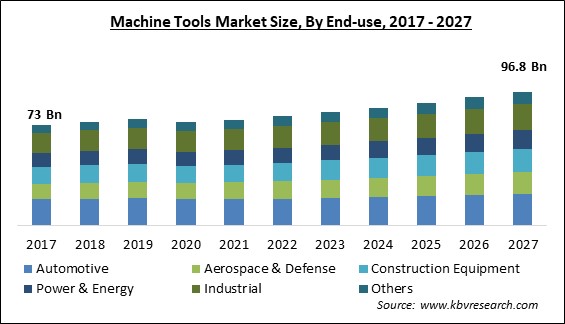

The Global Machine Tools Market size is expected to reach $96.8 billion by 2027, rising at a market growth of 4.0% CAGR during the forecast period.

The industrial sector's great focus on increasing efficiency and decreasing downtime is projected to fuel market growth. The growing demand for mass production in industries such as aerospace and military, as well as other industries and industry verticals, is likely to increase machine tool usage. Metal cutting tool demand is increasing in tandem with the high use of metals in numerous industries, which bodes well for market growth. Integration of Computer-Aided Producing (CAM) in machine tools to cut the time necessary for manufacturing work pieces and make sure trouble-free production of micro components is becoming a prominent market trend.

The goal of Industry 4.0 is to reduce idle time and improve the usage of machine tools. Analyzing data linked to tool changes and program stops can be particularly useful in identifying and correcting the source of idle time, resulting in more efficient machine tool utilization. Various bearing manufacturers, like The Timken Company and NSK Ltd., are concentrating on the development of bearings for machine tools at the very same time. The Timken Company, for example, launched a new range of precision cylindrical roller bearings in October 2019 that are designed to maximize efficiency and speed in high-demand applications.

Computer Numerical Control (CNC) systems have emerged as a result of advances in machine learning and automation. CNC systems enable operators to send assembly code to a computer and conduct several operations on the same machine without wasting time. Different lubricant makers, on the other hand, are collaborating with market players such as DMG MORI and Komatsu, Ltd. to develop lubricants for their equipment. DMG MORI and FUCHS PETROLUB SE, for example, signed a partnership deal in September 2017 that entails the two firms working together to develop novel lubricant services and solutions for machine tool applications

In 2020, the outbreak of the COVID 19 pandemic had a significant economic impact on all industrial sectors around the world. Additionally, machine tool manufacturers are encountering issues as a result of this downturn, which has resulted in a production and sales slowdown in 2020. Furthermore, the imposed lockdown has resulted in the complete halt of manufacturing operations, supply chain problems, personnel availability, and raw material shortages.

Amid the emergence of a global strain caused by a new coronavirus, suppliers are concentrating on resuming production while complying with government guidelines to finish pre-existing orders and support end-users. For example, Mazak Corporation is reportedly serving its clients' existing orders and aggressively giving help to the healthcare and power generation industries, despite the government's execution of worker safety regulations.

The technological breakthroughs such as the increased deployment of robotics and human-machine interaction are found to have an impact on market growth. The demand for real-time connectivity is fuelling the emergence of smart factories that are cloud-enabled. As a result, the tool is becoming an important component of smart systems, which is projected to boost the product's popularity. Sensors are included in these smart equipment to help optimize machine time and maintenance schedules. This information can be examined and used to boost productivity. Furthermore, the sensors can help with predictive analysis of these tool parts and their life cycle.

A rise in demand for additive manufacturing is contributing to the market growth. Manufacturers are moving toward more cost-effective and quick production processes, which is leading to a rise in the use of additive manufacturing. Moreover, the market is predicted to expand due to the increased popularity of heterogeneous material manufacturing capabilities. CNC manufacturers intend to incorporate additive manufacturing into their operations. Okuma, for instance, plans to offer its new Laser EX equipment in the future, which will provide laser hardening for carbon steel materials, as well as laser heating and self-cooling hardening. As a result, such creative technology combinations are projected to continue to support market expansion in the future.

Changes in overall economic conditions are causing a significant change in the operation of various industries, including manufacturing sector. The manufacturing industry's expenditures are proportionate to the sales of these tools. As a result, if the global economy slows, machine tool income is projected to fall. Similarly, due to the increased acceptance of machinery in the industry, trends in the automobile industry have had a greater impact on the tools sector. The patterns in capital investment in the automotive manufacturing sector, on the other hand, have a substantial impact on market revenue. Unexpected changes in a country's economic, political, or social situations, as well as legislation, can have an impact on the market revenue growth.

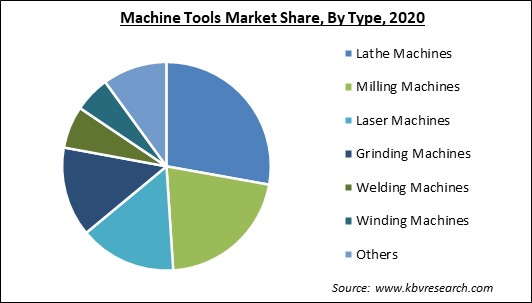

Based on Type, the market is segmented into Lathe Machines, Milling Machines, Laser Machines, Grinding Machines, Welding Machines, Winding Machines, and Others. The Lathe segment acquired the highest revenue share in the machine tools market in 2020. This can be ascribed to the increasing use of lathe equipment for tasks like chamfering, filleting, turning, and slot cutting. The use of lathe machines has increased in recent years as a result of their ability to eliminate human intervention while boosting the precision of machining processes. Manufacturers like Georg Fischer Ltd. and Haas Automation, Inc. are reacting to the trend by concentrating on the creation of novel lathe machines, which is helping the category grow.

Based on Technology, the market is segmented into Computer Numerical Control (CNC) and Conventional. The Conventional market segment procured a substantial revenue share in the machine tools market in 2020. It is due to increased demand for mass manufacturing in industries such as paper, pharmaceuticals, and textiles, among others. The construction industry's increased employment of traditional systems such as saws, drills, and bores, among others, is also propelling the segment's rise. Conventional machining is often less expensive and is utilized for smaller-scale jobs.

Based on Sales Channel, the market is segmented into Direct and Indirect. The Indirect sales segment garnered a substantial revenue share in the machine tools market in 2020. An indirect sales channel is when a third party, like an affiliate or partner, sells a product or service instead of a company's employees. Indirect sales can be used in combination with direct sales efforts or as a replacement for hiring. Because indirect distribution relieves manufacturers of some beginning expenses and obligations, which might reduce the amount of time they have to devote to running their businesses, the demand for machine tools via this channel is expected to increase in the future years.

Based on End-use, the market is segmented into Automotive, Aerospace & Defense, Construction Equipment, Power & Energy, Industrial and Others. The Automotive segment acquired the largest revenue share in the machine tools market in 2020. This is due to an increase in the use of machine tools for the fabrication of engine cylinder heads, transmission housings, brake drums, and gearbox cases among other automotive components. The segment's growth has also been fueled by the increased demand for CNC machines from carmakers. The COVID-19 epidemic, on the other hand, has impacted Chinese part exports. The closure of assembly factories in nations such as India, South Korea, and Germany among others, is having an impact on automakers' usage of machine tools.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 74.7 Billion |

| Market size forecast in 2027 | USD 96.8 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 4% from 2021 to 2027 |

| Number of Pages | 299 |

| Number of Tables | 494 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Technology, Sales Channel, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia Pacific procured the maximum revenue share in the machine tools market in 2020. This can be attributable to efforts like "Make in India" and "Made in China 2025," which are being pursued by regional governments to stimulate indigenous manufacturing. To encourage manufacturing investment, the Indian government stated in September 2019 that manufacturing enterprises registered on or after October 1, 2019, will be able to pay corporation tax at a rate of 15%. Moreover, nations in the area, like India, South Korea, and China are among the world's largest automotive component producers, and the use of machine tools in the manufacturing of automotive components has been increasing across the region. The growing construction industry in the Asia Pacific is expected to increase the demand for machine tools in the region.

Free Valuable Insights: Global Machine Tools Market size to reach USD 96.8 Billion by 2027

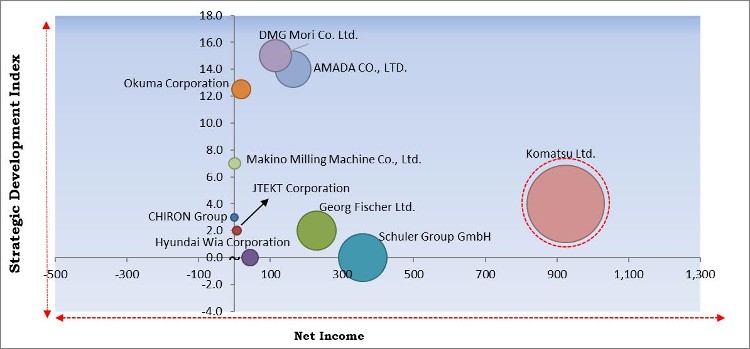

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Komatsu Ltd. is the major forerunner in the Machine Tools Market. Companies such as AMADA CO., LTD., Okuma Corporation, DMG Mori Co. Ltd. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Hyundai Wia Corporation (Hyundai Motor Company), Schuler Group GmbH, CHIRON Group, JTEKT Corporation, AMADA CO., LTD., Okuma Corporation, DMG Mori Co. Ltd., Komatsu Ltd., Georg Fischer Ltd., and Makino Milling Machine Co., Ltd.

By Type

By Technology

By Sales Channel

By End-use

By Geography

The machine tools market size is projected to reach USD 96.8 billion by 2027.

Growing need for smart machine tools are driving the market in coming years, however, uncertainty related to social and economic factors limited the growth of the market.

Hyundai Wia Corporation (Hyundai Motor Company), Schuler Group GmbH, CHIRON Group, JTEKT Corporation, AMADA CO., LTD., Okuma Corporation, DMG Mori Co. Ltd., Komatsu Ltd., Georg Fischer Ltd., and Makino Milling Machine Co., Ltd.

The expected CAGR of the machine tools market is 4% from 2021 to 2027.

The Direct segment acquired maximum revenue share in the Global Machine Tools Market by Sales Channel 2020, thereby, achieving a market value of $62.1 billion by 2027.

The Asia Pacific market dominated the Global Machine Tools Market by Region 2020, and would continue to be a dominant market till 2027; thereby, achieving a market value of $36.9 billion by 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.