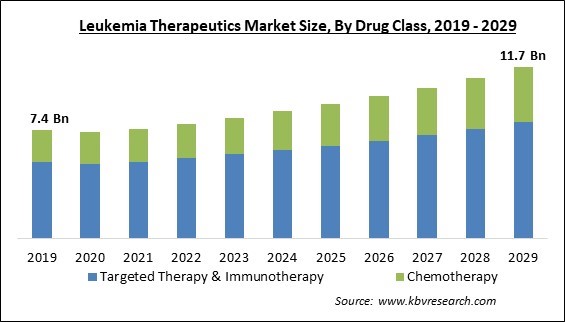

The Global Leukemia Therapeutics Market size is expected to reach $11.7 billion by 2029, rising at a market growth of 6.0% CAGR during the forecast period.

Chronic lymphocytic leukemia (CLL) is the major contributor to the market because of the growing older population. Thus, it is expected to generate approximately $4,834.8 million revenue of the total market by 2029. One in six deaths, or 9.6 million, was attributed to cancer in 2018, making it the second largest cause of death worldwide. For example, in the US, CLL accounts for 25 to 30% of all cases of leukemia. The American Cancer Society predicted that in the year 2020, there would be roughly 21,040 new cases of CLL and about 4,060 fatalities. CLL/SLL is responsible for 191,000 cases and 61,000 deaths annually. Adults as young as 30 years old can develop CLL. However, people over the age of 70 are most likely to experience it. Children with CLL are incredibly uncommon. It is well known that the incidence rises quickly with age.

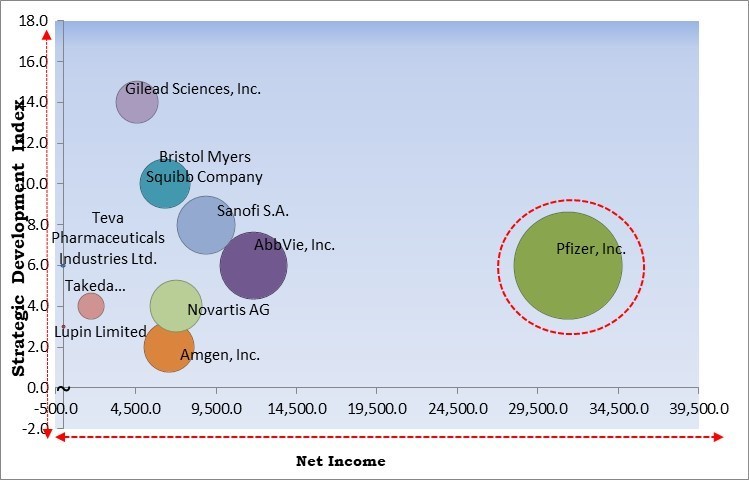

The major strategies followed by the market participants are partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In October, 2022, Gilead joined hands with MacroGenics to develop and commercialization of advanced monoclonal antibody-based therapeutics for the treatment of cancer. Under this collaboration, both companies would develop MGD024, an investigational, bispecific antibody that binds CD3 and CD123 utilizing MacroGenics’ DART® platform. Additionally, In October, 2022, Bristol Myers Squibb signed an agreement with Century Therapeutics and aims to develop and supply up to 4 induced pluripotent stems cell-derived, engineered natural killer cell and T cell programs for hematologic malignancies and solid tumors.

Based on the Analysis presented in the Cardinal matrix; Pfizer, Inc. is the forerunner in the Leukemia Therapeutics Market. In June, 2020, Pfizer, Inc. received approval from DAURISMO, a Hedgehog pathway inhibitor, combined with low-dose cytarabine, a chemotherapy type, for the treatment of newly diagnosed acute myeloid leukemia (AML) in adult patients. Through this approval, Pfizer would serve people living with cancers by providing a new treatment option for certain patients across Europe. Companies such as AbbVie, Inc., Bristol Myers Squibb Company, Sanofi S.A. and Gilead Sciences, Inc. are some of the key innovators in Leukemia Therapeutics Market.

Numerous research projects are being carried out to create distinct therapeutic techniques that combine diverse medicines to boost patient outcomes for various leukemia types. For example, although chemotherapy is the standard of care, a new strategy is being used that combines chemotherapy with the medicines cytarabine and anthracyclines to enhance patient outcomes. Because many people resist several chemotherapy medications, businesses are creating immune treatments to treat this illness. Therefore, market growth is anticipated to be boosted by the development of such cutting-edge diagnostics and therapies for leukemia patients during the anticipated period.

Pharmaceutical companies are currently concentrating their efforts on finding novel therapeutic agents and prospective new compounds that can alter the activity of the determined target. Additionally, preclinical, and clinical studies are a drawn-out, frequently pricey, and risky procedure. To boost the drug development process, an efficient and cutting-edge method of predicting drug efficacy is therefore required. Target identification, lead optimization, and lead validation can all be accomplished with the use of bioinformatic technologies like statistical algorithms. These tools support both drug development and drug discovery. The market is anticipated to expand as a result of the increasing use of a bioinformatics tool for improving current drug development solutions.

The expansion of the market for leukemia therapeutics is projected to be constrained by the side effects and unfavorable responses associated with the treatments. Chemotherapy, for example, causes side effects, including skin conditions, hair loss, infections, high blood pressure, fatigue, and other similar side effects. Different therapies also have different adverse reactions. For example, similar side events, like nausea, liver issues, hair color loss, diarrhea, and vomiting, can be brought on by targeted therapy. Additionally, some side effects of other treatment modalities, including radiotherapy, may reduce the rate at which leukemia therapeutic agents are adopted. During the forecast period, these factors are expected to restrain market growth.

Based on type, the leukemia therapeutics market is segmented into acute lymphocytic leukemia, acute myeloid leukemia, chronic lymphocytic leukemia, chronic myeloid leukemia, and others. In 2022, the chronic lymphocytic leukemia segment held the highest revenue share in the leukemia therapeutics market. Chronic lymphocytic leukemia (CLL) is a cancer that spreads slowly from lymphocytes in the bone marrow to the blood. The three main trends influencing the segment's growth are the accelerated adoption of a less active way of life, an increasing incidence of chronic lymphocytic leukemia, and the growing elderly population.

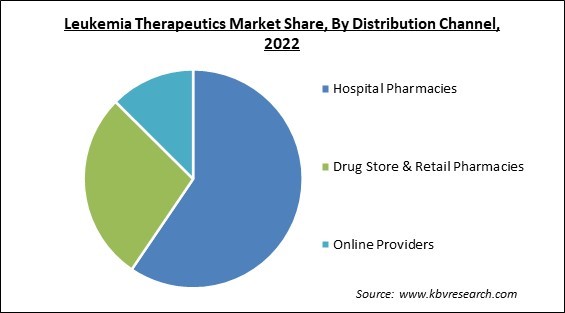

On the basis of distribution channel, the leukemia therapeutics market is bifurcated into hospital pharmacies, drug store & retail pharmacies and online providers. The online providers segment acquired a substantial revenue share in the leukemia therapeutics market in 2022. This is due to ongoing services and various solutions being readily available. In addition, the market's expansion is also fueled by a surge in e-commerce sales, better logistical services, and simple payment options.

By drug class, the leukemia therapeutics market is fragmented into chemotherapy, and targeted therapy & immunotherapy. The targeted therapy & immunotherapy segment witnessed the largest revenue share in the leukemia therapeutics market in 2022. Drug therapies that target specific abnormalities in cancer cells are used. Targeted medication therapies can kill cancer cells by obstructing these aberrations. The patient's immune system is used in immunotherapy to combat cancer. Cancer cells create proteins that assist them evade detection by immune system cells, thus the body's immune system that fights disease may not attack the cancer. Immunotherapy works by obstructing that procedure.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 7.8 Billion |

| Market size forecast in 2029 | USD 11.7 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 6% from 2023 to 2029 |

| Number of Pages | 236 |

| Number of Table | 364 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Drug Class, Distribution Channel, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the leukemia therapeutics market is analysed across North America, Europe, Asia Pacific and LAMEA. In 2022, the North America region led the leukemia therapeutics market with the maximum revenue share. North America now holds a leading position in the market due to high healthcare spending, many significant players in creating new leukemia medicines, and an increasing number of leukemia patients. Diagnostic clinics, hospitals, and other medical institutions have a lot of medical equipment installed. In the pharmaceutical & biotechnology industries, the United States is home to many original equipment manufacturers that lead the world.

Free Valuable Insights: Global Leukemia Therapeutics Market size to reach USD 11.7 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Gilead Sciences, Inc., Bristol Myers Squibb Company, Sanofi S.A., AbbVie, Inc., Teva Pharmaceuticals Industries Ltd., Lupin Limited, Amgen, Inc., Takeda Pharmaceutical Company Limited, Pfizer, Inc. and Novartis AG.

By Drug Class

By Distribution Channel

By Type

By Geography

The Market size is projected to reach USD 11.7 billion by 2029.

Developing bioinformatics tool to support drug development are driving the Market in coming years, however, Side Effects of leukemia therapeutics and strict regulations restraints the growth of the Market.

Gilead Sciences, Inc., Bristol Myers Squibb Company, Sanofi S.A., AbbVie, Inc., Teva Pharmaceuticals Industries Ltd., Lupin Limited, Amgen, Inc., Takeda Pharmaceutical Company Limited, Pfizer, Inc. and Novartis AG.

The Hospital Pharmacies segment acquired maximum revenue share in the Market by Distribution Channel in 2022 thereby, achieving a market value of $6.8 billion by 2029.

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $4.6 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.