Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 17-May-2024 |

Pages: 83 |

Formats: PDF |

The Japan Start Stop Technology Market size is expected to reach $169.59 Million by 2030, rising at a market growth of 7.2% CAGR during the forecast period.

Japan's start stop technology market has witnessed significant growth and adoption in recent years. This technology, aimed at reducing fuel consumption and emissions by automatically shutting off the engine when the vehicle stops and restarting it when the accelerator is pressed, has gained traction in the automotive sector globally, including in Japan.

Japan, known for its technological advancements and environmental consciousness, has embraced start-stop technology to mitigate carbon emissions and promote sustainability in the transportation sector. As a result, several automotive manufacturers in Japan have been incorporating start-stop systems into their vehicles, ranging from compact cars to luxury models. This adoption has been further fueled by government regulations promoting fuel efficiency and reducing greenhouse gas emissions.

Moreover, automotive manufacturers in Japan are continuously innovating and enhancing start-stop systems to improve performance and reliability. This includes advancements in battery technology, engine management systems, and auxiliary components to ensure seamless operation and durability of start-stop systems in various driving conditions.

The COVID-19 pandemic has profoundly impacted the automotive industry, including the start stop technology market in Japan. The temporary shutdown of manufacturing plants, disruptions in the supply chain, and a decline in consumer demand due to economic uncertainties have resulted in a slowdown in production and sales of vehicles equipped with start stop systems. However, as the automotive industry gradually recovers from the pandemic's effects and with the growing emphasis on sustainability and environmental conservation, the demand for start stop technology is expected to rebound in the post-pandemic era.

In Japan, the automotive industry is witnessing a notable surge in the demand for hybrid electric vehicles (HEVs), driven largely by the increasing adoption of start stop technology. One of the primary factors fueling the demand for HEVs with start stop technology in Japan is the growing emphasis on environmental sustainability and fuel efficiency. With stringent regulations aimed at curbing carbon emissions and promoting cleaner transportation solutions, automakers in Japan are under pressure to innovate and offer vehicles that align with these objectives.

According to the Japan Automobile Dealers Association (JADA), the robust demand for hybrid electric vehicles (HEVs) in Japan, exemplified by the enduring popularity of models like the Toyota Prius since its introduction in 1997, has laid a strong foundation for the adoption of advanced automotive technologies. Notably, HEVs accounted for an impressive 97.8% share of new electric vehicles sold in 2020, indicating a significant preference for this eco-friendly option among Japanese consumers. As Japan's automotive industry continues to prioritize fuel efficiency, emissions reduction, and sustainability, the rising demand for hybrid electric vehicles directly correlates with the increasing interest in technologies like start stop systems, which further enhance fuel economy and environmental friendliness.

Another driving force behind the popularity of HEVs with start stop technology is the government incentives and subsidies to promote the adoption of eco-friendly vehicles. In Japan, various tax breaks, rebates, and other financial incentives are available to consumers purchasing HEVs, making these vehicles more affordable and appealing.

Moreover, Japan's rising fuel cost has prompted consumers to seek more fuel-efficient alternatives. HEVs, with their ability to switch seamlessly between electric and combustion modes, offer improved fuel economy compared to conventional vehicles, making them an attractive choice for budget-conscious consumers. Thus, the surge in demand for HEVs with start stop technology in Japan is driven by environmental concerns, government incentives, and the desire for fuel efficiency amidst rising fuel costs.

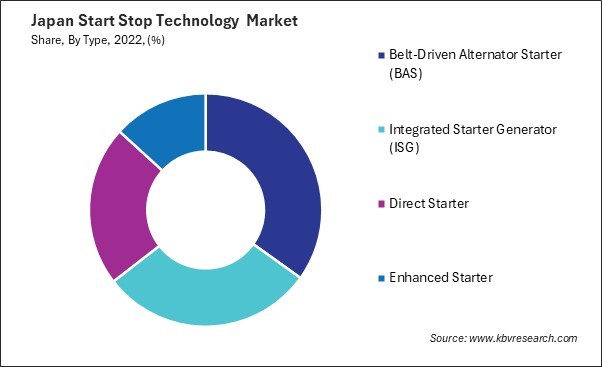

The adoption of belt-driven alternator starter (BAS) technology has been steadily increasing in Japan's start stop technology market, primarily driven by the country's commitment to environmental sustainability and stringent emission regulations. One key factor fueling the adoption of BAS in Japan is the government's push for cleaner transportation solutions to mitigate air pollution and combat climate change. Japan has been proactive in implementing policies and incentives to encourage the adoption of eco-friendly technologies in the automotive sector.

Furthermore, Japanese automakers have been at the forefront of developing innovative technologies to meet these stringent requirements. They have been investing heavily in research and development to enhance the performance and efficiency of start stop systems, with BAS being a critical component in this endeavor. As a result, BAS-equipped vehicles have gained popularity among Japanese consumers who prioritize fuel efficiency and environmental consciousness.

Moreover, BAS technology has evolved significantly in recent years, becoming more reliable, compact, and cost-effective. This has made it more attractive for automakers to integrate BAS into their vehicle models across different segments, further boosting its adoption in the Japanese industry. Therefore, the increasing adoption of belt-driven alternator starter (BAS) technology in Japan underscores governmental commitment to environmental sustainability and automakers' dedication to advancing eco-friendly solutions in the automotive sector.

One of the prominent players in the Japanese start stop technology market is Panasonic Corporation, a multinational electronics company that has diversified its offerings to include automotive solutions. Panasonic provides start stop systems and components, such as advanced lead-acid batteries and battery management systems, designed to support start stop functionality in vehicles. These solutions leverage Panasonic's battery technology and electronics expertise to enhance vehicle performance and efficiency while reducing environmental impact.

Another significant contributor to the Japanese start stop technology market is Denso Corporation, a leading supplier of automotive components and systems. Denso offers a comprehensive range of start stop solutions, including integrated starter generators, start stop batteries, and engine control units. These solutions are designed to optimize engine restarts and improve fuel economy, contributing to the overall sustainability of vehicles in the Japanese industry.

Furthermore, Mitsubishi Electric Corporation is actively involved in developing and supplying start stop technology for the automotive industry in Japan. Mitsubishi Electric provides start stop systems and components, such as starter motors, alternators, and power management systems, to enhance vehicle efficiency and reduce emissions. These solutions leverage Mitsubishi Electric's electrical and electronic technologies expertise to deliver reliable performance and compatibility with a wide range of vehicle platforms.

Additionally, GS Yuasa Corporation, a Japanese battery manufacturer, plays a significant role in the Japanese start stop technology market. GS Yuasa offers a variety of start stop batteries optimized for use in vehicles equipped with start stop systems. These batteries feature advanced technologies, such as enhanced cycling capability and improved durability, to ensure reliable performance and long service life in demanding automotive applications.

Moreover, Hitachi Automotive Systems, Ltd., a subsidiary of Hitachi, Ltd., is a key player in the Japanese start stop technology market. Hitachi Automotive Systems provides a range of start stop systems and components, including integrated starter generators, power management systems, and engine control units. These solutions leverage Hitachi's automotive electronics and powertrain technologies expertise to deliver seamless operation and enhanced vehicle fuel efficiency. As environmental concerns continue to drive automotive innovation, these companies are poised to play a crucial role in shaping the future of mobility in Japan.

By Application

By Type