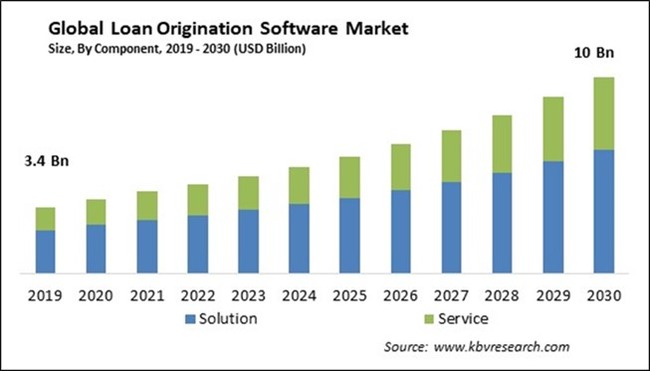

The Global Loan Origination Software Market size is expected to reach $10.0 billion by 2030, rising at a market growth of 10.5% CAGR during the forecast period.

Banks use loan origination software to automate and streamline the loan application and approval process. Therefore, the banks segment is poised to acquire more than 43% share of the market by 2030. This helps reduce manual tasks, lowers operational costs, and accelerates the time to approve and disburse loans. Banks often require customized LOS solutions to meet their lending criteria and processes. Loan origination software can be tailored to align with the bank's lending policies and business objectives. The bank segment is a significant player in the loan origination software market and plays a crucial role in the lending industry. Banks use loan origination software (LOS) to streamline and automate the process of originating, underwriting, and managing loans.

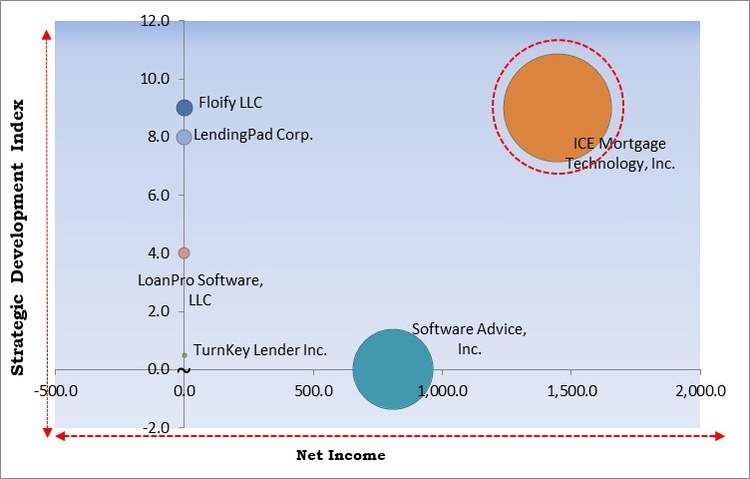

The major strategies followed by the market participants are Partnerships as the key developmental strategy in order to keep pace with the changing demands of end users. In November, 2022, LendingPad Corp. formed a partnership with Shape Software, Inc to provide comprehensive LOS and CRM solutions for larger broker clients. Additionally, In September, 2023, Floify LLC teamed up with Wolters Kluwer N.V. to utilize the features offered by Wolters Kluwer's original product suite.

Based on the Analysis presented in the KBV Cardinal matrix; ICE Mortgage Technology, Inc. is the forerunner in the Market. In July, 2023, ICE Mortgage Technology, Inc. partnered with Electronic Appraisal Solutions, Inc. Through this partnership, mortgage industry stakeholders would be provided with efficient access to every single collateral valuation-related product and service. Companies such as Software Advice, Inc., Floify LLC, LendingPad Corp. are some of the key innovators in the Market.

The increased adoption of AI, ML, and blockchain technology significantly impacts the loan origination software market, transforming how lenders evaluate, process, and manage loans. These technological advances have increased efficiency, precision, and security, propelling the market growth for loan origination software. AI and ML optimize risk assessment, allowing lenders to make informed decisions, while blockchain ensures the integrity and security of sensitive borrower information. This accelerates the lending cycle and reduces the probability of errors, fraud, and compliance violations. Therefore, the growing use of AI, ML, and blockchain technology, which encourages efficiency, accuracy, and security across the lending process, is fueling the growth of the loan origination software market.

In a financial landscape that is undergoing rapid change, consumers demand streamlined, convenient, and customized experiences throughout the entire borrowing journey. Incorporating automation and AI-driven tools into loan origination processes has significantly accelerated the application processing and risk assessment. As a result, consumers experience quicker approvals, fast disbursals, and lower error rates, boosting their confidence in the lending institution. These platforms transform borrowing into a positive, effective, and secure experience by offering ease, personalization, efficiency, and security. As customer expectations continue to evolve, the market for loan origination software must remain dynamic, incorporating innovative technologies to exceed these expectations and propel the market forward consistently.

Nowadays, in the digital landscape, where financial transactions and sensitive information are predominantly processed electronically, assuring the security and confidentiality of customer data is of the utmost importance. Nonetheless, loan origination involves acquiring, storing, and transmitting susceptible data, such as personal and financial information. In addition, customers are worried about exposing their personal information online due to increased user awareness of data security. This prudence extends to loan applications and financial transactions, causing prospective borrowers to seek out lenders that prioritize data security. Concerns about data security and compliance have substantially slowed the expansion of the loan origination software market.

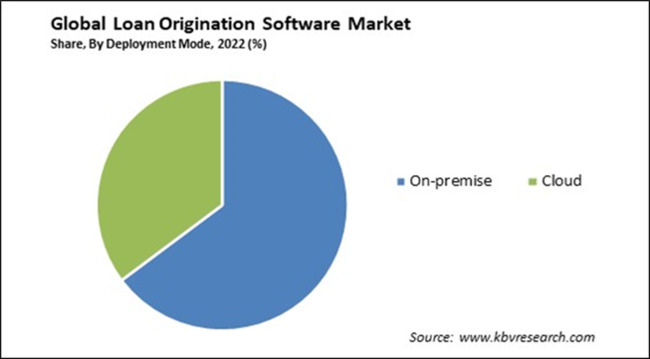

By deployment mode, the market is categorized into on-premise and cloud. The cloud segment covered a considerable revenue share in the market in 2022. The adoption of cloud technology will likely fuel the expansion of the loan origination software market by providing financial institutions with the flexibility, cost-efficiency, and advanced capabilities needed to streamline their loan origination processes and stay competitive in a rapidly evolving market. Cloud-based loan origination software can easily scale up or down based on the needs of financial institutions. This flexibility allows banks and lending organizations to handle fluctuations in loan origination volume without significant infrastructure investments. Cloud-based loan origination software can enhance the customer experience by offering online application forms, document uploads, and real-time status updates.

On the basis of component, the market is bifurcated into solution and service. In 2022, the solution segment dominated the market with maximum revenue share. The growth of the solution segment in the LOS market is directly tied to the evolving needs of lenders, regulatory requirements, and technological advancements. As financial institutions seek to provide faster, more efficient, and compliant loan origination processes, the demand for comprehensive and adaptable LOS solutions will continue to grow. The loan origination software market offers a range of solutions tailored to the needs of various financial institutions, including banks, credit unions, mortgage lenders, and online lending platforms. These solutions can vary regarding features, scalability, and deployment options (on-premises or cloud-based). Loan origination software solutions come with a wide array of features and functionalities.

Based on end-user, the market is classified into banks, credit unions, mortgage lenders & brokers, NBFCs, and others. The credit unions segment projected a prominent revenue share in the market in 2022. Loan origination software (LOS) helps credit unions automate and digitize their loan origination processes, reducing manual paperwork and administrative tasks. This automation increases operational efficiency and cost savings, allowing credit unions to allocate resources more effectively. Members of credit unions expect convenient and fast loan approval processes. LOS solutions enable credit unions to offer quicker loan decisions and a seamless application experience, enhancing member satisfaction and retention. Adopting loan origination software among credit unions may vary depending on their size, budget, and strategic priorities.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 4.6 Billion |

| Market size forecast in 2030 | USD 10 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 10.5% from 2023 to 2030 |

| Number of Pages | 247 |

| Number of Table | 353 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Mode, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region acquired a significant revenue share in the market. This expansion can be ascribed to the surge in small and medium-sized businesses (SMEs) and e-commerce in the region, which has expanded demand for business loans. Online lenders and fintech platforms are filling the need for loan origination software with simplified loan origination procedures. As a result of rising income levels, urbanization, and a developing middle class, the Asia-Pacific region is also associated with some of the fastest-growing economies in the world. As economies expand, so does the demand for mortgage, personal, and commercial loan origination software.

Free Valuable Insights: Global Loan Origination Software Market size to reach USD 10 Billion by 2030

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Finastra Group Holdings Limited (Vista Equity Partners), Software Advice, Inc. (Gartner, Inc.), Floify LLC (Porch Group, Inc.), Bryt Software LCC, LendingPad Corporation, ICE Mortgage Technology, Inc. (Intercontinental Exchange, Inc.), Nelito Systems Pvt. Ltd., LoanPro Software, LLC, TurnKey Lender Inc., and nCino, Inc.

By Component

By Deployment Mode

By End-User

By Geography

This Market size is expected to reach $10.0 billion by 2030.

Growing Adoption of Blockchain, AI, and Machine Learning Technologies are driving the Market in coming years, however, Issues About Compliance and Data Security restraints the growth of the Market.

Finastra Group Holdings Limited (Vista Equity Partners), Software Advice, Inc. (Gartner, Inc.), Floify LLC (Porch Group, Inc.), Bryt Software LCC, LendingPad Corporation, ICE Mortgage Technology, Inc. (Intercontinental Exchange, Inc.), Nelito Systems Pvt. Ltd., LoanPro Software, LLC, TurnKey Lender Inc., and nCino, Inc.

The expected CAGR of this Market is 10.5% from 2023 to 2030.

The On-premise segment is leading the Market, By Deployment Mode in 2022; thereby, achieving a market value of $6.0 billion by 2030.

The North America region dominated the Market, By Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $4.1 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.