Japan PMI Foam Market Size, Share & Trends Analysis Report By Application (Aerospace & Defense, Automotive & Transportation, Wind Energy, Sports Goods, and Others), and Forecast, 2023 - 2030

Published Date : 16-May-2024 |

Pages: 81 |

Formats: PDF |

COVID-19 Impact on the Japan PMI Foam Market

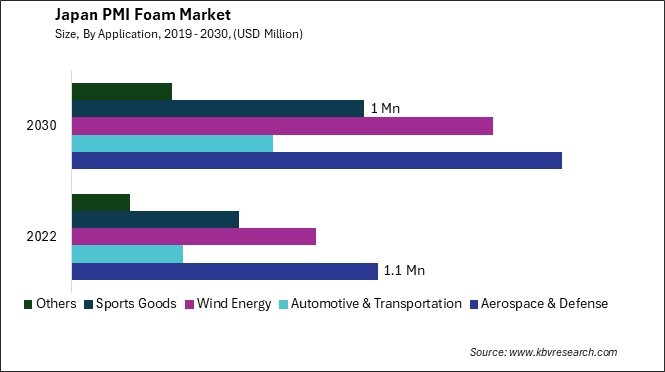

The Japan PMI Foam Market size is expected to reach $5.3 Million by 2030, rising at a market growth of 6.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 206.28 Thousand Square Meter, experiencing a growth of 3.0% (2019-2022).

The PMI foam market in Japan has witnessed significant growth over recent years, driven by the expanding demand across various end-use industries such as aerospace, automotive, wind energy, and construction. PMI foam is extensively utilized in aircraft interior components, sandwich panels, and structural parts in the aerospace sector due to its exceptional strength and fire-resistant properties. Japan's thriving aerospace industry, characterized by major aircraft manufacturers and suppliers, has been a key contributor to the increasing adoption of PMI foam in the region.

Additionally, the wind energy sector has emerged as a key growth driver for the PMI foam market in Japan. With increasing investments in renewable energy infrastructure, there is a rising demand for lightweight materials that withstand harsh environmental conditions while ensuring optimal energy generation. PMI foam's high strength-to-weight ratio and corrosion resistance make it well-suited for the manufacturing of wind turbine blades, contributing to the expansion of Japan's wind energy capacity.

The COVID-19 pandemic has significantly impacted the PMI foam market in Japan, causing disruptions in the supply chain and production activities. The pandemic-induced lockdowns and restrictions led to temporary closures of manufacturing facilities, resulting in project timelines and shipment schedule delays. Additionally, subdued demand from end-use industries such as aerospace and automotive further exacerbated the challenges faced by PMI foam manufacturers in Japan. However, as the economy gradually recovers and industrial activities resume, the PMI foam market is expected to rebound, supported by renewed investments in infrastructure projects and technological advancements driving product innovation and efficiency improvements.

Market Trends

Expansion of the automotive industry

Japan's automotive industry has pioneered innovative technologies to enhance the performance, safety, and sustainability of vehicles. One such technology gaining significant traction is using PMI (polymethacrylimide) foam in various automotive applications. One key area where PMI foam is making inroads in the Japanese automotive sector is the production of lightweight components. As automakers in Japan strive to comply with stringent fuel efficiency regulations and reduce the environmental footprint of their vehicles, the demand for lightweight materials has surged.

According to the Japan Automobile Dealers Association (JADA), sales of new electric vehicles in 2020 reached close to 1.4 million. New electric vehicles accounted for 36.2% of total new car sales, up from 35.2% in 2019 and 32.9% in 2017. This growth reflects a broader trend toward adopting electric vehicles within the automotive sector, driving demand for innovative materials like PMI foam in Japan's automotive manufacturing landscape.

Moreover, PMI foam's excellent thermal and acoustic insulation properties are invaluable in enhancing vehicle occupants' comfort and cabin experience. By effectively dampening noise, vibration, and harshness (NVH), PMI foam in Japan helps create a quieter and more serene driving environment, elevating the overall perceived quality of the vehicle. Additionally, its thermal insulation capabilities improve energy efficiency by reducing the workload on heating, ventilation, and air conditioning (HVAC) systems.

Furthermore, the adoption of PMI foam in electric and hybrid vehicles is gaining momentum, driven by the need to optimize battery performance and range. By utilizing PMI foam in battery enclosures and thermal management systems, Japanese automakers enhance battery safety, efficiency, and longevity, thereby bolstering the appeal and competitiveness of electric vehicles in the Japanese industry. Therefore, the expansion of the automotive industry in Japan is intrinsically linked to the proliferation of innovative materials like PMI foam.

Growing demand for high-performance sports equipment

In recent years, Japan has witnessed a burgeoning demand for high-performance sports equipment, driving significant growth within the PMI foam market. One key driver behind the rising demand for high-performance sports equipment is the country's evolving fitness culture. With an increasing awareness of the importance of physical activity for overall health and well-being, more Japanese consumers are actively engaging in various sports and fitness activities. This trend has created a robust industry for premium sports equipment that offers superior performance, durability, and comfort – qualities that PMI foam is well-suited to provide.

Moreover, Japan's aging population has also contributed to the demand for high-performance sports equipment. As individuals seek to maintain an active lifestyle well into their later years, there is a growing need for sports gear to support their changing physical capabilities and enhance safety features. Furthermore, the continuous innovation in material science and manufacturing technologies has expanded the possibilities for incorporating PMI foam into a wide range of sports equipment. Manufacturers in Japan are leveraging the unique properties of PMI foam, such as its high strength-to-weight ratio, impact resistance, and energy absorption capabilities, to develop cutting-edge products that meet the evolving needs of athletes and sports enthusiasts.

In addition to its performance benefits, PMI foam aligns with growing sustainability concerns in Japan. As consumers become more environmentally conscious, there is a growing preference for sports equipment manufactured using eco-friendly materials and production processes. Hence, the increasing demand for high-performance sports equipment in Japan, driven by evolving fitness culture, an aging population, and sustainability concerns, has propelled significant growth in the PMI foam market.

Competition Analysis

In Japan, the PMI foam market has experienced notable growth and technological advancements, propelled by the country's strong manufacturing base and emphasis on innovation across industries. One of the key players in the Japanese PMI foam market is Sekisui Chemical Co., Ltd., a leading diversified chemical company headquartered in Osaka. Sekisui Chemical manufactures PMI foam under the brand name "Sekisui Aerospace Corporation," catering primarily to the aerospace industry. The company's PMI foam products, known for their exceptional mechanical properties and fire resistance, are utilized in aircraft interiors, structural components, and sandwich panels. With a strong commitment to research and development, Sekisui Chemical continues to innovate and expand its PMI foam portfolio to meet the evolving needs of its customers.

Another prominent contributor to the Japanese PMI foam market is Kaneka Corporation, a multinational chemical company headquartered in Osaka. Kaneka produces PMI foam under the brand name "Kaneka Aero," offering a range of high-performance foam products tailored to meet the stringent requirements of the aerospace and automotive industries. The company is known for its lightweight construction, excellent dimensional stability, and resistance to heat and chemicals, making it an ideal choice for applications such as aircraft seating, interior panels, and automotive components. With a focus on sustainability and technological innovation, Kaneka Corporation remains at the forefront of PMI foam development in Japan.

Mitsui Chemicals, Inc. plays a significant role in the Japanese PMI foam market. The company produces PMI foam under the brand name "ALPOLIC™/fr," primarily targeting the construction and architectural industries. ALPOLIC™/fr foam panels, featuring a core of PMI foam sandwiched between two aluminum sheets, offer excellent fire resistance, thermal insulation, and structural integrity, making them suitable for building facades, cladding systems, and interior partitions. Mitsui Chemicals' commitment to quality and innovation has positioned it as a trusted provider of PMI foam solutions for architectural applications in Japan and beyond.

Furthermore, Nippon Steel Chemical Co., Ltd., a subsidiary of Nippon Steel Corporation, is actively involved in the Japanese PMI foam market. Nippon Steel Chemical manufactures PMI foam under the brand name "NSCC-EX," targeting applications in the automotive, marine, and sporting goods sectors. NSCC-EX foam products boast superior strength, stiffness, and impact resistance, making them suitable for lightweight structural components, hulls, and sporting equipment. As industries continue to prioritize lightweight materials and enhanced performance, companies in Japan are well-positioned to leverage their expertise and capabilities to meet the evolving demands of the industry and drive further growth and innovation in PMI foam applications.

List of Key Companies Profiled

- BASF SE

- SABIC (Saudi Arabian Oil Company)

- Evonik Industries AG (RAG-Stiftung)

- Solvay SA

- Zotefoams plc

- DuPont de Nemours, Inc.

- Diab Group

- The Dow Chemical Company

- Huntsman Corporation

- Covestro AG

Japan PMI Foam Market Report Segmentation

By Application

- Aerospace & Defense

- Automotive & Transportation

- Wind Energy

- Sports Goods

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Japan PMI Foam Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities

2.2.3 Market Restraints

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter Five Forces Analysis

Chapter 3. Japan PMI Foam Market

3.1 Japan PMI Foam Market, By Application

Chapter 4. Company Profiles – Global Leaders

4.1 BASF SE

4.1.1 Company Overview

4.1.2 Financial Analysis

4.1.3 Segmental and Regional Analysis

4.1.4 Research & Development Expense

4.1.5 SWOT Analysis

4.2 SABIC (Saudi Arabian Oil Company)

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 Segmental and Regional Analysis

4.2.4 SWOT Analysis

4.3 Evonik Industries AG (RAG-Stiftung)

4.3.1 Company Overview

4.3.2 Financial Analysis

4.3.3 Segmental and Regional Analysis

4.3.4 Research & Development Expenses

4.3.5 SWOT Analysis

4.4 Solvay SA

4.4.1 Company Overview

4.4.2 Financial Analysis

4.4.3 Segmental and Regional Analysis

4.4.4 Research & Development Expenses

4.4.5 SWOT Analysis

4.5 Zotefoams plc

4.5.1 Company Overview

4.5.2 Financial Analysis

4.5.3 Segmental and Regional Analysis

4.5.4 Research & Development Expenses

4.5.5 SWOT Analysis

4.6 DuPont de Nemours, Inc.

4.6.1 Company Overview

4.6.2 Financial Analysis

4.6.3 Segmental and Regional Analysis

4.6.4 Research & Development Expense

4.6.5 SWOT Analysis

4.7 Diab Group

4.7.1 Company Overview

4.7.2 SWOT Analysis

4.8 The Dow Chemical Company

4.8.1 Company Overview

4.8.2 Financial Analysis

4.8.3 Segmental and Regional Analysis

4.8.4 Research & Development Expenses

4.8.5 SWOT Analysis

4.9 Huntsman Corporation

4.9.1 Company Overview

4.9.2 Financial Analysis

4.9.3 Segment and Regional Analysis

4.9.4 Research & Development Expense

4.9.5 SWOT Analysis

4.10. Covestro AG

4.10.1 Company Overview

4.10.2 Financial Analysis

4.10.3 Segmental and Regional Analysis

4.10.4 Research & Development Expenses

4.10.5 SWOT Analysis

TABLE 2 Japan PMI Foam Market, 2023 - 2030, USD Thousands

TABLE 3 Japan PMI Foam Market, 2019 - 2022, Thousand Square Meter

TABLE 4 Japan PMI Foam Market, 2023 - 2030, Thousand Square Meter

TABLE 5 Japan PMI Foam Market, By Application, 2019 - 2022, USD Thousands

TABLE 6 Japan PMI Foam Market, By Application, 2023 - 2030, USD Thousands

TABLE 7 Japan PMI Foam Market, By Application, 2019 - 2022, Thousand Square Meter

TABLE 8 Japan PMI Foam Market, By Application, 2023 - 2030, Thousand Square Meter

TABLE 9 Key Information – BASF SE

TABLE 10 Key Information – SABIC

TABLE 11 Key Information – Evonik Industries AG

TABLE 12 Key Information – Solvay SA

TABLE 13 Key Information – Zotefoams plc

TABLE 14 Key Information –DuPont de Nemours, Inc.

TABLE 15 Key Information – Diab Group

TABLE 16 Key Information – The Dow Chemical Company

TABLE 17 key Information – Huntsman Corporation

TABLE 18 key information – Covestro AG

List of Figures

FIG 1 Methodology for the research

FIG 2 Japan PMI Foam Market, 2019 - 2030, USD Thousands

FIG 3 Key Factors Impacting PMI Foam Market

FIG 4 Porter’s Five Forces Analysis – PMI Foam Market

FIG 5 Japan PMI Foam Market share, By Application, 2022

FIG 6 Japan PMI Foam Market share, By Application, 2030

FIG 7 Japan PMI Foam Market, By Application, 2019 - 2030, USD Thousands

FIG 8 SWOT Analysis: BASF SE

FIG 9 SWOT Analysis: SABIC

FIG 10 SWOT Analysis: Evonik Industries AG

FIG 11 SWOT Analysis: Solvay SA

FIG 12 Swot Analysis: Zotefoams plc

FIG 13 Swot Analysis: DuPont de Nemours, Inc.

FIG 14 Swot Analysis: Diab Group

FIG 15 SWOT Analysis: The Dow Chemical Company

FIG 16 SWOT Analysis: Huntsman Corporation

FIG 17 SWOT Analysis: Covestro AG