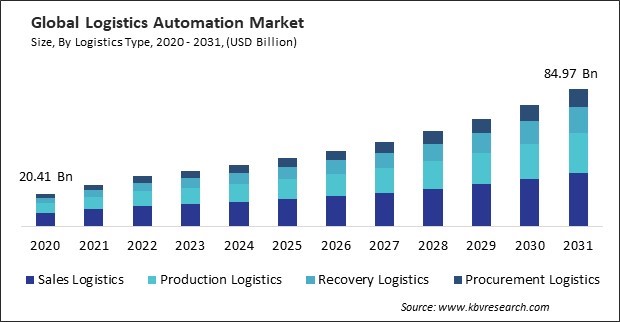

“Global Logistics Automation Market to reach a market value of 84.97 Billion by 2031 growing at a CAGR of 12.2%”

The Global Logistics Automation Market size is expected to reach $84.97 billion by 2031, rising at a market growth of 12.2% CAGR during the forecast period.

The automotive segment is fueled by the complexity of its supply chains, which require precise coordination of components, assembly processes, and distribution networks. Automation technologies such as automated guided vehicles (AGVs), robotic arms, and IoT-enabled systems play a critical role in optimizing production logistics and ensuring just-in-time (JIT) delivery of components. The automotive industry's requirement for automation has been further exacerbated by the transition to electric vehicles (EVs) and the implementation of smart manufacturing practices. These technologies enable manufacturers to improve efficiency, reduce production timelines, and enhance supply chain flexibility in a highly competitive environment. Thus, the automotive segment witnessed 25% revenue share in the market in 2023.

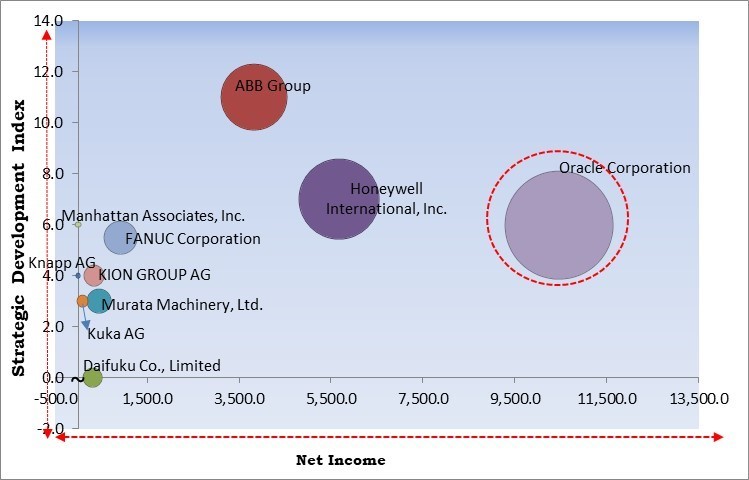

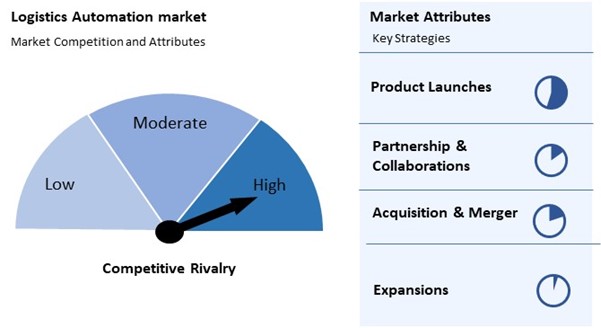

The major strategies followed by the market participants are Product Launch as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2024, ABB Group has launched OmniCore, an advanced automation platform offering modular control architecture integrating AI, sensors, and cloud computing. OmniCore delivers high-speed, precise robot performance with up to 25% faster operation and 20% less energy consumption. Its scalable design supports diverse applications, enhancing flexibility and efficiency in automation. Additionally, In May, 2024, Manhattan Associates, Inc. unveiled Manhattan Active Supply Chain Planning, the first unified platform that integrates supply chain planning and execution systems. This solution enables real-time collaboration across inventory, labor, transportation, and warehouse operations, eliminating silos and optimizing resources for a shared business objective.

Based on the Analysis presented in the KBV Cardinal matrix; Oracle Corporation is the forerunner in the Logistics Automation Market. Companies such as Honeywell International, Inc., ABB Group, FANUC Corporation are some of the key innovators in Logistics Automation Market. In June, 2024, ABB Group has launched OmniCore, an advanced automation platform offering modular control architecture integrating AI, sensors, and cloud computing. OmniCore delivers high-speed, precise robot performance with up to 25% faster operation and 20% less energy consumption. Its scalable design supports diverse applications, enhancing flexibility and efficiency in automation

Another critical area that has been affected by the e-commerce boom is last-mile delivery, which is the concluding stage of the logistics process. As consumer expectations for same-day and next-day delivery grow, companies increasingly turn to advanced technologies like autonomous delivery vehicles, drones, and route optimization algorithms to streamline this stage.

Additionally, IoT enhances connectivity and data exchange between devices, enabling real-time inventory, equipment, and transportation monitoring. IoT sensors in warehouses and vehicles track temperature, humidity, and location, ensuring that perishable goods and high-value items are stored and delivered optimally. Thus, these advancements are supporting the growth of the market.

Logistics automation relies on advanced technologies such as robotics, artificial intelligence (AI), Internet of Things (IoT) devices, and automated storage systems. While these technologies offer significant long-term benefits, their implementation requires a substantial initial investment. Businesses must allocate funds to purchase these systems, upgrade existing infrastructure, and train employees to operate them effectively. Hence, the combination of high initial investments and recurring maintenance costs poses a significant barrier to the widespread adoption of logistics automation.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Based on application, the market is segmented into transport management, warehouse management, labor management, and others. The transport management segment procured 39% revenue share in the market in 2023. The logistics automation market is currently led by the transport management segment, which is being driven by the growing demand for cost-effective and efficient transportation solutions in response to the growth of e-commerce and globalization.

By component, the market is divided into hardware, software, and services. The software segment garnered 29% revenue share in the market in 2023. Solutions such as warehouse management systems (WMS), transportation management systems (TMS), and real-time tracking platforms are critical for optimizing workflows, enhancing visibility, and supporting data-driven decision-making.

On the basis of industry, retail & e-commerce, food & beverages, healthcare & pharma, aerospace & defense, energy & utility, automotive, and others. The retail & e-commerce segment recorded 30% revenue share in the market in 2023. The consumer demand for fast, accurate, and cost-effective deliveries and the exponential growth of online purchasing are the primary factors driving the retail and e-commerce segment.

On the basis of logistics type, the market is classified into sale logistics, production logistics, recovery logistics, and procurement logistics. The sale logistics segment acquired 41% revenue share in the market in 2023. This dominance results from the retail and e-commerce industries' explosive growth, which calls for effective distribution networks and last-mile delivery solutions.

Based on enterprise type, the market is bifurcated into large enterprises and SMEs. The SMEs segment procured 31% revenue share in the market in 2023. Cost-effective and modular automation systems designed specifically for SMEs have lowered entry barriers, enabling smaller businesses to implement automated storage solutions, IoT devices, and cloud-based logistics software.

Free Valuable Insights: Global Logistics Automation Market size to reach USD 84.97 Billion by 2031

The Logistics Automation market is fiercely competitive, driven by increasing demand for efficiency and speed in supply chains. Players compete on innovation, offering advanced robotics, AI-powered systems, and real-time tracking solutions. Customization to meet specific industry needs, scalability for global operations, and cost-effectiveness are key differentiators. Regional competitors challenge global providers by offering localized solutions, while partnerships and acquisitions are common strategies to expand market reach and capabilities. The race to integrate sustainability further intensifies competition.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment acquired 29% revenue share in the market in 2023. The region’s focus on sustainability, regulatory support, and cross-border trade optimization drives Europe's logistics automation market. Germany and the United Kingdom have been at the forefront of the incorporation of AI and robotics to improve efficiency and reduce carbon footprints in accordance with the sustainability objectives of the European Union.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 34.33 Billion |

| Market size forecast in 2031 | USD 84.97 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 12.2% from 2024 to 2031 |

| Number of Pages | 375 |

| Tables | 584 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Logistics Type, Enterprise Type, Application, Industry, Region |

| Country scope |

|

| Companies Included | Honeywell International, Inc., Murata Machinery, Ltd., Knapp AG, ABB Group, FANUC Corporation, Kuka AG (Midea Group Co., Ltd.), Oracle Corporation, KION GROUP AG, Daifuku Co., Limited, and Manhattan Associates, Inc. |

By Enterprise Type

By Logistics Type

By Component

By Application

By Industry

By Geography

This Market size is expected to reach $84.97 billion by 2031.

Immense Growth of E-commerce Platforms are driving the Market in coming years, however, High Initial Investment and Operational Costs restraints the growth of the Market.

Honeywell International, Inc., Murata Machinery, Ltd., Knapp AG, ABB Group, FANUC Corporation, Kuka AG (Midea Group Co., Ltd.), Oracle Corporation, KION GROUP AG, Daifuku Co., Limited, and Manhattan Associates, Inc.

The expected CAGR of this Market is 12.2% from 2023 to 2031.

The Large Enterprises segment is leading the Market by Enterprise Type in 2023; thereby, achieving a market value of $57.7 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $31.3 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges