The Japan Polycarbonate Market size is expected to reach $3.4 Billion by 2030, rising at a market growth of 4.4% CAGR during the forecast period. In the year 2022, the market attained a volume of 694 Kilo Tonnes, experiencing a growth of 2.2% (2019-2022).

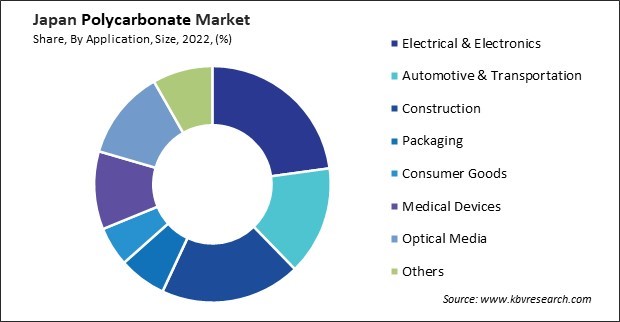

The polycarbonate market in Japan has experienced significant growth and development in recent years. One of the primary drivers of the polycarbonate market in Japan is the growing automotive industry. With the rising trend towards fuel efficiency and emission reduction, automakers in Japan are increasingly incorporating polycarbonate components in vehicles to achieve weight reduction and enhance performance. Additionally, the demand for electric vehicles (EVs) has further boosted the consumption of polycarbonate, as it is essential for manufacturing lightweight and aerodynamic components such as glazing, bumpers, and interior trims. According to the Japan Automobile Dealers Association (JADA), sales of new electric vehicles in 2020 reached close to 1.4 million. As the sales of EVs increased, the consumption of polycarbonate market also expanded.

Moreover, the packaging industry in Japan is another significant contributor to the demand for polycarbonate. The packaging sector relies on polycarbonate for manufacturing durable and lightweight packaging materials such as bottles, containers, and blister packs. Polycarbonate packaging offers excellent clarity, impact resistance, and barrier properties, making it suitable for various products including food, beverages, pharmaceuticals, and personal care items.

Japan's electronics and electrical industry extensively utilizes polycarbonate in producing consumer electronics, electrical components, and appliances due to its excellent electrical insulation properties and high heat resistance. Additionally, the healthcare sector relies on polycarbonate for manufacturing medical devices, equipment, and packaging materials due to its biocompatibility and sterilization capabilities.

In recent years, technological advancements have further propelled Japan's polycarbonate market growth. Japanese manufacturers are continuously innovating to develop advanced grades of polycarbonate with enhanced properties such as improved heat resistance, chemical resistance, and scratch resistance. These innovations have expanded the application scope of polycarbonate, allowing its usage in demanding environments such as automotive under-the-hood components, medical devices, and aerospace applications.

However, the polycarbonate market in Japan has been impacted by the COVID-19 pandemic. The outbreak led to disruptions in the global supply chain, causing shortages of raw materials and affecting manufacturing operations. The slowdown in economic activities and restrictions on movement resulted in reduced demand for polycarbonate products across industries. Moreover, fluctuations in currency exchange rates and uncertainty regarding trade policies added to the challenges faced by the industry players.

The Japanese industry for medical devices made from polycarbonate has been experiencing a notable uptick in adoption, owing to several key factors driving demand and innovation within the healthcare sector. One significant driver behind the increasing adoption of polycarbonate-based medical devices in Japan is the growing emphasis on patient safety and comfort. With a rapidly aging population, there is a heightened focus on developing medical devices that enhance patient care and promote better health outcomes. Polycarbonate's biocompatibility makes it suitable for prolonged contact with human tissue, reducing the risk of adverse reactions and ensuring patient comfort during medical procedures.

According to the International Trade Administration, the Japanese medical devices industry achieved a significant milestone in 2021, reaching a total value of $40 billion. The polycarbonate market in Japan also experienced significant growth during the same period.

Moreover, the lightweight nature of polycarbonate makes it particularly advantageous for fabricating wearable medical devices and equipment. From wearable glucose monitors to drug delivery systems, polycarbonate offers a balance of strength and lightweight properties that improve patient comfort and mobility while ensuring reliable performance.

In addition, the versatility of polycarbonate enables the design and production of complex medical devices with precision and cost-effectiveness. Advanced manufacturing techniques such as injection molding and 3D printing allow for the creation of intricate geometries and customized components, facilitating innovation in medical device design and functionality. Thus, the surge in adoption of polycarbonate-based medical devices in Japan is driven by their biocompatibility, lightweight nature, and versatility, revolutionizing patient care and promoting innovation in the healthcare sector.

In recent years, Japan has witnessed a resurgence in the demand for optical media, particularly within the polycarbonate market. One significant driver of this trend is the increasing adoption of high-definition (HD) technologies across multiple industries. With the proliferation of HD content in sectors such as entertainment, gaming, and data storage, there has been a corresponding need for optical media capable of storing and delivering such content efficiently.

Moreover, the enduring appeal of physical media in Japan's cultural landscape has also played a pivotal role in driving the demand for optical discs. Despite the growing prevalence of digital streaming platforms, many consumers in Japan still value the tactile experience and permanence offered by physical media. Furthermore, the burgeoning industry for archival storage solutions has bolstered the demand for optical media in Japan.

Additionally, advancements in manufacturing technologies have enhanced the capabilities and versatility of optical media, further fueling its adoption in Japan. Hence, Japan's renewed interest in optical media is driven by the surge in HD technologies, cultural affinity for physical formats, growing demand for archival solutions, and advancements in manufacturing, expanding its applications across various industries.

The polycarbonate market in Japan is a significant sector within the country's chemical industry, driven by the diverse applications and properties of polycarbonate materials. One of the prominent players in the Japanese polycarbonate market is Mitsubishi Engineering-Plastics Corporation (MEP). MEP is a subsidiary of Mitsubishi Chemical Corporation and specializes in developing and manufacturing engineering plastics, including polycarbonate. With a strong focus on research and development, MEP continuously introduces new grades of polycarbonate resins with enhanced properties such as heat resistance, impact strength, and optical clarity, meeting the demanding requirements of various industries.

Another key player in the Japanese polycarbonate market is Teijin Limited, a diversified chemical company with a significant presence in the global plastics industry. Teijin produces polycarbonate resins under its engineering plastics division, offering a wide range of grades tailored for automotive, electrical electronics, and consumer goods applications. The company's commitment to innovation and sustainability drives its efforts to develop eco-friendly polycarbonate materials and manufacturing processes, aligning with the growing focus on environmental responsibility.

Sumitomo Chemical Company also contributes to the Japanese polycarbonate market, supplying high-quality polycarbonate resins for various applications. Leveraging its expertise in polymer chemistry and manufacturing technology, Sumitomo Chemical delivers innovative solutions that meet customers' evolving needs in industries such as automotive, construction, and medical devices. The company's dedication to quality and customer satisfaction has established it as a trusted partner in the polycarbonate market.

In addition to these major players, several other companies play important roles in Japan's polycarbonate market, contributing to its competitiveness and innovation. Companies such as Asahi Kasei Corporation, Idemitsu Kosan Co., Ltd., and LG Chem are actively involved in producing and distributing polycarbonate resins, sheets, and compounds, serving diverse industries and applications. With a focus on quality, innovation, and sustainability, these companies are well-positioned to capitalize on emerging opportunities and address the evolving needs of customers in Japan.

By Product Type

By Application

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.