The Latin America, Middle East and Africa Soy Milk Market would witness market growth of 15.1% CAGR during the forecast period (2024-2031). In the year 2027, the LAMEA market's volume is expected to surge to 121.49 kilo tonnes, showcasing a growth of 13.1% (2024-2031).

Flavored soy milk includes varieties such as chocolate, vanilla, almond, strawberry, and other innovative options that cater to taste preferences. This segment targets children, young adults, and first-time soy milk consumers who may find plain soy milk’s natural taste unappealing. Flavored soy milk combines taste and nutrition, positioning itself as a healthy yet indulgent beverage. Brands are innovating with unique, regional, and exotic flavors to attract diverse consumer groups and increase market penetration. Flavored soy milk is often fortified with vitamins, minerals, and proteins, enhancing its nutritional profile while maintaining its enjoyable taste. Thus, Saudi Arabia market is expected to utilize 30.55 kilo tonnes of flavored soy milk by the year 2031.

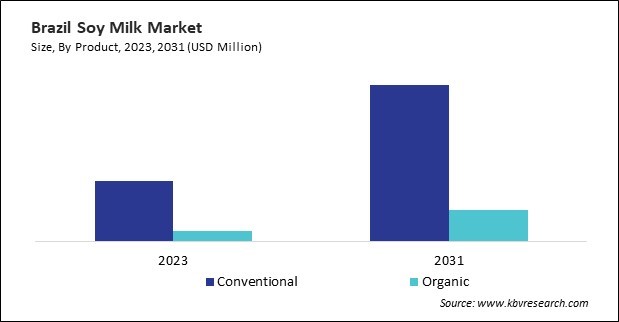

The Brazil market dominated the LAMEA Soy Milk Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $243.5 Million by 2031. The Argentina market is showcasing a CAGR of 16% during (2024 - 2031). Additionally, The UAE market would register CAGR of 14.8% during (2024 - 2031).

The increasing awareness of dietary and environmental sustainability is at the heart of the soy milk market’s growth. A growing number of individuals have chosen plant-based alternatives to reduce their carbon footprint as the global population becomes more cognizant of the ecological consequences of their dietary choices.

Additionally, soy milk is particularly appealing, as its production requires significantly less water, land, and energy than dairy milk while generating fewer greenhouse gas emissions. These environmental benefits have resonated strongly with millennials and Gen Z consumers, who drive demand for eco-friendly products and shape market trends. Soy milk’s alignment with these values has elevated its status, making it a dietary and ethical choice.

In Brazil, soy milk has become more than just a dairy alternative—it is a staple for health-conscious families and an affordable option for those managing lactose intolerance, which affects nearly 63% of Brazilians. Brazil’s long-standing agricultural expertise in soybean production has naturally positioned soy milk as an accessible and affordable beverage for many consumers. Iconic local brands like Ades, once a symbol of simple soy-based drinks, have evolved to embrace modern trends with products enriched in flavors like tropical fruits, vanilla, and chocolate. Due to government campaigns promoting healthier lifestyles, Brazilian consumers also embrace fortified soy milk as part of a balanced diet. In cities such as São Paulo and Rio de Janeiro, soy milk has become a staple due to the presence of urban supermarkets like Carrefour and vibrant online platforms. Meanwhile, rural regions are beginning to investigate the nutritional benefits of this adaptable beverage.

Free Valuable Insights: The Worldwide Soy Milk Market is Projected to reach USD 13.23 Billion by 2031, at a CAGR of 13.2%

Based on Product, the market is segmented into Conventional and Organic. Based on Flavor, the market is segmented into Plain/Unflavored and Flavored. Based on Distribution Channel, the market is segmented into Supermarkets & Hypermarkets, Convenience Stores, Online, and Other Distribution Channel. Based on Type, the market is segmented into Sweetened and Unsweetened. Based on countries, the market is segmented into Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria, and Rest of LAMEA.

By Product (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Flavor (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Distribution Channel (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2031)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.