Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 16-May-2024 |

Pages: 108 |

Formats: PDF |

The Japan Position Sensor Market size is expected to reach $787.0 Million by 2030, rising at a market growth of 8.9% CAGR during the forecast period. In the year 2022, the market attained a volume of 1511.2 Thousand Units, experiencing a growth of 11.5% (2019-2022).

The position sensor market in Japan has witnessed significant growth and innovation in recent years, driven by the country's advanced manufacturing capabilities and increasing demand across various industries. Position sensors play a crucial role in providing accurate and real-time information about the position of objects or machinery, enabling precise control and monitoring in applications ranging from automotive to industrial automation.

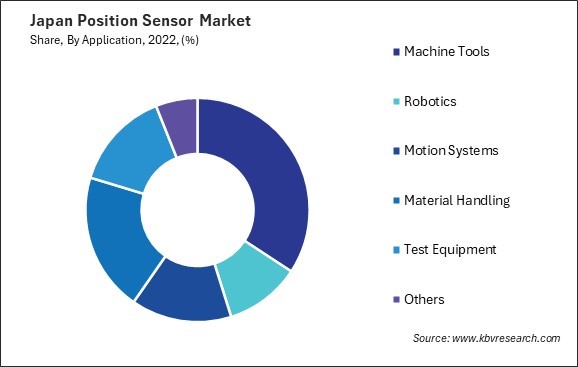

In Japan, the automotive sector is a major contributor to the position sensor market. The demand for high-precision position sensors has surged with renowned automakers such as Toyota, Honda, and Nissan. Furthermore, the industrial automation sector in Japan has embraced position sensors to optimize manufacturing processes. In industries like robotics, where precision is paramount, these sensors enable precise positioning and control of robotic arms and machinery.

The COVID-19 pandemic accelerated the adoption of automation and robotics in response to the need for contactless and efficient processes in Japan. This trend positively influenced the position sensor market as industries sought to improve their manufacturing capabilities and supply chain resilience. The healthcare sector, in particular, witnessed an increased demand for medical robots and diagnostic equipment, driving the need for advanced position sensing technologies.

The position sensor market in Japan has experienced a profound transformation driven by the rapid expansion of advanced manufacturing and robotics. The advent of Industry 4.0 has propelled Japan's manufacturing sector into a new era characterized by smart factories and seamless human-robot collaboration. Advanced manufacturing processes, such as precision machining and 3D printing, rely heavily on precise position feedback to ensure optimal performance.

Robotics, a cornerstone of Japan's technological prowess, has witnessed a surge in adoption across the automotive and electronics industries. Collaborative robots have become integral to the manufacturing landscape, enhancing efficiency and flexibility. Position sensors are pivotal in enabling robots to navigate and manipulate objects with unparalleled precision, contributing to the seamless integration of automation in Japanese industries.

According to the International Trade Administration, in 2022, Japan solidified its global dominance in advanced manufacturing and robotics, with a staggering 45% of all industrial robots worldwide originating from Japanese companies. The remarkable expansion of this industry was evident as orders for industrial robots from Japanese manufacturers reached an unprecedented $7.35 billion, marking a noteworthy 1.6% increase from the previous year. Furthermore, the production of industrial robots in Japan experienced a remarkable surge of 5.6%, setting a new record in the field. This surge underscores Japan's pivotal role in shaping the position sensor market, reflecting the nation's unparalleled advancements in advanced manufacturing and robotics.

Moreover, Japan's commitment to innovation is evident in developing next-generation robotics, including humanoid robots and robotic exoskeletons. The automotive industry, a cornerstone of Japan's economy, has been a key driver in expanding the position sensor market. With the rise of electric vehicles and autonomous driving technologies, the demand for position sensors in components like throttle position sensors and steering angle sensors has witnessed a substantial uptick.

According to the Japan Automobile Dealers Association (JADA), the surge in sales of new electric vehicles in 2020, reaching nearly 1.4 million units, marked a significant increase, with electric vehicles accounting for 36.2% of total new car sales, up from 35.2% in 2019. As the prominence of electric vehicles continues to grow, there is a heightened demand for innovative solutions to support the evolving automotive landscape. This shift is anticipated to extend its influence on the position sensor market in Japan, particularly with the expansion of advanced manufacturing and robotics. Thus, Japan's position sensor market is undergoing a transformative phase fueled by the rapid integration of advanced manufacturing and robotics, driven by Industry 4.0 initiatives.

In Japan, the agricultural sector is undergoing a transformative shift with the growing adoption of advanced agricultural vehicles equipped with cutting-edge position sensor technology. One key driver behind the surge in demand for advanced agricultural vehicles is the pressing need to address the challenges posed by an aging farming population and a shrinking workforce. Japan's agricultural landscape has been grappling with a shortage of skilled labor, prompting the industry to turn towards automation and technology-driven solutions.

Position sensors, integrated into tractors, harvesters, and other agricultural machinery, enable precise navigation, efficient planting, and targeted spraying, minimizing the reliance on manual labor and optimizing resource utilization in Japan. The adoption of precision farming practices is gaining momentum, supported by government initiatives and subsidies to promote technology integration in agriculture. Japanese farmers increasingly recognize the benefits of position sensor-equipped vehicles in improving yield, reducing environmental impact, and ensuring sustainable agricultural practices.

Furthermore, the topography of Japan, characterized by varied landscapes and terrains, makes precise navigation and control essential for effective farming. Collaborations between agricultural machinery manufacturers and technology providers also contribute to the proliferation of position sensor-equipped vehicles in Japan. These collaborations focus on developing customized solutions that cater to the unique demands of Japanese agriculture, further fueling the adoption of advanced technologies in the sector. Therefore, Japan's widespread adoption of advanced agricultural vehicles with position sensor technology reflects a strategic response to labor shortages, leading to increased efficiency and precision in farming practices.

Japan's position sensor market is characterized by a dynamic landscape with several key players contributing to its growth and innovation. One prominent player in the Japanese position sensor market is Renesas Electronics Corporation. Renesas is a leading semiconductor company specializing in providing advanced solutions for various applications, including automotive, industrial, and consumer electronics. The company's position sensors play a crucial role in enhancing the performance and reliability of various systems, making them a key player in Japan.

Another noteworthy contributor to the position sensor market in Japan is Alps Alpine Co., Ltd. Alps Alpine is renowned for its expertise in electronic components and systems. The company offers various position sensors that find applications in automotive navigation systems, industrial equipment, and consumer electronics. With a commitment to innovation, Alps Alpine continues to shape the landscape of position sensing technologies in Japan.

Panasonic Corporation is also a significant player in the Japanese position sensor market. As a multinational electronics corporation, Panasonic has a broad portfolio of products, and its position sensors cater to the needs of the automotive and industrial sectors. The company's emphasis on research and development ensures that its position sensing technologies align with the evolving requirements of the Japanese industry.

In addition to these established players, emerging companies like Sensata Technologies Japan Co., Ltd. are making significant strides in the Japanese position sensor market. The company focuses on developing sensor solutions for the automotive industry, contributing to the growing demand for advanced vehicle safety and control systems. These entities, each with unique strengths and focus areas, collectively drive innovation and contribute to Japan's position sensor market growth across diverse industries.

By Type

By Contact Type

By Output

By Application

By Vertical