The Japan Ready to Drink Shakes Market size is expected to reach $898.72 Million by 2030, rising at a market growth of 5.8% CAGR during the forecast period. In the year 2022, the market attained a volume of 85.46 Million Units, experiencing a growth of 6.8% (2019-2022).

The ready to drink shakes market in Japan has witnessed significant growth in recent years, driven by changing consumer lifestyles and a growing awareness of the importance of convenient and nutritious food options. As the demand for on-the-go and healthy products rises, ready to drink shakes have become a popular choice among Japanese consumers. One key factor contributing to the success of the ready to drink shakes market in Japan is the country's dynamic work culture, where individuals often find themselves pressed for time. With a focus on efficiency and convenience, ready to drink shakes provide a quick and hassle-free solution for those looking to maintain a balanced diet without compromising on nutrition.

Japanese consumers, known for their discerning taste and preference for high-quality products, have embraced the diverse range of flavors and formulations offered by ready to drink shakes brands. From protein-rich options targeting fitness enthusiasts to shakes tailored to specific dietary needs, the industry has adapted to cater to the diverse demands of the Japanese consumer base. The cultural shift towards health and wellness has further fueled the growth of the ready to drink shakes market in Japan.

The COVID-19 pandemic has reshaped consumer behavior and disrupted supply chains globally, including in Japan. While the initial months saw a surge in demand for health-focused products, the economic uncertainties brought about by the pandemic also led to changes in spending patterns. Consumers, in some cases, shifted towards more budget-friendly options. Brands adapted by strengthening their online presence and implementing contactless delivery options to meet the changing needs of consumers. Moreover, heightened health concerns during the pandemic reinforced the importance of wellness, further boosting the demand for nutritious and immune-boosting ready to drink shakes.

Protein shakes, in particular, have gained traction in Japan, with consumers recognizing the importance of protein intake for muscle health and satiety. Ready to drink shakes formulated with plant-based proteins, such as soy or pea protein, have found a receptive audience among those looking for vegetarian or vegan options. Traditional Japanese flavors like matcha (green tea), sakura (cherry blossom), and yuzu (citrus fruit) have been incorporated into shake formulations, appealing to Japanese consumers who appreciate a fusion of local and global tastes.

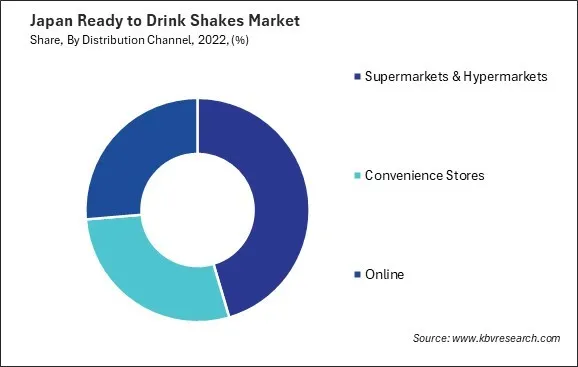

In recent years, Japan has witnessed a significant surge in convenience stores catering to the burgeoning ready to drink shakes market. The market in Japan has evolved into a dynamic and competitive landscape, with convenience stores playing a pivotal role in shaping its growth. These stores have become key distribution channels, offering a diverse range of ready-to-drink shakes that cater to various dietary preferences and health-conscious Japanese consumers.

According to the Japan Franchise Association, the notable surge in convenience stores in Japan has been remarkable, reaching 57,544 by 2021. With Japan's population hovering around 125 million, this surge equates to an impressive ratio of approximately one convenience store for every 2,170 people. The rising number of convenience stores further underscores the evolving consumer preferences and demands for convenient and accessible options, contributing to the country's flourishing ready to drink shakes market.

One of the driving factors behind the proliferation of convenience stores in the ready to drink shakes market is the increasing demand for functional and nutritious beverages. Japanese consumers are increasingly seeking beverages that offer convenience and deliver health benefits. Ready to drink shakes, fortified with vitamins, minerals, and protein, are a convenient yet nourishing option for individuals looking to maintain a balanced diet amid their busy schedules.

Furthermore, the strategic placement of convenience stores in urban centers, train stations, and residential areas contributes to the accessibility of ready to drink shakes. The Japanese consumer, known for valuing time and efficiency, finds these outlets well-suited to their lifestyle. As a result, the ready to drink shakes market has become intertwined with the daily routines of many Japanese consumers, who rely on convenience stores for a quick and nutritious refreshment. Therefore, the surge in convenience stores in Japan has driven the growth of the ready to drink shakes market, meeting the rising demand for convenient and nutritious beverages among health-conscious consumers.

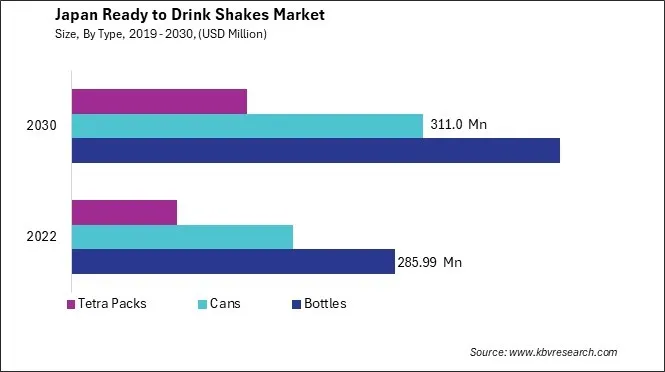

In recent years, Japan has witnessed a remarkable surge in the adoption of canned packaging within the ready to drink shakes market. The Japanese industry has traditionally been known for its emphasis on innovation and efficiency, and the growing popularity of canned packaging aligns seamlessly with these values. Canned ready to drink shakes offer many advantages, such as portability, durability, and convenience, making them an ideal choice for Japanese consumers on the go. Moreover, the Japanese consumer base places a premium on the aesthetic appeal of products, and canned packaging provides an attractive and modernized presentation for ready to drink shakes.

The convenience factor plays a pivotal role in adopting canned packaging, as it facilitates easy storage and disposal, aligning with the space-conscious habits of urban dwellers in Japan. Additionally, the trend towards smaller households and an aging population further amplifies the demand for conveniently packaged, single-serving ready to drink shakes in cans.

Furthermore, the packaging material contributes to preserving the product's freshness and nutritional quality, a critical consideration for health-conscious Japanese consumers. The aseptic technology employed in canning ensures that the ready to drink shakes remain uncontaminated, addressing concerns about food safety and quality. Hence, Japan's ready to drink shakes market has experienced a notable surge in the adoption of canned packaging, driven by the country's emphasis on innovation, efficiency, and consumer preferences for portability, durability, and aesthetic appeal.

Japan's ready to drink shakes market has witnessed significant growth in recent years, driven by a shift in consumer preferences towards convenient and nutritious beverage options. One prominent player in the Japanese ready to drink shakes market is Yakult Honsha Co., Ltd. Renowned for its probiotic beverages, Yakult has expanded its product portfolio to include ready-to-drink shakes infused with the goodness of probiotics. These shakes provide a convenient on-the-go option and address the growing interest in gut health among Japanese consumers.

Suntory Holdings Limited is another key player in the industry, leveraging its expertise in the beverage industry to offer a variety of RTD shakes. The brand's focus on innovation and flavor differentiation has resonated well with Japanese consumers. The company has introduced shakes with unique ingredients, catering to diverse taste preferences prevalent in the local industry.

The Coca-Cola Company, a global beverage giant, has also made significant inroads into the Japanese ready to drink shakes market. Utilizing its vast distribution network and brand recognition, Coca-Cola has introduced various shake options, tapping into the growing demand for functional beverages. The company has tailored its offerings to suit the preferences of Japanese consumers, emphasizing both traditional and innovative flavors.

Meiji Holdings Co., Ltd. has a strong presence in the ready to drink shakes market, offering a range of products that combine nutritional benefits with great taste. With a reputation for producing high-quality dairy products, Meiji has successfully positioned its ready to drink shakes as a healthy and indulgent choice for consumers seeking a quick energy boost or a post-workout refreshment.

In recent years, Kirin Holdings Company, Limited has also gained traction in the ready to drink shakes market. Known for its diverse range of beverages, Kirin has introduced shakes that cater to specific dietary needs, such as protein-enriched options for fitness enthusiasts. This strategic approach has helped Kirin establish a foothold in the competitive Japanese ready to drink shakes market. As Japanese consumers prioritize health-conscious choices, the ready to drink shakes market is expected to expand further, providing opportunities for both domestic and international players to thrive in this dynamic and competitive sector.

By Type

By Distribution Channel

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.