Global Loan Origination Software Market Size, Share & Industry Trends Analysis Report By Component (Solution, and Service), By Deployment Mode (On-premise, and Cloud), By End-User, By Regional Outlook and Forecast, 2023 - 2030

Published Date : 30-Sep-2023 |

Pages: 247 |

Formats: PDF |

COVID-19 Impact on the Loan Origination Software Market

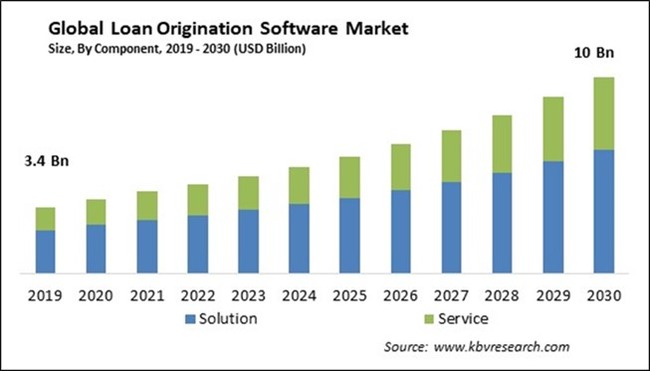

The Global Loan Origination Software Market size is expected to reach $10.0 billion by 2030, rising at a market growth of 10.5% CAGR during the forecast period.

Banks use loan origination software to automate and streamline the loan application and approval process. Therefore, the banks segment is poised to acquire more than 43% share of the market by 2030. This helps reduce manual tasks, lowers operational costs, and accelerates the time to approve and disburse loans. Banks often require customized LOS solutions to meet their lending criteria and processes. Loan origination software can be tailored to align with the bank's lending policies and business objectives. The bank segment is a significant player in the loan origination software market and plays a crucial role in the lending industry. Banks use loan origination software (LOS) to streamline and automate the process of originating, underwriting, and managing loans.

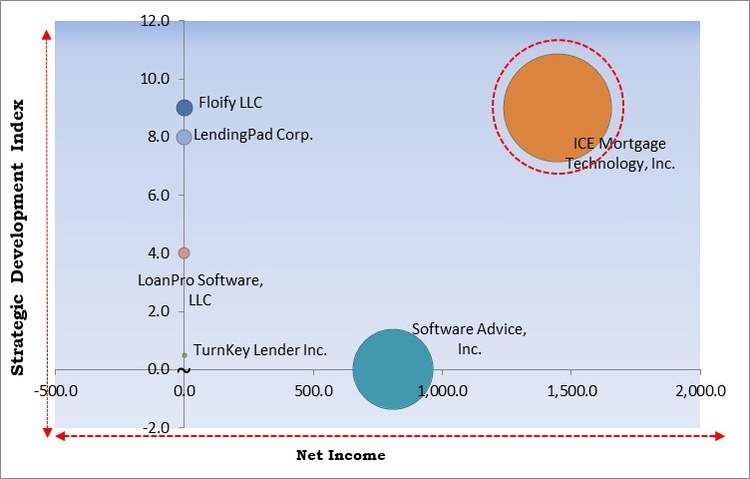

The major strategies followed by the market participants are Partnerships as the key developmental strategy in order to keep pace with the changing demands of end users. In November, 2022, LendingPad Corp. formed a partnership with Shape Software, Inc to provide comprehensive LOS and CRM solutions for larger broker clients. Additionally, In September, 2023, Floify LLC teamed up with Wolters Kluwer N.V. to utilize the features offered by Wolters Kluwer's original product suite.

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; ICE Mortgage Technology, Inc. is the forerunner in the Market. In July, 2023, ICE Mortgage Technology, Inc. partnered with Electronic Appraisal Solutions, Inc. Through this partnership, mortgage industry stakeholders would be provided with efficient access to every single collateral valuation-related product and service. Companies such as Software Advice, Inc., Floify LLC, LendingPad Corp. are some of the key innovators in the Market.

Market Growth Factors

Growing Adoption of Blockchain, AI, and Machine Learning Technologies

The increased adoption of AI, ML, and blockchain technology significantly impacts the loan origination software market, transforming how lenders evaluate, process, and manage loans. These technological advances have increased efficiency, precision, and security, propelling the market growth for loan origination software. AI and ML optimize risk assessment, allowing lenders to make informed decisions, while blockchain ensures the integrity and security of sensitive borrower information. This accelerates the lending cycle and reduces the probability of errors, fraud, and compliance violations. Therefore, the growing use of AI, ML, and blockchain technology, which encourages efficiency, accuracy, and security across the lending process, is fueling the growth of the loan origination software market.

Enhanced Customer Experience

In a financial landscape that is undergoing rapid change, consumers demand streamlined, convenient, and customized experiences throughout the entire borrowing journey. Incorporating automation and AI-driven tools into loan origination processes has significantly accelerated the application processing and risk assessment. As a result, consumers experience quicker approvals, fast disbursals, and lower error rates, boosting their confidence in the lending institution. These platforms transform borrowing into a positive, effective, and secure experience by offering ease, personalization, efficiency, and security. As customer expectations continue to evolve, the market for loan origination software must remain dynamic, incorporating innovative technologies to exceed these expectations and propel the market forward consistently.

Market Restraining Factors

Issues About Compliance and Data Security

Nowadays, in the digital landscape, where financial transactions and sensitive information are predominantly processed electronically, assuring the security and confidentiality of customer data is of the utmost importance. Nonetheless, loan origination involves acquiring, storing, and transmitting susceptible data, such as personal and financial information. In addition, customers are worried about exposing their personal information online due to increased user awareness of data security. This prudence extends to loan applications and financial transactions, causing prospective borrowers to seek out lenders that prioritize data security. Concerns about data security and compliance have substantially slowed the expansion of the loan origination software market.

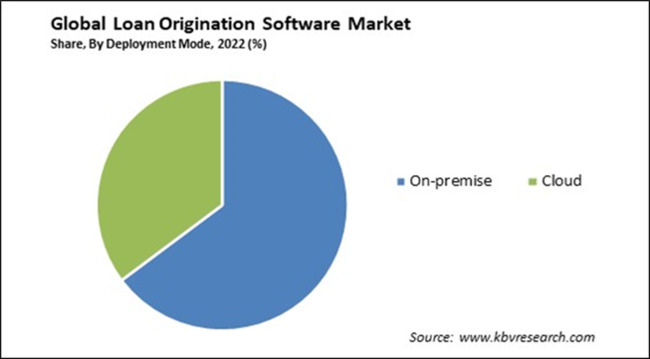

Deployment Mode Outlook

By deployment mode, the market is categorized into on-premise and cloud. The cloud segment covered a considerable revenue share in the market in 2022. The adoption of cloud technology will likely fuel the expansion of the loan origination software market by providing financial institutions with the flexibility, cost-efficiency, and advanced capabilities needed to streamline their loan origination processes and stay competitive in a rapidly evolving market. Cloud-based loan origination software can easily scale up or down based on the needs of financial institutions. This flexibility allows banks and lending organizations to handle fluctuations in loan origination volume without significant infrastructure investments. Cloud-based loan origination software can enhance the customer experience by offering online application forms, document uploads, and real-time status updates.

Component Outlook

On the basis of component, the market is bifurcated into solution and service. In 2022, the solution segment dominated the market with maximum revenue share. The growth of the solution segment in the LOS market is directly tied to the evolving needs of lenders, regulatory requirements, and technological advancements. As financial institutions seek to provide faster, more efficient, and compliant loan origination processes, the demand for comprehensive and adaptable LOS solutions will continue to grow. The loan origination software market offers a range of solutions tailored to the needs of various financial institutions, including banks, credit unions, mortgage lenders, and online lending platforms. These solutions can vary regarding features, scalability, and deployment options (on-premises or cloud-based). Loan origination software solutions come with a wide array of features and functionalities.

End-User Outlook

Based on end-user, the market is classified into banks, credit unions, mortgage lenders & brokers, NBFCs, and others. The credit unions segment projected a prominent revenue share in the market in 2022. Loan origination software (LOS) helps credit unions automate and digitize their loan origination processes, reducing manual paperwork and administrative tasks. This automation increases operational efficiency and cost savings, allowing credit unions to allocate resources more effectively. Members of credit unions expect convenient and fast loan approval processes. LOS solutions enable credit unions to offer quicker loan decisions and a seamless application experience, enhancing member satisfaction and retention. Adopting loan origination software among credit unions may vary depending on their size, budget, and strategic priorities.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 4.6 Billion |

| Market size forecast in 2030 | USD 10 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 10.5% from 2023 to 2030 |

| Number of Pages | 247 |

| Number of Table | 353 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Mode, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region acquired a significant revenue share in the market. This expansion can be ascribed to the surge in small and medium-sized businesses (SMEs) and e-commerce in the region, which has expanded demand for business loans. Online lenders and fintech platforms are filling the need for loan origination software with simplified loan origination procedures. As a result of rising income levels, urbanization, and a developing middle class, the Asia-Pacific region is also associated with some of the fastest-growing economies in the world. As economies expand, so does the demand for mortgage, personal, and commercial loan origination software.

Free Valuable Insights: Global Loan Origination Software Market size to reach USD 10 Billion by 2030

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Finastra Group Holdings Limited (Vista Equity Partners), Software Advice, Inc. (Gartner, Inc.), Floify LLC (Porch Group, Inc.), Bryt Software LCC, LendingPad Corporation, ICE Mortgage Technology, Inc. (Intercontinental Exchange, Inc.), Nelito Systems Pvt. Ltd., LoanPro Software, LLC, TurnKey Lender Inc., and nCino, Inc.

Strategies deployed in the Market

» Partnerships, Collaborations, and Agreements:

- Sep-2023: Floify LLC teamed up with Wolters Kluwer N.V., an information services company, to utilize the features offered by Wolters Kluwer's original product suite. This partnership would offer Floify customers a digital e-closing capability, enabling digital signatures as an alternative to the traditional wet-signing approach.

- Jul-2023: ICE Mortgage Technology, Inc. partnered with Electronic Appraisal Solutions, Inc., also known as Valligent, a company that offers appraisal, compliance solutions, and valuation services to integrate its offerings with Valligent's platform. Through the partnership, mortgage industry stakeholders would be provided with efficient access to every single collateral valuation-related product and service.

- Dec-2022: LendingPad Corp. signed an integration partnership with Mortech, a Zillow Group business, product, and pricing engine. LendingPad's loan origination software users would have the capability to effortlessly access up-to-date and precise mortgage rates from Mortech's product and pricing engine directly through the platform, eliminating the requirement for manual data input. This enhancement would result in time savings for loan officers, as data transfer would be seamless, and it would enhance the locking process by granting access to real-time and historical pricing information within the LendingPad platform, offering greater visibility.

- Nov-2022: LendingPad Corp. formed a partnership with Shape Software, Inc., a customer relationship management (CRM) platform, to provide comprehensive LOS and CRM solutions for larger broker clients. This seamless integration between LendingPad and Shape eliminates the need for manual data entry regarding borrower information and ensures that critical loan data and statuses remain synchronized.

- Sep-2022: LendingPad Corp. came into partnership with Lender Price., a mortgage loan pricing technology provider, to integrate its offerings with Lender Price's portfolio. Through this partnership, loan officers would have the opportunity to consolidate the complex loan origination process. This would enable them to access both product eligibility information and competitive pricing analysis within a single application, all seamlessly integrated through the LendingPad system.

- Sep-2022: LoanPro Software, LLC partnered with Anovaa, a next-generation consumer loan origination platform, to provide end-to-end loan servicing & and loan origination solutions. This partnership would provide users of LoanPro and Anovaa with full command over the entire loan journey, starting from Anovaa's origination solution and extending to LoanPro's capacity to manage loans and enhance collections.

- Mar-2022: ICE Mortgage Technology, Inc. came into an integration partnership with Maxwell Financial Labs, Inc., a mortgage fintech solutions platform for small to midsize lenders, for its Encompass eClose. This solution would be integrated into Maxwell's point-of-sale platform, aimed to make the closing process easier and more efficient for both lenders and borrowers throughout the United States. By adding eClose to Maxwell's platform, the company would be able to give all the Encompass lenders using their system a real digital experience. This would make things work better, speed up the steps, and lower expenses for the lender.

- Mar-2022: ICE Mortgage Technology, Inc. formed a partnership with Roostify, Inc., a leading mortgage technology provider, to provide an extensive digital closing solution that would strengthen Roostify's two-way integration with Encompass. This partnership would enable lenders to offer borrowers an improved lending experience characterized by speed, efficiency, and accuracy.

- Sep-2021: Floify LLC partnered with Unify, a customer relationship management (CRM) and marketing automation software. The partnership would empower loan originators utilizing Floify to automate their mortgage process and unify to oversee their customer database.

» Product Launches and Product Expansions:

- Apr-2021: ICE Mortgage Technology, Inc. launched Encompass eClose, an edge solution that facilitates mortgage loans eClosing workflow. The solution offers several benefits including lowering operational costs, providing a single platform for multiple eClose platforms, reducing the acquisition cycle, etc.

- Feb-2021: Floify LLC revealed that it would be updating to Floify E-Sign, the company's widely used native e-signature solution. This update aims to include support for the Disclosure Desk. The update namely, Floify E-Sign for Disclosure Desk would enable enterprise lenders to smoothly combine their existing loan origination system (LOS) with Floify and the platform's built-in e-signature solution, creating a mobile-friendly point-of-sale (POS) system that would streamline the origination and disclosure process. Floify E-Sign for Disclosure Desk would make getting a loan easier and help lenders make more money by providing useful features.

» Geographical Expansions:

- Nov-2022: TurnKey Lender Inc. has expanded its reach to the United Kingdom. This move would allow the company to provide comprehensive automation, adaptability, AI-driven credit scoring, and top-tier reporting capabilities that would benefit the wider global TurnKey Lender community in the UK.

Scope of the Study

Market Segments Covered in the Report:

By Component

- Solution

- Service

By Deployment Mode

- On-premise

- Cloud

By End-User

- Banks

- NBFCs

- Mortgage Lenders & Brokers

- Credit Unions

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Finastra Group Holdings Limited (Vista Equity Partners)

- Software Advice, Inc. (Gartner, Inc.)

- Floify LLC (Porch Group, Inc.)

- Bryt Software LCC

- LendingPad Corporation

- ICE Mortgage Technology, Inc. (Intercontinental Exchange, Inc.)

- Nelito Systems Pvt. Ltd.

- LoanPro Software, LLC

- TurnKey Lender Inc.

- nCino, Inc

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Loan Origination Software Market, by Component

1.4.2 Global Loan Origination Software Market, by Deployment Mode

1.4.3 Global Loan Origination Software Market, by End-User

1.4.4 Global Loan Origination Software Market, by Geography

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.3 Top Winning Strategies

4.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

4.3.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2021, Sep – 2023,Sep) Leading Players

4.4 Porter’s Five Force Analysis

Chapter 5. Global Loan Origination Software Market, By Component

5.1 Global Solution Market, By Region

5.2 Global Service Market, By Region

Chapter 6. Global Loan Origination Software Market, By Deployment Mode

6.1 Global On-premise Market, By Region

6.2 Global Cloud Market, By Region

Chapter 7. Global Loan Origination Software Market, By End-User

7.1 Global Banks Market, By Region

7.2 Global NBFCs Market, By Region

7.3 Global Mortgage Lenders & Brokers Market, By Region

7.4 Global Credit Unions Market, By Region

7.5 Global Others Market, By Region

Chapter 8. Global Loan Origination Software Market, By Region

8.1 North America Loan Origination Software Market

8.1.1 North America Loan Origination Software Market, By Component

8.1.1.1 North America Solution Market, By Country

8.1.1.2 North America Service Market, By Country

8.1.2 North America Loan Origination Software Market, By Deployment Mode

8.1.2.1 North America On-premise Market, By Country

8.1.2.2 North America Cloud Market, By Country

8.1.3 North America Loan Origination Software Market, By End-User

8.1.3.1 North America Banks Market, By Country

8.1.3.2 North America NBFCs Market, By Country

8.1.3.3 North America Mortgage Lenders & Brokers Market, By Country

8.1.3.4 North America Credit Unions Market, By Country

8.1.3.5 North America Others Market, By Country

8.1.4 North America Loan Origination Software Market, By Country

8.1.4.1 US Loan Origination Software Market

8.1.4.1.1 US Loan Origination Software Market, By Component

8.1.4.1.2 US Loan Origination Software Market, By Deployment Mode

8.1.4.1.3 US Loan Origination Software Market, By End-User

8.1.4.2 Canada Loan Origination Software Market

8.1.4.2.1 Canada Loan Origination Software Market, By Component

8.1.4.2.2 Canada Loan Origination Software Market, By Deployment Mode

8.1.4.2.3 Canada Loan Origination Software Market, By End-User

8.1.4.3 Mexico Loan Origination Software Market

8.1.4.3.1 Mexico Loan Origination Software Market, By Component

8.1.4.3.2 Mexico Loan Origination Software Market, By Deployment Mode

8.1.4.3.3 Mexico Loan Origination Software Market, By End-User

8.1.4.4 Rest of North America Loan Origination Software Market

8.1.4.4.1 Rest of North America Loan Origination Software Market, By Component

8.1.4.4.2 Rest of North America Loan Origination Software Market, By Deployment Mode

8.1.4.4.3 Rest of North America Loan Origination Software Market, By End-User

8.2 Europe Loan Origination Software Market

8.2.1 Europe Loan Origination Software Market, By Component

8.2.1.1 Europe Solution Market, By Country

8.2.1.2 Europe Service Market, By Country

8.2.2 Europe Loan Origination Software Market, By Deployment Mode

8.2.2.1 Europe On-premise Market, By Country

8.2.2.2 Europe Cloud Market, By Country

8.2.3 Europe Loan Origination Software Market, By End-User

8.2.3.1 Europe Banks Market, By Country

8.2.3.2 Europe NBFCs Market, By Country

8.2.3.3 Europe Mortgage Lenders & Brokers Market, By Country

8.2.3.4 Europe Credit Unions Market, By Country

8.2.3.5 Europe Others Market, By Country

8.2.4 Europe Loan Origination Software Market, By Country

8.2.4.1 Germany Loan Origination Software Market

8.2.4.1.1 Germany Loan Origination Software Market, By Component

8.2.4.1.2 Germany Loan Origination Software Market, By Deployment Mode

8.2.4.1.3 Germany Loan Origination Software Market, By End-User

8.2.4.2 UK Loan Origination Software Market

8.2.4.2.1 UK Loan Origination Software Market, By Component

8.2.4.2.2 UK Loan Origination Software Market, By Deployment Mode

8.2.4.2.3 UK Loan Origination Software Market, By End-User

8.2.4.3 France Loan Origination Software Market

8.2.4.3.1 France Loan Origination Software Market, By Component

8.2.4.3.2 France Loan Origination Software Market, By Deployment Mode

8.2.4.3.3 France Loan Origination Software Market, By End-User

8.2.4.4 Russia Loan Origination Software Market

8.2.4.4.1 Russia Loan Origination Software Market, By Component

8.2.4.4.2 Russia Loan Origination Software Market, By Deployment Mode

8.2.4.4.3 Russia Loan Origination Software Market, By End-User

8.2.4.5 Spain Loan Origination Software Market

8.2.4.5.1 Spain Loan Origination Software Market, By Component

8.2.4.5.2 Spain Loan Origination Software Market, By Deployment Mode

8.2.4.5.3 Spain Loan Origination Software Market, By End-User

8.2.4.6 Italy Loan Origination Software Market

8.2.4.6.1 Italy Loan Origination Software Market, By Component

8.2.4.6.2 Italy Loan Origination Software Market, By Deployment Mode

8.2.4.6.3 Italy Loan Origination Software Market, By End-User

8.2.4.7 Rest of Europe Loan Origination Software Market

8.2.4.7.1 Rest of Europe Loan Origination Software Market, By Component

8.2.4.7.2 Rest of Europe Loan Origination Software Market, By Deployment Mode

8.2.4.7.3 Rest of Europe Loan Origination Software Market, By End-User

8.3 Asia Pacific Loan Origination Software Market

8.3.1 Asia Pacific Loan Origination Software Market, By Component

8.3.1.1 Asia Pacific Solution Market, By Country

8.3.1.2 Asia Pacific Service Market, By Country

8.3.2 Asia Pacific Loan Origination Software Market, By Deployment Mode

8.3.2.1 Asia Pacific On-premise Market, By Country

8.3.2.2 Asia Pacific Cloud Market, By Country

8.3.3 Asia Pacific Loan Origination Software Market, By End-User

8.3.3.1 Asia Pacific Banks Market, By Country

8.3.3.2 Asia Pacific NBFCs Market, By Country

8.3.3.3 Asia Pacific Mortgage Lenders & Brokers Market, By Country

8.3.3.4 Asia Pacific Credit Unions Market, By Country

8.3.3.5 Asia Pacific Others Market, By Country

8.3.4 Asia Pacific Loan Origination Software Market, By Country

8.3.4.1 China Loan Origination Software Market

8.3.4.1.1 China Loan Origination Software Market, By Component

8.3.4.1.2 China Loan Origination Software Market, By Deployment Mode

8.3.4.1.3 China Loan Origination Software Market, By End-User

8.3.4.2 Japan Loan Origination Software Market

8.3.4.2.1 Japan Loan Origination Software Market, By Component

8.3.4.2.2 Japan Loan Origination Software Market, By Deployment Mode

8.3.4.2.3 Japan Loan Origination Software Market, By End-User

8.3.4.3 India Loan Origination Software Market

8.3.4.3.1 India Loan Origination Software Market, By Component

8.3.4.3.2 India Loan Origination Software Market, By Deployment Mode

8.3.4.3.3 India Loan Origination Software Market, By End-User

8.3.4.4 South Korea Loan Origination Software Market

8.3.4.4.1 South Korea Loan Origination Software Market, By Component

8.3.4.4.2 South Korea Loan Origination Software Market, By Deployment Mode

8.3.4.4.3 South Korea Loan Origination Software Market, By End-User

8.3.4.5 Singapore Loan Origination Software Market

8.3.4.5.1 Singapore Loan Origination Software Market, By Component

8.3.4.5.2 Singapore Loan Origination Software Market, By Deployment Mode

8.3.4.5.3 Singapore Loan Origination Software Market, By End-User

8.3.4.6 Malaysia Loan Origination Software Market

8.3.4.6.1 Malaysia Loan Origination Software Market, By Component

8.3.4.6.2 Malaysia Loan Origination Software Market, By Deployment Mode

8.3.4.6.3 Malaysia Loan Origination Software Market, By End-User

8.3.4.7 Rest of Asia Pacific Loan Origination Software Market

8.3.4.7.1 Rest of Asia Pacific Loan Origination Software Market, By Component

8.3.4.7.2 Rest of Asia Pacific Loan Origination Software Market, By Deployment Mode

8.3.4.7.3 Rest of Asia Pacific Loan Origination Software Market, By End-User

8.4 LAMEA Loan Origination Software Market

8.4.1 LAMEA Loan Origination Software Market, By Component

8.4.1.1 LAMEA Solution Market, By Country

8.4.1.2 LAMEA Service Market, By Country

8.4.2 LAMEA Loan Origination Software Market, By Deployment Mode

8.4.2.1 LAMEA On-premise Market, By Country

8.4.2.2 LAMEA Cloud Market, By Country

8.4.3 LAMEA Loan Origination Software Market, By End-User

8.4.3.1 LAMEA Banks Market, By Country

8.4.3.2 LAMEA NBFCs Market, By Country

8.4.3.3 LAMEA Mortgage Lenders & Brokers Market, By Country

8.4.3.4 LAMEA Credit Unions Market, By Country

8.4.3.5 LAMEA Others Market, By Country

8.4.4 LAMEA Loan Origination Software Market, By Country

8.4.4.1 Brazil Loan Origination Software Market

8.4.4.1.1 Brazil Loan Origination Software Market, By Component

8.4.4.1.2 Brazil Loan Origination Software Market, By Deployment Mode

8.4.4.1.3 Brazil Loan Origination Software Market, By End-User

8.4.4.2 Argentina Loan Origination Software Market

8.4.4.2.1 Argentina Loan Origination Software Market, By Component

8.4.4.2.2 Argentina Loan Origination Software Market, By Deployment Mode

8.4.4.2.3 Argentina Loan Origination Software Market, By End-User

8.4.4.3 UAE Loan Origination Software Market

8.4.4.3.1 UAE Loan Origination Software Market, By Component

8.4.4.3.2 UAE Loan Origination Software Market, By Deployment Mode

8.4.4.3.3 UAE Loan Origination Software Market, By End-User

8.4.4.4 Saudi Arabia Loan Origination Software Market

8.4.4.4.1 Saudi Arabia Loan Origination Software Market, By Component

8.4.4.4.2 Saudi Arabia Loan Origination Software Market, By Deployment Mode

8.4.4.4.3 Saudi Arabia Loan Origination Software Market, By End-User

8.4.4.5 South Africa Loan Origination Software Market

8.4.4.5.1 South Africa Loan Origination Software Market, By Component

8.4.4.5.2 South Africa Loan Origination Software Market, By Deployment Mode

8.4.4.5.3 South Africa Loan Origination Software Market, By End-User

8.4.4.6 Nigeria Loan Origination Software Market

8.4.4.6.1 Nigeria Loan Origination Software Market, By Component

8.4.4.6.2 Nigeria Loan Origination Software Market, By Deployment Mode

8.4.4.6.3 Nigeria Loan Origination Software Market, By End-User

8.4.4.7 Rest of LAMEA Loan Origination Software Market

8.4.4.7.1 Rest of LAMEA Loan Origination Software Market, By Component

8.4.4.7.2 Rest of LAMEA Loan Origination Software Market, By Deployment Mode

8.4.4.7.3 Rest of LAMEA Loan Origination Software Market, By End-User

Chapter 9. Company Profiles

9.1 Finastra Group Holdings Limited (Vista Equity Partners)

9.1.1 Company Overview

9.1.2 SWOT Analysis

9.2 Software Advice, Inc. (Gartner, Inc.)

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Segmental and Regional Analysis

9.2.4 SWOT Analysis

9.3 Floify LLC (Porch Group, Inc.)

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Segmental and Regional Analysis

9.3.4 Recent strategies and developments:

9.3.4.1 Partnerships, Collaborations, and Agreements:

9.3.4.2 Product Launches and Product Expansions:

9.3.5 SWOT Analysis

9.4 Bryt Software LCC.

9.4.1 Company Overview

9.4.2 SWOT Analysis

9.5 LendingPad Corporation

9.5.1 Company Overview

9.5.2 Recent strategies and developments:

9.5.2.1 Partnerships, Collaborations, and Agreements:

9.5.3 SWOT Analysis

9.6 ICE Mortgage Technology, Inc. (Intercontinental Exchange, Inc.)

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 Recent strategies and developments:

9.6.4.1 Partnerships, Collaborations, and Agreements:

9.6.4.2 Product Launches and Product Expansions:

9.6.5 SWOT Analysis

9.7 Nelito Systems Pvt. Ltd.

9.7.1 Company Overview

9.7.2 SWOT Analysis

9.8 LoanPro Software, LLC

9.8.1 Company Overview

9.8.2 Recent strategies and developments:

9.8.2.1 Partnerships, Collaborations, and Agreements:

9.8.3 SWOT Analysis

9.9 TurnKey Lender Inc.

9.9.1 Company Overview

9.9.2 Recent strategies and developments:

9.9.2.1 Geographical Expansions:

9.9.3 SWOT Analysis

9.10. nCino, Inc

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Regional Analysis

9.10.4 Research & Development Expenses

9.10.5 SWOT Analysis

Chapter 10. Winning Imperative for Loan Origination Software Market

TABLE 2 Global Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Loan Origination Software Market

TABLE 4 Product Launches And Product Expansions– Loan Origination Software Market

TABLE 5 Goegraphic Expanssions– Loan Origination Software Market

TABLE 6 Global Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 7 Global Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 8 Global Solution Market, By Region, 2019 - 2022, USD Million

TABLE 9 Global Solution Market, By Region, 2023 - 2030, USD Million

TABLE 10 Global Service Market, By Region, 2019 - 2022, USD Million

TABLE 11 Global Service Market, By Region, 2023 - 2030, USD Million

TABLE 12 Global Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 13 Global Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 14 Global On-premise Market, By Region, 2019 - 2022, USD Million

TABLE 15 Global On-premise Market, By Region, 2023 - 2030, USD Million

TABLE 16 Global Cloud Market, By Region, 2019 - 2022, USD Million

TABLE 17 Global Cloud Market, By Region, 2023 - 2030, USD Million

TABLE 18 Global Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 19 Global Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 20 Global Banks Market, By Region, 2019 - 2022, USD Million

TABLE 21 Global Banks Market, By Region, 2023 - 2030, USD Million

TABLE 22 Global NBFCs Market, By Region, 2019 - 2022, USD Million

TABLE 23 Global NBFCs Market, By Region, 2023 - 2030, USD Million

TABLE 24 Global Mortgage Lenders & Brokers Market, By Region, 2019 - 2022, USD Million

TABLE 25 Global Mortgage Lenders & Brokers Market, By Region, 2023 - 2030, USD Million

TABLE 26 Global Credit Unions Market, By Region, 2019 - 2022, USD Million

TABLE 27 Global Credit Unions Market, By Region, 2023 - 2030, USD Million

TABLE 28 Global Others Market, By Region, 2019 - 2022, USD Million

TABLE 29 Global Others Market, By Region, 2023 - 2030, USD Million

TABLE 30 Global Loan Origination Software Market, By Region, 2019 - 2022, USD Million

TABLE 31 Global Loan Origination Software Market, By Region, 2023 - 2030, USD Million

TABLE 32 North America Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 33 North America Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 34 North America Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 35 North America Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 36 North America Solution Market, By Country, 2019 - 2022, USD Million

TABLE 37 North America Solution Market, By Country, 2023 - 2030, USD Million

TABLE 38 North America Service Market, By Country, 2019 - 2022, USD Million

TABLE 39 North America Service Market, By Country, 2023 - 2030, USD Million

TABLE 40 North America Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 41 North America Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 42 North America On-premise Market, By Country, 2019 - 2022, USD Million

TABLE 43 North America On-premise Market, By Country, 2023 - 2030, USD Million

TABLE 44 North America Cloud Market, By Country, 2019 - 2022, USD Million

TABLE 45 North America Cloud Market, By Country, 2023 - 2030, USD Million

TABLE 46 North America Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 47 North America Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 48 North America Banks Market, By Country, 2019 - 2022, USD Million

TABLE 49 North America Banks Market, By Country, 2023 - 2030, USD Million

TABLE 50 North America NBFCs Market, By Country, 2019 - 2022, USD Million

TABLE 51 North America NBFCs Market, By Country, 2023 - 2030, USD Million

TABLE 52 North America Mortgage Lenders & Brokers Market, By Country, 2019 - 2022, USD Million

TABLE 53 North America Mortgage Lenders & Brokers Market, By Country, 2023 - 2030, USD Million

TABLE 54 North America Credit Unions Market, By Country, 2019 - 2022, USD Million

TABLE 55 North America Credit Unions Market, By Country, 2023 - 2030, USD Million

TABLE 56 North America Others Market, By Country, 2019 - 2022, USD Million

TABLE 57 North America Others Market, By Country, 2023 - 2030, USD Million

TABLE 58 North America Loan Origination Software Market, By Country, 2019 - 2022, USD Million

TABLE 59 North America Loan Origination Software Market, By Country, 2023 - 2030, USD Million

TABLE 60 US Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 61 US Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 62 US Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 63 US Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 64 US Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 65 US Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 66 US Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 67 US Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 68 Canada Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 69 Canada Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 70 Canada Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 71 Canada Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 72 Canada Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 73 Canada Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 74 Canada Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 75 Canada Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 76 Mexico Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 77 Mexico Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 78 Mexico Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 79 Mexico Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 80 Mexico Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 81 Mexico Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 82 Mexico Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 83 Mexico Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 84 Rest of North America Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 85 Rest of North America Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 86 Rest of North America Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 87 Rest of North America Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 88 Rest of North America Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 89 Rest of North America Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 90 Rest of North America Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 91 Rest of North America Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 92 Europe Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 93 Europe Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 94 Europe Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 95 Europe Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 96 Europe Solution Market, By Country, 2019 - 2022, USD Million

TABLE 97 Europe Solution Market, By Country, 2023 - 2030, USD Million

TABLE 98 Europe Service Market, By Country, 2019 - 2022, USD Million

TABLE 99 Europe Service Market, By Country, 2023 - 2030, USD Million

TABLE 100 Europe Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 101 Europe Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 102 Europe On-premise Market, By Country, 2019 - 2022, USD Million

TABLE 103 Europe On-premise Market, By Country, 2023 - 2030, USD Million

TABLE 104 Europe Cloud Market, By Country, 2019 - 2022, USD Million

TABLE 105 Europe Cloud Market, By Country, 2023 - 2030, USD Million

TABLE 106 Europe Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 107 Europe Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 108 Europe Banks Market, By Country, 2019 - 2022, USD Million

TABLE 109 Europe Banks Market, By Country, 2023 - 2030, USD Million

TABLE 110 Europe NBFCs Market, By Country, 2019 - 2022, USD Million

TABLE 111 Europe NBFCs Market, By Country, 2023 - 2030, USD Million

TABLE 112 Europe Mortgage Lenders & Brokers Market, By Country, 2019 - 2022, USD Million

TABLE 113 Europe Mortgage Lenders & Brokers Market, By Country, 2023 - 2030, USD Million

TABLE 114 Europe Credit Unions Market, By Country, 2019 - 2022, USD Million

TABLE 115 Europe Credit Unions Market, By Country, 2023 - 2030, USD Million

TABLE 116 Europe Others Market, By Country, 2019 - 2022, USD Million

TABLE 117 Europe Others Market, By Country, 2023 - 2030, USD Million

TABLE 118 Europe Loan Origination Software Market, By Country, 2019 - 2022, USD Million

TABLE 119 Europe Loan Origination Software Market, By Country, 2023 - 2030, USD Million

TABLE 120 Germany Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 121 Germany Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 122 Germany Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 123 Germany Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 124 Germany Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 125 Germany Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 126 Germany Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 127 Germany Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 128 UK Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 129 UK Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 130 UK Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 131 UK Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 132 UK Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 133 UK Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 134 UK Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 135 UK Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 136 France Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 137 France Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 138 France Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 139 France Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 140 France Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 141 France Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 142 France Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 143 France Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 144 Russia Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 145 Russia Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 146 Russia Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 147 Russia Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 148 Russia Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 149 Russia Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 150 Russia Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 151 Russia Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 152 Spain Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 153 Spain Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 154 Spain Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 155 Spain Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 156 Spain Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 157 Spain Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 158 Spain Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 159 Spain Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 160 Italy Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 161 Italy Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 162 Italy Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 163 Italy Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 164 Italy Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 165 Italy Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 166 Italy Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 167 Italy Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 168 Rest of Europe Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 169 Rest of Europe Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 170 Rest of Europe Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 171 Rest of Europe Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 172 Rest of Europe Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 173 Rest of Europe Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 174 Rest of Europe Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 175 Rest of Europe Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 176 Asia Pacific Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 177 Asia Pacific Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 178 Asia Pacific Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 179 Asia Pacific Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 180 Asia Pacific Solution Market, By Country, 2019 - 2022, USD Million

TABLE 181 Asia Pacific Solution Market, By Country, 2023 - 2030, USD Million

TABLE 182 Asia Pacific Service Market, By Country, 2019 - 2022, USD Million

TABLE 183 Asia Pacific Service Market, By Country, 2023 - 2030, USD Million

TABLE 184 Asia Pacific Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 185 Asia Pacific Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 186 Asia Pacific On-premise Market, By Country, 2019 - 2022, USD Million

TABLE 187 Asia Pacific On-premise Market, By Country, 2023 - 2030, USD Million

TABLE 188 Asia Pacific Cloud Market, By Country, 2019 - 2022, USD Million

TABLE 189 Asia Pacific Cloud Market, By Country, 2023 - 2030, USD Million

TABLE 190 Asia Pacific Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 191 Asia Pacific Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 192 Asia Pacific Banks Market, By Country, 2019 - 2022, USD Million

TABLE 193 Asia Pacific Banks Market, By Country, 2023 - 2030, USD Million

TABLE 194 Asia Pacific NBFCs Market, By Country, 2019 - 2022, USD Million

TABLE 195 Asia Pacific NBFCs Market, By Country, 2023 - 2030, USD Million

TABLE 196 Asia Pacific Mortgage Lenders & Brokers Market, By Country, 2019 - 2022, USD Million

TABLE 197 Asia Pacific Mortgage Lenders & Brokers Market, By Country, 2023 - 2030, USD Million

TABLE 198 Asia Pacific Credit Unions Market, By Country, 2019 - 2022, USD Million

TABLE 199 Asia Pacific Credit Unions Market, By Country, 2023 - 2030, USD Million

TABLE 200 Asia Pacific Others Market, By Country, 2019 - 2022, USD Million

TABLE 201 Asia Pacific Others Market, By Country, 2023 - 2030, USD Million

TABLE 202 Asia Pacific Loan Origination Software Market, By Country, 2019 - 2022, USD Million

TABLE 203 Asia Pacific Loan Origination Software Market, By Country, 2023 - 2030, USD Million

TABLE 204 China Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 205 China Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 206 China Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 207 China Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 208 China Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 209 China Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 210 China Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 211 China Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 212 Japan Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 213 Japan Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 214 Japan Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 215 Japan Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 216 Japan Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 217 Japan Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 218 Japan Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 219 Japan Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 220 India Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 221 India Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 222 India Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 223 India Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 224 India Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 225 India Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 226 India Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 227 India Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 228 South Korea Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 229 South Korea Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 230 South Korea Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 231 South Korea Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 232 South Korea Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 233 South Korea Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 234 South Korea Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 235 South Korea Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 236 Singapore Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 237 Singapore Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 238 Singapore Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 239 Singapore Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 240 Singapore Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 241 Singapore Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 242 Singapore Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 243 Singapore Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 244 Malaysia Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 245 Malaysia Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 246 Malaysia Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 247 Malaysia Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 248 Malaysia Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 249 Malaysia Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 250 Malaysia Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 251 Malaysia Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 252 Rest of Asia Pacific Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 253 Rest of Asia Pacific Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 254 Rest of Asia Pacific Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 255 Rest of Asia Pacific Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 256 Rest of Asia Pacific Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 257 Rest of Asia Pacific Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 258 Rest of Asia Pacific Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 259 Rest of Asia Pacific Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 260 LAMEA Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 261 LAMEA Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 262 LAMEA Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 263 LAMEA Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 264 LAMEA Solution Market, By Country, 2019 - 2022, USD Million

TABLE 265 LAMEA Solution Market, By Country, 2023 - 2030, USD Million

TABLE 266 LAMEA Service Market, By Country, 2019 - 2022, USD Million

TABLE 267 LAMEA Service Market, By Country, 2023 - 2030, USD Million

TABLE 268 LAMEA Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 269 LAMEA Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 270 LAMEA On-premise Market, By Country, 2019 - 2022, USD Million

TABLE 271 LAMEA On-premise Market, By Country, 2023 - 2030, USD Million

TABLE 272 LAMEA Cloud Market, By Country, 2019 - 2022, USD Million

TABLE 273 LAMEA Cloud Market, By Country, 2023 - 2030, USD Million

TABLE 274 LAMEA Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 275 LAMEA Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 276 LAMEA Banks Market, By Country, 2019 - 2022, USD Million

TABLE 277 LAMEA Banks Market, By Country, 2023 - 2030, USD Million

TABLE 278 LAMEA NBFCs Market, By Country, 2019 - 2022, USD Million

TABLE 279 LAMEA NBFCs Market, By Country, 2023 - 2030, USD Million

TABLE 280 LAMEA Mortgage Lenders & Brokers Market, By Country, 2019 - 2022, USD Million

TABLE 281 LAMEA Mortgage Lenders & Brokers Market, By Country, 2023 - 2030, USD Million

TABLE 282 LAMEA Credit Unions Market, By Country, 2019 - 2022, USD Million

TABLE 283 LAMEA Credit Unions Market, By Country, 2023 - 2030, USD Million

TABLE 284 LAMEA Others Market, By Country, 2019 - 2022, USD Million

TABLE 285 LAMEA Others Market, By Country, 2023 - 2030, USD Million

TABLE 286 LAMEA Loan Origination Software Market, By Country, 2019 - 2022, USD Million

TABLE 287 LAMEA Loan Origination Software Market, By Country, 2023 - 2030, USD Million

TABLE 288 Brazil Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 289 Brazil Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 290 Brazil Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 291 Brazil Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 292 Brazil Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 293 Brazil Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 294 Brazil Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 295 Brazil Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 296 Argentina Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 297 Argentina Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 298 Argentina Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 299 Argentina Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 300 Argentina Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 301 Argentina Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 302 Argentina Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 303 Argentina Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 304 UAE Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 305 UAE Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 306 UAE Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 307 UAE Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 308 UAE Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 309 UAE Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 310 UAE Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 311 UAE Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 312 Saudi Arabia Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 313 Saudi Arabia Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 314 Saudi Arabia Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 315 Saudi Arabia Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 316 Saudi Arabia Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 317 Saudi Arabia Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 318 Saudi Arabia Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 319 Saudi Arabia Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 320 South Africa Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 321 South Africa Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 322 South Africa Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 323 South Africa Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 324 South Africa Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 325 South Africa Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 326 South Africa Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 327 South Africa Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 328 Nigeria Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 329 Nigeria Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 330 Nigeria Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 331 Nigeria Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 332 Nigeria Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 333 Nigeria Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 334 Nigeria Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 335 Nigeria Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 336 Rest of LAMEA Loan Origination Software Market, 2019 - 2022, USD Million

TABLE 337 Rest of LAMEA Loan Origination Software Market, 2023 - 2030, USD Million

TABLE 338 Rest of LAMEA Loan Origination Software Market, By Component, 2019 - 2022, USD Million

TABLE 339 Rest of LAMEA Loan Origination Software Market, By Component, 2023 - 2030, USD Million

TABLE 340 Rest of LAMEA Loan Origination Software Market, By Deployment Mode, 2019 - 2022, USD Million

TABLE 341 Rest of LAMEA Loan Origination Software Market, By Deployment Mode, 2023 - 2030, USD Million

TABLE 342 Rest of LAMEA Loan Origination Software Market, By End-User, 2019 - 2022, USD Million

TABLE 343 Rest of LAMEA Loan Origination Software Market, By End-User, 2023 - 2030, USD Million

TABLE 344 Key Information – Finastra Group Holdings Limited

TABLE 345 Key Information – Software Advice, Inc.

TABLE 346 Key Information – Floify LLC

TABLE 347 Key Information – Bryt Software LCC.

TABLE 348 Key Information – LendingPad Corporation

TABLE 349 Key Information – ICE Mortgage Technology, Inc.

TABLE 350 Key Information – Nelito Systems Pvt. Ltd.

TABLE 351 Key Information – LoanPro Software, LLC

TABLE 352 Key Information – TurnKey Lender Inc.

TABLE 353 Key Information – nCino, Inc

List of Figures

FIG 1 Methodology for the research

FIG 2 Global Loan Origination Software Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting loan origination software market

FIG 4 KBV Cardinal Matrix

FIG 5 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 6 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2021, Sep – 2023,Sep) Leading Players

FIG 7 Porter’s Five Force Analysis: Loan Origination Software Market

FIG 8 Global Loan Origination Software Market share, By Component, 2022

FIG 9 Global Loan Origination Software Market share, By Component, 2030

FIG 10 Global Loan Origination Software Market, By Component, 2019 - 2030, USD Million

FIG 11 Global Loan Origination Software Market share, By Deployment Mode, 2022

FIG 12 Global Loan Origination Software Market share, By Deployment Mode, 2030

FIG 13 Global Loan Origination Software Market, By Deployment Mode, 2019 - 2030, USD Million

FIG 14 Global Loan Origination Software Market share, By End-User, 2022

FIG 15 Global Loan Origination Software Market share, By End-User, 2030

FIG 16 Global Loan Origination Software Market, By End-User, 2019 - 2030, USD Million

FIG 17 Global Loan Origination Software Market share, By Region, 2022

FIG 18 Global Loan Origination Software Market share, By Region, 2030

FIG 19 Global Loan Origination Software Market, By Region, 2019 - 2030, USD Million

FIG 20 SWOT Analysis: Finastra Group Holdings Limited

FIG 21 SWOT Analysis: Software Advice, Inc.

FIG 22 Recent strategies and developments: Floify LLC

FIG 23 SWOT Analysis: Floify LLC

FIG 24 SWOT Analysis: Bryt Software LCC.

FIG 25 SWOT Analysis: LendingPad Corporation

FIG 26 Recent strategies and developments: ICE Mortgage Technology, Inc.

FIG 27 SWOT Analysis: ICE Mortgage Technology, Inc.

FIG 28 SWOT Analysis: Nelito Systems Pvt. Ltd.

FIG 29 SWOT Analysis: LoanPro Software, LLC

FIG 30 SWOT Analysis: TurnKey Lender Inc.

FIG 31 SWOT Analysis: nCino Opco, Inc.