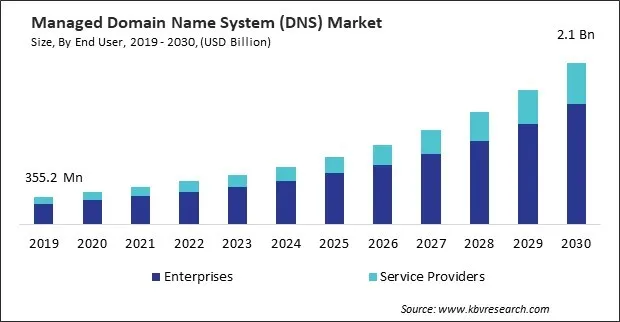

“Global Managed Domain Name System (DNS) Market to reach a market value of USD 2.1 Billion by 2030 growing at a CAGR of 18.2%”

The Global Managed Domain Name System (DNS) Market size is expected to reach $2.1 billion by 2030, rising at a market growth of 18.2% CAGR during the forecast period.

The healthcare segment deals with sensitive patient information. Managed DNS services contribute to patient data security by providing robust security measures, including encryption, DDoS protection, and DNS filtering, to safeguard against cyber threats and unauthorized access. Consequently, the healthcare segment would generate approximately 11.07% share of the market by 2030. The growing importance of telehealth services requires a reliable and responsive online infrastructure. Managed DNS services optimize DNS resolution times, ensuring that patients and healthcare providers experience minimal latency during telehealth sessions, leading to a better overall user experience.

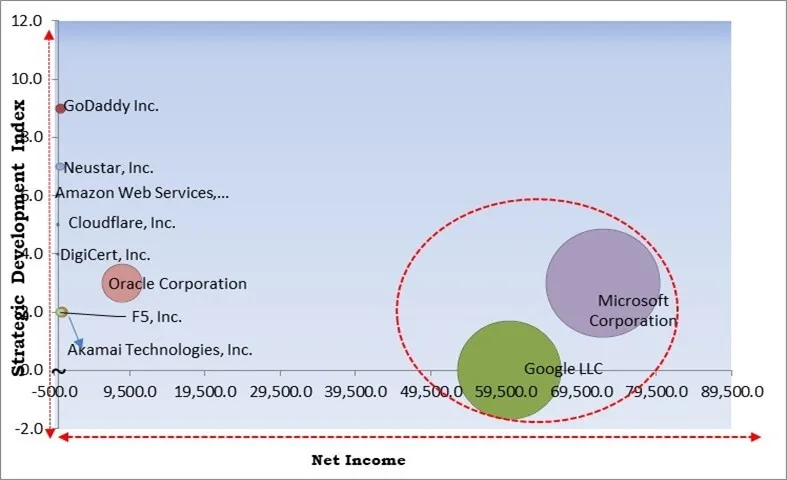

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In December 2023, Amazon Web Services, Inc. has enhanced Amazon Route 53 Resolver, enabling support for DNS over HTTPS (DoH) in both inbound and outbound Resolver endpoints. The incorporation of TLS encryption with DoH provides heightened privacy and security, protecting against potential eavesdropping and manipulation of DNS data during the interaction between a DoH client and the DoH-based DNS resolver. This upgrade guarantees a more secure and private communication process for users utilizing Amazon Route 53 Resolver. In July 2023, GoDaddy Inc. has unveiled .AI domain extension in India. With this launch, GoDaddy Inc. aims to empower individuals and organizations by providing them with the tools to create a unique online presence. This initiative is designed to facilitate collaborations and attract like-minded professionals or potential customers for enhanced visibility and engagement.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Market. In October 2022, Microsoft Corporation launched Azure DNS Private Resolver. For Azure virtual networks, Azure DNS Private Resolver now offers conditional forwarding and fully managed recursive resolution. With the help of this service, you may resolve DNS names hosted in Azure DNS private zones from networks that are on-premises as well as DNS queries that come from Azure virtual networks and can be sent to a designated destination server for resolution. And Companies such as Oracle Corporation, Akamai Technologies, Inc., and GoDaddy Inc. are some of the key innovators in Market.

The increasing global internet penetration and the growing number of online activities, including e-commerce, streaming services, and collaboration tools, drive the demand for robust DNS infrastructure. Managed DNS services are pivotal in optimizing the online user experience by ensuring fast and reliable DNS resolutions. The rise of streaming services for video, music, and other media content contributes to increased internet traffic. Hence, the market is expanding significantly due to the rising internet penetration and online activities.

Organizations are increasingly prioritizing network performance and optimization. Managed DNS services contribute to these efforts by providing features like load balancing, traffic management, and adaptive DNS strategies that enhance the efficiency of network operations. Managed DNS services provide advanced traffic management strategies, allowing organizations to prioritize and route traffic based on specific criteria. Thus, increasing focus on network performance and optimization has been a pivotal factor in driving the growth of the market.

Certain pricing models may have hidden costs or additional charges that are not immediately apparent. Organizations may encounter unexpected expenses related to specific features, usage thresholds, or support services, impacting their budgeting and cost management efforts. Some managed DNS service providers may employ complex pricing models that are challenging for organizations to understand and predict. The perceived cost savings associated with open-source solutions can impact market adoption rates. Thus, cost management and pricing models can slow down the growth of the market.

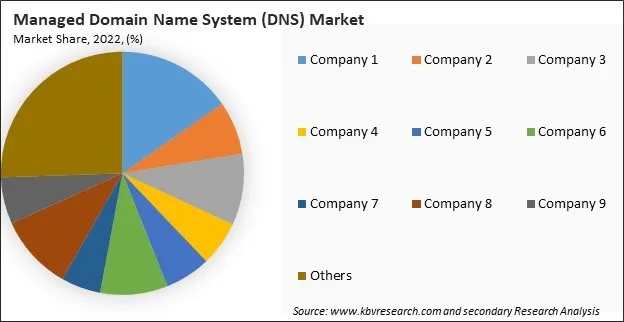

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Based on DNS server, the market is classified into primary and secondary. The secondary segment acquired a substantial revenue share in the market in 2022. Secondary DNS servers are backup servers replicating DNS zone data from primary servers. This redundancy ensures high availability and minimizes the risk of service disruptions. Secondary DNS servers take over in the event of primary server failures, providing uninterrupted DNS resolution services. This redundancy is crucial for organizations that prioritize continuous online availability. Secondary DNS servers assist load balancing by distributing DNS queries across multiple servers. This distributed architecture enhances scalability and ensures optimal performance, particularly during increased query volumes or traffic spikes. Managed DNS providers leverage Secondary DNS servers to handle growing demands on DNS infrastructure efficiently.

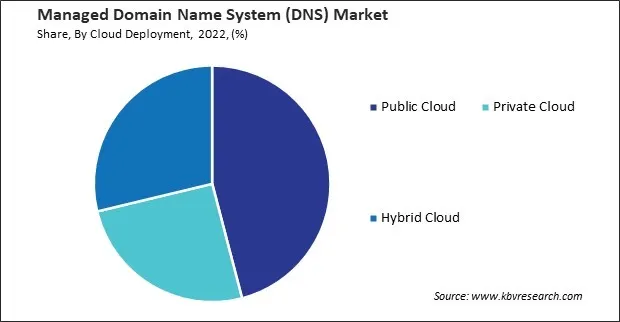

On the basis of cloud deployment, the market is divided into public cloud, private cloud, and hybrid cloud. In 2022, the public cloud segment dominated the market with maximum revenue share. Public cloud environments offer unparalleled scalability, allowing organizations to scale their resources up or down based on demand. Managed DNS services are well-suited to complement the scalability of cloud infrastructure, ensuring that DNS configurations can seamlessly adapt to changes in workload and traffic patterns. Public cloud providers often offer DNS services as part of their cloud infrastructure. Managed DNS providers integrate with cloud DNS services to offer enhanced capabilities, such as advanced traffic management, security features, and seamless management across hybrid environments. This integration enhances the overall DNS strategy for organizations utilizing public cloud services.

By DNS service, the market is categorized into anycast network, distributed denial of service protection, GeoDNS, and others. The GeoDNS segment covered a considerable revenue share in the market in 2022. GeoDNS assists organizations in optimizing the allocation of resources by directing traffic to servers that are best equipped to handle the load in specific regions. This ensures efficient resource utilization and helps organizations scale their infrastructure based on geographic demand patterns. GeoDNS enables organizations to adapt to regional variations in internet conditions, such as network congestion or latency issues. Organizations can provide a more reliable and responsive online experience by directing users to servers with optimal network conditions.

By end user, the market is segmented into enterprises and service providers. In 2022, the enterprises segment registered the maximum revenue share in the market. Managed DNS services streamline the management of DNS records, allowing enterprises to easily configure, update, and modify DNS settings through user-friendly interfaces or APIs. Automation features simplify routine tasks, reducing the risk of human error and ensuring efficient DNS management. Enterprises experiencing growth or fluctuations in web traffic can easily scale their DNS infrastructure with managed DNS services. The scalable nature of these services allows organizations to adapt to changing demands without significant infrastructure investments.

Based on enterprises type, the market is fragmented into BFSI, healthcare, media & entertainment, retail & ecommerce, education, IT & ITeS, and others. The media & entertainment segment covered a considerable revenue share in the market in 2022. Managed DNS solutions offer load-balancing features that distribute traffic efficiently across multiple servers. This is crucial for handling the high traffic volumes associated with media streaming, ensuring resource utilization, and preventing server overloads. Protecting digital assets, intellectual property, and user data is paramount in the media & entertainment segment. Managed DNS services often include security features like DDoS protection and DNS filtering to safeguard against cyber threats and unauthorized access.

Free Valuable Insights: Global Managed Domain Name System (DNS) Market size to reach USD 2.1 Billion by 2030

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region acquired a significant revenue share in the market. Asia Pacific has a large and diverse population that is predominantly mobile-first. Asia Pacific has emerged as a major hub for e-commerce, with a rapidly growing online consumer base. MSPs are gaining prominence in Asia Pacific as organizations seek comprehensive IT solutions. The expansion of managed DNS is facilitated by partnerships with MSPs that offer integrated managed services packages to regional businesses.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 566.5 Million |

| Market size forecast in 2030 | USD 2.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 18.2% from 2023 to 2030 |

| Number of Pages | 356 |

| Number of Tables | 563 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | DNS Server, Cloud Deployment, DNS Service, End User, Region |

| Country scope |

|

| Companies Included | Amazon Web Services, Inc. (Amazon.Com, Inc.), Cloudflare, Inc., DigiCert, Inc. (Clearlake Capital Group, L.P.), GoDaddy Inc., Neustar, Inc. (TransUnion LLC), Akamai Technologies, Inc., Microsoft CorporationOracle Corporation, Google LLC (Alphabet Inc.), F5, Inc |

By DNS Server

By Cloud Deployment

By DNS Service

By End User

By Geography

The Market size is projected to reach USD $2.1 billion by 2030.

Expansion of security concerns and DNS threats are driving the Market in coming years, however, Regulatory compliance and data governance restraints the growth of the Market.

Amazon Web Services, Inc. (Amazon.Com, Inc.), Cloudflare, Inc., DigiCert, Inc. (Clearlake Capital Group, L.P.), GoDaddy Inc., Neustar, Inc. (TransUnion LLC), Akamai Technologies, Inc., Microsoft CorporationOracle Corporation, Google LLC (Alphabet Inc.), F5, Inc

The Distributed Denial of Service Protection segment is leading the Market by DNS Service in 2022 thereby, achieving a market value of $796.4 million by 2030.

The North America region dominated the Market by Region in 2022 thereby, achieving a market value of $769.5 million by 2030, growing at a CAGR of 17.4 % during the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints