Int'l : +1(646) 832-2886 | query@kbvresearch.com

Int'l : +1(646) 832-2886 | query@kbvresearch.com

Published Date : 15-Jul-2024 |

Pages: 91 |

Formats: PDF |

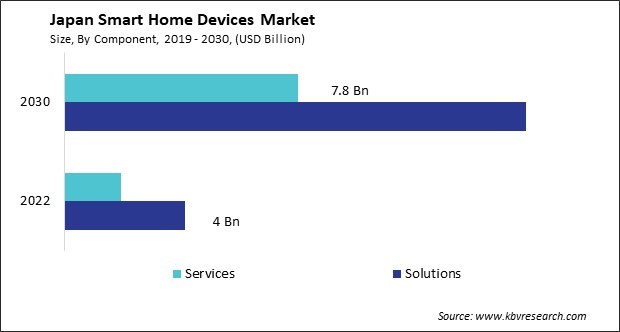

The Japan Smart Home Devices Market size is expected to reach $23.1 Billion by 2030, rising at a market growth of 19% CAGR during the forecast period.

Japan's smart home devices market has witnessed significant growth in recent years. One of the key drivers of Japan's smart home devices market is the country's aging population. Smart home technologies offer features such as remote monitoring and assistance, which appeal to elderly individuals and their caregivers. The emphasis on energy conservation and sustainability has also fueled the adoption of smart home devices that optimize energy usage and reduce utility costs. According to the International Trade Administration, the proportion of the population older than 65 will rise from 29% to 40 % by 2060. As the elderly population expands, their demand for solutions that enable independent living.

In addition to convenience and safety, energy efficiency is another factor driving the adoption of smart home devices in Japan. With a strong emphasis on sustainability and environmental conservation, consumers are increasingly turning to smart home solutions to monitor and manage their energy consumption. Smart thermostats, lighting systems, and appliances equipped with energy-saving features enable users to reduce their carbon footprint and lower utility bills, aligning with Japan's efforts to promote a greener lifestyle.

Security and surveillance systems are among Japan's most popular smart home devices, with homeowners increasingly investing in smart cameras, motion sensors, and smart door locks to enhance home security and deter potential intruders. These systems provide real-time monitoring and alerts and integrate with other smart home devices to automate actions such as turning on lights or sending notifications to mobile devices.

Additionally, the COVID-19 pandemic has had a mixed impact on Japan's smart home devices market. The increased focus on home-based activities and remote work has spurred demand for smart home solutions that enhance comfort, productivity, and entertainment within the home. However, economic uncertainty and supply chain disruptions have dampened consumer spending and slowed down the pace of adoption for some high-ticket smart home products in Japan.

The adoption of smart wearable technology in Japan's smart home devices market has witnessed a significant rise in recent years, driven by several key factors contributing to its popularity and integration into everyday life. One of the primary drivers of this trend is the increasing emphasis on health and wellness monitoring. Smart wearables such as fitness trackers, smartwatches, and health monitoring devices have become ubiquitous among Japanese consumers seeking to track their physical activity, monitor vital signs, and manage their overall well-being.

According to the International Trade Administration, the smart wearable technology industry is poised for substantial growth in Japan and is projected to reach a valuation of 16 billion by 2025. Within this burgeoning sector, Japan's health tech segment is expected to soar to USD 2 billion by the same year, particularly in sleep and baby tech areas. This entails a broad spectrum of innovations, including sleep improvement support services featuring diagnostic testing, bed sensors, and an array of baby and infant apps and devices, such as nursing room search systems and video cameras for enhanced monitoring. This surge in adoption reflects a significant trend toward integrating smart wearable technology within Japan's smart home devices market.

Moreover, the proliferation of Internet of Things (IoT) technology has led to greater interoperability between wearable devices and smart home platforms. Furthermore, the Japanese culture's inclination towards innovation and technological advancement has fostered a fertile ground for adopting smart wearables in the smart home segment. Japanese consumers are early adopters of new technologies and are keen on incorporating them into their daily routines to streamline tasks and enhance convenience. Therefore, the increasing emphasis on health and wellness monitoring and Japan's culture of innovation has propelled the adoption of smart wearables in the smart home devices market.

Japan's smart home devices market is witnessing a significant surge in demand for home appliances. One of the primary drivers of the rising demand for home appliances in the smart home devices market is the growing awareness and appreciation of the convenience and efficiency offered by these products. Japanese consumers are increasingly seeking ways to streamline household tasks and enhance their quality of life. From smart refrigerators that help manage grocery lists and track food expiration dates to intelligent washing machines that optimize water and energy usage, these appliances offer practical benefits that resonate with modern consumers.

Additionally, emphasizing energy efficiency and sustainability influences purchasing decisions in the Japanese smart home devices market. Smart home appliances are designed to be more energy efficient than their traditional counterparts, allowing consumers to reduce their carbon footprint and lower utility bills. As environmental concerns become more prominent, Japanese consumers increasingly invest in products that align with their values, further driving the demand for smart home appliances.

Furthermore, government initiatives and incentives aimed at promoting the adoption of smart technologies are contributing to the industry's growth. In Japan, policymakers actively support initiatives to accelerate the adoption of IoT and smart home solutions as part of broader efforts to drive innovation and economic growth. Thus, the surge in demand for smart home appliances in Japan is driven by consumer appreciation for convenience and supportive government initiatives.

In Japan, the smart home devices market is burgeoning, driven by technological innovation, a growing awareness of energy conservation, and an aging population that seeks solutions for independent living and healthcare monitoring. One of the key players in the Japanese smart home devices market is Panasonic Corporation. Panasonic offers a comprehensive range of smart home devices, including smart appliances, home monitoring systems, lighting solutions, and energy management products. With a focus on quality, reliability, and innovation, Panasonic has established itself as a trusted brand in the Japanese industry, catering to consumers seeking advanced technologies that enhance convenience, comfort, and sustainability in their homes.

In the smart lighting segment, companies like Toshiba Lighting & Technology Corporation and LIXIL Corporation are leading the way with advanced lighting solutions designed to improve energy efficiency, ambiance, and convenience in Japanese households. Toshiba Lighting offers a diverse portfolio of LED lighting products with smart features such as remote dimming, color adjustment, and motion sensing. In contrast, LIXIL's smart lighting systems incorporate cutting-edge technologies for personalized lighting experiences and energy savings.

Another major player in the Japanese smart home devices market is Sony Corporation. Sony's presence in the smart home space is primarily driven by its smart TVs, audio systems, and entertainment devices that integrate seamlessly with other smart home ecosystems. The company's commitment to cutting-edge design, high-quality audiovisual experiences, and compatibility with popular streaming services appeals to Japanese consumers who prioritize entertainment and connectivity in their smart homes.

Security-focused companies such as Secom Co., Ltd. and Sony Corporation's subsidiary Sony Security Solutions Corporation are addressing Japan's growing demand for smart home security systems. Secom offers integrated security solutions that combine alarm systems, surveillance cameras, and remote monitoring services to protect homes and properties against intruders and emergencies. Sony Security Solutions provides various video surveillance solutions, including network cameras, video management software, and analytics tools, leveraging Sony's expertise in imaging technology and cybersecurity. With the continued advancement of technology and the increasing adoption of smart home devices, competition among companies in Japan is expected to intensify as they strive to differentiate themselves through product innovation, reliability, and customer satisfaction.

By Component

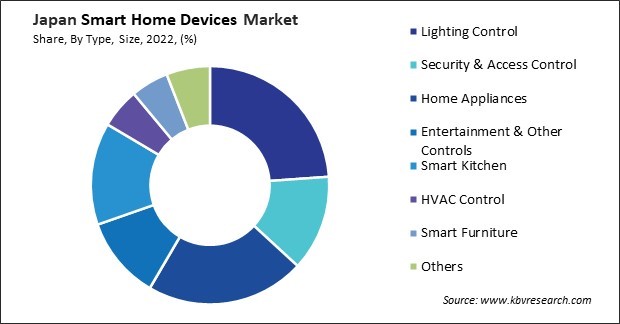

By Type