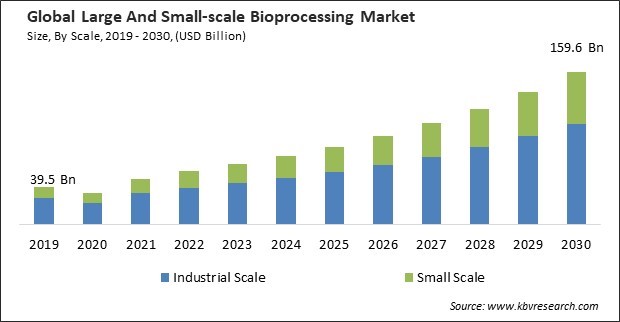

The Global Large And Small-scale Bioprocessing Market size is expected to reach $159.6 billion by 2030, rising at a market growth of 14.2% CAGR during the forecast period.

The biopharmaceutical industry's expansion has spurred continuous advancements in bioprocessing technologies. Therefore, Biopharmaceuticals segment would generate $35,141.7 million revenue in the market in 2022. As a result, the constant innovation within the biopharmaceutical industry has a positive feedback loop, driving the evolution of bioprocessing technologies and equipment. As biopharmaceutical companies strive to optimize their manufacturing processes, they invest in cutting-edge equipment, automation, and process control systems.

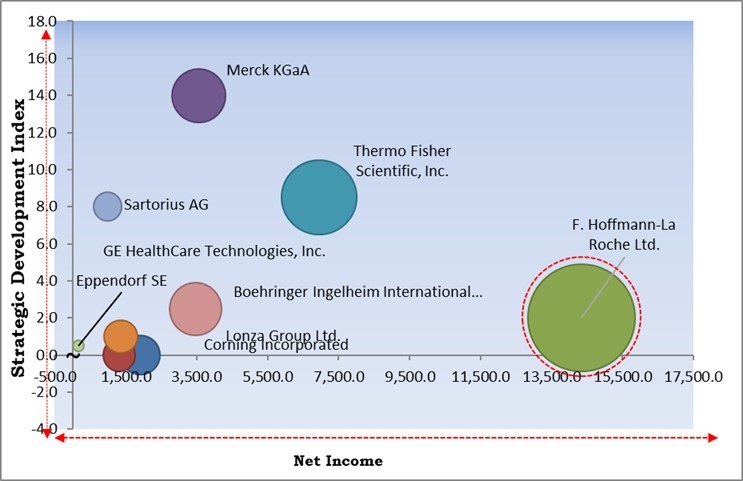

The major strategies followed by the market participants are Geographical Expansion as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2022, Eppendorf Group expanded its Jülich bioprocess site by constructing a new multifunctional building. Moreover, In April, 2022, Thermo Fisher Scientific set up a new single-use technology manufacturing site in Ogden, Utah, enhancing capacity for high-quality materials crucial in developing vaccines and therapies. This expansion strengthens the company's Utah presence and facilitates close collaboration with the Logan site, tapping into a skilled workforce for manufacturing intricate, customized solutions.

Based on the Analysis presented in the KBV Cardinal matrix; F. Hoffmann-La Roche Ltd. is the major forerunner in the Market. Companies such as Merck KGaA, Thermo Fisher Scientific, Inc., and Boehringer Ingelheim International GmbH are some of the key innovators in the Market. In July, 2023, Sartorius AG expanded its site in Yauco, Puerto Rico, by incorporating a new cell culture media manufacturing facility. This addition solidified their extensive portfolio, particularly catering to customers in the Americas.

The pandemic led to an urgent need for COVID-19 vaccines, which required rapidly scaling up large-scale bioprocessing facilities. This resulted in increased demand for bioprocessing equipment, single-use technologies, and expertise in large-scale vaccine production. The pandemic prompted increased funding for research, including small-scale bioprocessing activities related to developing diagnostics, therapeutics, and vaccines. Academic and research labs received substantial funding for COVID-19-related projects. Many small-scale bioprocessing labs shifted to remote work and virtual collaboration to comply with social distancing measures. This accelerated the adoption of digital tools and software for data analysis, experiment planning, and communication. Therefore, COVID-19 impact had an overall positive effect on the market.

The demand for biosimilars and generic biologics, driven by the expiration of patents on biologic drugs, has significantly impacted the large-scale bioprocessing. Biosimilars and generic biologics aim to provide more affordable alternatives to biologic drugs, making them more accessible to patients. To meet this growing demand, large-scale bioprocessing facilities are required to produce these biologics efficiently and cost-effectively. As a result, the large-scale bioprocessing businesses have seen a boost in activity, with increased investment in production facilities and equipment. Therefore, the increasing demand for these pharmaceuticals is propelling the growth of the market.

Continuous advancements in bioprocessing equipment, automation, and analytics improve the efficiency and scalability of large-scale production. Single-use bioprocessing equipment and systems have become increasingly popular in large-scale bioprocessing. These systems eliminate the need for cleaning and sterilization, reducing downtime and the risk of contamination. Continuous bioprocessing is gaining traction as an alternative to traditional batch processing. Automated high-throughput screening technologies help rapidly screen cell lines, culture conditions, and process parameters, accelerating process development for large-scale production. Advancements in bioprocessing technologies have significantly impacted the market.

Small-scale bioprocessing labs, especially in academic or startup settings, have limited resources and expertise to navigate complex regulatory requirements. Establishing and maintaining quality systems, including standard operating procedures (SOPs) and documentation, can be challenging for smaller organizations with fewer personnel. Transitioning from small-scale to larger-scale production while maintaining compliance can be difficult, especially when processes and equipment need to be adapted. Thus, regulatory compliance is a significant challenge in large and small-scale bioprocessing market.

By scale, the market is categorized into industrial scale and small scale. In 2022, the industrial scale segment held the highest revenue share in the market. Large-scale bioprocessing at volumes exceeding 50,000 litres is often associated with producing monoclonal antibodies, vaccines, and other biopharmaceuticals. These products require large quantities to meet global demand. Due to their durability and capacity to endure high pressures and volumes, stainless steel bioreactors are frequently used in large-scale bioprocessing facilities.

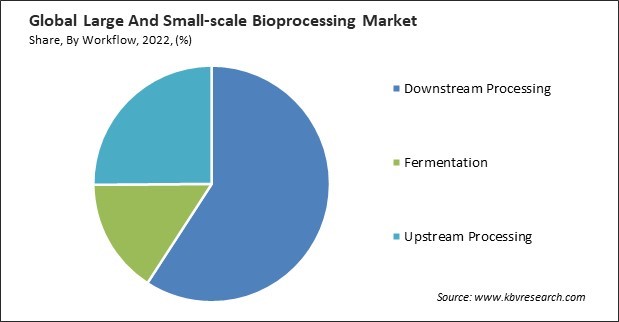

Based on workflow, the market is classified into downstream processing, fermentation, and upstream processing. The fermentation segment acquired a substantial revenue share in the market in 2022. Large-scale fermentation allows the production of substantial quantities of products. Large-scale fermentation processes often benefit from economies of scale, resulting in lower production costs per product unit. This is critical for cost-effective manufacturing of biopharmaceuticals and other high-value products. Large-scale fermenters have advanced monitoring and control systems to ensure consistent product quality.

Based on use type, the market is fragmented into multi use and single use. The single use segment covered a considerable revenue share in the market in 2022. Single use systems are highly adaptable and readily scaled to accommodate fluctuating production requirements. This scalability is valuable for large and small-scale bioprocessing operations, allowing them to adapt to evolving market demands. Single-use systems can reduce downtime associated with cleaning, sterilization, and changeover between batches. This results in faster turnaround times, making it easier to quickly meet production schedules and respond to market demands.

On the basis of mode, the market is bifurcated into in-house and outsourced. The outsourced segment acquired a substantial revenue share in the large and small-scale bioprocessing market in 2022. Large pharmaceutical and biotechnology companies outsource bioprocessing to contract manufacturing organizations (CMOs) to produce biopharmaceuticals. CMOs have the infrastructure and expertise to scale up production quickly to meet high demand. CMOs often specialize in certain types of bioprocessing, such as monoclonal antibody production or vaccine manufacturing. Large-scale companies can benefit from these service providers' specialized knowledge and experience. Small biotech startups and research institutions lack the specialized equipment and facilities for certain bioprocessing activities. Outsourcing provides access to advanced equipment and infrastructure.

By application, the market is segmented into biopharmaceuticals, speciality industrial chemicals, and environmental aids. In 2022, the biopharmaceuticals segment registered the maximum revenue share in the market. The primary application of bioprocessing is the commercial production of biopharmaceuticals for the market. This includes manufacturing large quantities of monoclonal antibodies, vaccines, recombinant proteins, and other biologics. Monoclonal antibodies are widely used to treat cancer, autoimmune diseases, and infectious diseases. Many biopharmaceutical companies outsource the large-scale production of their products to contract manufacturing organizations (CMOs).

On the basis of product, the market is divided into bioreactors/fermenters, cell culture products, filtration assemblies, bioreactors accessories, bags & containers, and others. In 2022, the bioreactors/fermenters segment dominated the market with maximum revenue share. Large-scale biopharmaceutical manufacturing facilities typically employ stainless steel bioreactors. These bioreactors are designed for high-volume production and are known for their durability, sterility, and ability to withstand high pressure and temperature conditions. There has been a growing trend in large-scale bioprocessing towards adopting single-use bioreactors. These systems offer flexibility, reduce the risk of contamination, and minimize the need for time-consuming cleaning and sterilization processes.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 55.8 Billion |

| Market size forecast in 2030 | USD 159.6 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 14.2% from 2023 to 2030 |

| Number of Pages | 425 |

| Number of Table | 624 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Scale, Use Type, Mode, Workflow, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. North America is home to numerous large pharmaceutical and biotechnology companies that use large-scale bioprocessing to produce biopharmaceuticals, including monoclonal antibodies, vaccines, gene therapies, and more. North America boasts state-of-the-art biomanufacturing facilities with large-scale bioreactors, downstream processing units, and quality control systems. North America, particularly the United States, has a thriving ecosystem of biotech startups that engage in small-scale bioprocessing for research, development, and early-stage product testing.

Free Valuable Insights: Global Large And Small-scale Bioprocessing Market size to reach USD 159.6 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Merck KGaA, Thermo Fisher Scientific, Inc., GE healthcare, Corning Incorporated, Sartorius AG, Lonza Group AG (Capsugel), Meissner Filtration Products, Inc., Boehringer Ingelheim International GmbH, F. Hoffmann-La Roche Ltd. and Eppendorf SE.

By Scale

By Use Type

By Mode

By Application

By Workflow

By Product

By Geography

This Market size is expected to reach $159.6 billion by 2030.

Rising demand for biosimilars, generic biologics, and personalized medicine are driving the Market in coming years, however, Stringent regulatory compliance restraints the growth of the Market.

Merck KGaA, Thermo Fisher Scientific, Inc., GE healthcare, Corning Incorporated, Sartorius AG, Lonza Group AG (Capsugel), Meissner Filtration Products, Inc., Boehringer Ingelheim International GmbH, F. Hoffmann-La Roche Ltd. and Eppendorf SE.

The expected CAGR of this Market is 14.2% from 2023 to 2030.

The In-house segment is generating the highest revenue in the Market by Mode in 2022; thereby, achieving a market value of $98.0 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $54.9 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.