Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 17-May-2024 |

Pages: 90 |

Formats: PDF |

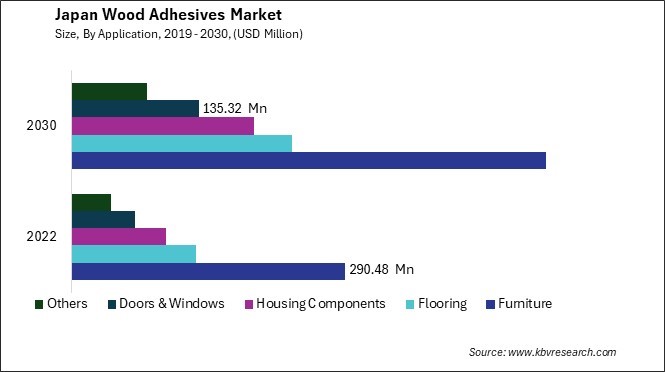

The Japan Wood Adhesives Market size is expected to reach $1.1 Billion by 2030, rising at a market growth of 7.8% CAGR during the forecast period. In the year 2022, the market attained a volume of 461.66 Kilo Tonnes, experiencing a growth of 7.1% (2019-2022).

The wood adhesives market in Japan has witnessed significant growth over the years owing to the country's thriving woodworking and construction industries. The wood adhesives market in Japan has been influenced by global trends such as the increasing emphasis on green building materials and the growing preference for engineered wood products. As a result, there is a growing demand for adhesives that effectively bond engineered wood products like laminated veneer lumber (LVL), glued laminated timber (glulam), and cross-laminated timber (CLT).

Japan's construction industry has been steadily growing, fueled by infrastructure development projects and investments in residential construction. As a result, there has been a consistent demand for wood adhesives for use in structural applications such as framing, flooring, and paneling. Additionally, the furniture manufacturing industry in Japan is renowned for its craftsmanship and quality, requiring high-performance wood adhesives to bond intricate pieces and ensure durability.

However, like many industries worldwide, Japan's wood adhesives market has yet to be immune to the impacts of the COVID-19 pandemic. The pandemic disrupted supply chains, leading to shortages of raw materials and components essential for adhesive production. Additionally, lockdown measures and social distancing protocols temporarily halted construction activities and manufacturing operations, resulting in a slowdown in demand for wood adhesives.

Furthermore, the economic uncertainty brought about by the pandemic has prompted some consumers to postpone or cancel construction and renovation projects, further dampening demand for wood adhesives. Despite these challenges, the wood adhesives market in Japan has shown resilience, with manufacturers adapting to the changing landscape by implementing safety measures, diversifying their product offerings, and exploring new avenues for growth.

The automotive industry in Japan has witnessed a significant trend towards incorporating wood and wood-based materials in car interiors, driven by a blend of aesthetic appeal, sustainability concerns, and technological advancements. One key factor driving the increased use of wood in automotive interiors is the growing emphasis on sustainability and eco-friendly materials. With consumers becoming more environmentally conscious, automakers in Japan are turning to renewable resources like wood to reduce the environmental footprint of their vehicles.

According to the Japan Automobile Dealers Association (JADA), sales of new electric vehicles in 2020 reached close to 1.4 million. As industries strive for more sustainable practices, developing eco-friendly adhesives tailored to the unique requirements of Japanese woodworking traditions offers exciting opportunities for industry expansion and technological breakthroughs.

Technological advancements in wood adhesives have also played a crucial role in facilitating the integration of wood in automotive interiors. Adhesive formulations have evolved to meet the demanding performance requirements of modern vehicles, offering superior bonding strength, durability, and resistance to heat, moisture, and vibration. These adhesives ensure that wood components remain securely fastened in a car interior's dynamic and challenging environment.

Furthermore, Japanese manufacturers are at the forefront of research and development in wood adhesives, continuously innovating to address the specific needs of the automotive industry. Collaborations between adhesive producers, automotive OEMs, and research institutions drive the development of next-generation adhesive technologies tailored for automotive wood applications. Thus, the convergence of sustainability concerns and innovative adhesive solutions propels wood integration into automotive interiors, marking a significant trend in the Japanese automotive industry.

The expansion of the packaging and woodworking industries in Japan has played a pivotal role in shaping the dynamics of the wood adhesives market. Japan, known for its technological advancement and industrial prowess, has seen significant growth in these sectors, directly influencing the demand and innovation in wood adhesives. In the packaging industry, there is a notable shift towards sustainable practices, driven by Japanese consumer awareness and regulatory policies aimed at reducing plastic use and promoting biodegradable and recyclable materials.

Wood-based packaging solutions are gaining traction, necessitating the use of adhesives that are not only strong and durable but also environmentally friendly. Manufacturers in Japan are increasingly investing in R&D to develop adhesives that meet these criteria, including bio-based adhesives, which have a lower environmental impact than traditional petroleum-based products. This trend is expected to continue, propelling the growth of the wood adhesives market in Japan.

Similarly, the woodworking industry in Japan is experiencing a resurgence, fueled by the global demand for high-quality furniture and wooden products. Japanese woodworking is renowned for its craftsmanship and use of traditional techniques, which are now being complemented with modern adhesive technologies to improve efficiency and product longevity. The demand for adhesives that offer superior bonding strength, aesthetic compatibility with various wood types, and enhanced durability is on the rise. Hence, the expansion of the packaging and woodworking industries in Japan is significantly driving the evolution of the wood adhesives market, underpinned by a strong focus on sustainability and technological innovation.

The wood adhesives market in Japan is a thriving sector fueled by a combination of traditional craftsmanship, advanced technology, and a strong focus on quality and innovation. One of the leading companies in the Japanese wood adhesives market is Kaneka Corporation. Founded in 1949, Kaneka has established itself as a pioneer in adhesive technologies, offering a wide range of products tailored to meet the diverse needs of its customers. The company's wood adhesives are known for their exceptional bonding strength, durability, and resistance to environmental factors, making them ideal for applications ranging from furniture manufacturing to construction and renovation projects.

Daiso Chemical Co., Ltd. is also a key contributor to the Japanese wood adhesives market, specializing in high-performance adhesives for industrial and commercial applications. Established in 1956, Daiso Chemical has leveraged its technical expertise and research capabilities to develop innovative adhesive solutions that enhance the efficiency and durability of wood-based assemblies. The company's products are widely used in furniture manufacturing, carpentry, and construction projects across Japan and beyond.

Another prominent player in the Japanese wood adhesives market is DIC Corporation. With a history spanning over a century, DIC has earned a reputation for excellence in chemical manufacturing, including adhesives and coatings. The company's wood adhesives portfolio includes a variety of formulations designed to meet the stringent quality standards of the Japanese woodworking industry, with an emphasis on performance, safety, and environmental sustainability.

Another notable player in the Japanese wood adhesives market is Nitta Gelatin Inc., which offers a range of specialty adhesives derived from natural sources such as collagen and gelatin. These bio-based adhesives are prized for their sustainability, biodegradability, and compatibility with various wood substrates, making them popular choices for eco-conscious consumers and manufacturers. As Japan continues to pursue economic growth and technological advancement, its wood adhesives market is poised to remain a vital component of its manufacturing landscape, driving innovation and supporting the country's longstanding tradition of craftsmanship and excellence in woodworking.

By Application (Volume, Kilo Tonnes, USD Billion, 2019-2030)

By Substrate (Volume, Kilo Tonnes, USD Billion, 2019-2030)

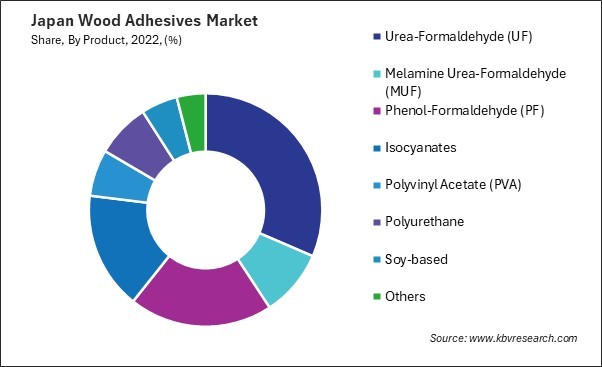

By Product (Volume, Kilo Tonnes, USD Billion, 2019-2030)