Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 27-Mar-2024 |

Pages: 89 |

Formats: PDF |

The Japan Workforce Management Market size is expected to reach $859.7 million by 2030, rising at a market growth of 10.4% CAGR during the forecast period.

The increasing prevalence of remote work arrangements has significantly influenced Japan's rising need for workforce management tools. This shift in work dynamics, accelerated by the COVID-19 pandemic, has prompted organizations across various industries to reevaluate their workforce management strategies. As more employees work remotely, the demand for tools to facilitate effective remote workforce management has grown substantially.

Technological advancements have played a pivotal role in enabling remote workforce management in Japan. The broad accessibility of high-speed internet, cloud computing services, and digital communication tools has made it feasible for employees to work remotely while staying connected to their colleagues and employers. This technological infrastructure has facilitated seamless collaboration and communication among remote teams.

The COVID-19 pandemic has acted as a catalyst for the growth of remote workforce management in Japan. The need for social distancing and remote work to curb the spread of the virus forced many businesses to adapt to remote work models quickly. This rapid transition demonstrated the viability of remote work arrangements and accelerated the adoption of remote workforce management technologies and practices across various industries.

Employees have the freedom to work from any location in remote work, necessitating the adoption of workforce management tools capable of accommodating diverse work schedules and locations. These tools enable organizations to maintain operational efficiency while ensuring employees have the flexibility to balance work and personal responsibilities. These factors have collectively contributed to transforming traditional work models and adopting remote work arrangements in Japan's business landscape.

The increasing use of workforce management tools in the government sector in Japan reflects a broader trend toward digital transformation and efficiency improvement in public administration. Government agencies often have large and diverse employee bases with varying skill sets and roles. Workforce management tools allow these agencies to streamline processes such as scheduling, time tracking, and resource allocation, allowing them to make more informed decisions about workforce deployment and utilization. According to the data provided by the Japanese government, the total number of persons employed in the government sector in 2022 was approximately 25 million.

Japan faces a rapidly aging workforce and a declining birth rate, which has led to a shortage of skilled workers in various industries, including public administration. To address this shortage and ensure the effective delivery of public services, the government has been actively recruiting new employees, particularly in healthcare, social services, and administrative roles.

Furthermore, the government sector in Japan is also responding to changing societal expectations and demands for greater transparency, accountability, and efficiency. This has led to initiatives aimed at modernizing government operations, improving service delivery, and enhancing the overall effectiveness of public administration. As part of these efforts, there has been a focus on recruiting talent with expertise in digital transformation, public policy, and project management to drive these initiatives forward. As government agencies modernize their operations, workforce management tools will likely play a key role in supporting their objectives.

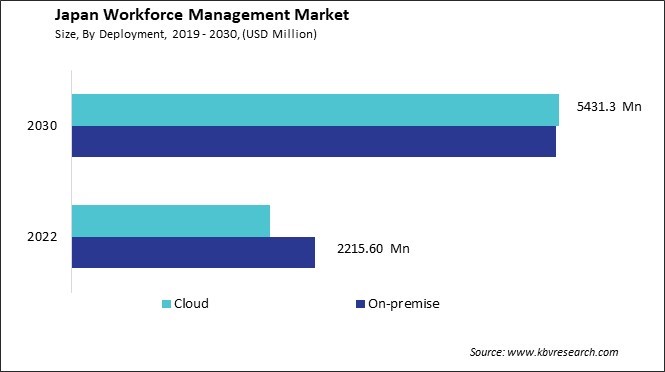

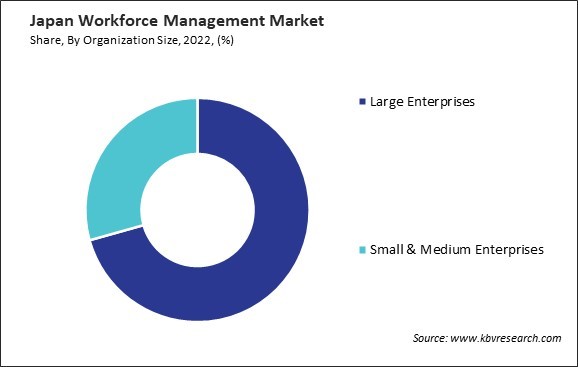

Large industries in Japan often have complex operational requirements, stringent data security regulations, and a desire for full control over their IT infrastructure, contributing to the preference for on-premise solutions. One of the primary drivers of this demand is data security and compliance. Many large industries, especially those in finance, healthcare, and manufacturing, handle sensitive data that requires high security and compliance with regulations. On-premise workforce management tools allow these organizations to maintain full control over their data, ensuring that it remains within their physical or virtual boundaries and meets their specific security requirements without relying on third-party infrastructure.

Another factor driving the demand for on-premise solutions is the need for high availability and performance. Large industries often operate on a large scale and require robust, high-performance solutions to handle the volume and complexity of their workforce management needs. On-premise solutions can be optimized for the organization's specific infrastructure and performance requirements, ensuring that they can scale and perform reliably even under heavy workloads.

Japanese hospitals and healthcare providers are increasingly turning to on-premise workforce management tools to manage their complex staffing needs in the healthcare industry. On-premise solutions offer the flexibility to customize the software to meet these specific needs while maintaining compliance with healthcare data privacy laws. These factors have led organizations in these sectors to prioritize on-premise solutions that offer greater control and flexibility over their workforce management processes.

Several companies are active in the workforce management market in Japan, offering a range of solutions and services to address the wants of businesses across various industries. Some of the key players in the Japanese workforce management market include NEC Corporation, Fujitsu Limited, Hitachi, Ltd., NTT Data Corporation, Workday, Inc., Oracle Corporation, SAP SE, Kronos Incorporated, ADP Japan, Workday Japan, IBM Japan, CyberAgent, Inc., etc.

One of the leading companies in this space is NEC Corporation, a global technology company headquartered in Japan. NEC offers workforce management solutions encompassing time and attendance tracking, scheduling, and labor optimization. The company leverages its IT and network solutions expertise to provide comprehensive workforce management tools that cater to various industries in Japan, including manufacturing, healthcare, and services.

Hitachi, Ltd., a diversified conglomerate with a significant presence in Japan, is also active in the workforce management market. Hitachi offers workforce management solutions that optimize productivity, improve scheduling accuracy, and ensure compliance with labor regulations. The company's expertise in various industries, including manufacturing, transportation, and healthcare, allows it to offer tailored workforce management solutions to businesses in Japan.

SAP Japan Co., Ltd. is a subsidiary of SAP SE, including workforce management tools. SAP offers workforce management solutions that help businesses in Japan streamline their HR processes, manage employee schedules, and optimize workforce efficiency. The company's solutions are designed to support businesses in Japan as they navigate the complexities of workforce management in a dynamic business environment.

Oracle Corporation Japan is another key player in the Japanese workforce management market, providing a range of workforce management software solutions that integrate with its broader suite of business applications. Oracle's workforce management offerings include tools for time and attendance tracking, employee scheduling, and workforce analytics, catering to the requirements of businesses across different sectors in Japan.

By Deployment

By Organization Size

By Solution

By Application