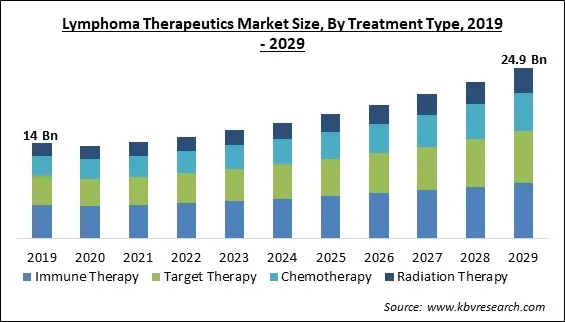

The Global Lymphoma Therapeutics Market size is expected to reach $24.9 billion by 2029, rising at a market growth of 7.8% CAGR during the forecast period.

The term "lymphoma therapeutics" refers to the numerous medical treatments and interventions that are intended to treat lymphoma, a form of cancer that impacts the lymphatic system, which is a component of the immune system of the body. Lymphoma is one of the most common types of cancer globally. The elimination of malignant cells, the prevention of the disease's progression, and an improvement in the patient's standard of life are the primary focuses of lymphoma treatment strategies.

The spleen, the thymus gland, lymph nodes (also known as lymph glands), and bone marrow are all elements that make up the lymphatic system. Lymphoma has the potential to affect not only these areas, but many other organs located throughout the body as well. Lymphoma patients have access to various treatment options, including radiation therapy, chemotherapy, immunotherapy, targeted therapy, and stem cell transplantation, among others.

The choice of treatment is determined not only by the type and stage of lymphoma but also by additional criteria, such as the patient's current state of health and medical history. Lymphoma treatments work toward the dual goals of inducing individuals with lymphoma into a state of long-term remission while also improving their chances of survival.

Cancer of the lymphatic system is referred to as lymphoma, and lymphoma is a subtype of cancer characterized by the fast proliferation of aberrant malignant cells. It typically affects the white blood cells (WBCs), also known as lymphocytes, in the lymph nodes, spleen, thymus, and bone marrow. This has the effect of reducing the body's ability to mount an immune response. As a result, the patient experiences symptoms such as swelling in the lymph nodes, high fever, loss of weight, shortness of breath, and weariness as a direct effect of the condition.

The pandemic further negatively impacted the lymphoma therapeutics market due to delayed diagnosis and treatment and disruptions to clinical trials. Lymphoma therapeutics pose a challenge for healthcare professionals due to the potential risk of chemotherapeutic and immunosuppressive treatment exacerbating comorbid COVID-19 infections, which are crucial aspect of cancer therapy. Patients with B-cell non-Hodgkin's lymphoma (B-NHL), who have recently undergone treatment with anti-CD20 antibodies, are susceptible to severe COVID-19 disease.

Various treatment developments have been introduced in lymphoma therapeutics by focusing on TAAs; cancer immunotherapy has become a crucial part of cancer treatment. It does not produce unintended off-target effects and has several clinical advantages. This encourages the creation of highly effective, low-side-effect tailored recombinant vaccines for cancer immunotherapy. Immune checkpoint inhibitors (ICIs), recently developed, have changed cancer treatment and increased patient survival. ICIs tailored to checkpoint proteins, like CTLA-4 or PD-1, have been approved to treat several cancer types. These factors are propelling market growth.

Around half a million new cases of NHL were reported globally in 2018, accounting for 2.8% of all cancer diagnoses. The gender-specific age-standardized probability of developing NHL was found to be 6.7 in men and 4.7 in women. This indicates that men have a cumulative lifetime risk of 0.72%, while women have a risk of 0.35%. Furthermore, men's incidence was 7.8/100,000, and women's was 5.6/100,000 and 2.9/100,000 in high and low/medium human development index nations, respectively. Hence, the growing cases of Lymphoma, especially non-Hodgins Lymphoma (NHL), are expected to increase the demand for numerous lymphoma therapeutics boosting the market growth in the projected period.

The treatment for lymphoma is associated with side effects. Some of them are digestive issues, "Chemo brain," itchy, painful, and dry skin, fatigue, nausea, and vomiting, hair loss, sleep issues, peripheral neuropathy (nerve injury), and oral mucositis (sore mouth). The risk of infection may rise after the treatment of lymphoma. Therefore, it's crucial to be aware of the warning signs and symptoms and how to get in touch with the medical team if necessary. Lack of specific blood cell types can result from cancer treatment. Low red blood cells, low white blood cells, and low platelets are all symptoms of anemia. These are expected to hinder the lymphoma therapeutics market growth in the projected period.

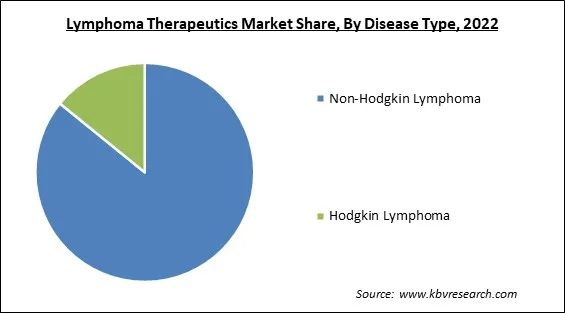

Based on disease Type, the lymphoma therapeutics market is segmented into Hodgkin lymphoma and non-Hodgkin lymphoma. The Hodgkin lymphoma segment acquired a significant revenue share in the lymphoma therapeutics market in 2022. The growth is attributed due to the reasons such as the rising prevalence of Hodgkin lymphoma, increased awareness of the disease, and the significant unmet needs of elderly patients and patients with relapsed or refractory (R/R) HL. The moderately aggressive cancer Hodgkin lymphoma can quickly spread throughout the body. Despite this, it's also one of the cancer forms that is most easily cured.

On the basis of treatment Type, the lymphoma therapeutics market is divided into immune therapy, chemotherapy, target therapy and radiation therapy. The immune therapy segment held the highest revenue share in the lymphoma therapeutics market in 2022. The growth of immune therapy can be attributed to the progress in immunology, the wider accessibility of immune therapies, and the increasing number of product approvals globally. Immunotherapy has been found to be a highly successful treatment option with positive outcomes.

By route of administration, the lymphoma therapeutics market is classified into oral route and injectable. The injectable segment witnessed the largest revenue share in the lymphoma therapeutics market in 2022. This is because the injection is administered subcutaneously and has a duration of 5-7 minutes. This method is significantly faster than intravenous administration. These products have been approved for usage in patients diagnosed with diffuse large B-cell lymphoma, follicular lymphoma, and chronic lymphocytic leukemia.

Based on the distribution channel, the lymphoma therapeutics market is bifurcated into hospital pharmacies, retail pharmacies and others. The retail pharmacies segment recorded a significant revenue share in the lymphoma therapeutics market in 2022. This is because retail pharmacies are responsible for the preparation and distribution of medications, as well as the counseling of customers regarding the proper use of medications and the provision of information regarding probable drug interactions. Also, customers can get advice from retail pharmacists regarding general health concerns as well as over-the-counter medications.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 14.9 Billion |

| Market size forecast in 2029 | USD 24.9 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 7.8% from 2023 to 2029 |

| Number of Pages | 260 |

| Number of Table | 434 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Treatment Type, Disease Type, Route of Administration, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the lymphoma therapeutics market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region led the lymphoma therapeutics market by generating the maximum revenue share in 2022. This is due to an increase in lymphoma prevalence, advancements in lymphoma therapeutics, including targeted therapies and immunotherapies, and an increase in the number of new product releases by significant market players in this region. Additionally, the existence of important players, the accessibility of cutting-edge medications, the well-established healthcare system, and substantial R&D spending will surge the market growth in the region.

Free Valuable Insights: Global Lymphoma Therapeutics Market size to reach USD 24.9 Billion by 2029

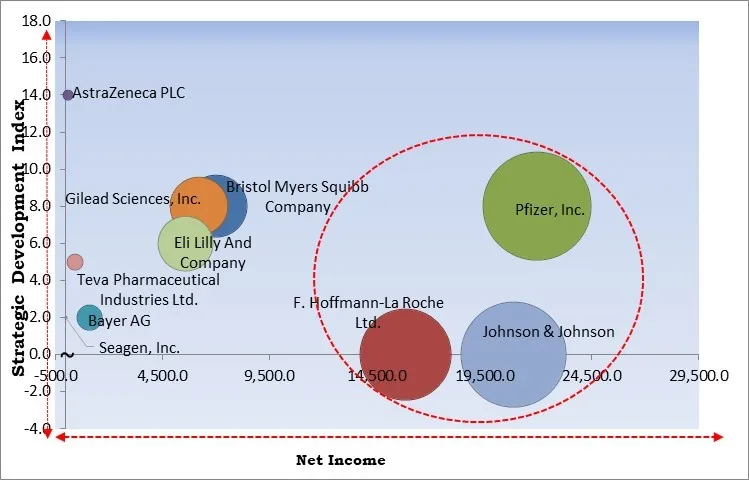

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Pfizer, Inc., Johnson & Johnson, and F. Hoffmann-La Roche Ltd. are the forerunners in the Lymphoma Therapeutics Market. Companies such as Eli Lilly And Company, Gilead Sciences, Inc., and Bristol Myers Squibb Company are some of the key innovators in Lymphoma Therapeutics Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include AstraZeneca PLC, Bayer AG, Bristol Myers Squibb Company, F. Hoffmann-La Roche Ltd., Johnson & Johnson, Gilead Sciences, Inc., Seagen, Inc., Teva Pharmaceutical Industries Ltd., Pfizer, Inc. and Eli Lilly And Company.

By Treatment Type

By Disease Type

By Route of Administration

By Distribution Channel

By Geography

The Market size is projected to reach USD 24.9 billion by 2029.

Technological advancement in the treatment options are driving the Market in coming years, however, The associated side effects of treatments restraints the growth of the Market.

AstraZeneca PLC, Bayer AG, Bristol Myers Squibb Company, F. Hoffmann-La Roche Ltd., Johnson & Johnson, Gilead Sciences, Inc., Seagen, Inc., Teva Pharmaceutical Industries Ltd., Pfizer, Inc. and Eli Lilly And Company.

The expected CAGR of this Market is 7.8% from 2023 to 2029.

The Non-Hodgkin Lymphoma segment acquired maximum revenue share in the Global Lymphoma Therapeutics Market by Disease Type in 2022 thereby, achieving a market value of $20.9 billion by 2029.

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $9.5 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.