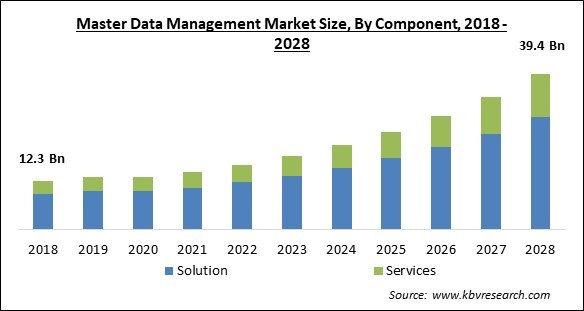

The Global Master Data Management Market size is expected to reach $39.4 billion by 2028, rising at a market growth of 15.6% CAGR during the forecast period.

Master data management, also called MDM, is a primary process for managing, centralizing, organizing, categorizing, localizing, synchronizing, and enriching master data in accordance with a company's sales, marketing, and operational plans. In addition to any sources of information that drive an organization, master data might take the shape of customers, products, suppliers, location, and asset information.

The efficient processing of master data within a central repository offers an individual authoritative perspective of information as well as removes data silos, which are costly inefficiencies. It helps a user achieve their company goals by identifying, linking, and distributing data and material across customers, products, stores/locations, workers, suppliers, digital assets, and more.

Most businesses nowadays use a variety of systems, all of which hold significant data about customers, the business, or other critical business KPIs, such as CRMs, ERPs, and so on. As a result, data silos, replicated data, missing data, and a fragmented perspective of the business emerge. Addressing simple business questions becomes challenging when data is scattered across multiple locations and languages.

Many firms nowadays, especially worldwide businesses, have a significant number of different applications and systems (e.g., ERP, CRM) where data that overlaps organizational departments or subdivisions can easily get fragmented, duplicated, and out of date. When this happens, it becomes difficult to accurately address even the most basic but crucial questions regarding any type of performance statistic or KPI for an organization. Businesses look to master data management to meet this challenge. Due to these factors, master data management is rapidly gaining traction among people all over the world and hence, is estimated to witness major growth prospects in the coming years.

The COVID-19 pandemic had a significant impact on every industry, particularly the IT industry, with the hardware company being the most impacted. The industry saw a considerable slowdown in the manufacturing and distribution of hardware components as a result of the imposition of lockdown in various countries all over the world. For a very long period, the software and service industries also experienced a significant slowdown. Cloud-based technologies, security solutions, collaborative applications, big data, and AI, on the other hand, helped the IT industry to recover more quickly during and post the lockdown.

Massive volumes of data generated across an organization are channeled through master data management services and solutions, which store data in a single location and ensure data security. Increased data churn needs advanced data quality technology to promote operational excellence. The first step in deploying MDM, the powerful system that enables businesses to track the phases of the flow of information and document data transformation, is to ensure data quality. Data quality technologies ensure data accuracy, while MDM systems update records and delete redundant data automatically.

The MDM market is being propelled forward by new technologies like as big data, artificial intelligence (AI), and machine learning (ML). This technology enables new data processing and storage capabilities, as well as the availability of large datasets. As new technologies' capabilities in processing multi-faceted and multi-domain data have developed, customers have a broader range of requirements. Integration of MDM solutions with technologies, like analytics, Big Data, and business intelligence has been the most prevalent request. Duplicate records are found and data quality is ensured, two frequent master data problems.

In the contemporary era of expanding data management and maintenance solutions, master data management solutions and services are evolving as the finest way to structure and retain data. However, this market's growth is constrained by widespread user concerns about data security. Organizations are now working in data-driven environments, increasing the risk of advanced cyber-attacks, data breaches, and phishing attempts. As a result of data being disseminated across various systems, several concerns develop, raising the security threats to the data.

On the basis of Component, the Master Data Management Market is segmented into Solution, Services, Consulting Services, Integration Services, and Training & Support Services. In 2021, the solutions segment registered the largest revenue share of the master data management market. Because of the operational benefits that multi-domain MDM systems give to enterprises, there has been a substantial increase in the design and deployment of these solutions. Multi-domain MDM systems are cost-effective, simple to maintain, and help enterprises avoid MDM platform failure. Due to these factors, the growth of this segment of the market is bolstering.

Based on the Vertical, the Master Data Management Market is segregated into BFSI, Government, Retail, IT & Telecom, Manufacturing, Energy & Utilities, Healthcare and Others. In 2021, the healthcare segment recorded a significant revenue share of the master data management market. The healthcare business is continually evolving as a result of numerous important technical developments that have improved the overall efficiency of the industry. It is a broad field that deals with a wide range of administrative, clinical, and financial data. This factor is augmenting the growth of this segment.

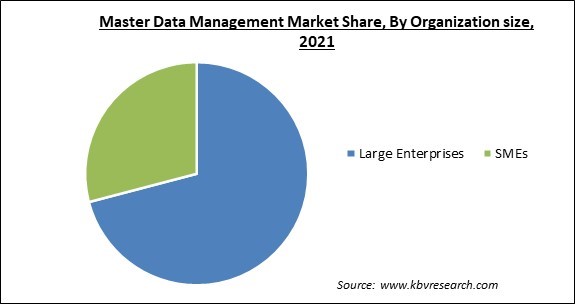

By the Organization Size, the Master Data Management Market is divided into SMEs and Large Enterprises. In 2021, the large enterprises segment procured the largest revenue share of the master data management market. The increased adoption of multi-domain MDM systems in large companies is primarily responsible for the rapidly increasing growth of this segment. This factor is playing a major role in expediting the growth of this segment.

Based on the Deployment Type, the Master Data Management Market is bifurcated into Cloud and On-premises. In 2021, the cloud segment procured a substantial revenue share of the master data management market. Businesses can operate without a dedicated server infrastructure or an office location using cloud-based deployment, enabling remote working. The expansion of cloud-based MDM solutions is being aided by these factors.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 14.5 Billion |

| Market size forecast in 2028 | USD 39.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 15.6% from 2022 to 2028 |

| Number of Pages | 284 |

| Number of Tables | 464 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Organization size, Deployment Mode, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-Wise, the Master Data Management Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America accounted for the highest revenue share of the master data management market. The rising technological improvements in the region are the key factors encouraging the growth of the regional market. Moreover, another factor that is expediting the growth of the master data management market in the region is the robust prevalence of market players in the region.

Free Valuable Insights: Global Master Data Management Market size to reach USD 39.4 Billion by 2028

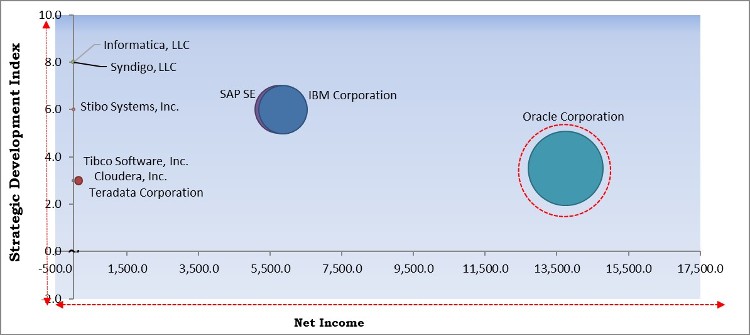

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Oracle Corporation is the major forerunner in the Master Data Management Market. Companies such as IBM Corporation, SAP SE and Informatics, LLC are some of the key innovators in Master Data Management Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Oracle Corporation, SAP SE, Teradata Corporation, Cloudera, Inc., Tibco Software, Inc. (Vista Equity Partners), SAS Institute, Inc., Stibo Systems, Inc. (The Stibo Group), Informatica, LLC, Syndigo, LLC (Riversand)

By Component

By Vertical

By Organization size

By Deployment Mode

By Geography

The global master data management market size is expected to reach $39.4 billion by 2028.

Rising Adoption of Data Management Tools are becoming more common and are driving the market in coming years, however, Security and Privacy Concerns limited the growth of the market.

IBM Corporation, Oracle Corporation, SAP SE, Teradata Corporation, Cloudera, Inc., Tibco Software, Inc. (Vista Equity Partners), SAS Institute, Inc., Stibo Systems, Inc. (The Stibo Group), Informatica, LLC, Syndigo, LLC (Riversand).

The BFSI market acquired the maximum revenue share in Global Master Data Management Market by Vertical in 2021, achieving a market value of $12.2 billion by 2028.

The Services market shows the high growth rate of 16.4% during (2022 - 2028).

The On-premise market is leading the Master Data Management Market by Deployment Mode in 2021, achieving a market value of $21.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.