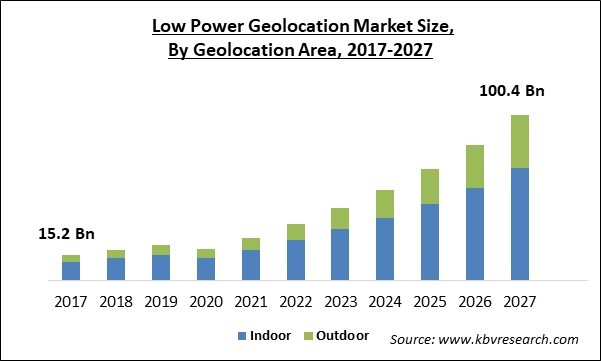

The Global Low Power Geolocation Market size is expected to reach $100.43 billion by 2027, rising at a market growth of 25.4% CAGR during the forecast period.

Geolocation is the process of identifying, locating, and communicating an accurate location of computer, networking device, or equipment. It enables any person or organization to identify the position of devices on the basis of geographical measures and coordinates. In addition, a low power geolocation system embedded into an advanced tracking solution is developed to monitor the location of devices by utilizing low power wireless technology like Wi-Fi, Bluetooth, and Zigbee.

Moreover, geolocation technology has a wide range of methods and uses. IP (Internet Protocol) addresses are utilized to recognize state, region, country, city, or postal Power.

The outbreak of the COVID-19 pandemic has a considerable impact on the growth of the low power geolocation market. The pandemic's effects on the logistics and consumer electronics industries, including a shortage of experienced labourers, delays in implementing geolocation solutions, project delays, contractual responsibilities, and cross-border travel bans, have had a negative impact on the low power geolocation market.

During the recovery phase, the implementation of 5G network solutions along with IoT-based smart infrastructure solutions in sectors such as agricultural, consumer electronics, and health care, would surge in the market. Along with that, many companies are highly investing in the development of geolocation apps to keep track of the location of their resources as well as potential customers.

Fleet management is one of the important aspects for various businesses to make sure that their customers receive the products that they have ordered. Companies operating through physical stores, online channels or both, need to optimize their fleet management. Geolocation technology helps companies to keep a track of all the products and vehicles that are deployed from the distribution centers. In addition, e-commerce sites with huge warehouses and logistic spaces are among the key users of geolocation technology since it helps them to manage their inventory, track orders, and ensure the safety of their staff.

Internet of Things is one of the emerging and popular technologies used across different business domains. Companies are highly integrating IoT technology to optimize their regular operations and improve interoperability. This innovation in technology is shifting the deployment of location-based devices towards the provision of integrated location services, which helps in extracting information to enhance location awareness among various business procedures.

While using geolocation, the major concern that arises from the consumers is the safety and privacy of their data. It is important for companies to aware consumers of the fact that their data is being utilized by the companies for their personal objectives. Any company cannot extract their location information without their permission owing to various regulations imposed on consumer data privacy. Along with that, many criminals can use geolocation technologies for their ill practices.

Based on Geolocation Area, the market is segmented into Indoor and Outdoor. The outdoor segment is projected to display the fastest growth rate over the forecast period. By using outdoor geolocations, governments and companies can track their delivery vehicles and equipment in real-time, along with that, this technology assists companies to receive alerts when an order is dispatched and received by the customer safely.

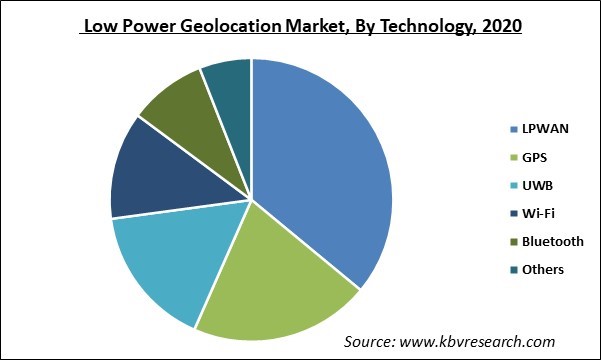

Based on Technology, the market is segmented into LPWAN, GPS, UWB, Wi-Fi, Bluetooth and Others. Wi-Fi is the network of devices that links a user to a specific radiofrequency. This technology transfers signals within the indoor and outdoor infrastructure. The power usage of Wi-Fi is low and majorly depends on two aspects including precision of the database and density of access points.

Based on Solutions, the market is segmented into Hardware, Software and Service. Geolocation software utilizes the IP address of any device connected to the internet to determine its location by identifying the device's country, city, region, or zip Power. In addition, IP geolocation vendors involve longitude, latitude, local time zone, language, currency, sunrise, calling Power, and sunset data.

Based on End User, the market is segmented into Logistics & Transportation, Healthcare, Consumer Electronics, Agriculture, Power Utilities and Others. The healthcare providers use geolocation in order to overcome all the challenges faced by the industry from conventional methods and technologies. Through geolocation, healthcare providers can locate their equipment, allocate resources, and plan routes for disabled people.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 18.85 Billion |

| Market size forecast in 2027 | USD 100.43 billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 25.4% from 2021 to 2027 |

| Number of Pages | 281 |

| Number of Tables | 492 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Geolocation Area, Technology, Solutions, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America dominated the low power geolocation market. It is because several organizations and government institutions in the US are heavily allocating funds and other resources in the technological advancements.

Free Valuable Insights: Global Low Power Geolocation Market size to reach USD 100.43 billion by 2027

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Digital Matter, Favendo GmbH, Semtech Corporation, Cisco Systems, Inc., Hoopo Systems Ltd., STMicroelectronics N.V., Kerlink SA, Nestwave SAS, Sigfox S.A. (Citymesh), and Tracktio.

By Geolocation Area

By Technology

By Solutions

By End User

By Geography

The global low power geolocation market size is expected to reach $100.43 billion by 2027.

Improve Fleet management operations are driving the market in coming years, however, Growing safety and security concerns limited the growth of the market.

Digital Matter, Favendo GmbH, Semtech Corporation, Cisco Systems, Inc., Hoopo Systems Ltd., STMicroelectronics N.V., Kerlink SA, Nestwave SAS, Sigfox S.A. (Citymesh), and Tracktio.

The expected CAGR of the low power geolocation market is 25.4% from 2021 to 2027.

The Hardware market dominated the Global Low Power Geolocation Market by Solutions 2020 thereby growing at a CAGR of 24.3% during the forecast period.

The North America market dominated the Global Low Power Geolocation Market by Region 2020, and would continue to be a dominant market till 2027; thereby, achieving a market value of $36.96 billion by 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.