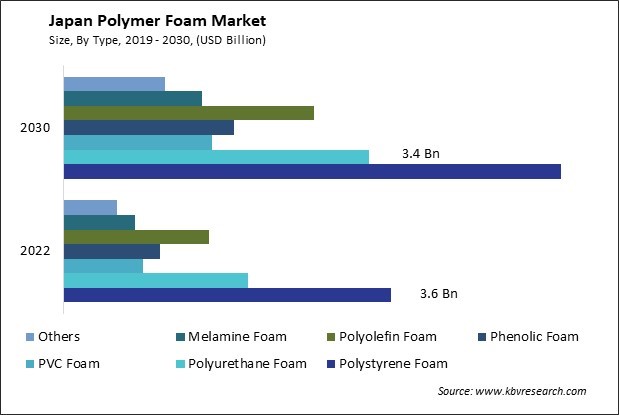

The Japan Polymer Foam Market size is expected to reach $17.9 Billion by 2030, rising at a market growth of 6.8% CAGR during the forecast period. In the year 2022, the market attained a volume of 4,759.2 Million Square Meter, experiencing a growth of 6.6% (2019-2022)

The polymer foam market in Japan has witnessed significant growth over the years. Technological advancements have played a crucial role in the growth of the polymer foam market in Japan. Manufacturers in Japan are constantly innovating to develop foam materials with enhanced properties such as improved strength, thermal resistance, and fire retardancy. Advanced manufacturing processes such as extrusion, injection molding, and chemical foaming have produced foam materials with precise dimensions and tailored properties to meet the specific requirements of different applications.

Furthermore, growing environmental concerns and regulations regarding sustainable materials have boosted Japan's demand for bio-based and recycled polymer foams. Manufacturers increasingly focus on developing eco-friendly foam materials derived from renewable sources such as plant-based feedstocks or recycled plastics. This shift towards sustainability aligns with Japan's long-term goal of achieving a circular economy and reducing dependency on fossil fuels.

The COVID-19 pandemic has significantly impacted Japan's polymer foam market, as it has disrupted supply chains, led to fluctuations in demand, and affected manufacturing operations. During the initial stages of the pandemic, the lockdown measures and restrictions on movement resulted in a temporary slowdown in construction activities and automotive production, leading to a decline in the demand for polymer foams. The uncertainty surrounding the economic outlook has also prompted companies to reassess their investment plans, further impacting the polymer foam market.

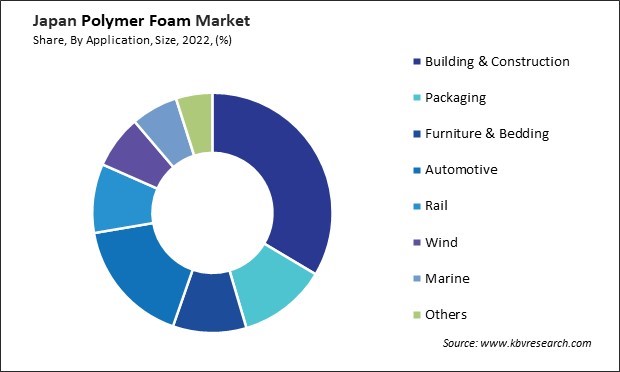

The polymer foam market in Japan is experiencing a significant upswing, primarily fueled by the expanding construction sector. One of the primary drivers behind the burgeoning demand for polymer foam in the construction sector is its lightweight nature and remarkable strength and insulation properties. According to the U.S. Geological Survey, in 2019, Japan's nominal gross domestic product (GDP) reached $5.13 trillion, with the construction sector contributing 5.4% of the overall GDP. Manufacturers increasingly develop bio-based and recycled polymer foam materials, aligning with the country's ambitious sustainability goals and stringent environmental regulations.

In Japan, where seismic activity is a constant concern, polymer foam materials are gaining traction due to their ability to enhance buildings' seismic resilience. These materials provide cushioning and flexibility, mitigating the impact of seismic forces and reducing the risk of structural damage during earthquakes. Moreover, the growing focus on sustainability is driving the adoption of eco-friendly polymer foam solutions in construction projects across Japan. The construction sector's reliance on polymer foam extends beyond insulation to include applications such as lightweight fillers, structural components, and moisture barriers.

Furthermore, the Japanese government's initiatives to promote energy-efficient building practices further propel the demand for polymer foam insulation materials. To reduce carbon emissions and enhance energy efficiency, policies such as the Energy Conservation Act and the Zero-Energy Building (ZEB) concept are incentivizing builders and developers to incorporate advanced insulation solutions into their projects. Hence, the convergence of seismic resilience, sustainability, and government incentives is driving a surge in demand for polymer foam in Japan's construction sector.

In recent years, Japan has witnessed a significant surge in the popularity of recreational activities, particularly those involving polymer foam products. One of the key drivers behind the growing popularity of polymer foam-based recreational activities is the versatility and durability of these materials. Polymer foam, known for its lightweight and resilient properties, has found wide-ranging applications in various recreational products, including water sports equipment, camping gear, and fitness accessories. From inflatable paddleboards and kayaks to yoga mats and foam rollers, polymer foam products offer users a comfortable and enjoyable experience while engaging in their favourite activities.

The growing emphasis on health and wellness has also contributed to Japan's rising demand for polymer foam-based recreational products. As more Japanese prioritize maintaining an active lifestyle, there has been a corresponding increase in the adoption of fitness activities incorporating foam-based equipment. Foam rollers, in particular, have gained popularity among fitness enthusiasts for their effectiveness in relieving muscle tension and improving flexibility, making them a staple in gyms and home workout spaces nationwide.

Additionally, the proliferation of online retail platforms has made it easier for individuals to purchase polymer foam-based recreational products. According to the International Trade Administration, there has been a consistent increase in the percentage of Japanese households engaging in online shopping, starting at 35.9% in 2018 and steadily rising to 47.8% in 2021. In December 2021, 56% of Japanese households shopped online, expanding their reach to a broader audience. Therefore, the combination of versatility, durability, and the emphasis on health and wellness has fueled the popularity of polymer foam-based recreational activities in Japan.

The polymer foam market in Japan is a vibrant and dynamic industry sector characterized by a diverse range of companies catering to various applications and industries. One prominent player in the Japanese polymer foam market is Sekisui Chemical Co., Ltd., a leading manufacturer of innovative foam materials. Sekisui offers a comprehensive range of foam products, including polyethylene (PE) foam, cross-linked polyethylene (XLPE) foam, and polyurethane (PU) foam, serving industries such as automotive, construction, and electronics. The company's foam solutions are known for their superior insulation properties, lightweight construction, and environmental sustainability, aligning with Japan's focus on energy efficiency and eco-friendly technologies.

Another key player in the Japanese polymer foam market is Toray Industries, Inc., a global conglomerate with a strong presence in advanced materials and chemicals. Toray's foam portfolio encompasses expanded polystyrene (EPS) foam, polyethylene terephthalate (PET) foam, and polyurethane (PU) foam, catering to diverse applications in packaging, automotive components, and building insulation. With a commitment to research and development, Toray continuously innovates its foam formulations to enhance performance, durability, and recyclability, meeting the evolving needs of customers in Japan.

JSR Corporation is also a significant player in the Japanese polymer foam market, specializing in synthetic rubber and specialty chemicals. The company's foam products include styrene-butadiene rubber (SBR) foam, thermoplastic elastomer (TPE) foam, and silicone foam, serving applications in automotive seals, consumer electronics, and medical devices. Leveraging its polymer science and engineering expertise, JSR develops tailored foam solutions with superior cushioning, sealing, and thermal insulation properties, meeting the stringent requirements of Japanese manufacturers.

Furthermore, Japan boasts a robust ecosystem of small and medium-sized enterprises (SMEs) specializing in niche foam materials and applications. These companies leverage their agility and technical expertise to develop specialized foam formulations for specific industries or customer requirements. For instance, Nippon Gohsei manufactures ethylene vinyl alcohol (EVOH) copolymer foam for food packaging, pharmaceuticals, and industrial applications, offering superior barrier properties and chemical resistance.

Japan's polymer foam market also benefits from collaboration between industry players, research institutions, and government agencies to drive innovation and sustainability. Initiatives such as the Japan Chemical Innovation Institute (JCII) promote research and development in advanced materials, including foam technologies, to enhance Japan's competitiveness in the global marketplace. Moreover, industry associations like the Japan Plastics Industry Federation (JPIF) facilitate knowledge exchange, industry standards development, and regulatory compliance to support the growth of the polymer foam sector. With a focus on quality, innovation, and collaboration, Japan remains at the forefront of the global polymer foam industry, delivering cutting-edge solutions to meet the evolving needs of customers and society.

By Type

By Application

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.