The Japan Video on Demand (VoD) Market size is expected to reach $17.4 Billion by 2030, rising at a market growth of 13% CAGR during the forecast period.

Japan's video on demand (VoD) market has witnessed significant growth in recent years. One of the key drivers of the video on demand (VoD) in Japan is the country's strong affinity for entertainment content. Japanese consumers, known for avid media consumption, have embraced digital streaming platforms as a convenient way to access their favorite shows and movies. Additionally, the popularity of anime has contributed to the growth of the video on demand (VoD) market, with platforms offering a vast selection of anime titles catering to diverse audiences.

The proliferation of smartphones and other connected devices has also played a crucial role in expanding the reach of VoD services in Japan. With more Japanese consumers opting for mobile viewing, VoD platforms have adapted their offerings to provide seamless streaming experiences across various devices. Moreover, the emergence of original content production has added a new dimension to the Japanese video on demand (VoD) market. This trend has led to collaborations between VoD platforms and Japanese filmmakers, actors, and production companies, fostering a vibrant ecosystem for content creation.

The COVID-19 pandemic has profoundly impacted Japan's video on demand (VoD) market, accelerating the shift toward digital consumption. With people spending more time indoors due to lockdowns and social distancing measures, there has been a surge in demand for online entertainment options. VoD platforms have experienced a spike in subscriber numbers and viewership as consumers in Japan turn to digital streaming for entertainment and escapism during these challenging times.

According to the National Library of Medicine, three main video-sharing platforms in Japan are YouTube, Niko Niko Douga, and TikTok; their usage rates in 2019 were 76.4%, 17.4%, and 12.5%, respectively, clearly indicating that YouTube is the most popular platform. Additionally, these platforms are significant players in Japan's video on demand (VoD) market, shaping the country's digital entertainment landscape.

The landscape of Japan's video on demand (VoD) market is undergoing a transformative shift with the growing adoption of 5G networks. As one of the leading technological innovators, Japan is embracing the potential of 5G to revolutionize the way content is consumed. One of the primary drivers behind the increasing adoption of 5G networks in the video on demand (VoD) market is the demand for high-quality streaming experiences.

With 5G's ultra-fast speeds and low latency, users enjoy seamless streaming of high-definition and even 4K content on their devices without buffering or lag issues. This enhanced streaming experience is particularly appealing to consumers in Japan, where there is a strong culture of consuming entertainment content. As the demand for high-bandwidth streaming increases, telecom companies need to invest heavily in expanding and upgrading their 5G infrastructure to meet the growing needs of consumers. Additionally, the surge in data traffic from VoD services strain 5G networks, leading to congestion issues during peak usage hours.

According to the International Trade Administration, the Japanese mobile carriers will spend more than $14 billion combined in capital expenditures over the next five years to build their 5G networks, anticipating a significant surge in demand for video on demand (VoD) services in Japan.

Moreover, the widespread availability of 5G networks across urban areas in Japan is paving the way for innovative content delivery models. Furthermore, 5G is facilitating the rise of personalized and targeted content recommendations. With its ability to support massive connectivity and handle vast amounts of real-time data, 5G enables VoD platforms to analyze user preferences and viewing habits more effectively. Thus, adopting 5G technology is reshaping Japan's video on demand (VoD) market, enhancing streaming experiences.

Japan's video on demand (VoD) market is experiencing a significant surge in demand driven by consumers' growing preference for convenience. One of the primary factors fueling this rising demand is the increasing penetration of high-speed internet and the widespread adoption of smartphones and other digital devices. With access to faster internet connections, Japanese consumers seamlessly stream their favorite movies, TV shows, and other content.

Moreover, the rise of original content production by VoD platforms has further bolstered their appeal. Additionally, the diversification of content offerings on VoD platforms has played a crucial role in driving demand. Japanese consumers have various interests, from anime and J-dramas to Hollywood blockbusters and international films. VoD services capitalize on this diversity by curating libraries catering to varied tastes and preferences, attracting a broader audience base.

Furthermore, the convenience of VoD extends beyond content accessibility to include features such as personalized recommendations, offline viewing options, and ad-free experiences. These value-added features enhance the overall Japanese user experience, further incentivizing consumers in Japan to subscribe to VoD platforms. Hence, the surge in demand for video on demand (VoD) services in Japan is driven by convenience, high-speed internet access, and value-added features, making it an integral part of the entertainment landscape.

The video on demand (VoD) market in Japan is a thriving and competitive sector within the entertainment industry, characterized by a diverse range of companies offering on-demand streaming services to cater to consumers' evolving preferences. One of the leading players in the Japanese video on demand (VoD) market is Hulu Japan, a subsidiary of The Walt Disney Company, offering a comprehensive streaming service focusing on both on-demand and live TV content. Hulu Japan features a vast library of movies, TV shows, anime, and original series, along with access to live TV channels and sports events, providing subscribers with a wide range of entertainment options. With competitive pricing, personalized recommendations, and a user-friendly interface, Hulu Japan has established itself as a popular destination for streaming enthusiasts in Japan.

Another noteworthy player in the Japanese video on demand (VoD) market is U-NEXT, operated by U-NEXT Co., Ltd. U-NEXT offers a comprehensive catalog of movies, TV dramas, anime, and various shows catering to various interests and demographics. The company emphasizes premium content and exclusive partnerships, providing subscribers early access to new releases and special features. Additionally, U-NEXT offers value-added services such as offline viewing, high-definition streaming, and personalized recommendations, enhancing the user experience and driving subscriber growth.

DMM.com LLC, a subsidiary of Kadokawa Corporation, operates DMM.com Labo, a VoD platform that offers a diverse selection of digital content, including movies, anime, dramas, and music videos, to subscribers in Japan. DMM.com Labo differentiates itself by providing access to exclusive content, early releases, and special events, catering to the interests and preferences of Japanese audiences. With a focus on user engagement and community building, DMM.com Labo continues to attract subscribers and expand its presence in the competitive video on demand (VoD) market in Japan.

In addition to these major players, several other companies contribute to the diversity and competitiveness of the Japanese video on demand (VoD) market. Streaming platforms such as AbemaTV, U-NEXT, and dTV offer a wide range of content and subscription options to cater to the diverse preferences of Japanese viewers. Furthermore, traditional broadcasters and media companies have launched their streaming services, adding to the richness and variety of on-demand content available to audiences in Japan. Hence, the Japanese video on demand (VoD) market is characterized by intense competition, innovation, and content differentiation as companies strive to attract and retain subscribers in a rapidly evolving landscape.

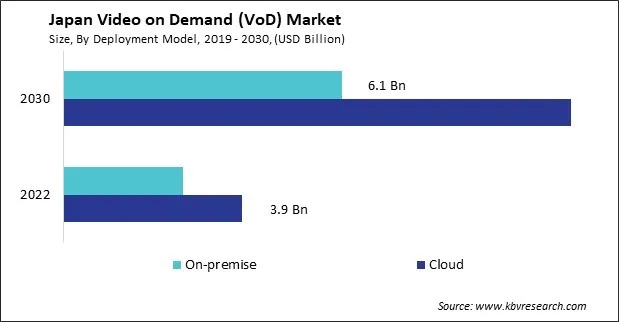

By Deployment Model

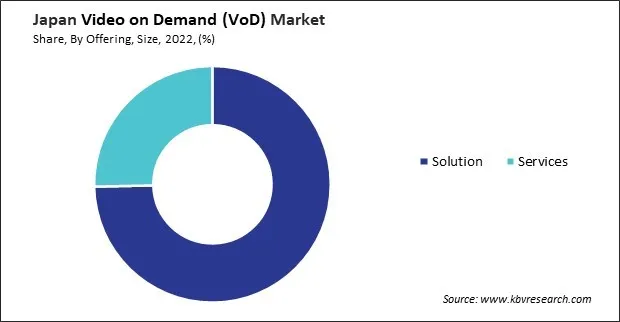

By Offering

By Platform Type

By Content-Type

By Monetization Model

By Vertical

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.