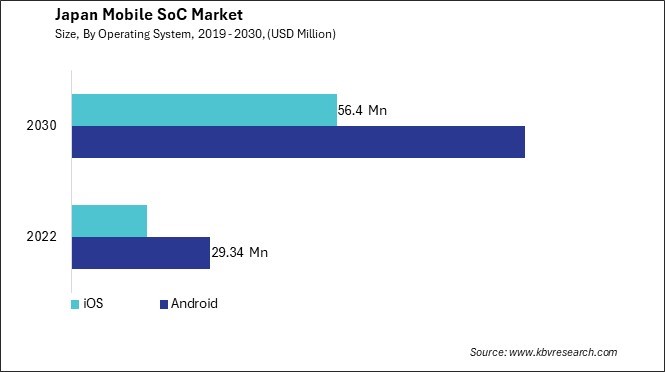

By Operating System

- Android

- iOS

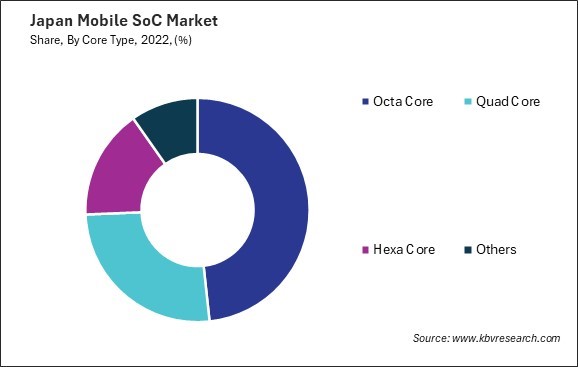

By Core Type

- Octa Core

- Quad Core

- Hexa Core

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Japan Mobile SoC Market, by Operating System

1.4.2 Japan Mobile SoC Market, by Core Type

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities

2.2.3 Market Restraints

2.2.4 Market Challenges

2.2.5 Market Trends

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

3.3.2 Key Strategic Move: (Product Launches and Product Expansions: 2021, Dec – 2024, Jan) Leading Players

3.4 Porter Five Forces Analysis

Chapter 4. Japan Mobile SoC Market

4.1 Japan Mobile SoC Market by Operating System

4.2 Japan Mobile SoC Market by Core Type

Chapter 5. Company Profiles - Global Leaders

5.1 Unisoc (Shanghai) Technologies Co., Ltd. (Wise Road Capital LTD)

5.1.1 Company Overview

5.1.2 Recent strategies and developments:

5.1.2.1 Partnerships, Collaborations, and Agreements:

5.2 HiSilicon (Shanghai) Technologies CO., LIMITED (Huawei Technologies Co., Ltd.) (Huawei Investment & Holding Co., Ltd.)

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expense

5.3 NVIDIA Corporation

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expenses

5.3.5 Recent strategies and developments:

5.3.5.1 Partnerships, Collaborations, and Agreements:

5.3.6 SWOT Analysis

5.4 Intel Corporation

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expenses

5.4.5 Recent strategies and developments:

5.4.5.1 Partnerships, Collaborations, and Agreements:

5.4.5.2 Product Launches and Product Expansions:

5.4.5.3 Acquisition and Mergers:

5.4.6 SWOT Analysis

5.5 Apple, Inc.

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Regional Analysis

5.5.4 Research & Development Expense

5.5.5 Recent strategies and developments:

5.5.5.1 Product Launches and Product Expansions:

5.5.6 SWOT Analysis

5.6 Advanced Micro Devices, Inc.

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expenses

5.6.5 Recent strategies and developments:

5.6.5.1 Partnerships, Collaborations, and Agreements:

5.6.5.2 Product Launches and Product Expansions:

5.6.5.3 Acquisition and Mergers:

5.6.6 SWOT Analysis

5.7 Qualcomm Incorporated

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expense

5.7.5 Recent strategies and developments:

5.7.5.1 Product Launches and Product Expansions:

5.7.5.2 Acquisition and Mergers:

5.7.6 SWOT Analysis

5.8 MediaTek, Inc.

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Regional Analysis

5.8.4 Research & Development Expenses

5.8.5 Recent strategies and developments:

5.8.5.1 Product Launches and Product Expansions:

5.8.6 SWOT Analysis

5.9 NXP Semiconductors N.V.

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Regional Analysis

5.9.4 Research & Development Expense

5.9.5 Recent strategies and developments:

5.9.5.1 Product Launches and Product Expansions:

5.9.6 SWOT Analysis

5.10. Samsung Electronics Co., Ltd. (Samsung Group)

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Segmental and Regional Analysis

5.10.4 Recent strategies and developments:

5.10.4.1 Partnerships, Collaborations, and Agreements:

5.10.5 SWOT Analysis

TABLE 2 Japan Mobile SoC Market, 2023 - 2030, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Mobile SoC Market

TABLE 4 Product Launches And Product Expansions– Mobile SoC Market

TABLE 5 Acquisition and Mergers– Mobile SoC Market

TABLE 6 Japan Mobile SoC Market by Operating System, 2019 - 2022, USD Million

TABLE 7 Japan Mobile SoC Market by Operating System, 2023 - 2030, USD Million

TABLE 8 Japan Mobile SoC Market by Core Type, 2019 - 2022, USD Million

TABLE 9 Japan Mobile SoC Market by Core Type, 2023 - 2030, USD Million

TABLE 10 Key Information – Unisoc (Shanghai) Technologies Co., Ltd.

TABLE 11 Key Information – HiSilicon (Shanghai) Technologies CO., LIMITED

TABLE 12 Key Information – NVIDIA Corporation

TABLE 13 Key Information – Intel Corporation

TABLE 14 Key Information – Apple, Inc.

TABLE 15 Key information – Advanced Micro Devices, Inc.

TABLE 16 Key Information – Qualcomm Incorporated

TABLE 17 Key Information – MediaTek, Inc.

TABLE 18 Key Information – NXP Semiconductors N.V.

TABLE 19 Key Information – Samsung Electronics Co., Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 Japan Mobile SoC Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Mobile SoC Market

FIG 4 KBV Cardinal Matrix

FIG 5 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 6 Key Strategic Move: (Product Launches and Product Expansions : 2021, Dec – 2024, Jan) Leading Players

FIG 7 Porter’s Five Forces Analysis – Mobile SoC Market

FIG 8 Japan Mobile SoC Market share by Operating System, 2022

FIG 9 Japan Mobile SoC Market share by Operating System, 2030

FIG 10 Japan Mobile SoC Market by Operating System, 2019 - 2030, USD Million

FIG 11 Japan Mobile SoC Market share by Core Type, 2022

FIG 12 Japan Mobile SoC Market share by Core Type, 2030

FIG 13 Japan Mobile SoC Market by Core Type, 2019 - 2030, USD Million

FIG 14 SWOT Analysis: NVIDIA Corporation

FIG 15 Recent strategies and developments: Intel Corporation

FIG 16 SWOT Analysis: Intel corporation

FIG 17 SWOT Analysis: Apple, Inc.

FIG 18 Recent strategies and developments: Advanced Micro Devices, Inc.

FIG 19 SWOT Analysis: Advanced Micro Devices, Inc.

FIG 20 Recent strategies and developments: Qualcomm, Inc.

FIG 21 SWOT Analysis: QUALCOMM Incorporated

FIG 22 SWOT Analysis: MediaTek, Inc.

FIG 23 SWOT Analysis: NXP Semiconductors N.V.

FIG 24 SWOT Analysis: Samsung Electronics Co., Ltd