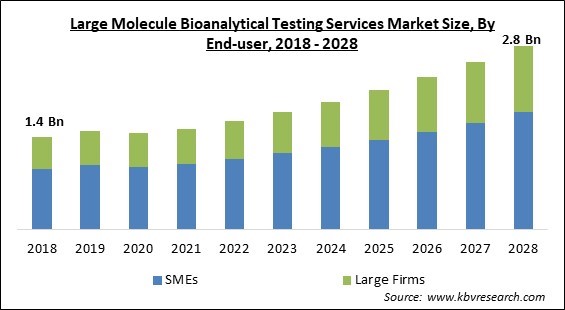

The Global Large Molecule Bioanalytical Testing Services Market size is expected to reach $2.8 billion by 2028, rising at a market growth of 9.1% CAGR during the forecast period.

A large molecule therapeutic is examined in a biological matrix in a process known as large molecule bioanalysis. The biological matrix is frequently serum or plasma. Peptides, proteins, and antibody drug conjugates are examples of large molecule drug products that have shown to be highly effective in treating a wide range of different disease indications. Large molecule bioanalysis by CROs like PBL has increased in popularity as more & more large molecule products are being developed. Pharmacokinetic (PK) studies, immunogenicity testing, pharmacodynamics (PD) studies, and biomarker assays are the most typical types of bioanalytical studies.

The demand for high-tech and dependable large molecule bioanalytical testing services is one of many factors contributing to the industry's expected growth. Additionally, the demand for analytical testing services has increased due to the complexity of product designs and engineering. To keep up with market demand, pharmaceutical companies now face a greater requirement than ever to implement innovative technology in their services.

The development of bioanalytical assays aids in identifying the design considerations, constraints, favorable circumstances, and applicability of a medicine for the intended treatment. The information on protein binding and in vivo/in vitro metabolism, combined with important facets of earlier work on the method, greatly influences the creation of bioanalytical assays. Given their capacity to ascertain the purity, identification, performance, and potency of these compounds, bioanalytical tests play a significant role in the discovery & development of pharmaceutical products. Additionally, the methodologies used enable the quantification of analytes in a variety of biological matrices, including plasma, blood, urine, or serum.

Reduced internal lab testing capacities at several biopharmaceutical companies led to a rise in CRO workload, the suspension of courier services, and initial IT problems, among other first interruptions. The market experienced a little positive growth in 2020, and it is projected that this trend will continue during the projection period. Following the pandemic, the industry experienced steady growth as a result of factors like the acceleration of COVID-19 vaccine R&D and the rise in agreements and partnerships between CROs and biopharmaceutical businesses to outsource their bioanalytical testing needs. Because healthcare costs are rising, there is a growing demand for high-quality care.

In the pharmaceutical industry, biologics are one of the most significant and latest therapeutic areas, and there are currently a large number of products in the pipeline. The increasing prevalence of chronic diseases is one of the main causes of this. However, the emphasis on biosimilars has grown in recent years due to the high cost of biologics and the growing focus of various governments on cutting healthcare costs. The development of follow-on biologics or biosimilars has also been made possible by the approaching expiration of biologics' patents and exclusivity periods. As a result, the market for large molecule bioanalytical testing services would expand at a significant rate.

Pharmaceutical firms have started outsourcing a number of R&D tasks that are not essential to their internal operations. Companies are attempting to develop drugs more effectively by concentrating on their internal core competencies in order to introduce new goods to the market more affordably. For major businesses, outsourcing bioanalytical testing has a number of benefits, including lower costs, increased productivity, and the best manpower. Therefore, the large molecule bioanalytical testing services market is expanding.

Making sure that procedures are sufficiently sensitive, quick to analyze, and robust is one of the major issues in this field. It is quite challenging for service providers to guarantee adequate testing capabilities due to fluctuations, changes, and variations in end-user demands & regulatory requirements; they must constantly search out and apply novel and fresh assays. For instance, to evaluate low CZP concentrations in newborn and umbilical cord blood, extremely sensitive and selective bioanalytical tests are needed to assess the placental transfer of certolizumab pegol (CZP).

Based on phase, the large molecule bioanalytical testing services market is segmented into preclinical (with antibody, without antibody), and clinical. The preclinical segment acquired a substantial revenue share in the large molecule bioanalytical testing services market in 2021. Preclinical segment includes pharmacokinetic bioanalysis of plasma or serum samples. In this stud, the drug product is administered to humans or animals, and blood samples are subsequently taken at various intervals. The serum or plasma is separated & sent to a lab for examination. The lab carries out two different kinds of preclinical studies (in vivo and in vitro).

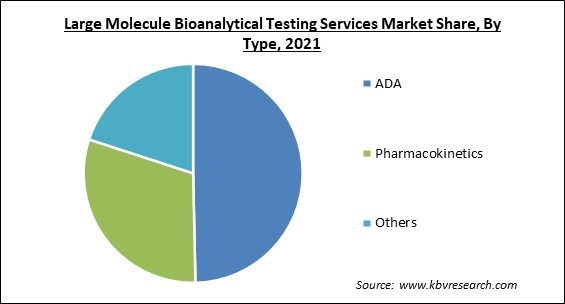

On the basis of type, the large molecule bioanalytical testing services market is fragmented into pharmacokinetics, ADA and others. In 2021, the ADA segment held the largest revenue share in the large molecule bioanalytical testing services market. Large molecule drug development is supported by the ADA assays. Antibodies are produced by the immune system in response to large molecular medications like antibodies and protein therapies. As a result, ADA assays can be used to detect ADAs. Owing to this, the demand for ADA is estimated to rise in the upcoming years supporting the market growth.

By test Type, the large molecule bioanalytical testing services market is classified into ADME, PD, bioavailability, bioequivalence and other tests. In 2021, the PD segment generated a substantial revenue share in the large molecule bioanalytical testing services market in 2021. Pharmacodynamic (PD) studies examine how the medication affects the patient, including its biochemical and physiological effects. The drug's mechanism of action, or how it functions on a biochemical level, can be better understood through pharmacodynamic big molecule bioanalysis.

Based on therapeutic areas, the large molecule bioanalytical testing services market is bifurcated into oncology, infectious diseases, cardiology, neurology and others. In 2021, the oncology segment accounted the maximum revenue share in the large molecule bioanalytical testing services market. The World Health Organization estimates that in year 2020, cancer was one of the top reasons of mortality worldwide, accounting for over 10 million fatalities. Some of the major drivers that are anticipated to propel the segment's growth include an increase in cancer incidence, a fast-growing senior population, and an unhealthy lifestyle.

On the basis of end-user, the large molecule bioanalytical testing services market is divided into SMEs (CROs & CMOs, sponsor Organizations, others) and large firms (CROs & CMOs, sponsor organizations, and others). In 2021, the SMEs segment registered the largest revenue share in the large molecule bioanalytical testing services market. This is because of the increasing innovations by the small-scale pharmaceutical companies. Further, the market is expanding in this segment due to the increased number of small local market players providing large molecule bioanalytical testing services in the upcoming years.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.5 Billion |

| Market size forecast in 2028 | USD 2.8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.1% from 2022 to 2028 |

| Number of Pages | 346 |

| Number of Tables | 629 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Test Type, Type, Phase, Therapeutic Areas, End-user, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the large molecule bioanalytical testing services market is analyzed across the North America, Europe, Asia Pacific and LAMEA. In 2021, the North America region led the large molecule bioanalytical testing services market by generating maximum revenue share. One of the top manufacturing regions for highly dependable, intricate, and expensive medications is North America. The regional market is expanding as a result of rising investments from companies that provide bioanalytical testing services, rising R&D expenditures in the biopharmaceutical industry, and favorable regulatory reforms.

Free Valuable Insights: Global Large Molecule Bioanalytical Testing Services Market size to reach USD 2.8 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Laboratory Corporation Of America Holdings, IQVIA Holdings, Inc., Syneos Health, Inc., SGS S.A., Intertek Group PLC, Pace Analytical Services, LLC, ICON Plc, Charles River Laboratories International, Inc., and Thermo Fisher Scientific, Inc.

By End-user

By Test Type

By Type

By Phase

By Therapeutic Areas

By Geography

The Large Molecule Bioanalytical Testing Services Market size is projected to reach USD 2.8 billion by 2028.

Increasing attention on biologics and biosimilars' analytical testing are driving the market in coming years, however, Growing demand for bioanalytical procedures to be made more sensitive restraints the growth of the market.

Laboratory Corporation Of America Holdings, IQVIA Holdings, Inc., Syneos Health, Inc., SGS S.A., Intertek Group PLC, Pace Analytical Services, LLC, ICON Plc, Charles River Laboratories International, Inc., and Thermo Fisher Scientific, Inc.

The Bioavailability market acquired the high revenue share in the Global Large Molecule Bioanalytical Testing Services Market by Test Type in 2021, thereby, achieving a market value of $803.6 million by 2028.

The Pharmacokinetics market shows the high growth rate of 9.4% during (2022 - 2028). Pharmacokinetic services are provided strictly in accordance with worldwide regulatory standards and Good Clinical Practice recommendations (FDA, ICH, and EMEA).

The North America market dominated the Global Large Molecule Bioanalytical Testing Services Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $1.2 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.