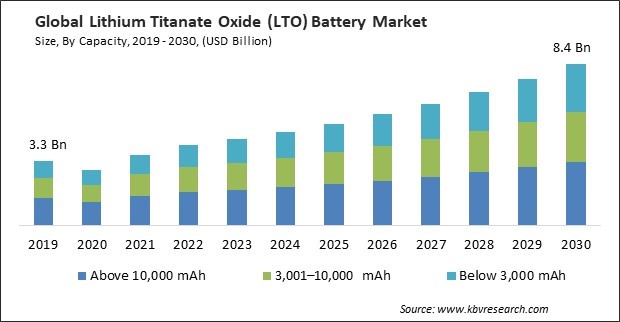

The Global Lithium Titanate Oxide (LTO) Battery Market size is expected to reach $8.4 billion by 2030, rising at a market growth of 9.4% CAGR during the forecast period.

Aerospace environments can be subjected to extreme temperatures, from the cold of high-altitude flight to the scorching heat of re-entry into Earth's atmosphere. Therefore, the aerospace segment would witness 1/5th share of the market by 2030. LTO batteries are renowned for their lightweight design, making them an attractive choice for aerospace applications. Weight is a critical factor in aviation and space missions, where every kilogram saved translates to improved fuel efficiency and payload capacity. LTO batteries are known for their ability to operate effectively across a wide temperature range, ensuring reliability in extreme conditions. Some of the factors impacting the market are Rising adoption due to focus on environmental sustainability, government incentives and regulations spurring the adoption, and higher upfront cost compared to other lithium-ion battery technologies.

LTO batteries are designed with a focus on recyclability. These batteries can be disassembled at the end of their useful life, and their components and materials can be recovered and reused. Recycling LTO batteries helps reduce the demand for virgin raw materials used in battery production. This, in turn, lessens the environmental impact of mining and extracting finite resources, such as lithium and titanium. Recycling LTO batteries minimizes hazardous waste and reduces the disposal of toxic materials in landfills. This aligns with environmental regulations and contributes to a more sustainable waste management system. The improved safety and durability of LTO batteries contribute to reduced soil and water contamination risks associated with battery leaks or disposal. LTO batteries generally require fewer raw materials than other battery chemistries, making them more resource-efficient and reducing the pressure on natural resources. Moreover, Governments invest in research and development initiatives to advance LTO battery technology. These programs can fund collaborative projects with industry partners and research institutions to develop next-generation LTO batteries with improved performance, safety, and cost-effectiveness. In disaster-prone areas, governments may mandate or incentivize using LTO batteries in critical infrastructure, such as hospitals, emergency response centers, and telecommunications facilities. Owing to these factors, the market will expand rapidly in the upcoming years.

However, LTO batteries use lithium titanate oxide as the anode material, which is more expensive to manufacture compared to common anode materials like graphite used in other lithium-ion batteries. Producing high-purity lithium titanate adds to the overall cost of LTO batteries. The production of LTO batteries often involves advanced manufacturing techniques and materials to ensure the high-performance characteristics they are known for, such as rapid charge-discharge capabilities and long cycle life. Manufacturers must balance the advantages of LTO batteries against their higher price point when marketing their products. These factors are expected to hamper the growth of the market in the future.

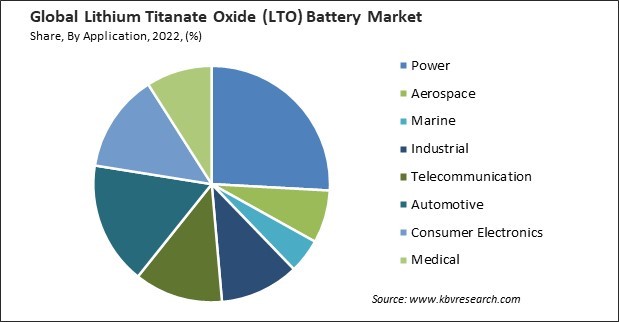

On the basis of application, the market is divided into consumer electronics, automotive, aerospace, marine, medical, industrial, power, and telecommunication. The automotive segment acquired a substantial revenue share in the market in 2022. LTO batteries find use in hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) as part of their energy storage systems. These vehicles combine combustion engines with electric propulsion, benefiting from LTO batteries' characteristics. Electric buses and commercial vehicles are increasingly adopting LTO battery technology.

By capacity, the market is segmented into below 3,000 mAh, 3,001-10,000 mAh, and above 10,000 mAh. The above 10,000 mAh segment procured the highest revenue share in the market in 2022. Industries and businesses require robust energy storage solutions for load leveling, peak shaving, and uninterruptible power supply (UPS) applications. LTO batteries with capacities exceeding 10,000 mAh provide ample energy storage for these critical operations. Integrating renewable energy sources, such as solar and wind, into the power grid necessitates higher-capacity energy storage solutions.

Based on voltage, the market is segmented into low, medium, and high. The high segment held the largest revenue share in the market in 2022. The demand for EVs and HEVs with longer driving ranges has led to the development of high voltage LTO batteries. These batteries can deliver higher power output and store more energy, extending the range of electric vehicles. High voltage LTO batteries can fast charging, reducing charging times for electric vehicles. This feature enhances the convenience of EV ownership and supports long-distance travel.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 4.1 Billion |

| Market size forecast in 2030 | USD 8.4 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 9.4% from 2023 to 2030 |

| Number of Pages | 275 |

| Number of Table | 400 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Capacity, Voltage, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured the highest revenue share in the market in 2022. APAC is a hotspot for the electric vehicle industry, with countries like China, Japan, South Korea, and India witnessing rapid EV adoption. LTO batteries are favored in this region due to their fast-charging capabilities, extended cycle life, and suitability for high-temperature environments. Many APAC countries have implemented favorable government policies and incentives to promote EV adoption, including subsidies, tax benefits, and emission reduction targets. These policies encourage automakers and consumers to choose EVs equipped with LTO batteries. Therefore, the segment will witness an increasing demand in the upcoming years.

Free Valuable Insights: Global Lithium Titanate Oxide (LTO) Battery Market size to reach USD 8.4 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Toshiba Corporation, Targray Technology International Inc., Microvast Holdings, Inc., Nichicon Corporation, Leclanché S.A., Yinlong Energy International Pte Ltd (Gree Altairnano New Energy), Clarios, LLC. (Brookfield Business Partners), Zenaji Pty Ltd, Log9 Materials and LiTech Power Co., Ltd.

By Capacity

By Application

By Voltage

By Geography

This Market size is expected to reach $8.4 billion by 2030.

Rising adoption due to focus on environmental sustainability are driving the Market in coming years, however, Higher upfront cost compared to other lithium-ion battery technologies restraints the growth of the Market.

Toshiba Corporation, Targray Technology International Inc., Microvast Holdings, Inc., Nichicon Corporation, Leclanche S.A., Yinlong Energy International Pte Ltd (Gree Altairnano New Energy), Clarios, LLC. (Brookfield Business Partners), Zenaji Pty Ltd, Log9 Materials and LiTech Power Co., Ltd.

The expected CAGR of this Market is 9.4% from 2023 to 2030.

The Power segment is leading the Market, by Application in 2022; thereby, achieving a market value of $1.9 billion by 2030.

The Asia Pacific region dominated the Market, by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $3.3 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.