LAMEA Mobile Banking Market Size, Share & Trends Analysis Report By Platform (Android, iOS, and Others), By Transaction (Consumer-to-business, and Consumer-to-consumer), By Country and Growth Forecast, 2024 - 2031

Published Date : 12-Apr-2024 |

Pages: 89 |

Formats: PDF |

COVID-19 Impact on the LAMEA Mobile Banking Market

The Latin America, Middle East and Africa Mobile Banking Market would witness market growth of 18.9% CAGR during the forecast period (2024-2031).

The Brazil market dominated the LAMEA Mobile Banking Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $130.2 Million by 2031. The Argentina market is showcasing a CAGR of 19.5% during (2024 - 2031). Additionally, The UAE market would register a CAGR of 18.5% during (2024 - 2031).

Consumer preferences are shifting towards convenience, accessibility, and flexibility in banking services. Banking apps offer users the ability to manage their finances anytime, anywhere, without the constraints of traditional branch banking. As customers grow more used to digital interactions in other areas of their lives, they anticipate comparable degrees of accessibility and ease from their banking services.

Likewise, banks and financial institutions are investing heavily in digital transformation initiatives, including developing banking platforms. These initiatives aim to meet the evolving needs of consumers who prefer digital banking channels and to enhance the overall customer experience. banking apps are a key component of these initiatives, providing users convenient access to banking services on their mobile devices.

Greater investment in fintech startups in the region fosters innovation in banking solutions. With increased funding, fintech companies have the resources to develop and enhance banking apps with advanced features and functionalities. The Middle East and North Africa had a 58 percent growth in venture capital for fintech, from $587 million in 2021 to $925 million in 2022. Money rounds are increasing larger, with 131 deals receiving money in 2022 compared to 124 deals in 2021. Venture capital funding to the sector climbed from 21% in 2021 to 29% in 2022. Hence, the increasing fintech industry in the region is propelling the market’s growth.

Free Valuable Insights: The Worldwide Mobile Banking Market is Projected to reach USD 5.7 Billion by 2031, at a CAGR of 16.5%

Based on Platform, the market is segmented into Android, iOS, and Others. Based on Transaction, the market is segmented into Consumer-to-business, and Consumer-to-consumer. Based on countries, the market is segmented into Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria, and Rest of LAMEA.

List of Key Companies Profiled

- Mitsubishi UFJ Financial Group, Inc. (Mitsubishi group)

- JPMorgan Chase & Co.

- Wells Fargo & Company

- BNP Paribas S.A.

- American Express Company

- HSBC Holdings plc

- UBS AG (UBS Group AG)

- CAPITAL ONE FINANCIAL CORPORATION

- The Bank of America Corporation

- Citigroup Inc.

LAMEA Mobile Banking Market Report Segmentation

By Platform

- Android

- iOS

- Others

By Transaction

- Consumer-to-business

- Consumer-to-consumer

By Country

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 LAMEA Mobile Banking Market, by Platform

1.4.2 LAMEA Mobile Banking Market, by Transaction

1.4.3 LAMEA Mobile Banking Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.3 Top Winning Strategies

4.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

4.3.2 Key Strategic Move: (Mergers & Acquisition: 2021, Jun – 2024, Feb) Leading Players

4.4 Porter Five Forces Analysis

Chapter 5. LAMEA Mobile Banking Market by Platform

5.1 LAMEA Android Market by Country

5.2 LAMEA iOS Market by Country

5.3 LAMEA Others Market by Country

Chapter 6. LAMEA Mobile Banking Market by Transaction

6.1 LAMEA Consumer-to-business Market by Country

6.2 LAMEA Consumer-to-consumer Market by Country

Chapter 7. LAMEA Mobile Banking Market by Country

7.1 Brazil Mobile Banking Market

7.1.1 Brazil Mobile Banking Market by Platform

7.1.2 Brazil Mobile Banking Market by Transaction

7.2 Argentina Mobile Banking Market

7.2.1 Argentina Mobile Banking Market by Platform

7.2.2 Argentina Mobile Banking Market by Transaction

7.3 UAE Mobile Banking Market

7.3.1 UAE Mobile Banking Market by Platform

7.3.2 UAE Mobile Banking Market by Transaction

7.4 Saudi Arabia Mobile Banking Market

7.4.1 Saudi Arabia Mobile Banking Market by Platform

7.4.2 Saudi Arabia Mobile Banking Market by Transaction

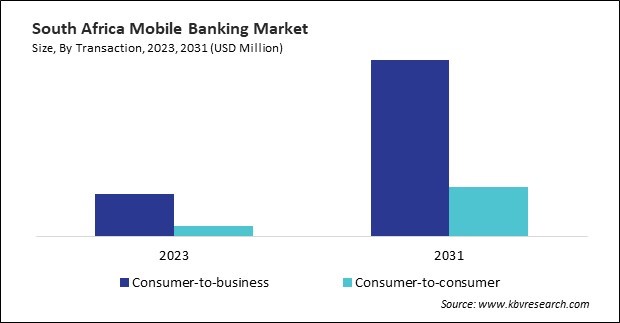

7.5 South Africa Mobile Banking Market

7.5.1 South Africa Mobile Banking Market by Platform

7.5.2 South Africa Mobile Banking Market by Transaction

7.6 Nigeria Mobile Banking Market

7.6.1 Nigeria Mobile Banking Market by Platform

7.6.2 Nigeria Mobile Banking Market by Transaction

7.7 Rest of LAMEA Mobile Banking Market

7.7.1 Rest of LAMEA Mobile Banking Market by Platform

7.7.2 Rest of LAMEA Mobile Banking Market by Transaction

Chapter 8. Company Profiles

8.1 Mitsubishi UFJ Financial Group, Inc. (Mitsubishi group)

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Recent strategies and developments:

8.1.3.1 Partnerships, Collaborations, and Agreements:

8.2 BNP Paribas S.A.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Regional Analysis

8.2.4 Recent strategies and developments:

8.2.4.1 Partnerships, Collaborations, and Agreements:

8.2.4.2 Acquisition and Mergers:

8.3 UBS AG (UBS Group AG)

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Recent strategies and developments:

8.3.4.1 Partnerships, Collaborations, and Agreements:

8.4 Capital One Financial Corporation

8.4.1 Company Overview

8.4.2 Financial Analysis

8.5 Citigroup Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.6 JPMorgan Chase & Co.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Recent strategies and developments:

8.6.4.1 Partnerships, Collaborations, and Agreements:

8.6.4.2 Acquisition and Mergers:

8.6.5 SWOT Analysis

8.7 HSBC Holdings plc

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Recent strategies and developments:

8.7.3.1 Product Launches and Product Expansions:

8.7.3.2 Acquisition and Mergers:

8.8 The Bank of America Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental and Regional Analysis

8.9 Wells Fargo & Company

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Recent strategies and developments:

8.9.3.1 Partnerships, Collaborations, and Agreements:

8.9.3.2 Product Launches and Product Expansions:

8.9.4 SWOT Analysis

8.10. American Express Company

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Regional Analysis

TABLE 2 LAMEA Mobile Banking Market, 2024 - 2031, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Mobile Banking Market

TABLE 4 Product Launches And Product Expansions– Mobile Banking Market

TABLE 5 Acquisition and Mergers– Mobile Banking Market

TABLE 6 LAMEA Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 7 LAMEA Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 8 LAMEA Android Market by Country, 2020 - 2023, USD Million

TABLE 9 LAMEA Android Market by Country, 2024 - 2031, USD Million

TABLE 10 LAMEA iOS Market by Country, 2020 - 2023, USD Million

TABLE 11 LAMEA iOS Market by Country, 2024 - 2031, USD Million

TABLE 12 LAMEA Others Market by Country, 2020 - 2023, USD Million

TABLE 13 LAMEA Others Market by Country, 2024 - 2031, USD Million

TABLE 14 LAMEA Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 15 LAMEA Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 16 LAMEA Consumer-to-business Market by Country, 2020 - 2023, USD Million

TABLE 17 LAMEA Consumer-to-business Market by Country, 2024 - 2031, USD Million

TABLE 18 LAMEA Consumer-to-consumer Market by Country, 2020 - 2023, USD Million

TABLE 19 LAMEA Consumer-to-consumer Market by Country, 2024 - 2031, USD Million

TABLE 20 LAMEA Mobile Banking Market by Country, 2020 - 2023, USD Million

TABLE 21 LAMEA Mobile Banking Market by Country, 2024 - 2031, USD Million

TABLE 22 Brazil Mobile Banking Market, 2020 - 2023, USD Million

TABLE 23 Brazil Mobile Banking Market, 2024 - 2031, USD Million

TABLE 24 Brazil Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 25 Brazil Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 26 Brazil Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 27 Brazil Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 28 Argentina Mobile Banking Market, 2020 - 2023, USD Million

TABLE 29 Argentina Mobile Banking Market, 2024 - 2031, USD Million

TABLE 30 Argentina Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 31 Argentina Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 32 Argentina Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 33 Argentina Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 34 UAE Mobile Banking Market, 2020 - 2023, USD Million

TABLE 35 UAE Mobile Banking Market, 2024 - 2031, USD Million

TABLE 36 UAE Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 37 UAE Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 38 UAE Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 39 UAE Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 40 Saudi Arabia Mobile Banking Market, 2020 - 2023, USD Million

TABLE 41 Saudi Arabia Mobile Banking Market, 2024 - 2031, USD Million

TABLE 42 Saudi Arabia Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 43 Saudi Arabia Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 44 Saudi Arabia Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 45 Saudi Arabia Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 46 South Africa Mobile Banking Market, 2020 - 2023, USD Million

TABLE 47 South Africa Mobile Banking Market, 2024 - 2031, USD Million

TABLE 48 South Africa Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 49 South Africa Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 50 South Africa Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 51 South Africa Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 52 Nigeria Mobile Banking Market, 2020 - 2023, USD Million

TABLE 53 Nigeria Mobile Banking Market, 2024 - 2031, USD Million

TABLE 54 Nigeria Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 55 Nigeria Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 56 Nigeria Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 57 Nigeria Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 58 Rest of LAMEA Mobile Banking Market, 2020 - 2023, USD Million

TABLE 59 Rest of LAMEA Mobile Banking Market, 2024 - 2031, USD Million

TABLE 60 Rest of LAMEA Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 61 Rest of LAMEA Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 62 Rest of LAMEA Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 63 Rest of LAMEA Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 64 Key Information – Mitsubishi UFJ Financial Group, Inc.

TABLE 65 Key Information – BNP Paribas S.A.

TABLE 66 Key Information – UBS AG

TABLE 67 Key Information – Capital One Financial Corporation

TABLE 68 Key Information – Citigroup Inc.

TABLE 69 key information – JPMorgan Chase & Co.

TABLE 70 Key Information – HSBC Holdings plc

TABLE 71 Key Information – The Bank of America Corporation

TABLE 72 Key Information – Wells Fargo & Company

TABLE 73 Key Information – American Express Company

List of Figures

FIG 1 Methodology for the research

FIG 2 LAMEA Mobile Banking Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Mobile Banking Market

FIG 4 KBV Cardinal Matrix

FIG 5 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 6 Key Strategic Move: (Mergers & Acquisition: 2021, Jun – 2024, Feb) Leading Players

FIG 7 Porter’s Five Forces Analysis – Mobile Banking Market

FIG 8 LAMEA Mobile Banking Market share by Platform, 2023

FIG 9 LAMEA Mobile Banking Market share by Platform, 2031

FIG 10 LAMEA Mobile Banking Market by Platform, 2020 - 2031, USD Million

FIG 11 LAMEA Mobile Banking Market share by Transaction, 2023

FIG 12 LAMEA Mobile Banking Market share by Transaction, 2031

FIG 13 LAMEA Mobile Banking Market by Transaction, 2020 - 2031, USD Million

FIG 14 LAMEA Mobile Banking Market share by Country, 2023

FIG 15 LAMEA Mobile Banking Market share by Country, 2031

FIG 16 LAMEA Mobile Banking Market by Country, 2020 - 2031, USD Million

FIG 17 Recent strategies and developments: JPMorgan Chase & Co.

FIG 18 SWOT Analysis: JPMorgan Chase & Co.

FIG 19 Recent strategies and developments: HSBC Holdings plc

FIG 20 Recent strategies and developments: Wells Fargo & Company

FIG 21 SWOT Analysis: Wells Fargo & Company