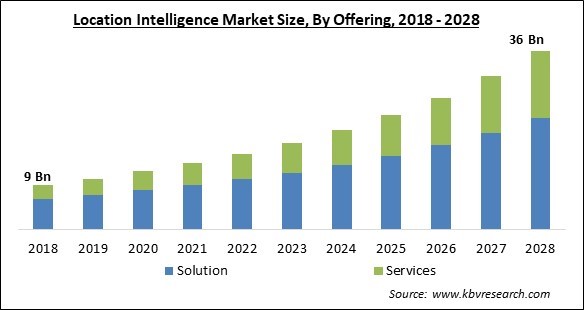

The Global Location Intelligence Market size is expected to reach $36 billion by 2028, rising at a market growth of 15.3% CAGR during the forecast period.

The approach of generating insights through location data to address spatial issues is known as location intelligence. LI analyzes location data as an integrated aspect of a business and societal problem, extending over simple data presentation on maps. Executives and decision-makers now have access to unprecedented volumes of corporate data, including a variety of geographic data due to a significant number of devices connected to the Internet of Things (IoT). Location intelligence is derived through visualizing and analyzing large amounts of data in relation to a specific location, and it is used to facilitate prediction, holistic planning, and problem-solving. Seeing all pertinent data in the context of a location on a smart map, application, or dashboard provides new perspectives. competitive edge.

The presentation and analysis of geographical data are used to achieve location intelligence (LI). Businesses can use location intelligence technologies to detect where an event has occurred, analyze why it is occurring, and gain insight into what caused it by layering geographic data, such as traffic, demographics, and weather, to a smart map or dashboard. Many businesses are using geographic information system (GIS) technology to build location intelligence as part of their digital transformation.

The majority of data points have a physical location and time associated with them. However, geography is not only a common thread that connects various data sources and helps to break down silos. It may also deliver the most profound insights. Location data analytics is used by major organizations to address business problems and identify new opportunities. Business intelligence (BI) technologies benefit greatly from location intelligence solutions. GIS technology is a software framework for managing, visualizing, analyzing, and finally determining the significance of geographical data. GIS, which is based on science, assists businesses in gaining valuable insight by combining various sorts of data. GIS-powered location intelligence transforms businesses as well as organizations in a variety of industries.

In addition, to carry out efficient COVID-19 public health measures, healthcare and government institutions utilized location-based solutions for vaccination efforts. In addition, the utilization of location analytics also aided in boosting businesses in dealing with the pandemic's uncertainty. Moreover, during the pandemic, location data was crucial in the administration of local emergency services. Overcrowding in hospitals, as well as a scarcity of ventilators, equipment, and other vital supplies, have all plagued the health infrastructure sector. In the healthcare sector, location data has become a significant tool for overcoming these obstacles and providing valuable information on resource planning and optimization.

Infrastructure data, like a digital twin of an electrical grid, can show where connections are made and offer a map of the digital network. Security experts may be able to use this information to predict where assaults are likely to occur. Decentralized data is also possible due to blockchain technology. This technology can update and distribute a specific block of data in a safe encrypted environment at the same time. With use applications, such as bitcoin, blockchain applications have grown in popularity. Blockchain has also been used in the field of spatial technology to track Earth observation as well as satellite communications.

Businesses are increasingly relying on data to give the finest customer service and hence boost their business revenues in an era of rapidly developing digitization. Companies can utilize geographic data visualization to better manage their company plans, such as defining regional priorities, pricing models, and peak sales seasons. Moreover, by merging geographic data with GIS, enterprises can tap into the location of customers to provide relevant product information and store recommendations on the basis of their requirements.

The advancements in various technologies along with the skills in order to leverage these technologies have significantly increased. Due to the advanced technical knowledge, the risk of cybercrimes is becoming a major concern across administrations. In order to eliminate this risk, governments and other local authorities are increasing their efforts to address this problem. As a result, various governments have imposed strict guidelines to protect the privacy of people.

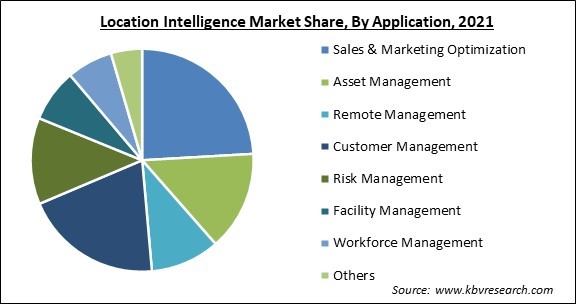

By the Application, the Location Intelligence Market is segregated into Workforce Management, Asset Management, Facility Management, Risk Management, Remote Monitoring, Sales & Marketing Optimization, Customer Management, and Others. In 2021, the sales & marketing optimization segment acquired the largest revenue share of the location intelligence market. The increasing growth of this segment is majorly owing to the rapid evolution in customer behaviors in the modern era. By consolidating appropriate relevant data for marketing campaigns and forecasting outcomes, location intelligence technologies lessen the complexity of sales and marketing processes.

On the basis of Offering, the Location Intelligence Market is segregated into Solutions and Services (Consulting, System Integration, and Others). In 2021, the services segment witnessed a significant revenue share of the location intelligence market. The growing demand for location intelligence services is attributed to the substantial number of market players operating in the sector. There is a significant prevalence of businesses that are offering location management services to customers.

By the End-User, the Location Intelligence Market is classified into Retail & Consumer Goods, Government & Defense, Manufacturing & Industrial, Transportation & Logistics, BFSI, IT & Telecom, Utilities & Energy, and Media & Entertainment. In 2021, the retail & consumer goods segment garnered a significant revenue share of the location intelligence market. The increasing growth of the segment is attributed to the rising demand for development by market players operating in the retail and consumer goods sector. Location intelligence is a framework that employs location selection strategies including advanced modeling and kicking-the-dirt.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 13.5 Billion |

| Market size forecast in 2028 | USD 36 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 15.3% from 2022 to 2028 |

| Number of Pages | 321 |

| Number of Tables | 531 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Offering, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-Wise, the Location Intelligence Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America accounted for the highest revenue share of the location intelligence market. The increasing growth of the segment is attributed to the rising penetration of smartphones across the region. The regional smartphone penetration has significantly expanded in recent years. Furthermore, the market expansion in the region is also likely to be aided by the significant presence of key manufacturers of IoT technologies and location intelligence. The rapid technological advancements in the region are another major factor aiding in the growth of the regional market.

Free Valuable Insights: Global Location Intelligence Market size to reach USD 36 Billion by 2028

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Qualcomm Technologies, Inc. is the forerunners in the Location Intelligence Market. Companies such as Robert Bosch GmbH, Autodesk, Inc., Trimble, Inc. are some of the key innovators in Location Intelligence Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Robert Bosch GmbH (Bosch Software Innovations GmbH), Autodesk, Inc., Qualcomm, Inc., Tibco Software, Inc. (Vista Equity Partners), Trimble, Inc., Esri, Inc., Navizon, Inc., SuperMap Software Co., ltd., MDA Corporation, and Cuebiq, Inc.

By Application

By Offering

By End User

By Geography

The global location intelligence market size is expected to reach $36 billion by 2028.

Increasing Adoption Of Location Intelligence In Various Applications are driving the market in coming years, however, Stringent Government Regulations limited the growth of the market.

Robert Bosch GmbH (Bosch Software Innovations GmbH), Autodesk, Inc., Qualcomm, Inc., Tibco Software, Inc. (Vista Equity Partners), Trimble, Inc., Esri, Inc., Navizon, Inc., SuperMap Software Co., ltd., MDA Corporation, and Cuebiq, Inc.

The expected CAGR of the location intelligence market is 15.3% from 2022 to 2028.

The Solution segment generated highest revenue share in the Global Location Intelligence Market by Offering in 2021, achieving a market value of $22.5 billion by 2028.

The North America market dominated the Global Location Intelligence Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $12.1 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.