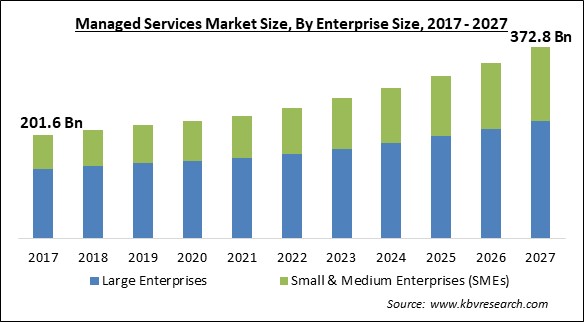

The Global Managed Services Market size is expected to reach $372.8 billion by 2027, rising at a market growth of 7.7% CAGR during the forecast period.

The practice of outsourcing business administration and management functions to a third party is referred to as managed services. This term isn't limited to IT because managed services can encompass anything from supply chain management to marketing strategy to call center operations.

Managed services assist firms in increasing operational efficiency and lowering operating costs while allowing them to concentrate more effectively on their core capabilities. Managed services help increase overall profitability and improve operational efficiency by ensuring optimal resource distribution and use. Businesses are finding it simpler to react to technology advances because of scalable infrastructure & flexible managed services models. Over the forecast period, all of these factors are expected to fuel the market growth.

To enhance commercial operations, managed services entail outsourcing managerial functions to a third party. Managed services have emerged as a result of the emergence of cloud-based technologies and their technical diffusion. Managed services help firms improve their operational efficiency and lower their operating costs. Over the projected period, the market is expected to rise due to the growing inclination for outsourcing management functions to cloud service providers & managed service providers.

Managed services might be beneficial to teams that don't have the time, expertise, or experience to handle some business processes internally, or who choose to focus their efforts elsewhere. Using an expert to provide a service helps the staff to concentrate on innovation rather than mundane activities. Because the managed service provider is responsible for keeping the service available at all times, companies don't have to worry about outages. A service level agreement (SLA) governs the delivery of the service and support, making it clear when to expect & what to expect it. An in-house staff is frequently juggling numerous duties, whereas an MSP may concentrate on mastering the delivery of a single service. This entails concentrating on the service's health & security, as well as applying patches and upgrades as needed.

Businesses are putting a major emphasis on remote working as a result of the COVID-19 pandemic outbreak. There are many companies that are increasingly shifting to cloud services to ensure business continuity amid the coronavirus lockdowns implemented by various governments as part of their efforts to restrict the virus' spread. The majority of businesses have already renewed their contracts with managed cloud service providers with the expectation of cloud migration becoming more widespread and, in some cases, getting traction. Moreover, as part of their attempts to stimulate digital transformation, businesses and organizations were putting a heavy emphasis on integrating the latest technologies, like augmented reality, and machine learning alongside their current IT infrastructure.

In today's technology-driven company environment, Bring Your Device (BYOD) is one of the most important components of digital technology and productivity across all sectors. To boost efficiency in the workplace, the BYOD concept allows employees to access and control data via personal devices. Companies that encourage the use of BYOD can save up to USD 350 per year, per team member, according to a report issued by Cisco Systems, Inc. Employees' work accountability and flexibility improve as a result of BYOD, resulting in increased productivity. As a result, enterprises are being advised to integrate BYOD solutions with current systems to build a workforce-friendly workplace. Because of the rising usage of BYOD, the number of intelligent devices in the workplace, like laptops, smartphones, tablets, and other gadgets, has expanded.

Cloud technology is used to create new customer engagement platforms as well as digital transformation platforms. An almost significant amount of businesses are working in a multi-cloud environment. But, most businesses find it difficult to implement a multi-cloud environment to improve consumer interaction due to a lack of skills and infrastructure. MSPs with DevOps competence and those who can offer consumption-based pricing models have a new opportunity. Various cloud-based solutions and services are gaining traction among enterprises due to its various features and advantages over traditional solutions.

The cost of a business service is determined by an organization's requirement for service criticality and availability. The MSP covers the regular costs of an IT department, like as training, equipment, and workers, and bills the employer on a monthly basis. This makes it easy to precisely predict spending each month when budgeting. The managed service can scale to accommodate such eventualities based on future needs and the speed with which the organization's IT maturity grows. The most major benefit is that a company may decide how much to scale based on factors like financing and the CIO's strategic vision. IT Service disruptions and unforeseen circumstances can also be avoided, reducing the danger of further losses.

Based on Enterprise Size, the market is segmented into Large Enterprises and Small & Medium Enterprises (SMEs). The Small & Medium enterprise segment garnered a substantial revenue share in the managed services market in 2020. Increased government support for SMEs in the form of tax reliefs, loans, financial assistance, and social assistance, as well as other digital SMEs campaigns around the world, is predicted to boost the segment's growth. SMEs' increased adoption of business operations automation and advanced information technology infrastructure is also predicted to promote segment expansion during the forecast period. Cloud computing, virtualization, and automation have come together to provide a delivery platform that allows small businesses to receive managed services at a lower cost and with greater efficiency.

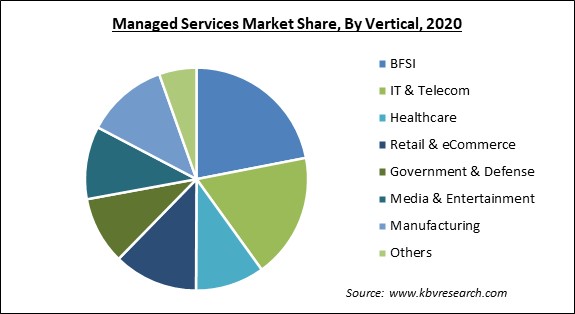

Based on Vertical, the market is segmented into BFSI, IT & Telecom, Healthcare, Retail & eCommerce, Government & Defense, Media & Entertainment, Manufacturing and Others. The BFSI segment acquired the highest revenue share in the managed services market in 2020. Managed services are being used by financial institutions to handle a variety of concerns, including keeping up with technology improvements, market & regulatory changes, and a looming shortage of staff with experience in cutting-edge technologies, among others. In the big scheme of things, the managed services model may help companies manage their processes and operations while also increasing product quality and operational efficiency. In addition, managed services are growing in popularity as companies seek a more strategic approach to successfully administer, organize, and safeguard their operations.

Based on Deployment Type, the market is segmented into On-premise and Hosted. The Hosted segment procured a substantial revenue share in the managed services market in 2020. It is due to technical advancements and other perks like cost-effectiveness and low operational costs. The key benefit of this deployment technique is that businesses using hosted services do not have to upgrade them regularly. The system software & services can be upgraded as needed by the service providers. Manufacturers are likely to embrace a hosted managed services (HMS)-based deployment model to reclaim control of escalating IT and licensing costs while freeing up IT staff to focus on new business instead of upgrades and system updates.

Based on Type, the market is segmented into Managed Data Center & IT Infrastructure, Managed Network & Communication Services, Managed Mobility Services, Managed Information Services, Managed Security Services, and Others. Based on Managed Information Service Type, the market is segmented into Business Process Outsourcing (BPO), Business Support Systems, Project & Portfolio Management and Others. The Managed data centre & IT infrastructure segment acquired the highest revenue share in the managed services market in 2020. Due to the continuing integration of cutting-edge technology into new and existing corporate infrastructures, the managed data centre market is likely to increase. In a hybrid IT architecture, managed data centre services could help optimize corporate operations by increasing business automation and enhancing business management.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 228.1 Billion |

| Market size forecast in 2027 | USD 372.8 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 7.7% from 2021 to 2027 |

| Number of Pages | 385 |

| Number of Tables | 603 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Enterprise Size, Deployment Type, Type, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia Pacific garnered a significant revenue share in the managed services market in 2020. Several companies in the Asia Pacific region are expected to contribute significantly to market growth over the projected period by employing cloud-based solutions and increasing data security investments. Moreover, the market expansion is likely to be aided by increased spending as a result of firms' acceptance of cutting-edge technologies like as advanced technology cloud-based technology for company development.

Free Valuable Insights: Global Managed Services Market size to reach USD 372.8 Billion by 2027

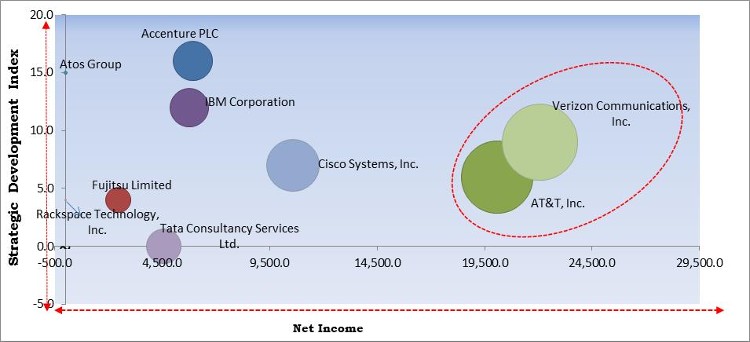

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; AT&T, Inc. and Verizon Communications, Inc. are the forerunners in the Managed Services Market. Companies such as Cisco Systems, Inc., IBM Corporation, and Accenture PLC are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Atos Group, Accenture PLC, Fujitsu Limited, Cisco Systems, Inc., DXC Technology Company, Tata Consultancy Services Ltd., Rackspace Technology, Inc., AT&T, Inc., and Verizon Communications, Inc.

By Enterprise Size

By Vertical

By Deployment Type

By Type

By Geography

The global managed services market size is expected to reach $372.8 billion by 2027.

Rising adoption of cloud solutions and services are driving the market in coming years, however, improved cost control factors limited the growth of the market.

IBM Corporation, Atos Group, Accenture PLC, Fujitsu Limited, Cisco Systems, Inc., DXC Technology Company, Tata Consultancy Services Ltd., Rackspace Technology, Inc., AT&T, Inc., and Verizon Communications, Inc.

The On-premise segment acquired maximum revenue share in the Global Managed Services Market by Deployment Type in 2020, thereby, achieving a market value of $228.2 billion by 2027.

North America is the fastest growing region in the Global Managed Services Market by Region in 2020, and would continue to be a dominant market till 2027; thereby, achieving a market value of $126.7 billion by 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.